Answered step by step

Verified Expert Solution

Question

1 Approved Answer

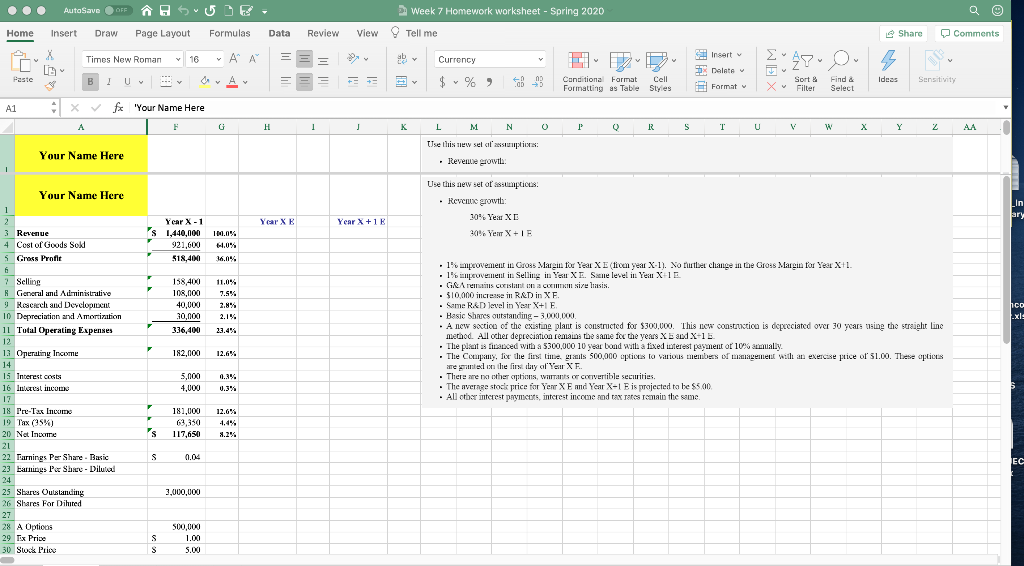

create a new set of projections for Years X E and X +1 E. For this Homework Assignment, your work should be completed on the

create a new set of projections for Years X E and X +1 E.

For this Homework Assignment, your work should be completed on the Week 7 Homework Worksheet (attached to this file). Please make sure you put your name in the appropriate box on the worksheet!

All historical information remains the same (through Year X-1).

Use this new set of assumptions:

- Revenue growth:

30% Year X E

30% Year X + 1 E

- 1% improvement in Gross Margin for Year X E (from year X-1). No further change in the Gross Margin for Year X+1.

- 1% improvement in Selling in Year X E. Same level in Year X+1 E.

- G&A remains constant on a common size basis.

- $10,000 increase in R&D in X E.

- Same R&D level in Year X+1 E.

- Basic Shares outstanding 3,000,000.

- A new section of the existing plant is constructed for $300,000. This new construction is depreciated over 30 years using the straight line method. All other depreciation remains the same for the years X E and X+1 E.

- The plant is financed with a $300,000 10 year bond with a fixed interest payment of 10% annually.

- The Company, for the first time, grants 500,000 options to various members of management with an exercise price of $1.00. These options are granted on the first day of Year X E.

- There are no other options, warrants or convertible securities.

- The average stock price for Year X E and Year X+1 E is projected to be $5.00.

- All other interest payments, interest income and tax rates remain the same.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started