Create a Statement of Cash Flows using the Direct Method for Financing Activities using the information below:

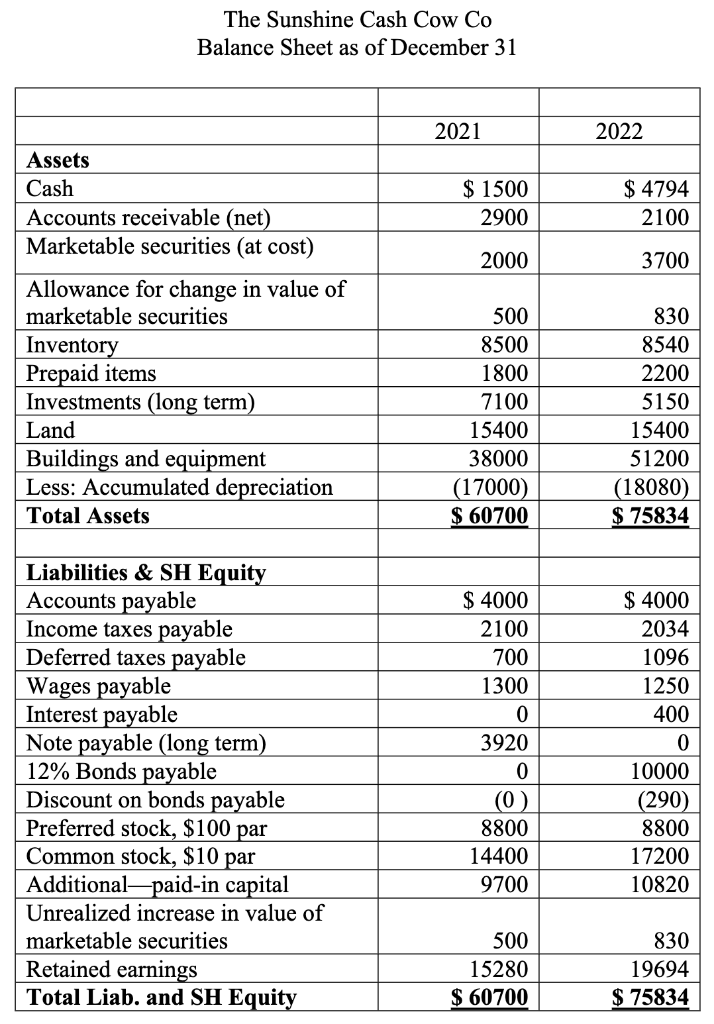

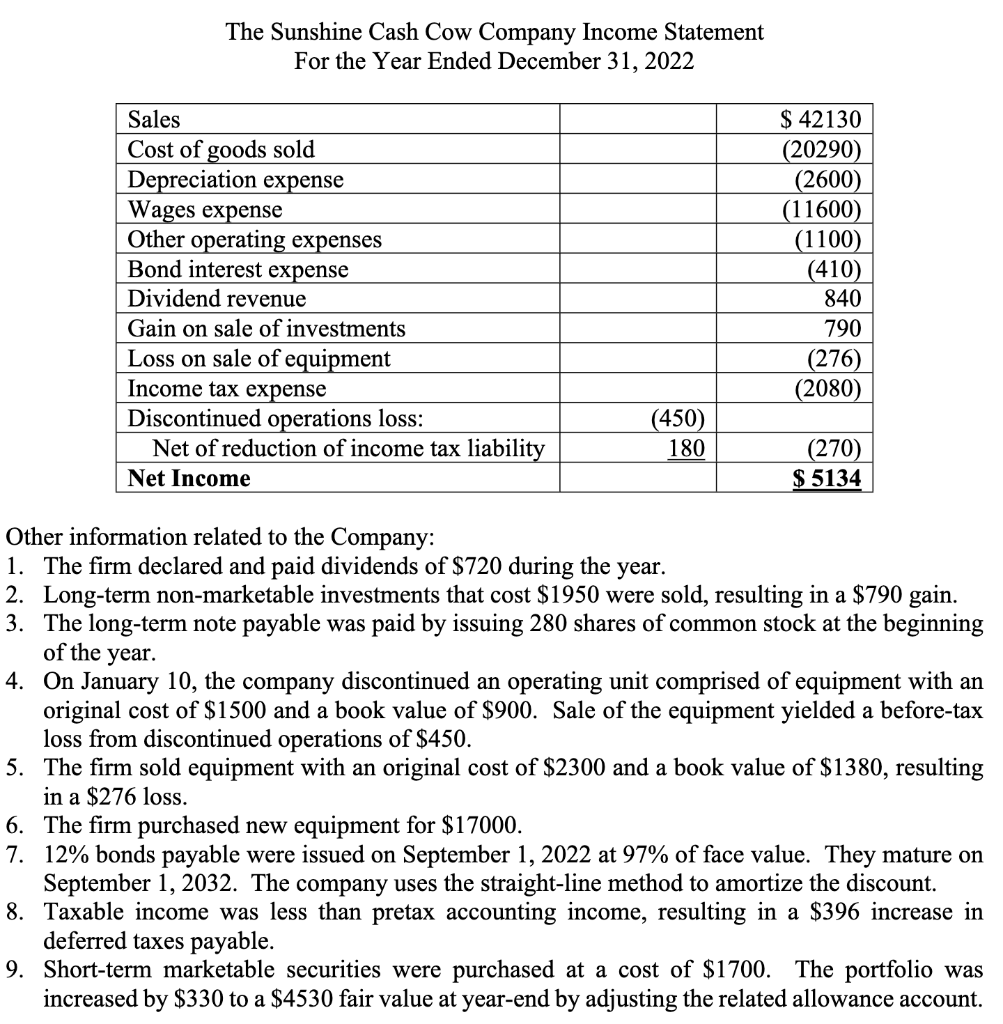

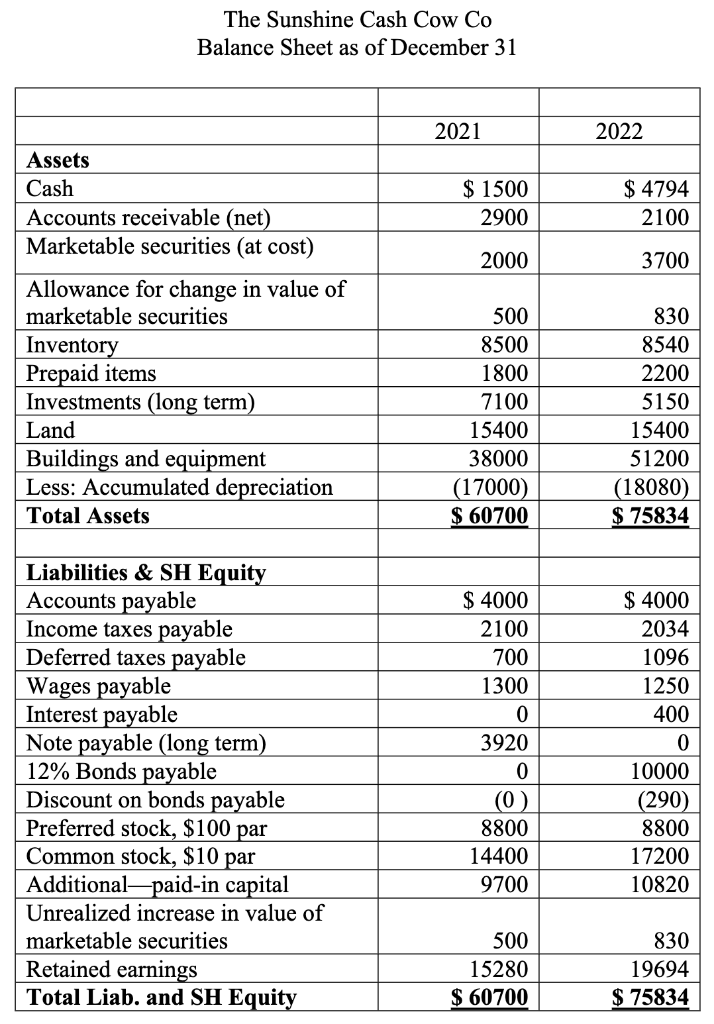

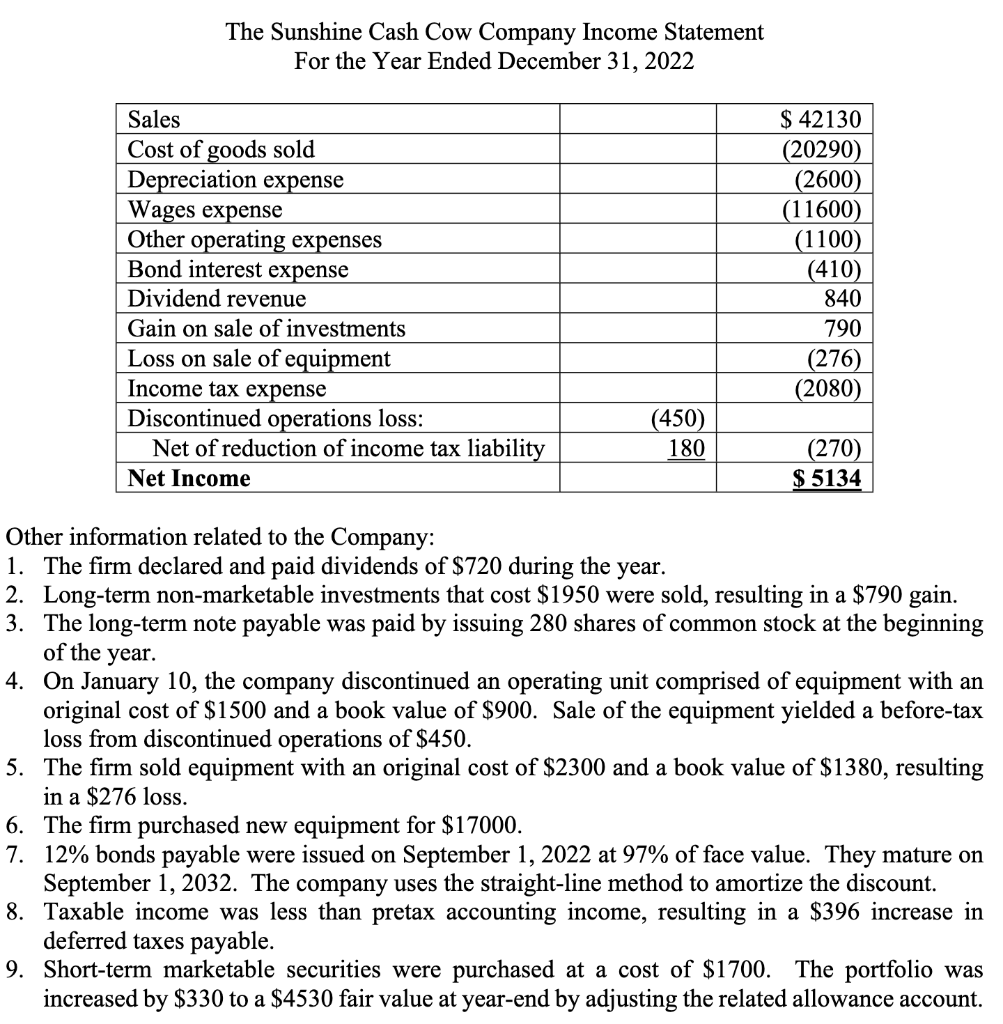

The Sunshine Cash Cow Co The Sunshine Cash Cow Company Income Statement For the Year Ended December 31, 2022 Other information related to the Company: 1. The firm declared and paid dividends of $720 during the year. 2. Long-term non-marketable investments that cost $1950 were sold, resulting in a $790 gain. 3. The long-term note payable was paid by issuing 280 shares of common stock at the beginning of the year. 4. On January 10, the company discontinued an operating unit comprised of equipment with an original cost of $1500 and a book value of $900. Sale of the equipment yielded a before-tax loss from discontinued operations of $450. 5. The firm sold equipment with an original cost of $2300 and a book value of $1380, resulting in a $276 loss. 6. The firm purchased new equipment for $17000. 7. 12% bonds payable were issued on September 1, 2022 at 97% of face value. They mature on September 1, 2032. The company uses the straight-line method to amortize the discount. 8. Taxable income was less than pretax accounting income, resulting in a $396 increase in deferred taxes payable. 9. Short-term marketable securities were purchased at a cost of $1700. The portfolio was increased by $330 to a $4530 fair value at year-end by adjusting the related allowance account. The Sunshine Cash Cow Co The Sunshine Cash Cow Company Income Statement For the Year Ended December 31, 2022 Other information related to the Company: 1. The firm declared and paid dividends of $720 during the year. 2. Long-term non-marketable investments that cost $1950 were sold, resulting in a $790 gain. 3. The long-term note payable was paid by issuing 280 shares of common stock at the beginning of the year. 4. On January 10, the company discontinued an operating unit comprised of equipment with an original cost of $1500 and a book value of $900. Sale of the equipment yielded a before-tax loss from discontinued operations of $450. 5. The firm sold equipment with an original cost of $2300 and a book value of $1380, resulting in a $276 loss. 6. The firm purchased new equipment for $17000. 7. 12% bonds payable were issued on September 1, 2022 at 97% of face value. They mature on September 1, 2032. The company uses the straight-line method to amortize the discount. 8. Taxable income was less than pretax accounting income, resulting in a $396 increase in deferred taxes payable. 9. Short-term marketable securities were purchased at a cost of $1700. The portfolio was increased by $330 to a $4530 fair value at year-end by adjusting the related allowance account