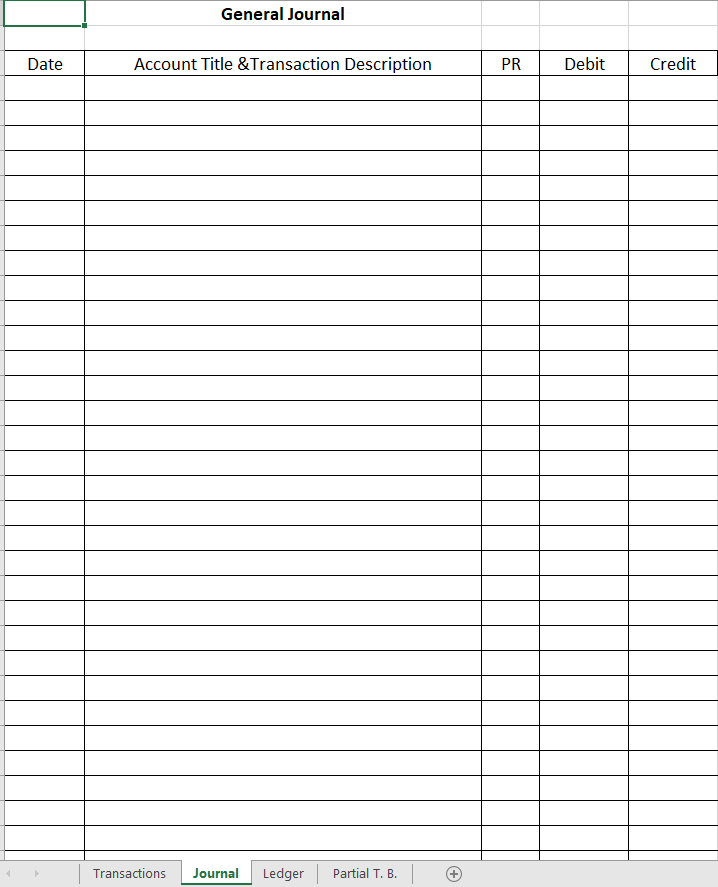

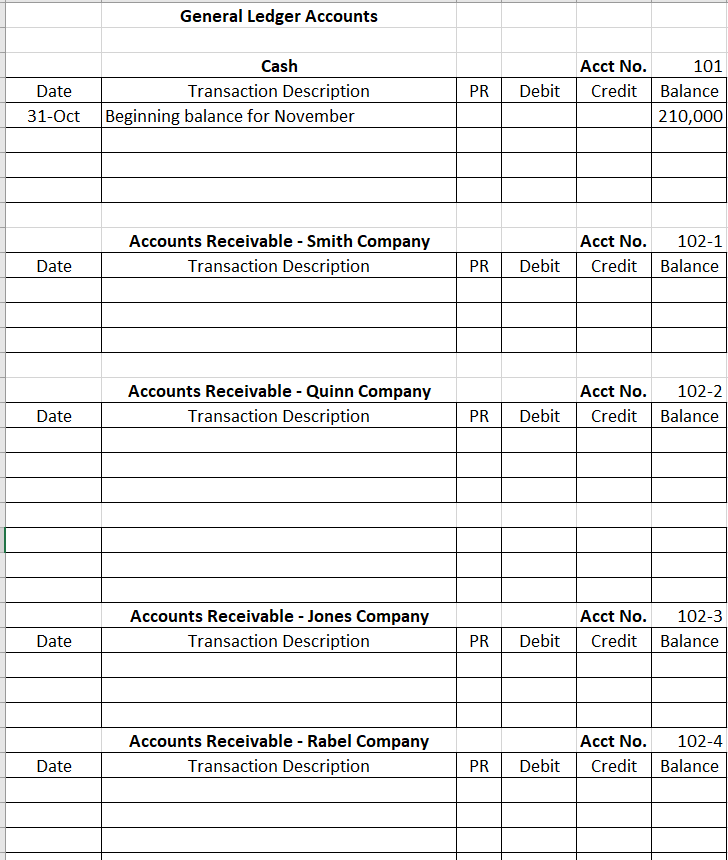

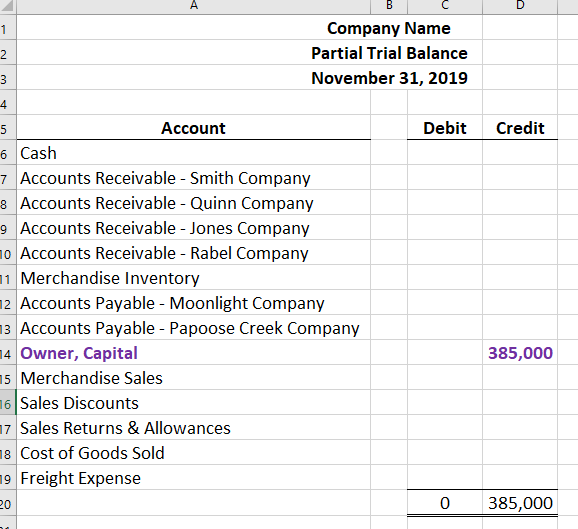

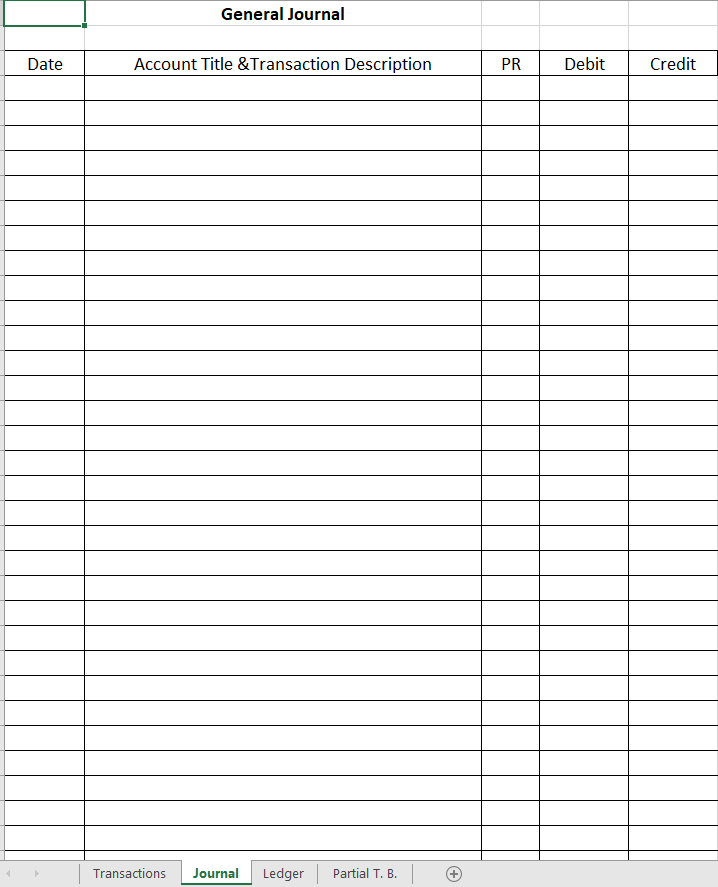

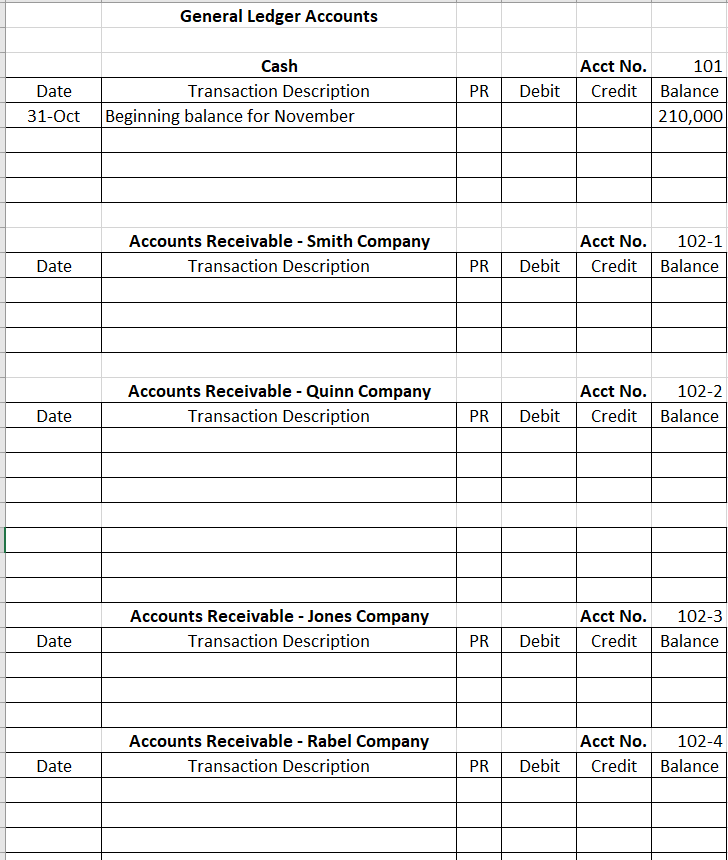

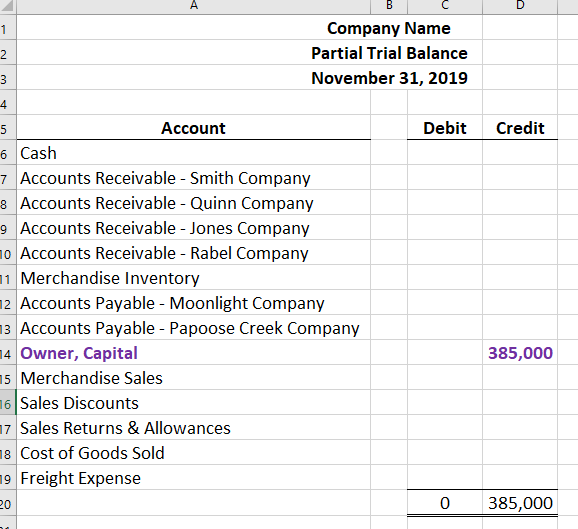

Create a journal, a Ledger, and a Partial T. B

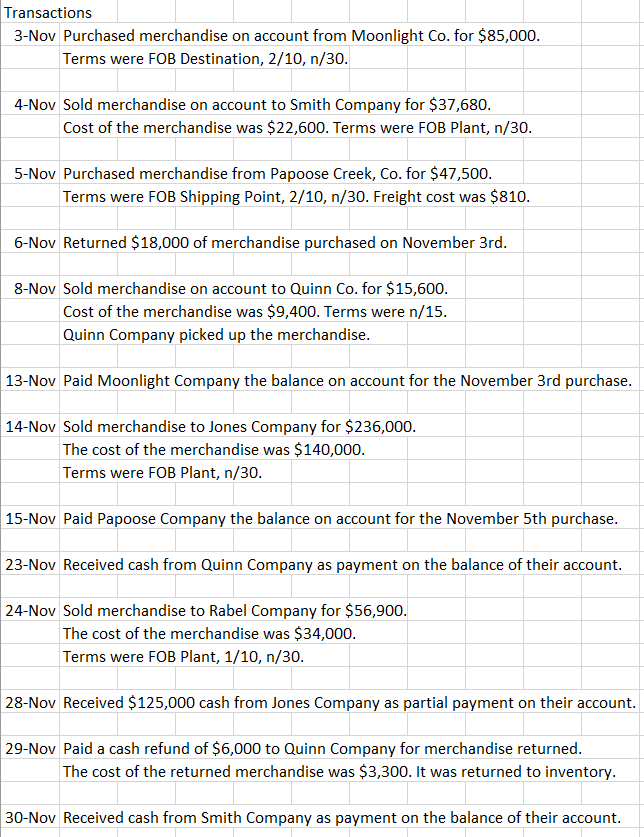

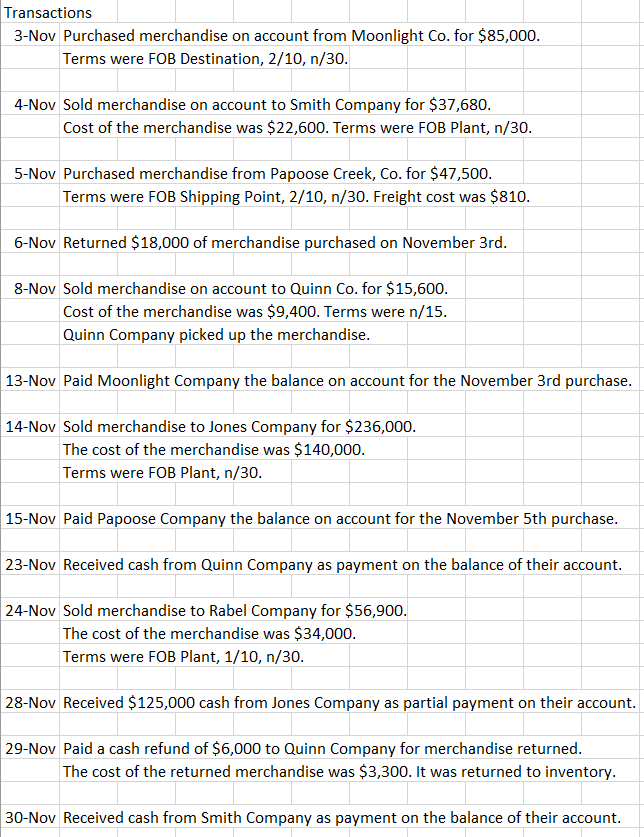

Transactions 3-Nov Purchased merchandise on account from Moonlight Co. for $85,000. Terms were FOB Destination, 2/10, n/30. 4-Nov Sold merchandise on account to Smith Company for $37,680. Cost of the merchandise was $22,600. Terms were FOB Plant, n/30. 5-Nov Purchased merchandise from Papoose Creek, Co. for $47,500. Terms were FOB Shipping Point, 2/10, n/30. Freight cost was $810. 6-Nov Returned $18,000 of merchandise purchased on November 3rd. 8-Nov Sold merchandise on account to Quinn Co. for $15,600. Cost of the merchandise was $9,400. Terms were n/15. Quinn Company picked up the merchandise. 13-Nov Paid Moonlight Company the balance on account for the November 3rd purchase. 14-Nov Sold merchandise to Jones Company for $236,000. The cost of the merchandise was $140,000. Terms were FOB Plant, n/30. 15-Nov Paid Papoose Company the balance on account for the November 5th purchase. 23-Nov Received cash from Quinn Company as payment on the balance of their account. 24-Nov Sold merchandise to Rabel Company for $56,900. The cost of the merchandise was $34,000. Terms were FOB Plant, 1/10, n/30. 28-Nov Received $125,000 cash from Jones Company as partial payment on their account. 29-Nov Paid a cash refund of $6,000 to Quinn Company for merchandise returned. The cost of the returned merchandise was $3,300. It was returned to inventory. 30-Nov Received cash from Smith Company as payment on the balance of their account. General Journal Date Account Title & Transaction Description PR Debit Credit Transactions Journal Ledger Partial T. B. + General Ledger Accounts Cash Transaction Description Beginning balance for November PR Date 31-Oct Debit Acct No. 101 Credit Balance 210,000 Accounts Receivable - Smith Company Transaction Description Acct No. 102-1 Credit Balance Date PR Debit Accounts Receivable - Quinn Company Transaction Description Acct No. 102-2 Credit Balance Date PR Debit Accounts Receivable - Jones Company Transaction Description Acct No. 102-3 Credit Balance Date PR Debit Accounts Receivable - Rabel Company Transaction Description Acct No. 102-4 Credit Balance Date PR Debit B D 1 2 3 4. Company Name Partial Trial Balance November 31, 2019 Debit Credit 5 Account 6 Cash 7 Accounts Receivable - Smith Company 8 Accounts Receivable - Quinn Company 9 Accounts Receivable - Jones Company 10 Accounts Receivable - Rabel Company 11 Merchandise Inventory 12 Accounts Payable - Moonlight Company 13 Accounts Payable - Papoose Creek Company 14 Owner, Capital 15 Merchandise Sales 16 Sales Discounts 17 Sales Returns & Allowances 18 Cost of Goods Sold 19 Freight Expense 20 385,000 0 385,000