Create a regression model capable of forecasting 5-year average return (DV) of a mutual fund with expense ratio, net asset value, and Morningstar rank.

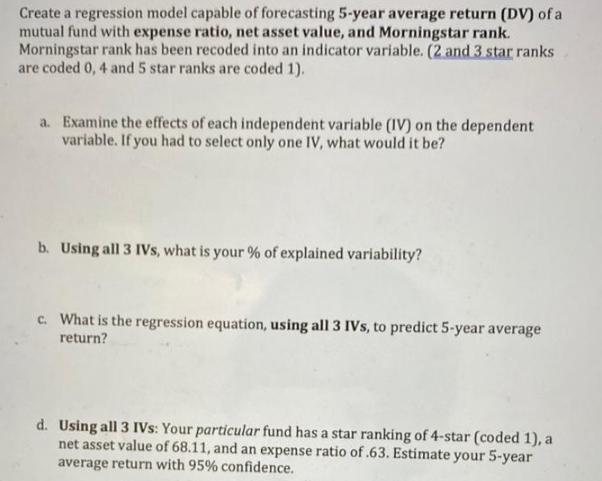

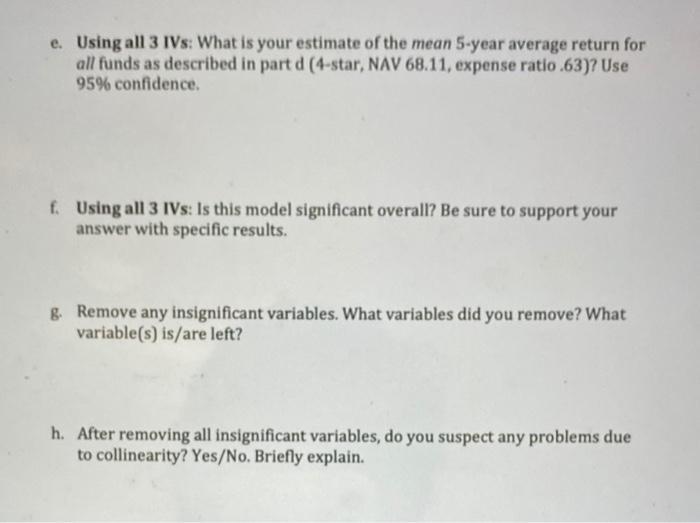

Create a regression model capable of forecasting 5-year average return (DV) of a mutual fund with expense ratio, net asset value, and Morningstar rank. Morningstar rank has been recoded into an indicator variable. (2 and 3 star ranks are coded 0, 4 and 5 star ranks are coded 1). a. Examine the effects of each independent variable (IV) on the dependent variable. If you had to select only one IV, what would it be? b. Using all 3 IVs, what is your % of explained variability? c. What is the regression equation, using all 3 IVs, to predict 5-year average return? d. Using all 3 IVs: Your particular fund has a star ranking of 4-star (coded 1), a net asset value of 68.11, and an expense ratio of .63. Estimate your 5-year average return with 95% confidence. e. Using all 3 IVs: What is your estimate of the mean 5-year average return for all funds as described in part d (4-star, NAV 68.11, expense ratio .63)? Use 95% confidence. f. Using all 3 IVs: Is this model significant overall? Be sure to support your answer with specific results. &. Remove any insignificant variables. What variables did you remove? What variable(s) is/are left? h. After removing all insignificant variables, do you suspect any problems due to collinearity? Yes/No. Briefly explain.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a A unit increases in expense ratio increases average returns by 1434 units The average return of 3 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started