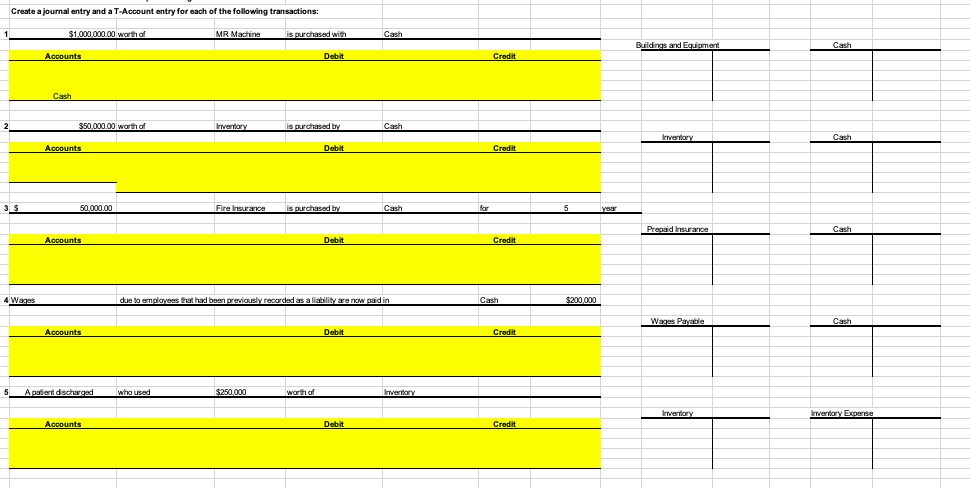

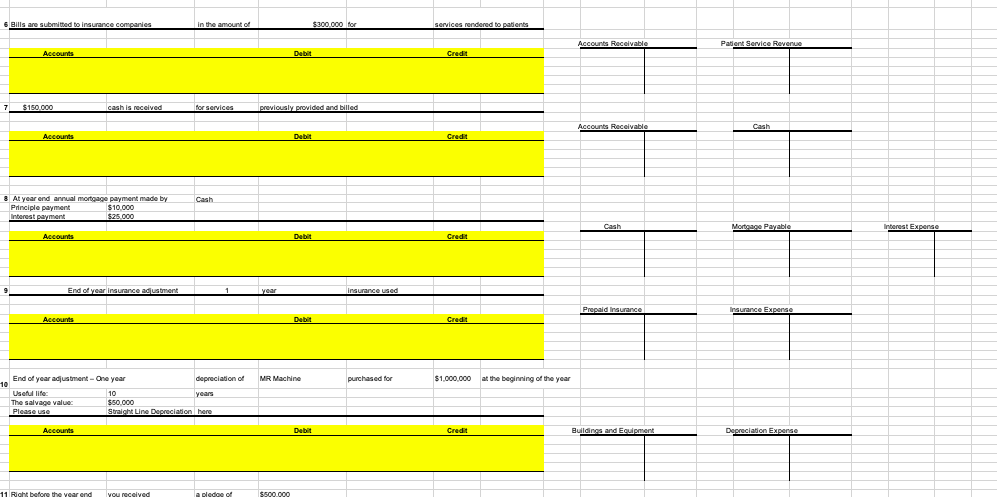

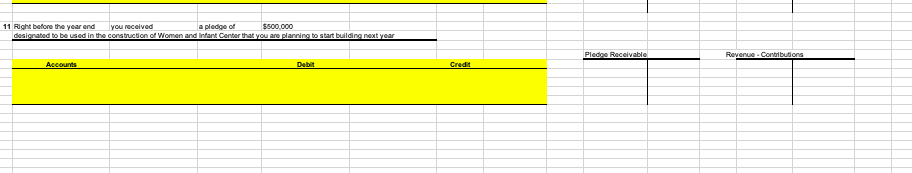

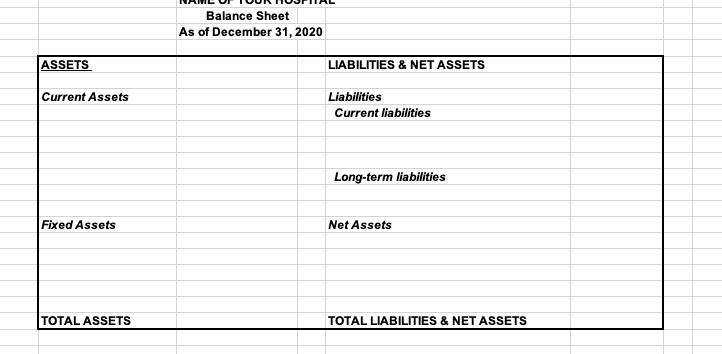

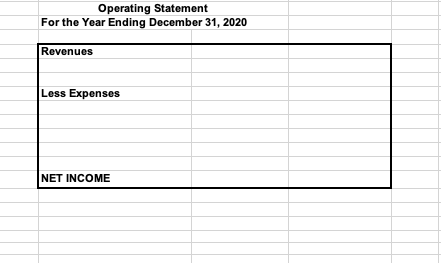

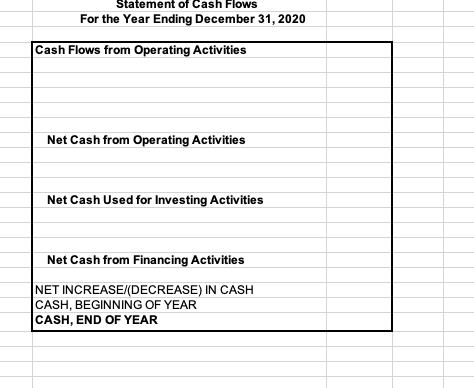

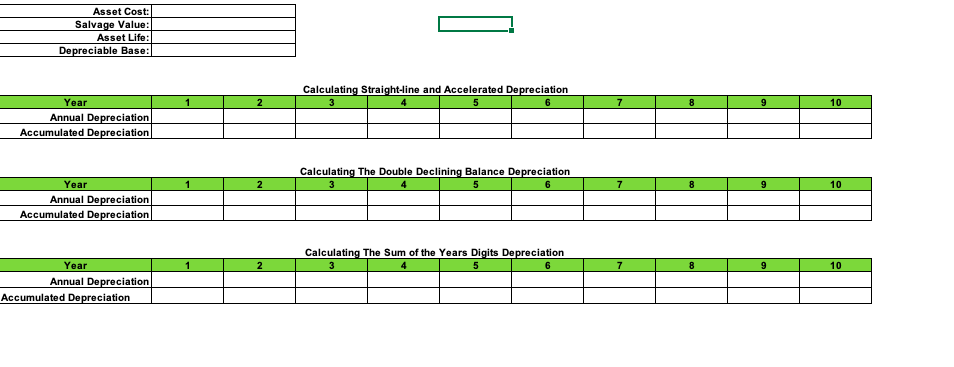

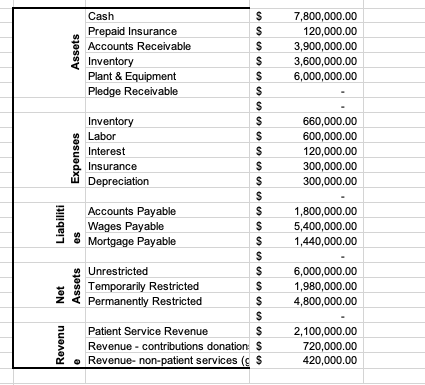

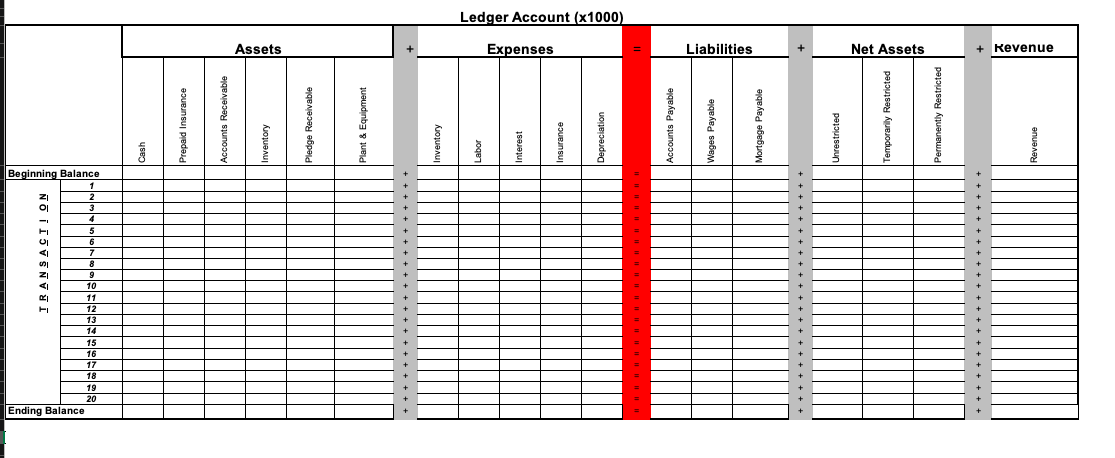

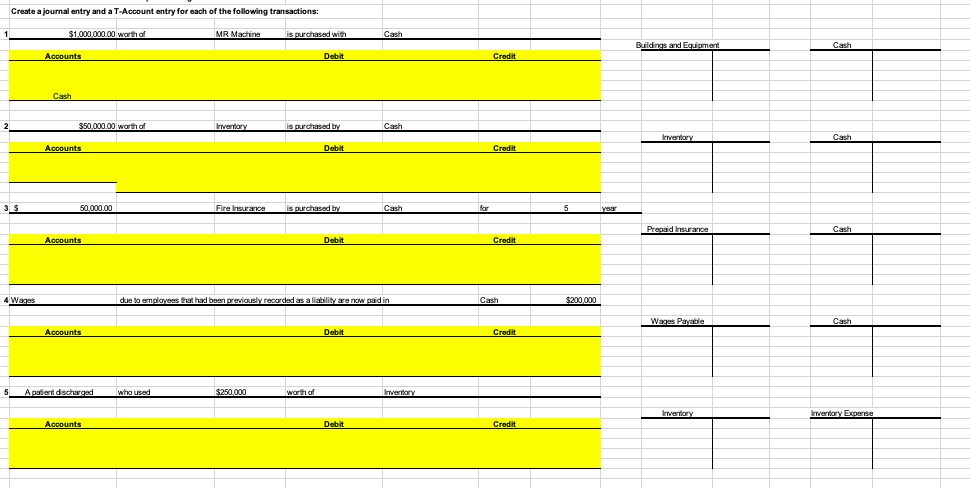

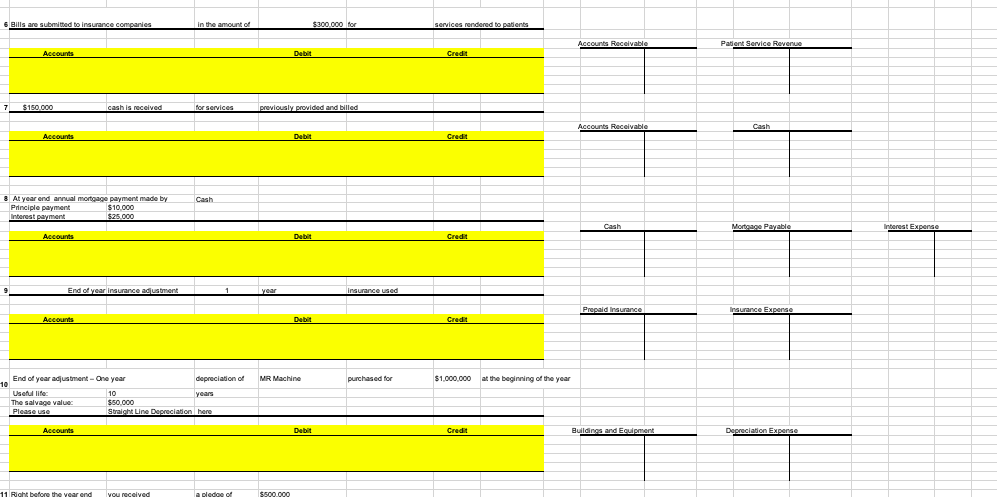

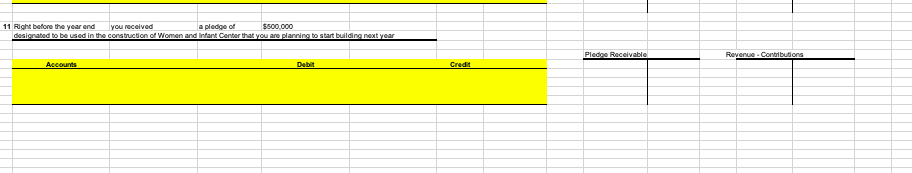

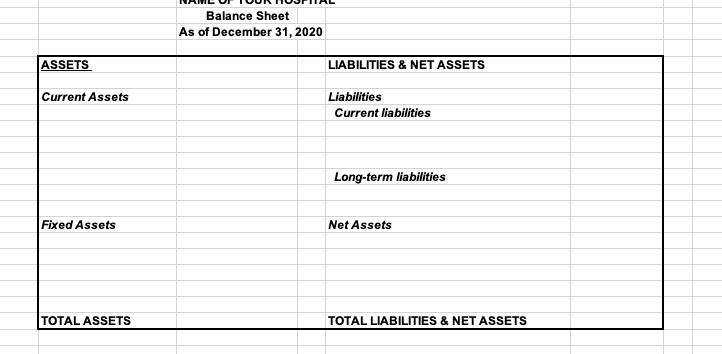

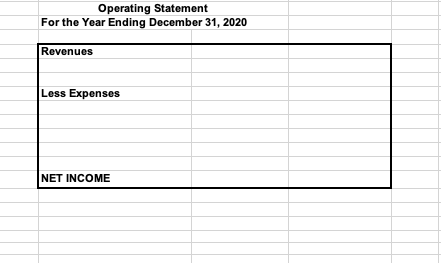

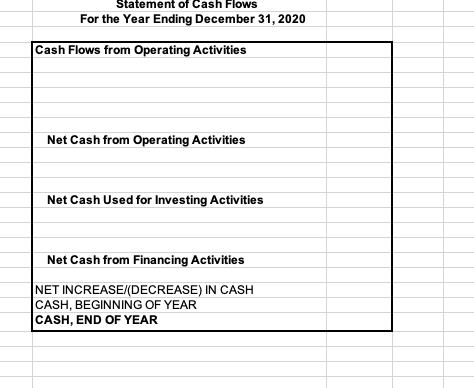

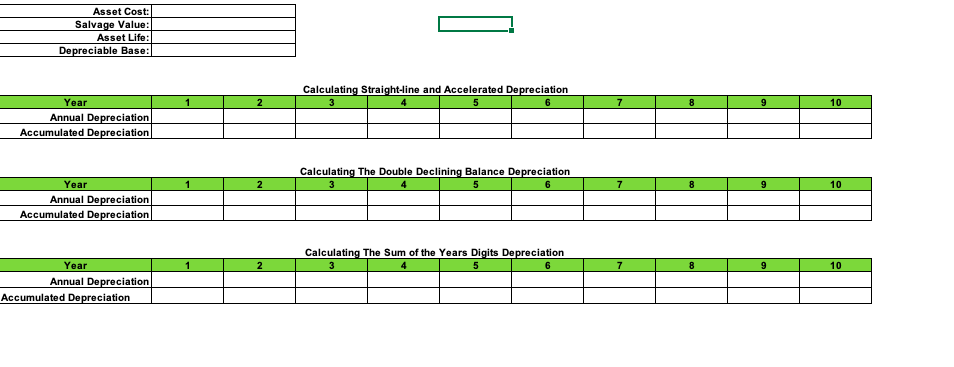

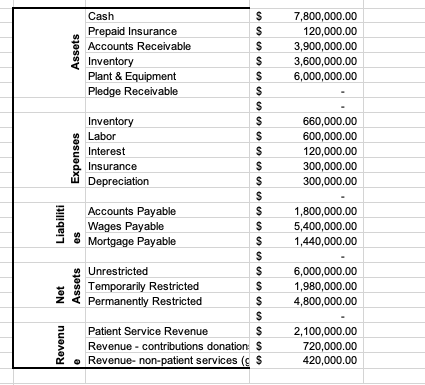

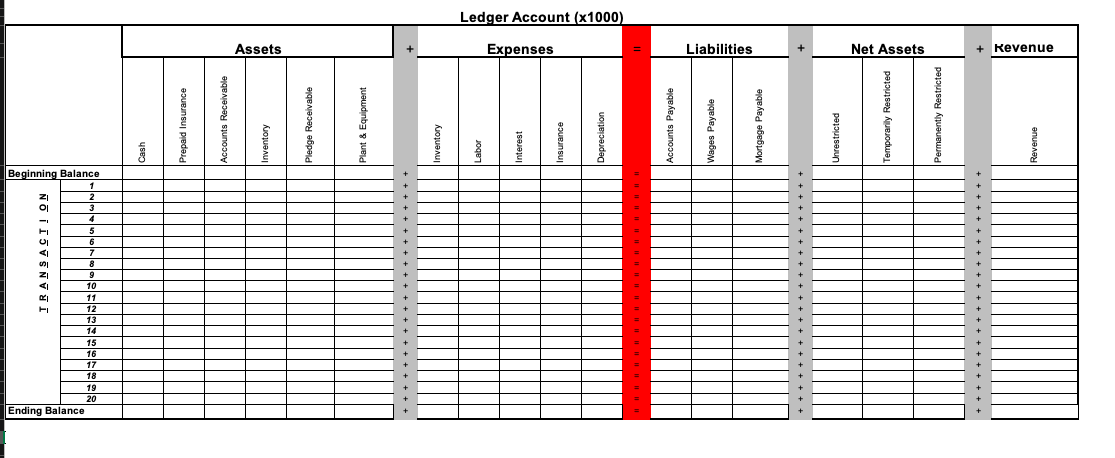

Create a journal entry and a T-Account entry for each of the following transactions: $1.000.000,00 worth of MR Machine is purchased with Cash Buildings and Equipm Accounts Debit $50,000.00 worth of Inventory is purchased by Cash Accounts Debit 50,000.00 Fire Insurance is purchased by Cash ccounts 4 Wages due to employees that had been previously recorded as a liability are now paid in Cash Wages Pa Accounts Debit 5 Apatient discharged Accounts 6 Bills are submitted tonsurance compa 8 At year and annual mortgage payment made by Principle payment Accounts End of year insurance adjustment End of year adjustment - One year depreciation of MR Machine Purches $1,000,000 at the beginning of the year The salvage value $50.000 Straight Line Depreciation here 11 Right before the year and you received 11 Right before the year and you received a pledge of $500.000 be used in the construction of Women and intant center that you are planning to start building NAITILUL TUUNTUURIAL Balance Sheet As of December 31, 2020 ASSETS LIABILITIES & NET ASSETS Current Assets Liabilities Current liabilities Long-term liabilities Fixed Assets Net Assets TOTAL ASSETS TOTAL LIABILITIES & NET ASSETS Operating Statement For the Year Ending December 31, 2020 Revenues Less Expenses NET INCOME Statement of Cash Flows For the Year Ending December 31, 2020 Cash Flows from Operating Activities Net Cash from Operating Activities Net Cash Used for Investing Activities Net Cash from Financing Activities NET INCREASE/DECREASE) IN CASH CASH, BEGINNING OF YEAR CASH, END OF YEAR Asset Cost: Salvage Value: Asset Life: Depreciable Base: 1 2 Calculating Straight-line and Accelerated Depreciation 3 4 5 6 7 8 9 10 Year Annual Depreciation Accumulated Depreciation Calculating The Double Declining Balance Depreciation 3 4 5 6 1 2 7 8 9 10 Year Annual Depreciation Accumulated Depreciation Calculating The Sum of the Years Digits Depreciation 5 6 Year 7 8 9 10 Annual Depreciation Accumulated Depreciation $ $ $ Cash Prepaid Insurance Accounts Receivable Inventory Plant & Equipment Pledge Receivable 7,800,000.00 120,000.00 3,900,000.00 3,600,000.00 6,000,000.00 $ Inventory Labor Interest Insurance Depreciation 660,000.00 600,000.00 120,000.00 300,000.00 300,000.00 Liabiliti Accounts Payable Wages Payable Mortgage Payable 1,800,000.00 5,400,000.00 1,440,000.00 Unrestricted Temporarily Restricted Permanently Restricted $ $ 6,000,000.00 1,980,000.00 4,800,000.00 $ Patient Service Revenue $ Revenue - contributions donation $ . Revenue-non-patient services ( $ 2,100,000.00 720,000.00 420,000.00 2 Ending Balance TRANSACTION Beginning Balance 20 Cash Prepaid Insurance Accounts Receivable Assets Inventory Pledge Receivable Plant & Equipment + + + + + + + + + + + + + + + + + + + + + + Inventory Labor Interest Expenses Ledger Account (x1000) Insurance Depreciation Accounts Payable Wages Payable Liabilities Mortgage Payable + + + + + + + + + + + + + + + + + + + + + + Unrestricted Temporarily Restricted Net Assets Permanently Restricted + Revenue Revenue Create a journal entry and a T-Account entry for each of the following transactions: $1.000.000,00 worth of MR Machine is purchased with Cash Buildings and Equipm Accounts Debit $50,000.00 worth of Inventory is purchased by Cash Accounts Debit 50,000.00 Fire Insurance is purchased by Cash ccounts 4 Wages due to employees that had been previously recorded as a liability are now paid in Cash Wages Pa Accounts Debit 5 Apatient discharged Accounts 6 Bills are submitted tonsurance compa 8 At year and annual mortgage payment made by Principle payment Accounts End of year insurance adjustment End of year adjustment - One year depreciation of MR Machine Purches $1,000,000 at the beginning of the year The salvage value $50.000 Straight Line Depreciation here 11 Right before the year and you received 11 Right before the year and you received a pledge of $500.000 be used in the construction of Women and intant center that you are planning to start building NAITILUL TUUNTUURIAL Balance Sheet As of December 31, 2020 ASSETS LIABILITIES & NET ASSETS Current Assets Liabilities Current liabilities Long-term liabilities Fixed Assets Net Assets TOTAL ASSETS TOTAL LIABILITIES & NET ASSETS Operating Statement For the Year Ending December 31, 2020 Revenues Less Expenses NET INCOME Statement of Cash Flows For the Year Ending December 31, 2020 Cash Flows from Operating Activities Net Cash from Operating Activities Net Cash Used for Investing Activities Net Cash from Financing Activities NET INCREASE/DECREASE) IN CASH CASH, BEGINNING OF YEAR CASH, END OF YEAR Asset Cost: Salvage Value: Asset Life: Depreciable Base: 1 2 Calculating Straight-line and Accelerated Depreciation 3 4 5 6 7 8 9 10 Year Annual Depreciation Accumulated Depreciation Calculating The Double Declining Balance Depreciation 3 4 5 6 1 2 7 8 9 10 Year Annual Depreciation Accumulated Depreciation Calculating The Sum of the Years Digits Depreciation 5 6 Year 7 8 9 10 Annual Depreciation Accumulated Depreciation $ $ $ Cash Prepaid Insurance Accounts Receivable Inventory Plant & Equipment Pledge Receivable 7,800,000.00 120,000.00 3,900,000.00 3,600,000.00 6,000,000.00 $ Inventory Labor Interest Insurance Depreciation 660,000.00 600,000.00 120,000.00 300,000.00 300,000.00 Liabiliti Accounts Payable Wages Payable Mortgage Payable 1,800,000.00 5,400,000.00 1,440,000.00 Unrestricted Temporarily Restricted Permanently Restricted $ $ 6,000,000.00 1,980,000.00 4,800,000.00 $ Patient Service Revenue $ Revenue - contributions donation $ . Revenue-non-patient services ( $ 2,100,000.00 720,000.00 420,000.00 2 Ending Balance TRANSACTION Beginning Balance 20 Cash Prepaid Insurance Accounts Receivable Assets Inventory Pledge Receivable Plant & Equipment + + + + + + + + + + + + + + + + + + + + + + Inventory Labor Interest Expenses Ledger Account (x1000) Insurance Depreciation Accounts Payable Wages Payable Liabilities Mortgage Payable + + + + + + + + + + + + + + + + + + + + + + Unrestricted Temporarily Restricted Net Assets Permanently Restricted + Revenue Revenue