Answered step by step

Verified Expert Solution

Question

1 Approved Answer

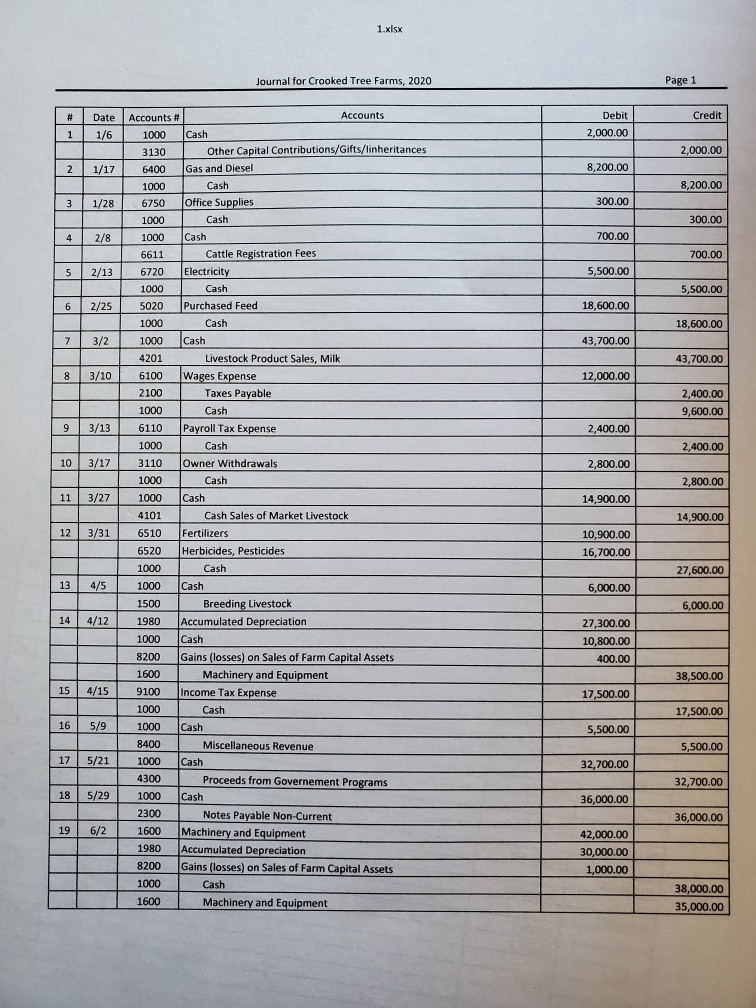

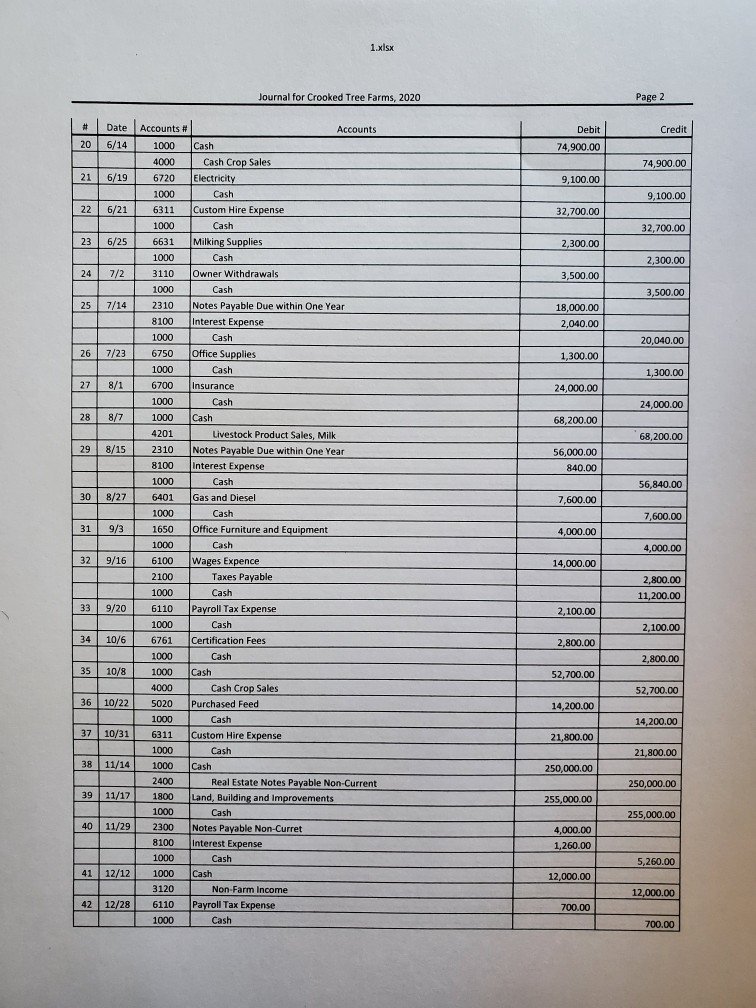

create an adjusted trial balance using the journal entries for 2020 and the 2019 balance sheet. also calculate depreciation expense. 1.xlsx Journal for Crooked Tree

create an adjusted trial balance using the journal entries for 2020 and the 2019 balance sheet. also calculate depreciation expense.

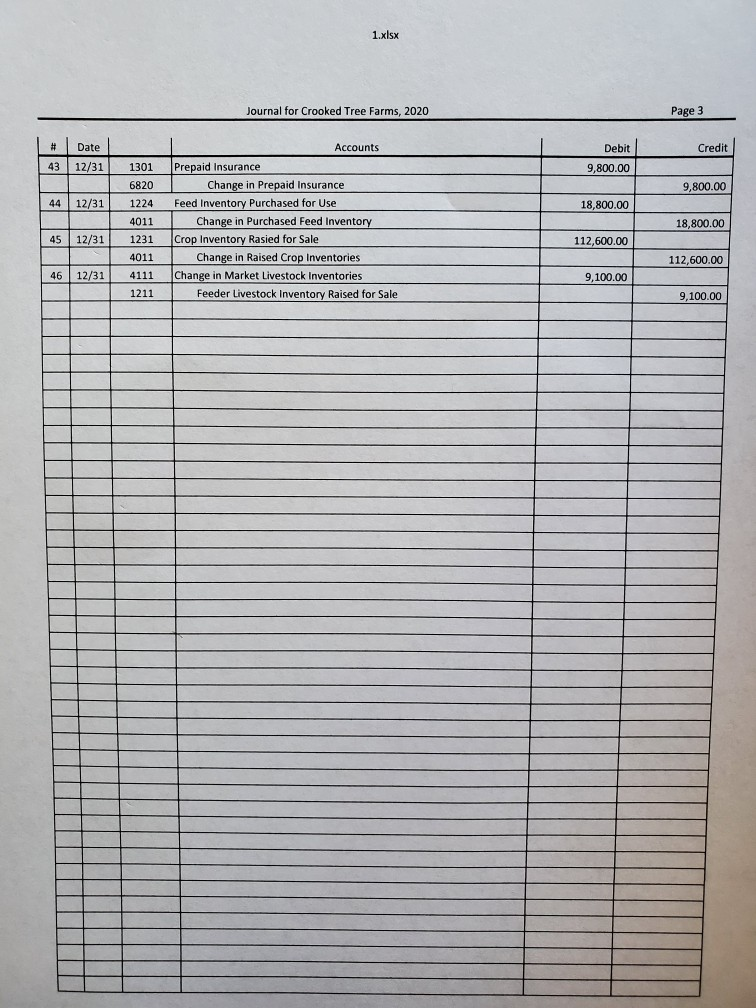

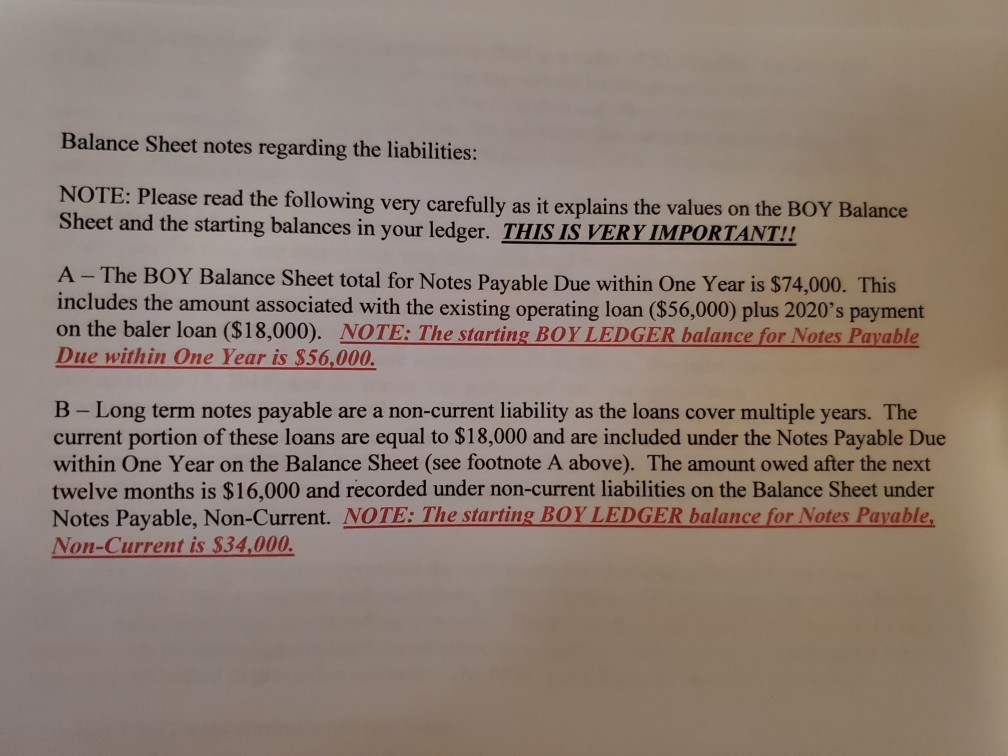

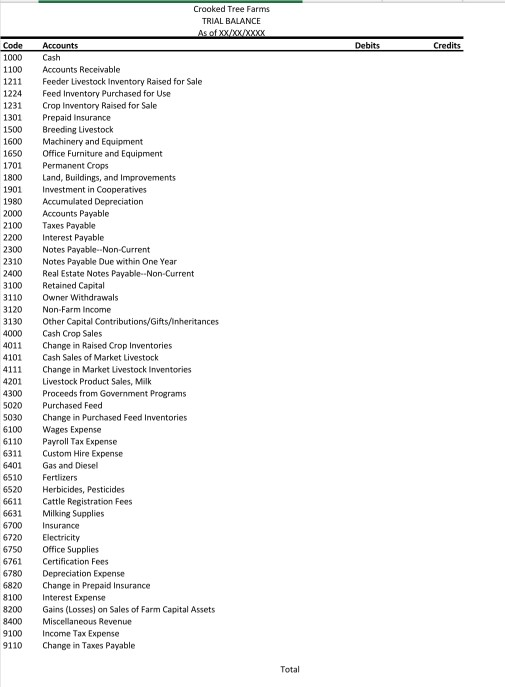

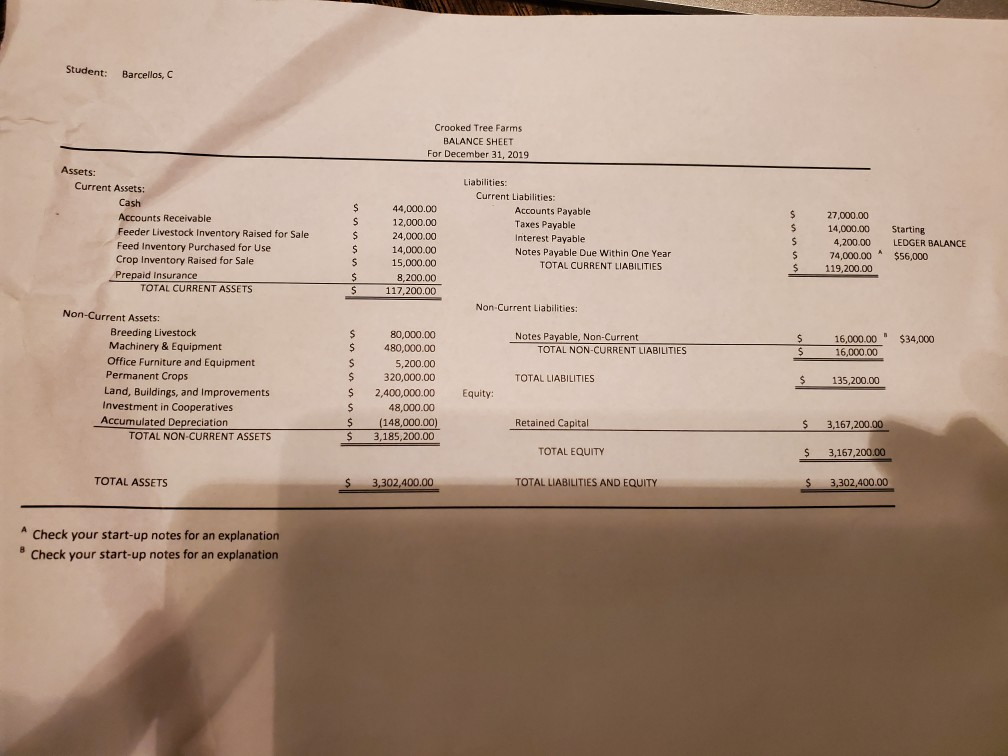

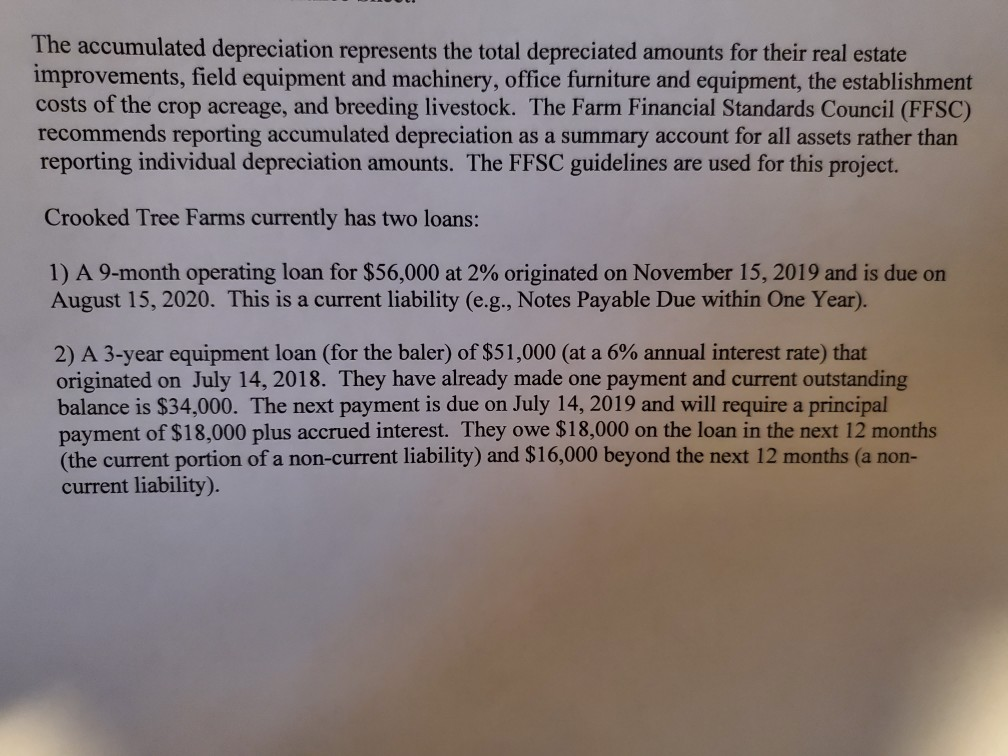

1.xlsx Journal for Crooked Tree Farms, 2020 Page 1 # Credit Date 1/6 Debit 2,000.00 1 Accounts # Accounts 1000 Cash 3130 Other Capital Contributions/Gifts/linheritances 6400 Gas and Diesel 2,000.00 2 1/17 8,200.00 1000 Cash 8,200.00 3 1/28 Office Supplies 300.00 6750 1000 1000 Cash 300.00 4 2/8 700.00 Cash Cattle Registration Fees Electricity 700.00 5 2/13 5,500.00 5,500.00 6 2/25 Cash Purchased Feed Cash 18,600.00 18,600.00 6611 6720 1000 5020 1000 1000 4201 6100 2100 1000 7 3/2 43,700.00 43,700.00 8 3/10 12,000.00 2,400.00 9.600.00 9 3/13 6110 2,400.00 2,400.00 10 3/17 2,800.00 1000 3110 1000 1000 4101 2,800.00 11 3/27 14,900.00 14,900.00 12 3/31 6510 10,900.00 16,700.00 6520 1000 Cash Livestock Product Sales, Milk Wages Expense Taxes Payable Cash Payroll Tax Expense Cash Owner Withdrawals Cash Cash Cash Sales of Market Livestock Fertilizers Herbicides, Pesticides Cash Cash Breeding Livestock Accumulated Depreciation Cash Gains (losses) on Sales of Farm Capital Assets Machinery and Equipment Income Tax Expense Cash Cash Miscellaneous Revenue Cash Proceeds from Governement Programs Cash 27,600.00 13 4/5 1000 6,000.00 1500 6,000.00 14 4/12 1980 1000 27,300.00 10,800.00 400.00 8200 1600 38,500.00 15 4/15 17,500.00 9100 1000 17,500.00 16 5/9 5,500.00 1000 8400 1000 5,500.00 17 5/21 32,700.00 4300 32,700.00 18 5/29 1000 36,000.00 36,000.00 19 6/2 2300 1600 1980 8200 1000 Notes Payable Non-Current Machinery and Equipment Accumulated Depreciation Gains (losses) on Sales of Farm Capital Assets Cash Machinery and Equipment 42,000.00 30,000.00 1,000.00 1600 38,000.00 35,000.00 1.xlsx Journal for Crooked Tree Farms, 2020 Page 2 # Credit Date 6/14 20 Accounts # 1000 4000 Debit 74,900.00 74,900.00 21 6/19 6720 9,100.00 9,100.00 22 6/21 32,700.00 32,700.00 23 6/25 2,300.00 Accounts Cash Cash Crop Sales Electricity Cash Custom Hire Expense Cash Milking Supplies Cash Owner Withdrawals Cash Cash Notes Payable Due within One Year Interest Expense Cash Office Supplies Cash Cach 1000 6311 100 1000 6631 100 1000 40 3110 100 1000 120 2310 8100 100 1000 2.300.00 24 7/2 3,500.00 3,500.00 25 7/14 18,000.00 2,040.00 20,040.00 26 7/23 1,300.00 1,300.00 27 8/1 Insurance 24,000.00 Cash 24,000.00 28 8/7 68,200.00 68,200.00 29 8/15 56,000.00 840.00 56,840.00 30 8/27 7,600.00 7,600.00 31 9/3 6750 10 1000 200 6700 100 1000 1000 1000 4201 2210 2310 8100 1000 6401 1000 1650 1000 6100 2100 1000 --- 6110 1000 6761 1000 1000 4000 5020 Cash Livestock Product Sales, Milk Notes Payable Due within One Year Interest Expense Cash Gas and Diesel Cash Office Furniture and Equipment Cash Wages Expence Taxes Payable Cash Payroll Tax Expense Cash Certification Fees Cash 4,000.00 4,000.00 32 9/16 14,000.00 2,800.00 11,200.00 33 9/20 2,100.00 2,100.00 34 10/6 2,800.00 2,800.00 35 10/8 52,700.00 Cash Cash Crop Sales Purchased Feed 52,700.00 36 10/22 14,200.00 1000 Cash 14,200.00 37 10/31 21,800.00 21,800.00 38 11/14 250,000.00 6311 1000 1000 2400 1800 1000 2300 8100 250,000.00 39 11/17 Custom Hire Expense Cash Cash Real Estate Notes Payable Non-Current Land, Building and improvements Cash Notes Payable Non-Curret Interest Expense Cash Cash 255,000.00 255,000.00 40 11/29 4,000.00 1,260.00 1000 5,260.00 41 12/12 12,000.00 1000 3120 6110 1000 12,000.00 42 12/28 Non-Farm Income Payroll Tax Expense Cash 700.00 700.00 1.xlsx Journal for Crooked Tree Farms, 2020 Page 3 Credit # Date 43 12/31 Debit 9,800.00 1301 6820 9,800.00 44 12/31 18,800.00 1224 4011 Accounts Prepaid Insurance Change in Prepaid Insurance Feed Inventory Purchased for Use Change in Purchased Feed Inventory Crop Inventory Rasied for Sale Change in Raised Crop Inventories Change in Market Livestock Inventories Feeder Livestock Inventory Raised for Sale 18,800.00 45 12/31 1231 112,600.00 112,600.00 4011 4111 46 12/31 9,100.00 1211 9,100.00 Balance Sheet notes regarding the liabilities: NOTE: Please read the following very carefully as it explains the values on the BOY Balance Sheet and the starting balances in your ledger. THIS IS VERY IMPORTANT!! A - The BOY Balance Sheet total for Notes Payable Due within One Year is $74,000. This includes the amount associated with the existing operating loan ($56,000) plus 2020's payment on the baler loan ($18,000). NOTE: The starting BOY LEDGER balance for Notes Payable Due within One Year is $56,000. B - Long term notes payable are a non-current liability as the loans cover multiple years. The current portion of these loans are equal to $18,000 and are included under the Notes Payable Due with One Year on the Balance Sheet (see footnote A above). The amount ow after the next twelve months is $16,000 and recorded under non-current liabilities on the Balance Sheet under Notes Payable, Non-Current. NOTE: The starting BOY LEDGER balance for Notes Payable, Non-Current is $34,000. Debits Credits Code 1000 1100 1211 1224 1231 1301 1500 1600 1650 1701 1800 1901 1980 2000 2100 2200 2300 2310 2400 3100 3110 3120 3130 4000 4011 4101 4111 4201 4300 5020 5030 6100 6110 6311 6401 6510 6520 6611 6631 6700 6720 6750 6761 6780 6820 8100 8200 8400 9100 9110 Crooked Tree Farms TRIAL BALANCE As of xx/xx/XXXX Accounts Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Insurance Breeding Livestock Machinery and Equipment Office Furniture and Equipment Permanent Crops Land, Buildings, and Improvements Investment in Cooperatives Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable--Non-Current Notes Payable Due within One Year Real Estate Notes Payable. Non-Current Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/Inheritances Cash Crop Sales Change in Raised Crop Inventories Cash Sales of Market Livestock Change in Market Livestock Inventories Livestock Product Sales, Milk Proceeds from Government Programs Purchased Feed Change in Purchased Feed Inventories Wages Expense Payroll Tax Expense Custom Hire Expense Gas and Diesel Fertlizers Herbicides, Pesticides Cattle Registration Fees Milking Supplies Insurance Electricity Office Supplies Certification Fees Depreciation Expense Change in Prepaid Insurance Interest Expense Gains (Losses) on Sales of Farm Capital Assets Miscellaneous Revenue Income Tax Expense Change in Taxes Payable Total Student: Barcellos, Crooked Tree Farms BALANCE SHEET For December 31, 2019 Assets: Current Assets: Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Insurance TOTAL CURRENT ASSETS $ S $ $ S 44,000.00 12,000.00 24,000.00 14,000.00 15,000.00 8,200.00 117,200.00 Liabilities: Current Liabilities Accounts Payable Taxes Payable Interest Payable Notes Payable Due Within One Year TOTAL CURRENT LIABILITIES $ $ $ 5 $ 27,000.00 14,000.00 4,200.00 74,000.00 119,200.00 Starting LEDGER BALANCE $56,000 $ $ Non-Current Liabilities: Notes Payable, Non-Current TOTAL NON-CURRENT LIABILITIES $ $ 16,000.00 16,000.00 $34,000 Non-Current Assets: Breeding Livestock Machinery & Equipment Office Furniture and Equipment Permanent Crops Land, Buildings, and improvements Investment in Cooperatives Accumulated Depreciation TOTAL NON-CURRENT ASSETS TOTAL LIABILITIES $ $ $ $ $ $ $ $ 135,200.00 80,000.00 480,000.00 5,200.00 320,000.00 2,400,000.00 48,000.00 (148,000.00) 3.185.200.00 $ Equity: Retained Capital $ 3,167,200.00 TOTAL EQUITY $ 3,167,200.00 TOTAL ASSETS $ 3,302,400.00 TOTAL LIABILITIES AND EQUITY $ 3,302,400.00 A Check your start-up notes for an explanation Check your start-up notes for an explanation The accumulated depreciation represents the total depreciated amounts for their real estate improvements, field equipment and machinery, office furniture and equipment, the establishment costs of the crop acreage, and breeding livestock. The Farm Financial Standards Council (FFSC) recommends reporting accumulated depreciation as a summary account for all assets rather than reporting individual depreciation amounts. The FFSC guidelines are used for this project. Crooked Tree Farms currently has two loans: 1) A 9-month operating loan for $56,000 at 2% originated on November 15, 2019 and is due on August 15, 2020. This is a current liability (e.g., Notes Payable Due within One Year). 2) A 3-year equipment loan (for the baler) of $51,000 (at a 6% annual interest rate) that originated on July 14, 2018. They have already made one payment and current outstanding balance is $34,000. The next payment is due on July 14, 2019 and will require a principal payment of $18,000 plus accrued interest. They owe $18,000 on the loan in the next 12 months (the current portion of a non-current liability) and $16,000 beyond the next 12 months (a non- current liability)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started