Answered step by step

Verified Expert Solution

Question

1 Approved Answer

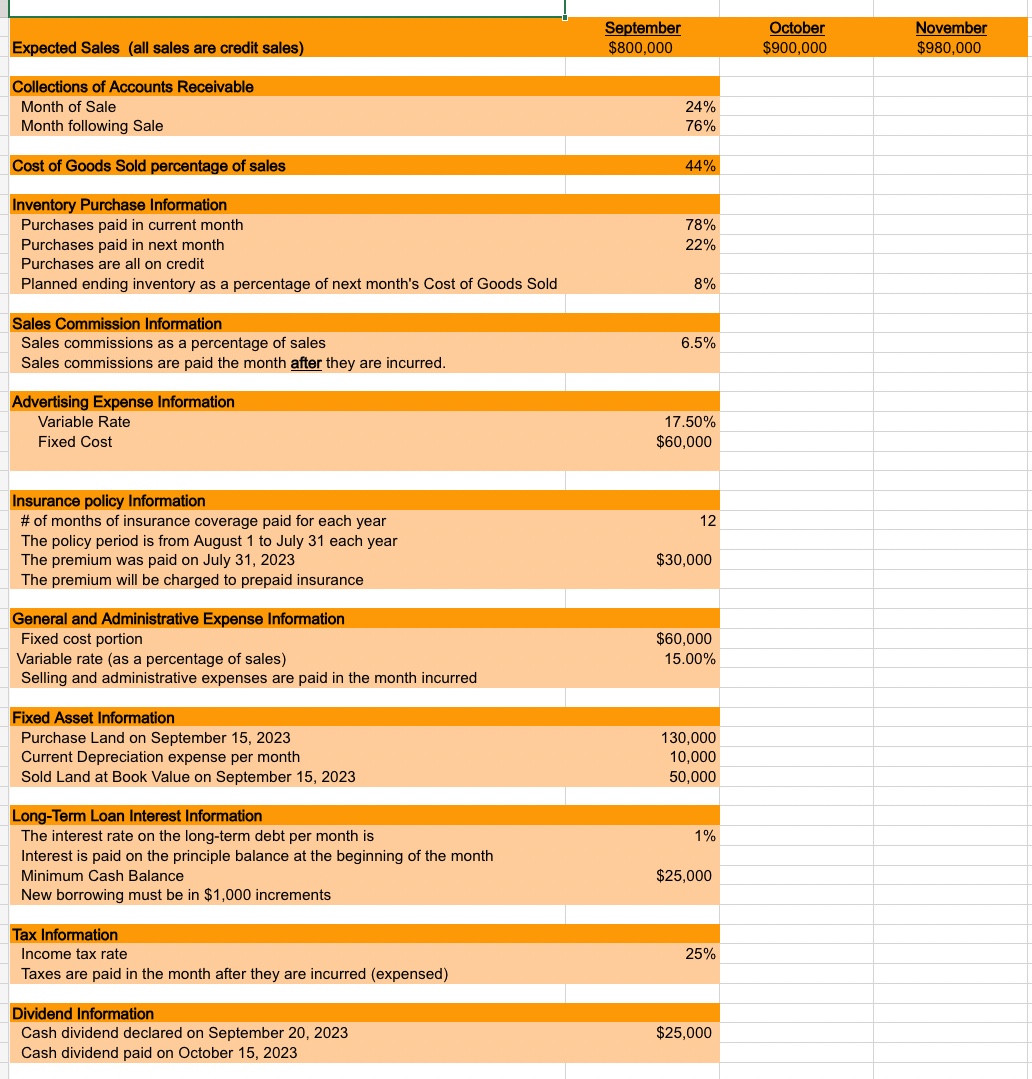

Create a Selling and Admin Budget sheet. Expected Sales (all sales are credit sales) $800,000September October $980,000November Collections of Accounts Receivable Month of Sale Month

Create a Selling and Admin Budget sheet.

Expected Sales (all sales are credit sales) $800,000September October $980,000November Collections of Accounts Receivable Month of Sale Month following Sale 24% Cost of Goods Sold percentage of sales 44% Inventory Purchase Information Purchases paid in current month Purchases paid in next month Purchases are all on credit Planned ending inventory as a percentage of next month's Cost of Goods Sold 76% Sales Commission Information Sales commissions as a percentage of sales 6.5% Sales commissions are paid the month after they are incurred. Advertising Expense Information Variable Rate Fixed Cost 78% 22% 8% Insurance policy Information \# of months of insurance coverage paid for each year The policy period is from August 1 to July 31 each year The premium was paid on July 31,2023 The premium will be charged to prepaid insurance General and Administrative Expense Information Fixed cost portion Variable rate (as a percentage of sales) $60,000 Selling and administrative expenses are paid in the month incurred 17.50% $60,000 Fixed Asset Information Purchase Land on September 15, 2023 Current Depreciation expense per month Sold Land at Book Value on September 15, 2023 12 Long-Term Loan Interest Information The interest rate on the long-term debt per month is Interest is paid on the principle balance at the beginning of the month Minimum Cash Balance New borrowing must be in $1,000 increments Tax Information Income tax rate $30,000 Taxes are paid in the month after they are incurred (expensed) Dividend Information Cash dividend declared on September 20, 2023 130,000 15.00% Cash dividend paid on October 15, 2023 $25,000 Expected Sales (all sales are credit sales) $800,000September October $980,000November Collections of Accounts Receivable Month of Sale Month following Sale 24% Cost of Goods Sold percentage of sales 44% Inventory Purchase Information Purchases paid in current month Purchases paid in next month Purchases are all on credit Planned ending inventory as a percentage of next month's Cost of Goods Sold 76% Sales Commission Information Sales commissions as a percentage of sales 6.5% Sales commissions are paid the month after they are incurred. Advertising Expense Information Variable Rate Fixed Cost 78% 22% 8% Insurance policy Information \# of months of insurance coverage paid for each year The policy period is from August 1 to July 31 each year The premium was paid on July 31,2023 The premium will be charged to prepaid insurance General and Administrative Expense Information Fixed cost portion Variable rate (as a percentage of sales) $60,000 Selling and administrative expenses are paid in the month incurred 17.50% $60,000 Fixed Asset Information Purchase Land on September 15, 2023 Current Depreciation expense per month Sold Land at Book Value on September 15, 2023 12 Long-Term Loan Interest Information The interest rate on the long-term debt per month is Interest is paid on the principle balance at the beginning of the month Minimum Cash Balance New borrowing must be in $1,000 increments Tax Information Income tax rate $30,000 Taxes are paid in the month after they are incurred (expensed) Dividend Information Cash dividend declared on September 20, 2023 130,000 15.00% Cash dividend paid on October 15, 2023 $25,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started