Answered step by step

Verified Expert Solution

Question

1 Approved Answer

create a table of computation of taxable jncome from.house property are due on 1th of every month: Page' 2 of 4 i. He gets 1/3rd

create a table of computation of taxable jncome from.house property

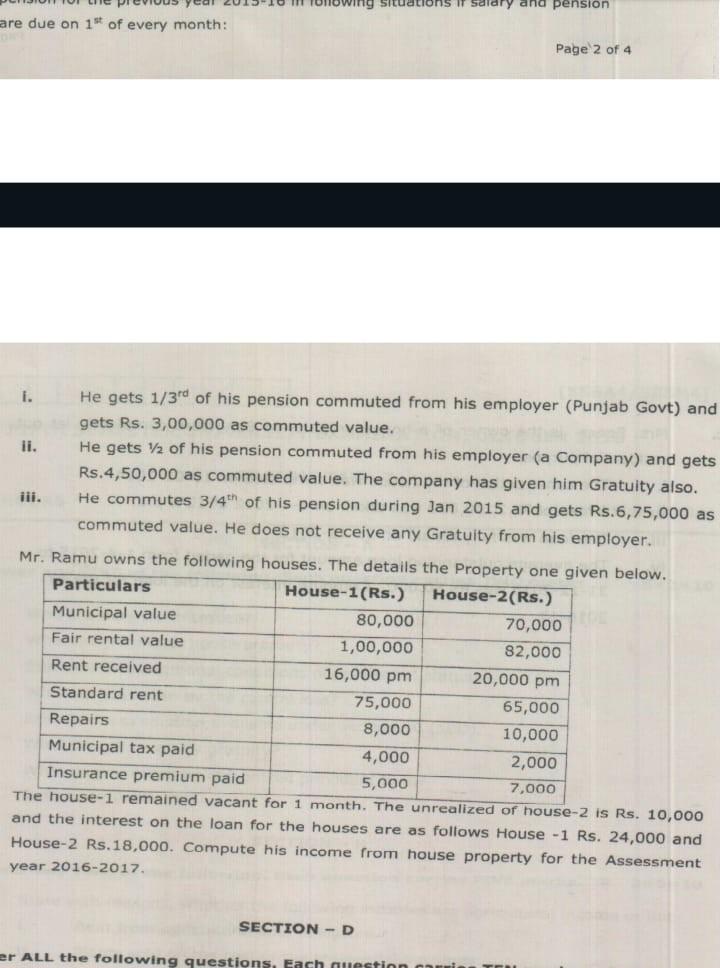

are due on 1th of every month: Page' 2 of 4 i. He gets 1/3rd of his pension commuted from his employer (Punjab Govt) and gets Rs. 3,00,000 as commuted value. ii. He gets 1/2 of his pension commuted from his employer (a Company) and gets Rs.4,50,000 as commuted value. The company has given him Gratuity also. iii. He commutes 3/4th of his pension during Jan 2015 and gets Rs.6,75,000 as commuted value. He does not receive any Gratuity from his employer. Mr. Ramu owns the following houses. The details the Drnnertu nm - a ven below. TI and the interest on the House-2 Rs.18,00 houses are as follows House -1 Rs. 24,000 and year 2016-2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started