Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Congratulations, you have just been hired by Billy Bob to do his accounting work. Billy Bob does not like to be disappointed; therefore, he

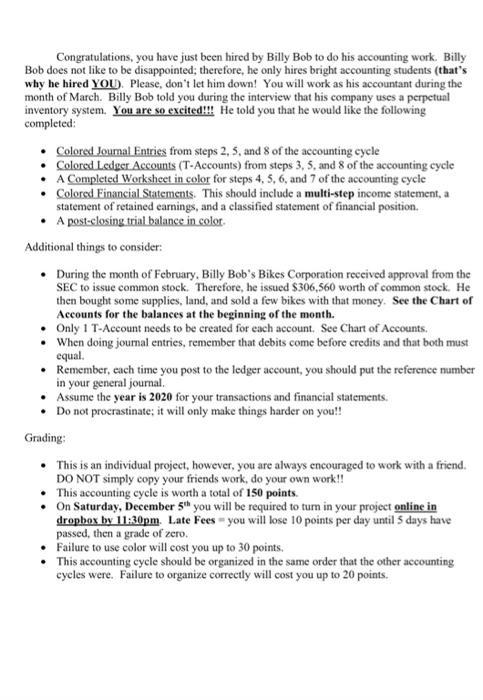

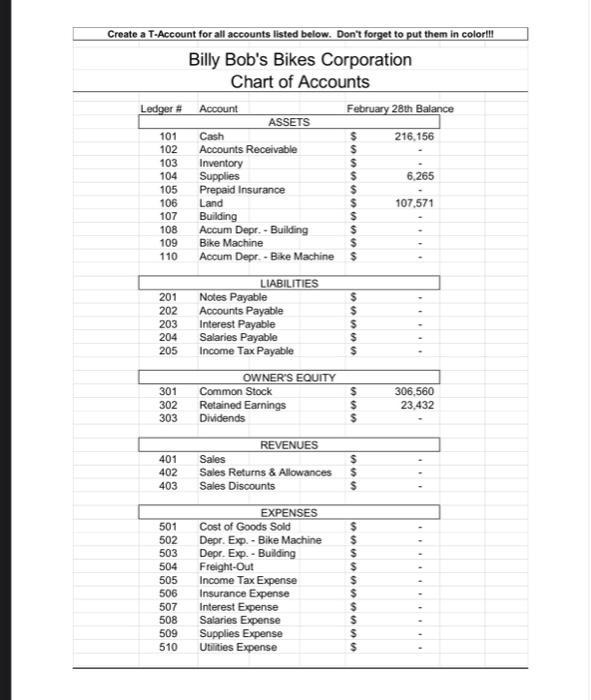

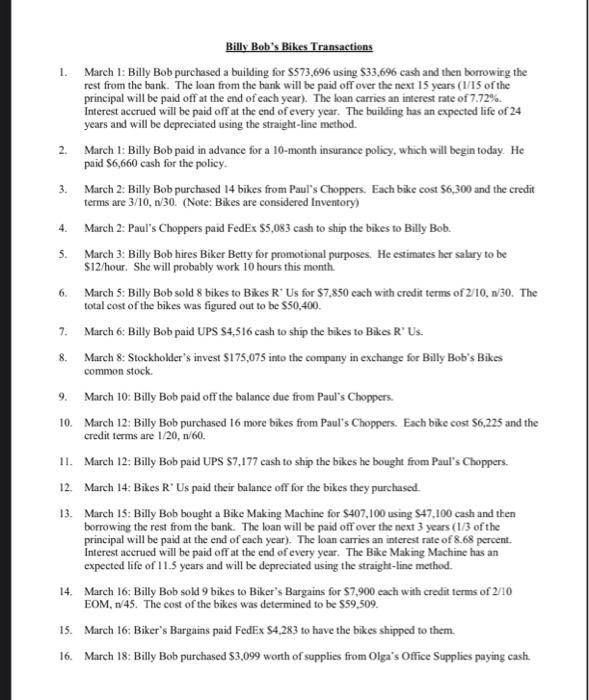

Congratulations, you have just been hired by Billy Bob to do his accounting work. Billy Bob does not like to be disappointed; therefore, he only hires bright accounting students (that's why he hired YOU). Please, don't let him down! You will work as his accountant during the month of March. Billy Bob told you during the interview that his company uses a perpetual inventory system. You are so excited!!! He told you that he would like the following completed: Colored Journal Entries from steps 2, 5, and 8 of the accounting cycle Colored Ledger Accounts (T-Accounts) from steps 3, 5, and 8 of the accounting cycle A Completed Worksheet in color for steps 4, 5, 6, and 7 of the accounting cycle Colored Financial Statements. This should include a multi-step income statement, a statement of retained earnings, and a classified statement of financial position. A post-closing trial balance in color. Additional things to consider: During the month of February, Billy Bob's Bikes Corporation received approval from the SEC to issue common stock. Therefore, he issued $306,560 worth of common stock. He then bought some supplies, land, and sold a few bikes with that money. See the Chart of Accounts for the balances at the beginning of the month. Only 1 T-Account needs to be created for each account. See Chart of Accounts. When doing journal entries, remember that debits come before credits and that both must equal. Remember, each time you post to the ledger account, you should put the reference number in your general journal. Assume the year is 2020 for your transactions and financial statements. Do not procrastinate; it will only make things harder on you!! Grading: This is an individual project, however, you are always encouraged to work with a friend. DO NOT simply copy your friends work, do your own work!! This accounting cycle is worth a total of 150 points. On Saturday, December 5th you will be required to turn in your project online in dropbox by 11:30pm. Late Fees you will lose 10 points per day until 5 days have passed, then a grade of zero. Failure to use color will cost you up to 30 points. This accounting cycle should be organized in the same order that the other accounting cycles were. Failure to organize correctly will cost you up to 20 points. Create a T-Account for all accounts listed below. Don't forget to put them in color!!! Billy Bob's Bikes Corporation Chart of Accounts Ledger # 101 102 103 104 105 106 107 108 109 110 201 202 203 204 205 301 302 303 401 402 403 Account ASSETS Cash Accounts Receivable Inventory Supplies Prepaid Insurance Land Building Accum Depr.- Building Bike Machine Accum Depr.- Bike Machine LIABILITIES Notes Payable Accounts Payable Interest Payable Salaries Payable Income Tax Payable OWNER'S EQUITY Common Stock Retained Earnings Dividends REVENUES Sales Sales Returns & Allowances Sales Discounts EXPENSES 501 502 503 504 505 Income Tax Expense 506 507 508 509 510 Cost of Goods Sold Depr. Exp. - Bike Machine Depr. Exp. - Building Freight-Out Insurance Expense Interest Expense Salaries Expense Supplies Expense Utilities Expense February 28th Balance $ $ $ SSSSSSSS $ $ $ $ $ $ $ SSSSS $ SSS 555 $ SSSSSSSSSS $ $ $ $ $ $ $ $ $ 216,156 6,265 107,571 .. 306,560 23,432 Billy Bob's Bikes Transactions 1. March 1: Billy Bob purchased a building for $573,696 using $33,696 cash and then borrowing the rest from the bank. The loan from the bank will be paid off over the next 15 years (1/15 of the principal will be paid off at the end of each year). The loan carries an interest rate of 7.72% Interest accrued will be paid off at the end of every year. The building has an expected life of 24 years and will be depreciated using the straight-line method. 2. March 1: Billy Bob paid in advance for a 10-month insurance policy, which will begin today. He paid $6,660 cash for the policy. 3. March 2: Billy Bob purchased 14 bikes from Paul's Choppers. Each bike cost $6,300 and the credit terms are 3/10, n/30. (Note: Bikes are considered Inventory) March 2: Paul's Choppers paid FedEx $5,083 cash to ship the bikes to Billy Bob. March 3: Billy Bob hires Biker Betty for promotional purposes. He estimates her salary to be $12/hour. She will probably work 10 hours this month. 4. 5. March 5: Billy Bob sold 8 bikes to Bikes R Us for $7,850 each with credit terms of 2/10, n/30. The total cost of the bikes was figured out to be $50,400. 7. March 6: Billy Bob paid UPS $4,516 cash to ship the bikes to Bikes R Us. 8. 6. March 8: Stockholder's invest $175,075 into the company in exchange for Billy Bob's Bikes common stock. 9. March 10: Billy Bob paid off the balance due from Paul's Choppers. 10. March 12: Billy Bob purchased 16 more bikes from Paul's Choppers. Each bike cost $6,225 and the credit terms are 1/20, n/60. 11. March 12: Billy Bob paid UPS S7,177 cash to ship the bikes he bought from Paul's Choppers. 12. March 14: Bikes R' Us paid their balance off for the bikes they purchased. 13. March 15: Billy Bob bought a Bike Making Machine for $407,100 using $47,100 cash and then borrowing the rest from the bank. The loan will be paid off over the next 3 years (1/3 of the principal will be paid at the end of each year). The loan carries an interest rate of 8.68 percent. Interest accrued will be paid off at the end of every year. The Bike Making Machine has an expected life of 11.5 years and will be depreciated using the straight-line method. 14. March 16: Billy Bob sold 9 bikes to Biker's Bargains for $7,900 each with credit terms of 2/10 EOM, n/45. The cost of the bikes was determined to be $59,509. 15. March 16: Biker's Bargains paid FedEx $4,283 to have the bikes shipped to them. 16. March 18: Billy Bob purchased $3,099 worth of supplies from Olga's Office Supplies paying cash. 17. March 19: Billy Bob's pay period ends and he now owes his employees $5,304 in salaries. These salaries will be paid on March 25 18. March 20: Billy Bob returned 4 of the bikes he bought from Paul's Choppers. They credited $24,900 to his account. 19. March 21: Billy Bob's Bikes paid cash dividends of $5,555. 20. March 22: Billy Bob purchased 12 bikes from Carly's Cars. Each bike cost $5,999 and the credit terms are 2/10 EOM, n90. 21. March 22: Billy Bob paid UPS $6,782 to have the bikes shipped to him. 22. March 23: Biker's Bargains returned two of the bikes they bought on March 16 because parts were falling off them. The cost of the bikes to Billy Bob was figured out to be $13,224. 23. March 25: Billy Bob paid his employees the $5,304 in salaries owed. 24. March 27: Billy Bob sells 18 bikes to Biker Chick's Chop Shop for $7,995 each with credit terms of 3/10, n/30. The cost of the bikes was determined to be $114,611. 25. March 27: Billy Bob paid FedEx $6,521 to ship the bikes to Biker Chick's Chop Shop. 26. March 28: Biker's Bargains paid their balance off for the bikes they purchased. 27. March 29: Billy Bob paid a utilities bill in the amount of $1,894. 28. March 30: Billy Bob paid off the balance due from Paul's Choppers. 28 B. Bob's Adjustments On March 31, you notice the following: a) You need to recognize depreciation on the building b) You have accrued salaries of $4,769 c) You have $1,525 worth of supplies on hand d) You need to recognize interest accumulated on the 2 bank loans e) You have used up one months worth of insurance 1) You need to recognize depreciation on the bike making machine g) You need to recognize/accrue federal income taxes of 32%. Round to the nearest dollar if needed. Hint: compute adjusted income based on all preceding information, and then determine and record income tax expense. The Accounting Cycle 1. Analyze business transactions 2. Journalize the transactions 3. Post to ledger accounts 4. Prepare a trial balance 5. Journalize and post adjusting entries 6. Prepare an adjusted trial balance 7. Prepare the financial statements (I/S, Stmt of RE, B/S) 8. Journalize and post closing entries 9. Prepare a post-closing trial balance Bikers Halle More F Than People Do

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 What is the current ratio and what does it indicate about Billy Bobs Bikes Corporation The current ratio is a measure of a companys ability to pay its shortterm obligations with its current assets I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started