Create a Journal entry based on the information

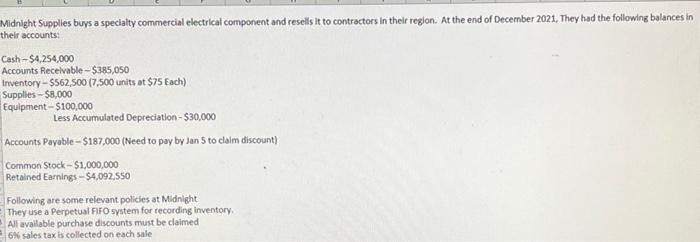

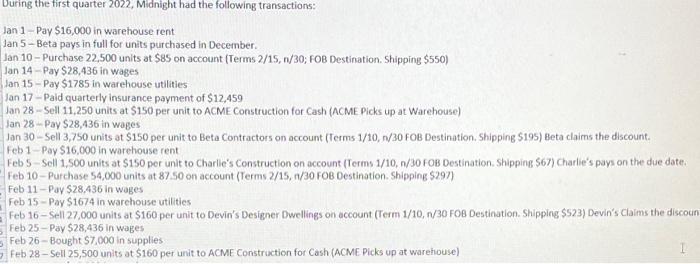

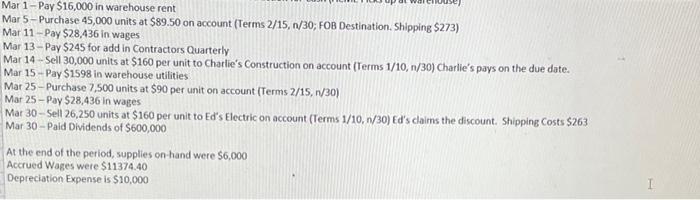

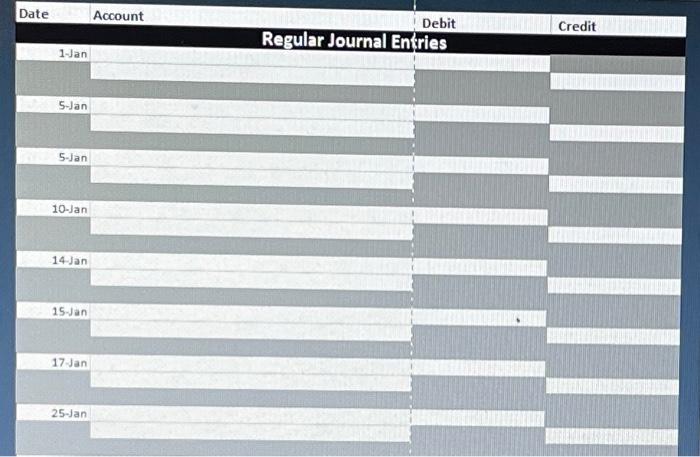

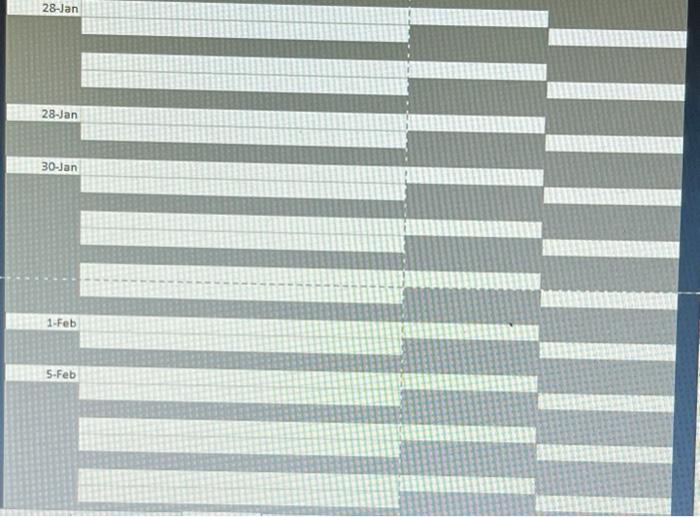

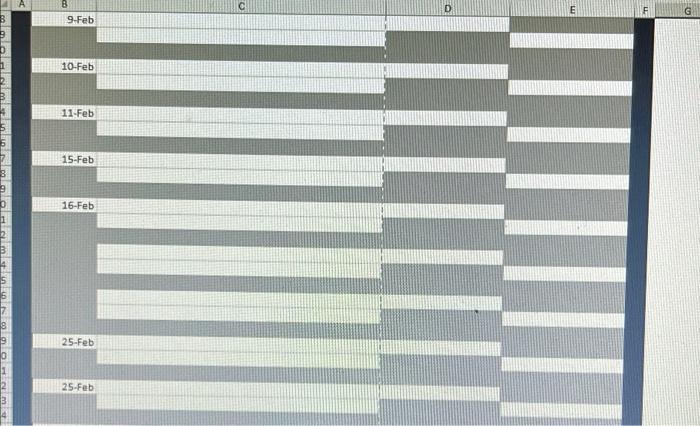

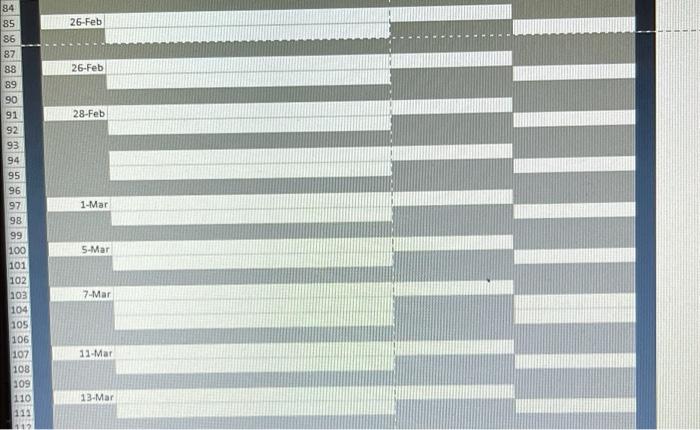

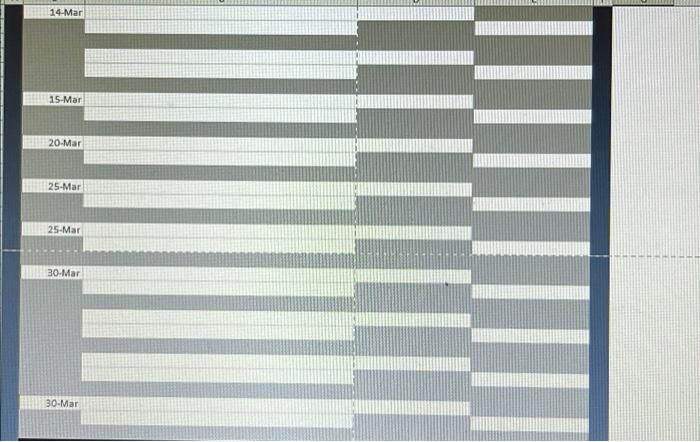

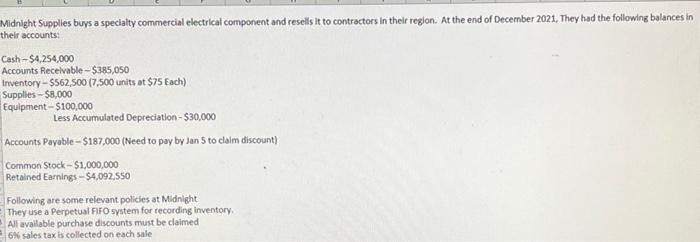

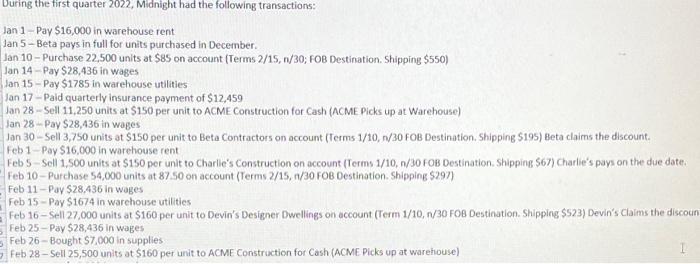

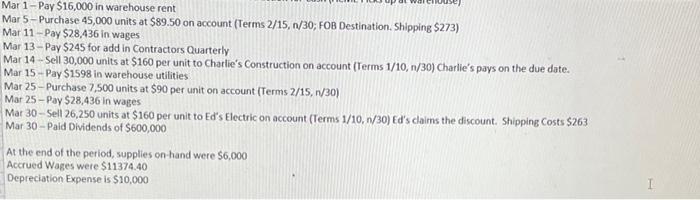

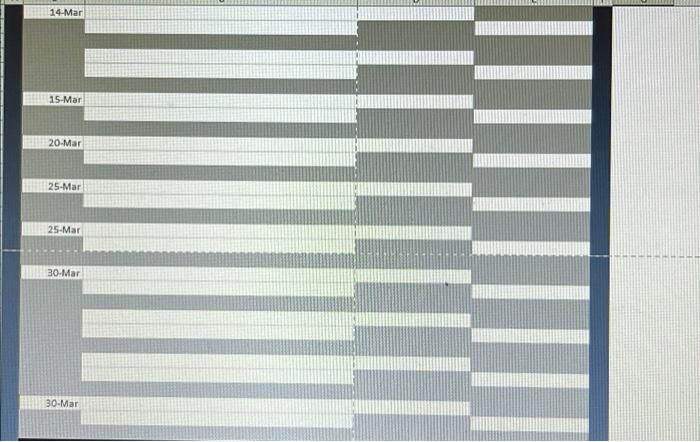

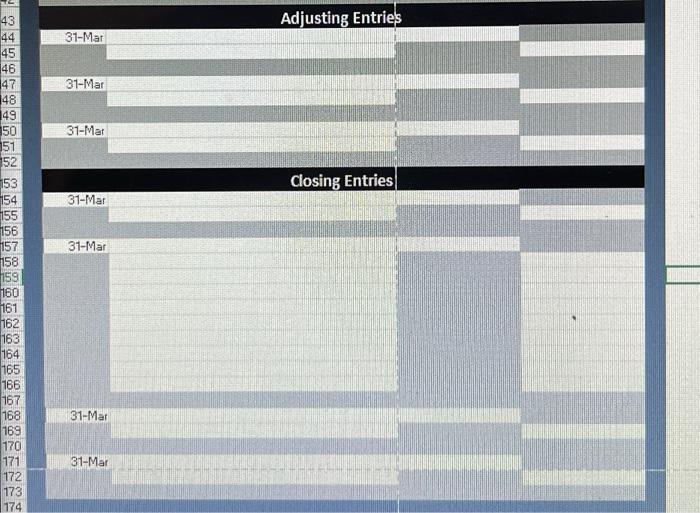

Midnight Supplies buys a specialty commercial electrical component and resells it to contractors in their region. At the end of December 2021, They had the following balances in their accounts: Cash - $4,254,000 Accounts Recevable - $385,050 Inventory - $562,500 (7,500 units at $75 Each) Supplies - $8.000 Equipment-$100,000 Less Accumulated Depreciation - $30,000 Accounts Payable - $187,000 (Need to pay by Jan 5 to claim discount) Common Stock - $1,000,000 Retained Earnings -S4,092,550 Following are some relevant policies at Midnight They use a Perpetual FIFO system for recording inventory All available purchase discounts must be claimed 6% sales tax is collected on each sale During the first quarter 2022, Midnight had the following transactions: Jan 1-Pay $16,000 in warehouse rent Jan 5 - Beta pays in full for units purchased in December. Jan 10 - Purchase 22,500 units at $85 on account (Terms 2/15, w/30; FOB Destination. Shipping $550) Jan 14 - Pay $28.436 in Wages Jan 15 - Pay $1785 in warehouse utilities Jan 17 - Pald quarterly insurance payment of $12,459 Jan 28 - Sell 11.250 units at $150 per unit to ACME Construction for Cash (ACME picks up at Warehouse) Jan 28 -Pay $28,436 in wages Jan 30 - Sell 3,750 units at $150 per unit to Beta Contractors on account (Terms 1/10, 1/30 FOB Destination. Shipping S195) Beta claims the discount. Feb 1-Pay S16,000 in warehouse rent Febs-Sell 1,500 units at $150 per unit to Charlie's Construction on account (Terms 1/10/30 FOB Destination. Shipping S67) Charlie's pays on the due date: Feb 10 - Purchase 54,000 units at 87 So on account (Terms 2/15, 1/30 FOB Destination. Shipping $297) Feb 11 - Pay $28.436 in Wages Feb 15 - Pay $1674 in warehouse utilities Feb 16-Sell 27,000 units at $160 per unit to Devin's Designer Dwellings on account (Term 1/10, 1/30 FOB Destination. Shipping $523) Devin's claims the discoun Feb 25 - Pay 528,436 in wages Feb 26 - Bought $7,000 in supplies Feb 28 - Sell 25,500 units at $160 per unit to ACME Construction for Cash (ACME picks up at warehouse) Mar 1-Pay $16,000 in warehouse rent Mar 5-Purchase 45,000 units at $89.50 on account (Terms 2/15, n/30; FOB Destination. Shipping $273) Mar 11 -- Pay $28.436 in wages Mar 13 - Pay $245 for add in Contractors Quarterly Mar 14 - Sell 30,000 units at $160 per unit to Charlie's Construction on account (Terms 1/10, 1/30) Charlie's pays on the due date. Mar 15- Pay $1598 in warehouse utilities Mar 25- Purchase 7.500 units at $90 per unit on account (Terms 2/15, 1/30) Mar 25- Pay $28,436 in Wages Mar 30-Sell 26,250 units at $160 per unit to Ed's Electric on account (Terms 1/10, 1/30) Ed's claims the discount. Shipping Costs $263 Mar 30 - Pald Dividends of $600,000 At the end of the period, supplies on hand were $6,000 Accrued Wages were $11374.40 Depreciation Expense is $10,000 Date Account Credit Debit Regular Journal Entries 1-Jan 5-Jan 5-Jan 10-Jan 14 Jan 15 Jan 17 Jan II. IT 25-Jan 28-Jan 28-Jan 30-Jan TI 1-Feb 5-Feb E F G 3 9-Feb 10-Feb 11-Feb 15-Feb 16-Feb 25-Feb 25-Feb 26-Feb 26-Feb 28-Feb 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 1-Mar 100 5-Mar 7-Mar 101 102 103 104 105 106 107 108 309 110 11-Mar ||| ES 13-Mar 14-Mar 15-Mar 20-Mar 25-Mar 25-Mar 30-Mar 30-Mar 43 Adjusting Entries 31-Mar 47 31-Mar BCA 31-Mat 50 151 52 153 154 155 156 157 Closing Entries 31-Mar 31-Mar 158 159 160 1161 162 163 164 165 166 167 168 169 170 171 172 173 174 31-Mar 31-Mar