Answered step by step

Verified Expert Solution

Question

1 Approved Answer

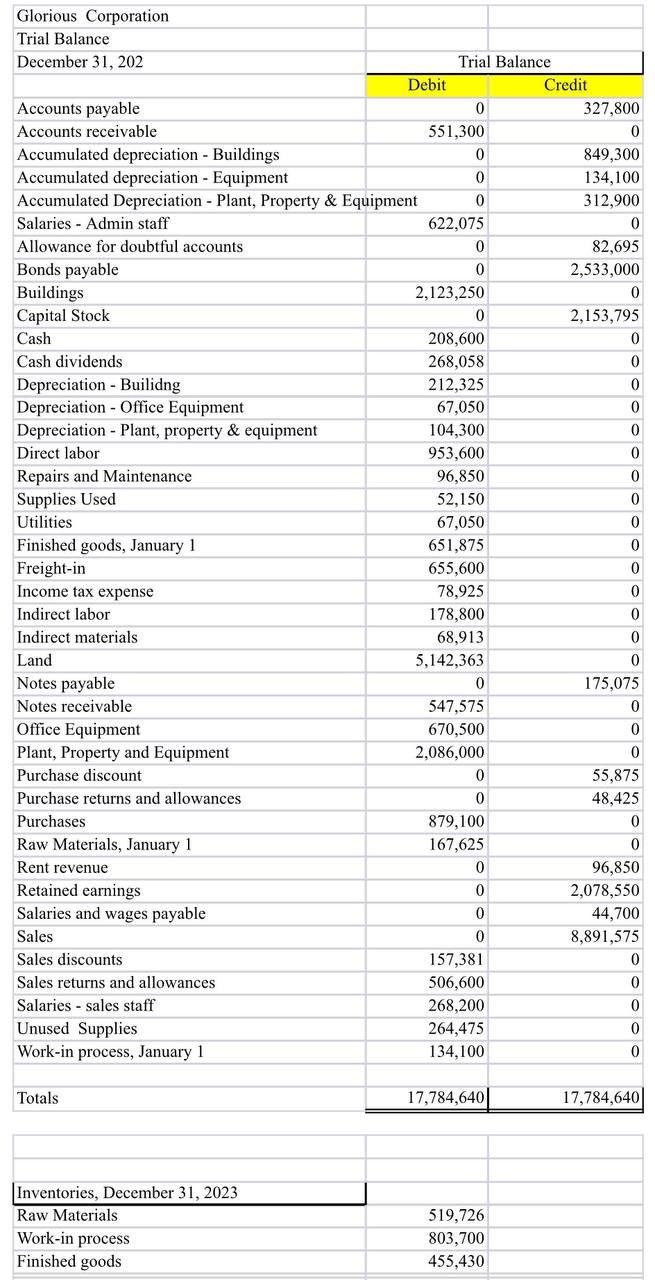

Create an Income Statement and COGM Schedule for the year ended December 31, 2023. Create a Balance Sheet Owners Equity as well. Glorious Corporation Trial

Create an Income Statement and COGM Schedule for the year ended December 31, 2023. Create a Balance Sheet Owners Equity as well.

Glorious Corporation Trial Balance December 31, 202 Trial Balance Debit Credit Accounts payable 0 327,800 Accounts receivable 551,300 0 Accumulated depreciation - Buildings 0 849,300 Accumulated depreciation - Equipment 0 134,100 Accumulated Depreciation - Plant, Property & Equipment 0 312,900 Salaries Admin staff 622,075 0 Allowance for doubtful accounts 0 82,695 Bonds payable 0 2,533,000 Buildings 2,123,250 0 Capital Stock 0 2,153,795 Cash 208,600 0 Cash dividends 268,058 0 Depreciation Builidng 212,325 0 Depreciation - Office Equipment 67,050 0 Depreciation - Plant, property & equipment 104,300 0 Direct labor 953,600 0 Repairs and Maintenance 96,850 0 Supplies Used 52,150 0 Utilities 67,050 0 Finished goods, January 1 651,875 0 Freight-in 655,600 0 Income tax expense 78,925 0 Indirect labor 178,800 0 Indirect materials 68,913 0 Land Notes payable 5,142,363 0 0 175,075 Notes receivable 547,575 0 Office Equipment 670,500 0 Plant, Property and Equipment 2,086,000 0 Purchase discount 0 55,875 Purchase returns and allowances 0 48,425 Purchases 879,100 0 Raw Materials, January 1 167,625 0 Rent revenue 0 96,850 Retained earnings 0 2,078,550 Salaries and wages payable 0 44,700 Sales 0 8,891,575 Sales discounts 157,381 0 Sales returns and allowances 506,600 0 Salaries sales staff 268,200 0 Unused Supplies 264,475 0 Work-in process, January 1 134,100 0 Totals 17,784,640 17,784,640 Inventories, December 31, 2023 Raw Materials Work-in process Finished goods 519,726 803,700 455,430

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started