Create a waterfall chart that explains the year over year change to WOU's general fund balance due to FY 2020 operations as described by our most recent FY20 budget. The FY19 year end and projected FY20 year end balances can be found on p. 4 of the budget. Structure the chart to begin with the FY19 year end balance and then show additions for revenue from total tuition, state funding, and other revenue as separate items, followed by subtractions for Personel, Services & Supplies, and Net Transfers to arrive at the FY20 year end balance. The revenue and expense can be found on p. 3 of the budget in the middle column "Proposed FY20 Budget".

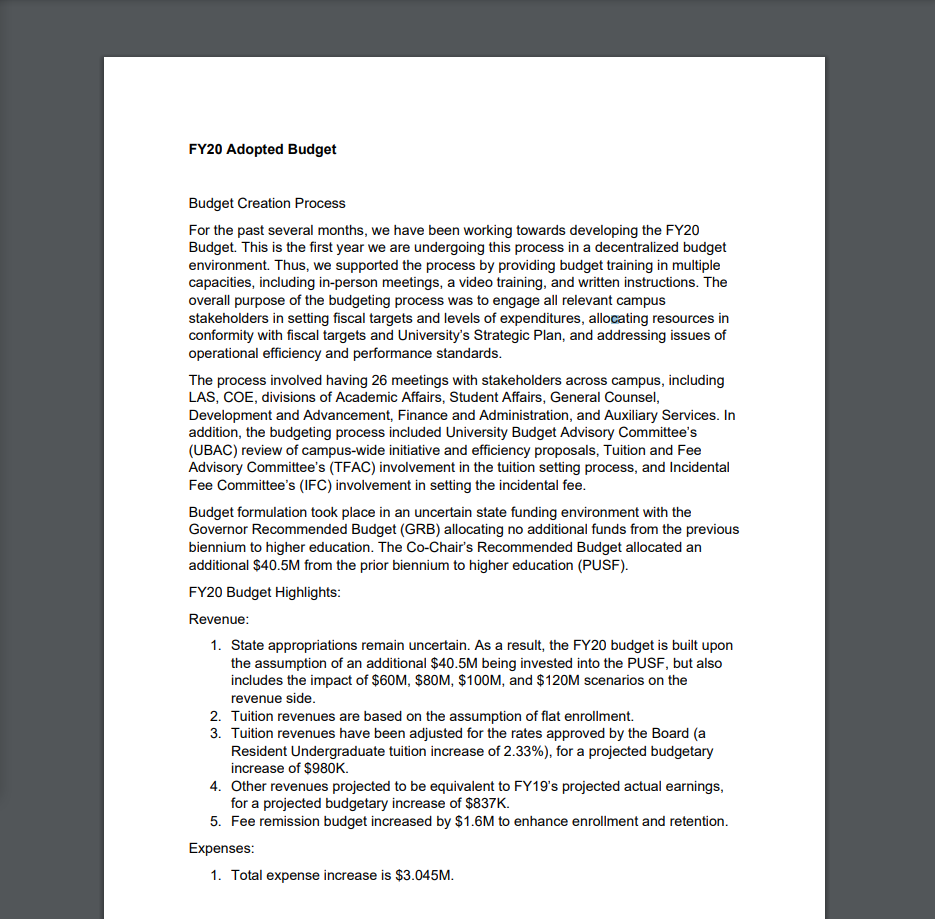

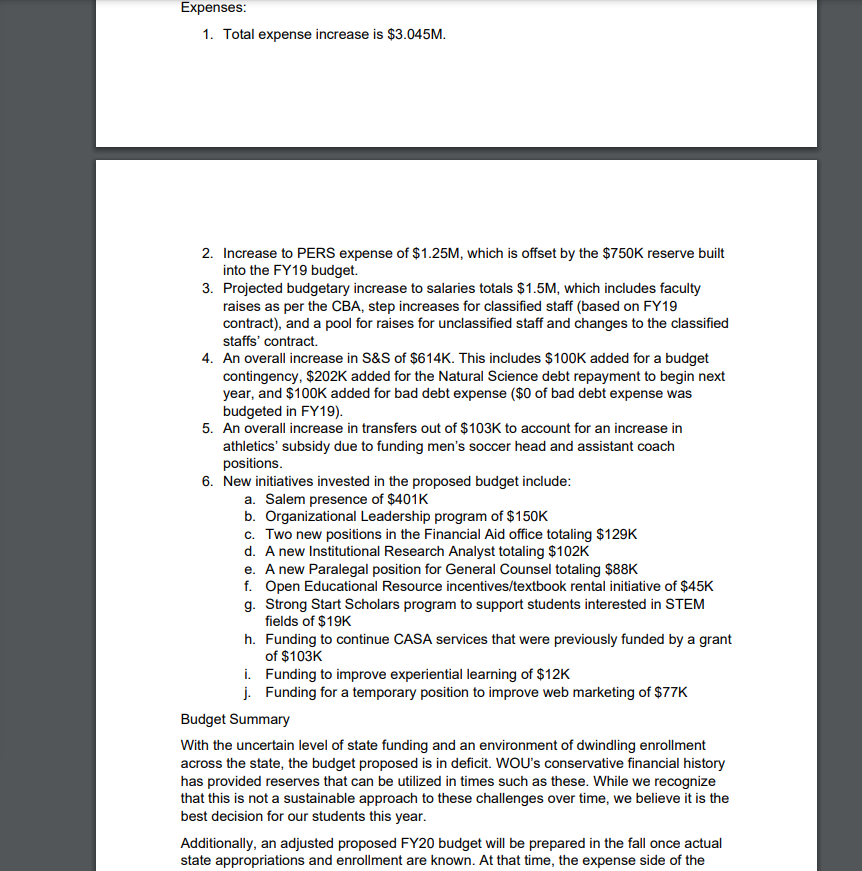

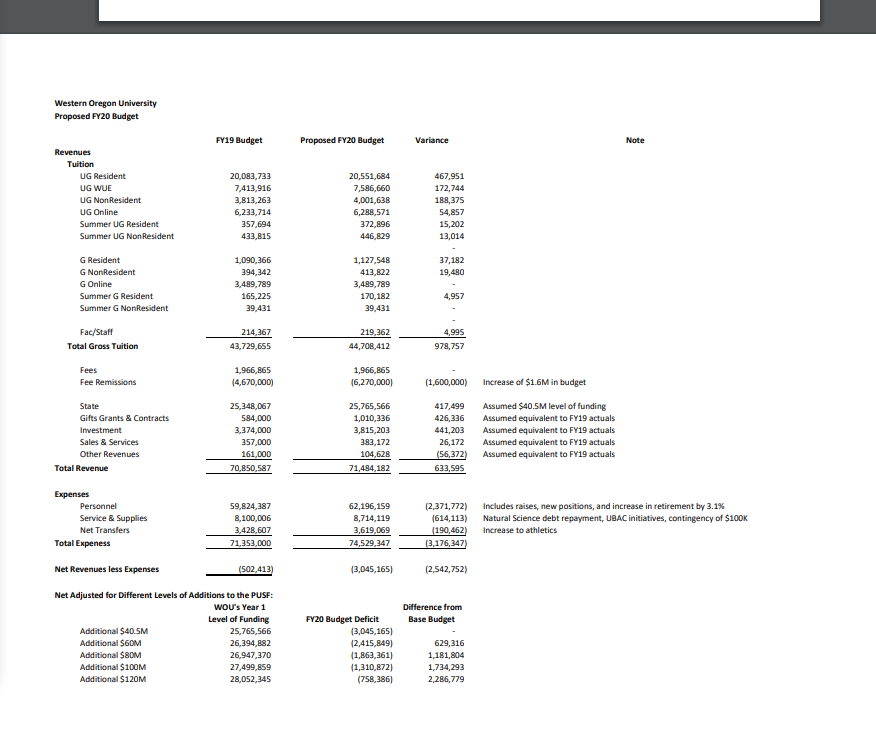

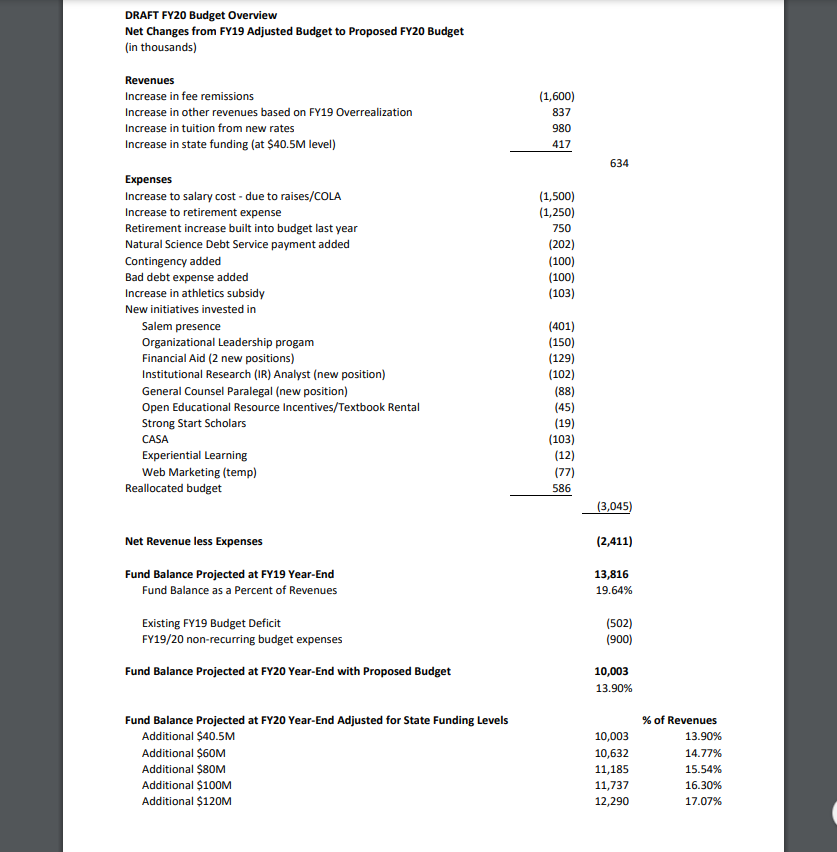

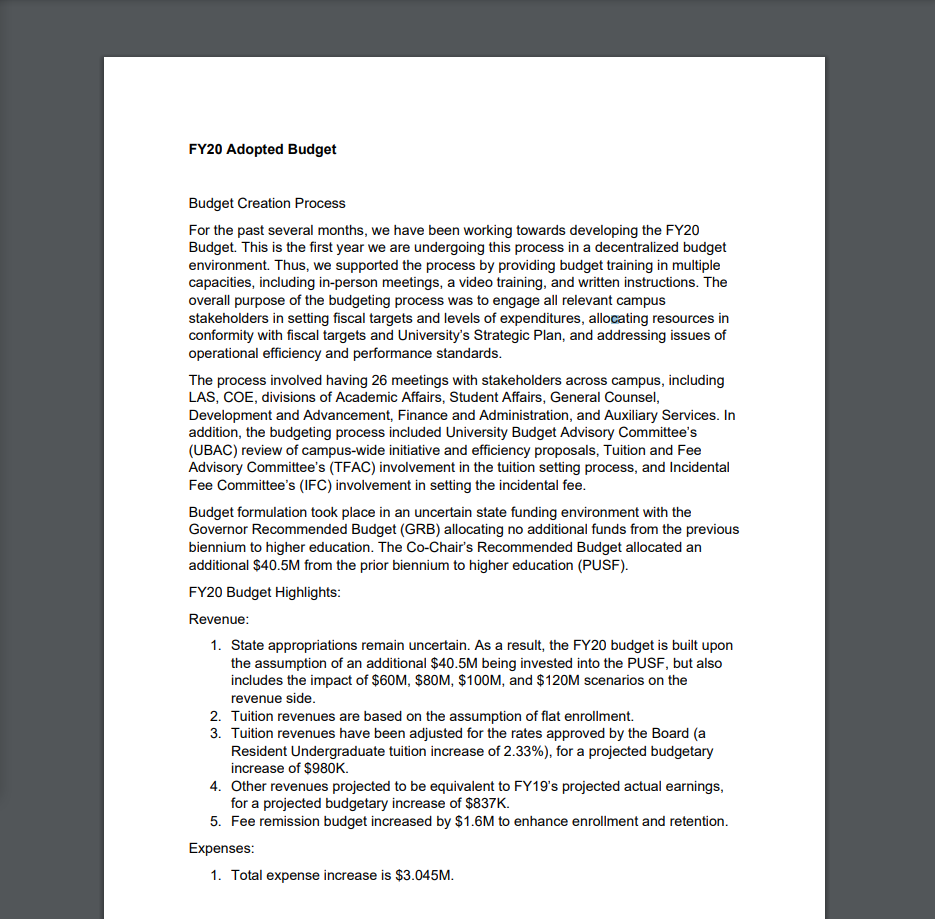

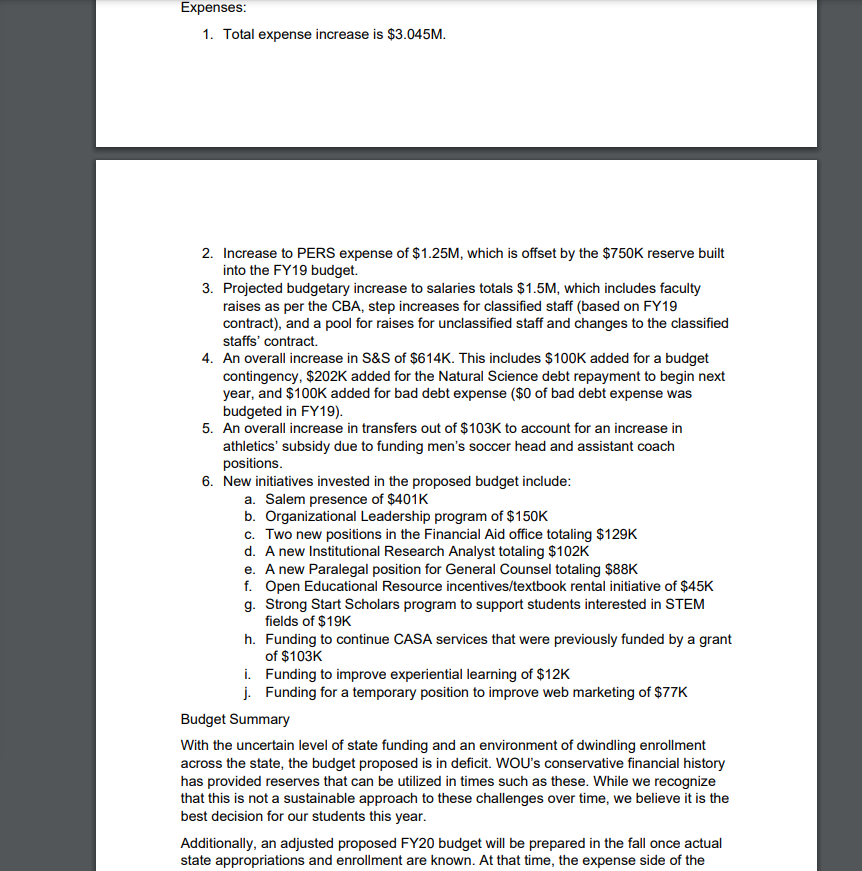

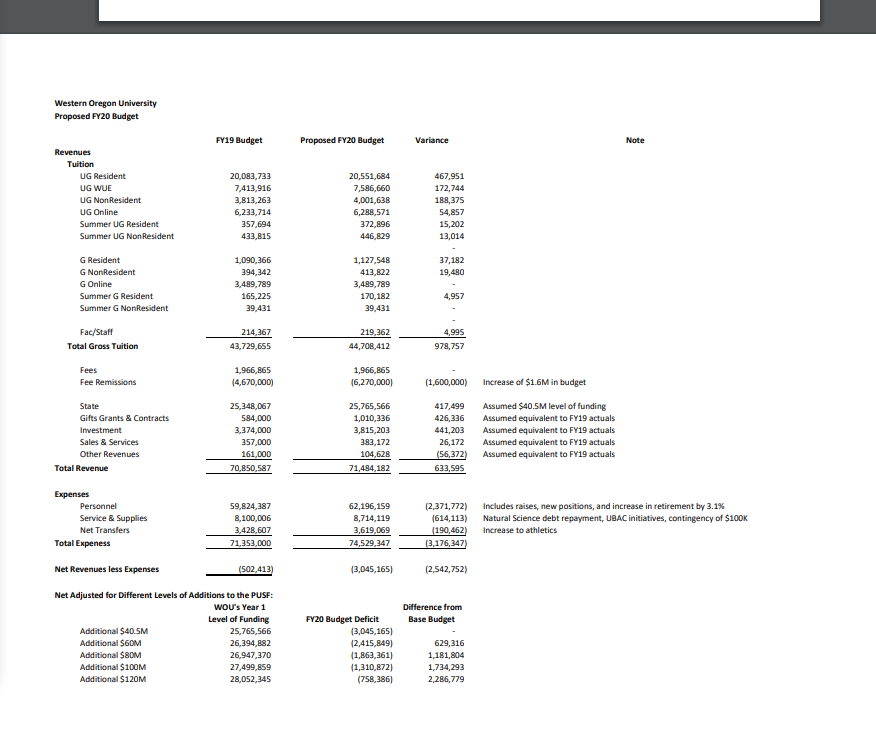

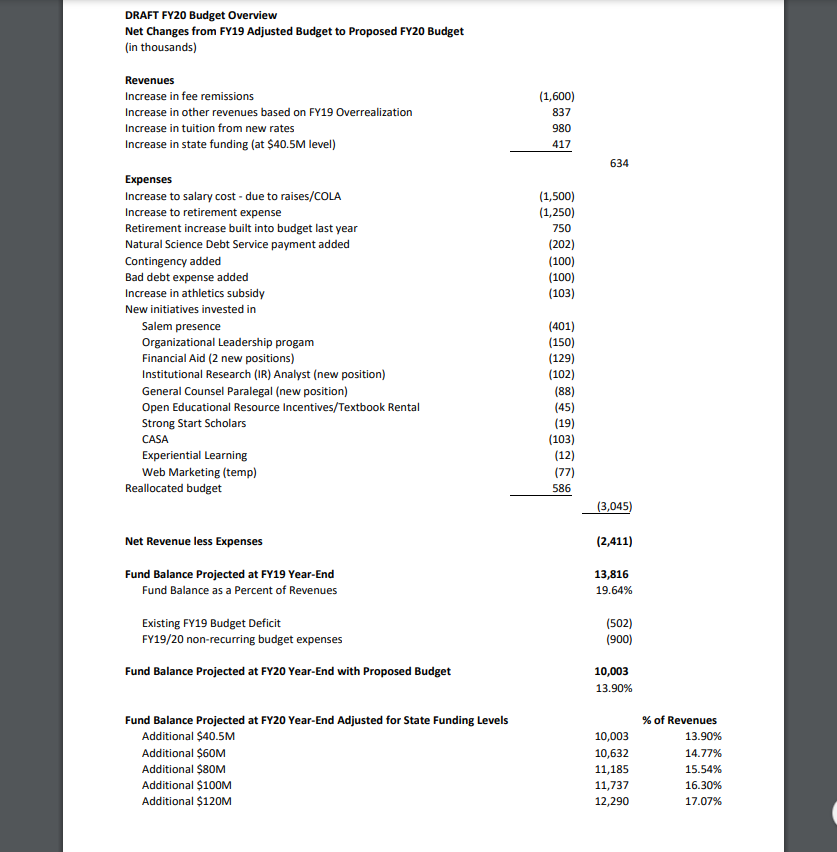

FY20 Adopted Budget Budget Creation Process For the past several months, we have been working towards developing the FY20 Budget. This is the first year we are undergoing this process in a decentralized budget environment. Thus, we supported the process by providing budget training in multiple capacities, including in-person meetings, a video training, and written instructions. The overall purpose of the budgeting process was to engage all relevant campus stakeholders in setting fiscal targets and levels of expenditures, allocating resources in conformity with fiscal targets and University's Strategic Plan, and addressing issues of operational efficiency and performance standards. The process involved having 26 meetings with stakeholders across campus, including LAS, COE, divisions of Academic Affairs, Student Affairs, General Counsel, Development and Advancement, Finance and Administration, and Auxiliary Services. In addition, the budgeting process included University Budget Advisory Committee's (UBAC) review of campus-wide initiative and efficiency proposals, Tuition and Fee Advisory Committee's (TFAC) involvement in the tuition setting process, and Incidental Fee Committee's (IFC) involvement in setting the incidental fee. Budget formulation took place in an uncertain state funding environment with the Governor Recommended Budget (GRB) allocating no additional funds from the previous biennium to higher education. The Co-Chair's Recommended Budget allocated an additional $40.5M from the prior biennium to higher education (PUSF). FY20 Budget Highlights: Revenue: 1. State appropriations remain uncertain. As a result, the FY20 budget is built upon the assumption of an additional $40.5M being invested into the PUSF, but also includes the impact of $60M, $80M, $100M, and $120M scenarios on the revenue side. 2. Tuition revenues are based on the assumption of flat enrollment. 3. Tuition revenues have been adjusted for the rates approved by the Board (a Resident Undergraduate tuition increase of 2.33%), for a projected budgetary increase of $980K. 4. Other revenues projected to be equivalent to FY19's projected actual earnings, for a projected budgetary increase of $837K. 5. Fee remission budget increased by $1.6M to enhance enrollment and retention. Expenses: 1. Total expense increase is $3.045M. Expenses: 1. Total expense increase is $3.045M. 2. Increase to PERS expense of $1.25M, which is offset by the $750K reserve built into the FY19 budget. 3. Projected budgetary increase to salaries totals $1.5M, which includes faculty raises as per the CBA, step increases for classified staff (based on FY19 contract), and a pool for raises for unclassified staff and changes to the classified staffs' contract. 4. An overall increase in S&S of $614K. This includes $100K added for a budget contingency, $202K added for the Natural Science debt repayment to begin next year, and $100K added for bad debt expense ($0 of bad debt expense was budgeted in FY19). 5. An overall increase in transfers out of $103K to account for an increase in athletics' subsidy due to funding men's soccer head and assistant coach positions. 6. New initiatives invested in the proposed budget include: a. Salem presence of $401K b. Organizational Leadership program of $150K C. Two new positions in the Financial Aid office totaling $129K d. A new Institutional Research Analyst totaling $102K e. A new Paralegal position for General Counsel totaling $88K f. Open Educational Resource incentives/textbook rental initiative of $45K g. Strong Start Scholars program to support students interested in STEM fields of $19K h. Funding to continue CASA services that were previously funded by a grant of $103K i. Funding to improve experiential learning of $12K j. Funding for a temporary position to improve web marketing of $77K Budget Summary With the uncertain level of state funding and an environment of dwindling enrollment across the state, the budget proposed is in deficit. WOU's conservative financial history has provided reserves that can be utilized in times such as these. While we recognize that this is not a sustainable approach to these challenges over time, we believe it is the best decision for our students this year. Additionally, an adjusted proposed FY20 budget will be prepared in the fall once actual state appropriations and enrollment are known. At that time, the expense side of the Western Oregon University Proposed FY20 Budget FY19 Budget Proposed FY20 Budget Variance Note Revenues Tuition UG Resident UG WUE UG Non Resident UG Online Summer UG Resident Summer UG Non Resident 20.083,733 7,413,916 3,813,263 6,233,714 357,694 433,815 20,551,684 7,586,660 4,001,638 6,288,571 372,896 446,829 467,951 172,744 188,375 54,857 15,202 13,014 37,182 19,480 G Resident G NonResident G Online Summer G Resident Summer G Non Resident 1,090,366 394,342 3,489,789 165,225 39,431 1,127,548 413,822 3,489,789 170,182 39,431 4,957 214,367 4,995 Fac/Staff Total Grass Tuition 219,362 44,708,412 43,729,655 978,757 Fees Fee Remissions 1,966,865 (4,670,000) 1,966,865 (6,270,000) (1,600,000) Increase of $1.6M in budget State Gifts Grants & Contracts Investment Sales & Services Other Revenues Total Revenue 25,348,067 584,000 3,374,000 357,000 161,000 70,850,587 25,765,566 1,010,336 3,815,203 383,172 104,628 71,484,182 417,499 426,336 441,203 26,172 (56,372) 633,595 Assumed $40.5M level of funding Assumed equivalent to FY19 actuals Assumed equivalent to FY19 actuals Assumed equivalent to FY19 actuals Assumed equivalent to FY19 actuals Expenses Personnel Service & Supplies Net Transfers Total Expeness 59,824,387 8,100,006 3,428,607 71,353,000 62,196,159 8,714,119 3,619,069 74,529,347 (2,371,772) (614,113) (190,462) (3,176,347) Includes raises, new positions, and increase in retirement by 3.1% Natural Science debt repayment, UBAC initiatives, contingency of $100K Increase to athletics Net Revenues less Expenses (502,413) (3,045,165) (2,542,752) Difference from Base Budget Net Adjusted for Different levels of Additions to the PUSF: WOU's Year 1 Level of Funding Additional $40.5M 25,765,566 Additional $60 26,394,882 Additional $8OM 26,947,370 Additional $100M 27,499,859 Additional $120M 28,052,345 FY20 Budget Deficit (3,045,165) (2,415,849) (1,863,361) (1,310,872) (758,386) 629,316 1,181,804 1,734,293 2,286,779 DRAFT FY20 Budget Overview Net Changes from FY19 Adjusted Budget to Proposed FY20 Budget (in thousands) Revenues Increase in fee remissions Increase in other revenues based on FY19 Overrealization Increase in tuition from new rates Increase in state funding (at $40.5M level) (1,600) 837 980 417 634 (1,500) (1,250) 750 (202) (100) (100) (103) Expenses Increase to salary cost - due to raises/COLA Increase to retirement expense Retirement increase built into budget last year Natural Science Debt Service payment added Contingency added Bad debt expense added Increase in athletics subsidy New initiatives invested in Salem presence Organizational Leadership progam Financial Aid (2 new positions) Institutional Research (IR) Analyst (new position) General Counsel Paralegal (new position) Open Educational Resource Incentives/Textbook Rental Strong Start Scholars CASA Experiential Learning Web Marketing (temp) Reallocated budget (401) (150) (129) (102) (88) (45) (19) (103) (12) (77) 586 (3,045) Net Revenue less Expenses (2,411) Fund Balance Projected at FY19 Year-End Fund Balance as a Percent of Revenues 13,816 19.64% Existing FY19 Budget Deficit FY19/20 non-recurring budget expenses (502) (900) Fund Balance Projected at FY20 Year-End with Proposed Budget 10,003 13.90% Fund Balance Projected at FY20 Year-End Adjusted for State Funding Levels Additional $40.5M Additional $60M Additional $80M Additional $100M Additional $120M 10,003 10,632 11,185 11,737 12,290 % of Revenues 13.90% 14.77% 15.54% 16.30% 17.07% FY20 Adopted Budget Budget Creation Process For the past several months, we have been working towards developing the FY20 Budget. This is the first year we are undergoing this process in a decentralized budget environment. Thus, we supported the process by providing budget training in multiple capacities, including in-person meetings, a video training, and written instructions. The overall purpose of the budgeting process was to engage all relevant campus stakeholders in setting fiscal targets and levels of expenditures, allocating resources in conformity with fiscal targets and University's Strategic Plan, and addressing issues of operational efficiency and performance standards. The process involved having 26 meetings with stakeholders across campus, including LAS, COE, divisions of Academic Affairs, Student Affairs, General Counsel, Development and Advancement, Finance and Administration, and Auxiliary Services. In addition, the budgeting process included University Budget Advisory Committee's (UBAC) review of campus-wide initiative and efficiency proposals, Tuition and Fee Advisory Committee's (TFAC) involvement in the tuition setting process, and Incidental Fee Committee's (IFC) involvement in setting the incidental fee. Budget formulation took place in an uncertain state funding environment with the Governor Recommended Budget (GRB) allocating no additional funds from the previous biennium to higher education. The Co-Chair's Recommended Budget allocated an additional $40.5M from the prior biennium to higher education (PUSF). FY20 Budget Highlights: Revenue: 1. State appropriations remain uncertain. As a result, the FY20 budget is built upon the assumption of an additional $40.5M being invested into the PUSF, but also includes the impact of $60M, $80M, $100M, and $120M scenarios on the revenue side. 2. Tuition revenues are based on the assumption of flat enrollment. 3. Tuition revenues have been adjusted for the rates approved by the Board (a Resident Undergraduate tuition increase of 2.33%), for a projected budgetary increase of $980K. 4. Other revenues projected to be equivalent to FY19's projected actual earnings, for a projected budgetary increase of $837K. 5. Fee remission budget increased by $1.6M to enhance enrollment and retention. Expenses: 1. Total expense increase is $3.045M. Expenses: 1. Total expense increase is $3.045M. 2. Increase to PERS expense of $1.25M, which is offset by the $750K reserve built into the FY19 budget. 3. Projected budgetary increase to salaries totals $1.5M, which includes faculty raises as per the CBA, step increases for classified staff (based on FY19 contract), and a pool for raises for unclassified staff and changes to the classified staffs' contract. 4. An overall increase in S&S of $614K. This includes $100K added for a budget contingency, $202K added for the Natural Science debt repayment to begin next year, and $100K added for bad debt expense ($0 of bad debt expense was budgeted in FY19). 5. An overall increase in transfers out of $103K to account for an increase in athletics' subsidy due to funding men's soccer head and assistant coach positions. 6. New initiatives invested in the proposed budget include: a. Salem presence of $401K b. Organizational Leadership program of $150K C. Two new positions in the Financial Aid office totaling $129K d. A new Institutional Research Analyst totaling $102K e. A new Paralegal position for General Counsel totaling $88K f. Open Educational Resource incentives/textbook rental initiative of $45K g. Strong Start Scholars program to support students interested in STEM fields of $19K h. Funding to continue CASA services that were previously funded by a grant of $103K i. Funding to improve experiential learning of $12K j. Funding for a temporary position to improve web marketing of $77K Budget Summary With the uncertain level of state funding and an environment of dwindling enrollment across the state, the budget proposed is in deficit. WOU's conservative financial history has provided reserves that can be utilized in times such as these. While we recognize that this is not a sustainable approach to these challenges over time, we believe it is the best decision for our students this year. Additionally, an adjusted proposed FY20 budget will be prepared in the fall once actual state appropriations and enrollment are known. At that time, the expense side of the Western Oregon University Proposed FY20 Budget FY19 Budget Proposed FY20 Budget Variance Note Revenues Tuition UG Resident UG WUE UG Non Resident UG Online Summer UG Resident Summer UG Non Resident 20.083,733 7,413,916 3,813,263 6,233,714 357,694 433,815 20,551,684 7,586,660 4,001,638 6,288,571 372,896 446,829 467,951 172,744 188,375 54,857 15,202 13,014 37,182 19,480 G Resident G NonResident G Online Summer G Resident Summer G Non Resident 1,090,366 394,342 3,489,789 165,225 39,431 1,127,548 413,822 3,489,789 170,182 39,431 4,957 214,367 4,995 Fac/Staff Total Grass Tuition 219,362 44,708,412 43,729,655 978,757 Fees Fee Remissions 1,966,865 (4,670,000) 1,966,865 (6,270,000) (1,600,000) Increase of $1.6M in budget State Gifts Grants & Contracts Investment Sales & Services Other Revenues Total Revenue 25,348,067 584,000 3,374,000 357,000 161,000 70,850,587 25,765,566 1,010,336 3,815,203 383,172 104,628 71,484,182 417,499 426,336 441,203 26,172 (56,372) 633,595 Assumed $40.5M level of funding Assumed equivalent to FY19 actuals Assumed equivalent to FY19 actuals Assumed equivalent to FY19 actuals Assumed equivalent to FY19 actuals Expenses Personnel Service & Supplies Net Transfers Total Expeness 59,824,387 8,100,006 3,428,607 71,353,000 62,196,159 8,714,119 3,619,069 74,529,347 (2,371,772) (614,113) (190,462) (3,176,347) Includes raises, new positions, and increase in retirement by 3.1% Natural Science debt repayment, UBAC initiatives, contingency of $100K Increase to athletics Net Revenues less Expenses (502,413) (3,045,165) (2,542,752) Difference from Base Budget Net Adjusted for Different levels of Additions to the PUSF: WOU's Year 1 Level of Funding Additional $40.5M 25,765,566 Additional $60 26,394,882 Additional $8OM 26,947,370 Additional $100M 27,499,859 Additional $120M 28,052,345 FY20 Budget Deficit (3,045,165) (2,415,849) (1,863,361) (1,310,872) (758,386) 629,316 1,181,804 1,734,293 2,286,779 DRAFT FY20 Budget Overview Net Changes from FY19 Adjusted Budget to Proposed FY20 Budget (in thousands) Revenues Increase in fee remissions Increase in other revenues based on FY19 Overrealization Increase in tuition from new rates Increase in state funding (at $40.5M level) (1,600) 837 980 417 634 (1,500) (1,250) 750 (202) (100) (100) (103) Expenses Increase to salary cost - due to raises/COLA Increase to retirement expense Retirement increase built into budget last year Natural Science Debt Service payment added Contingency added Bad debt expense added Increase in athletics subsidy New initiatives invested in Salem presence Organizational Leadership progam Financial Aid (2 new positions) Institutional Research (IR) Analyst (new position) General Counsel Paralegal (new position) Open Educational Resource Incentives/Textbook Rental Strong Start Scholars CASA Experiential Learning Web Marketing (temp) Reallocated budget (401) (150) (129) (102) (88) (45) (19) (103) (12) (77) 586 (3,045) Net Revenue less Expenses (2,411) Fund Balance Projected at FY19 Year-End Fund Balance as a Percent of Revenues 13,816 19.64% Existing FY19 Budget Deficit FY19/20 non-recurring budget expenses (502) (900) Fund Balance Projected at FY20 Year-End with Proposed Budget 10,003 13.90% Fund Balance Projected at FY20 Year-End Adjusted for State Funding Levels Additional $40.5M Additional $60M Additional $80M Additional $100M Additional $120M 10,003 10,632 11,185 11,737 12,290 % of Revenues 13.90% 14.77% 15.54% 16.30% 17.07%