Answered step by step

Verified Expert Solution

Question

1 Approved Answer

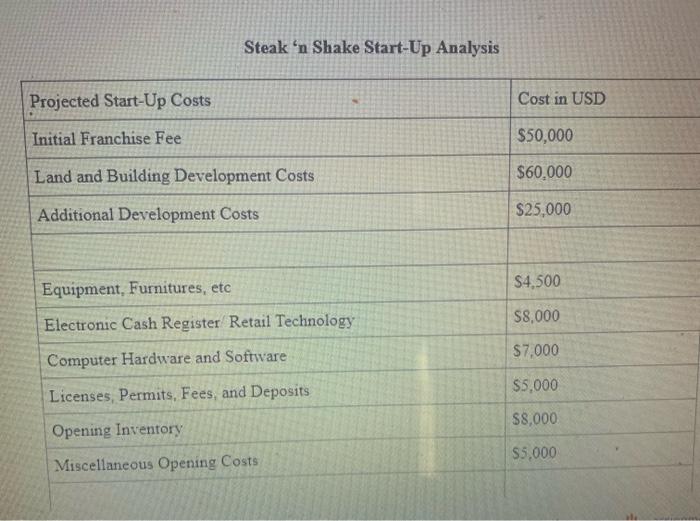

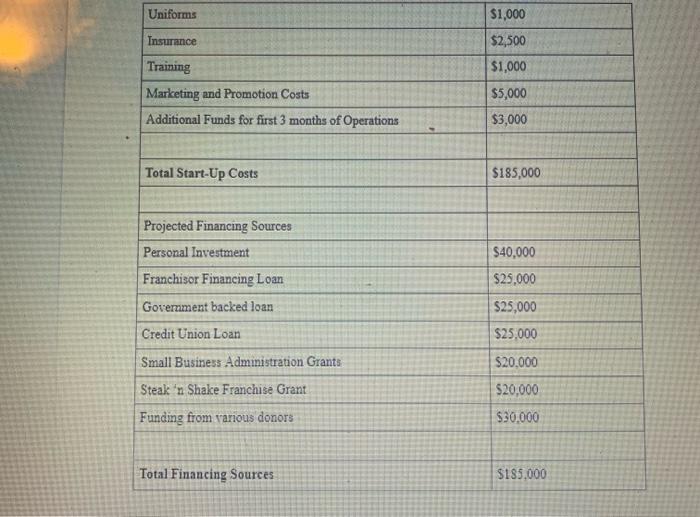

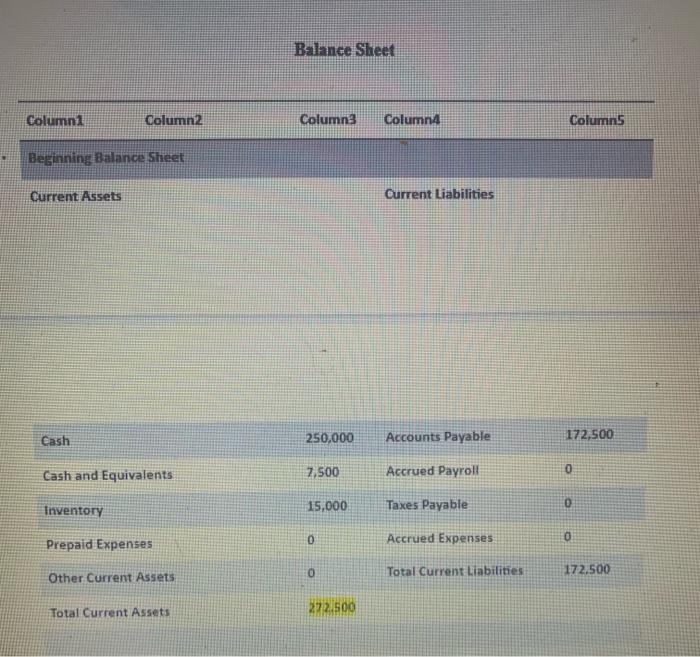

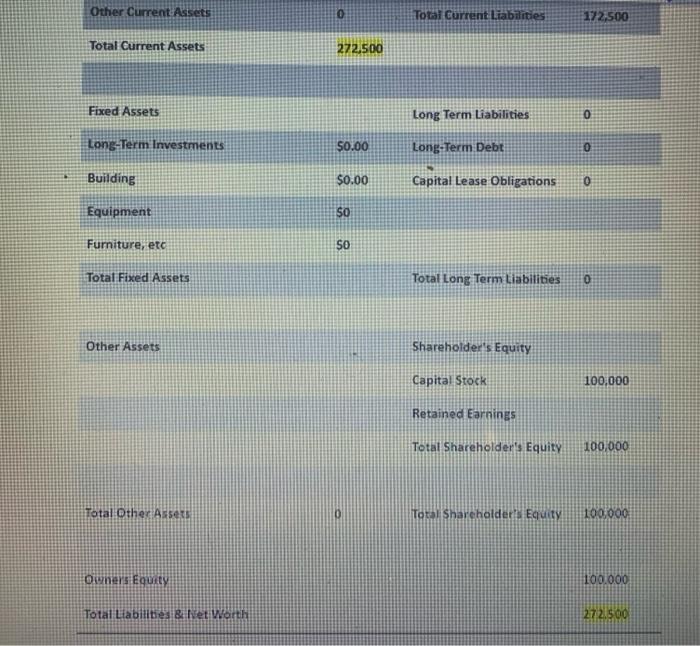

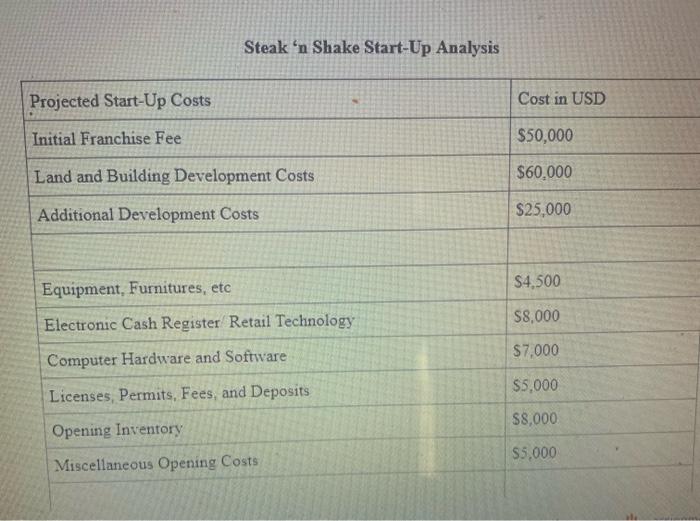

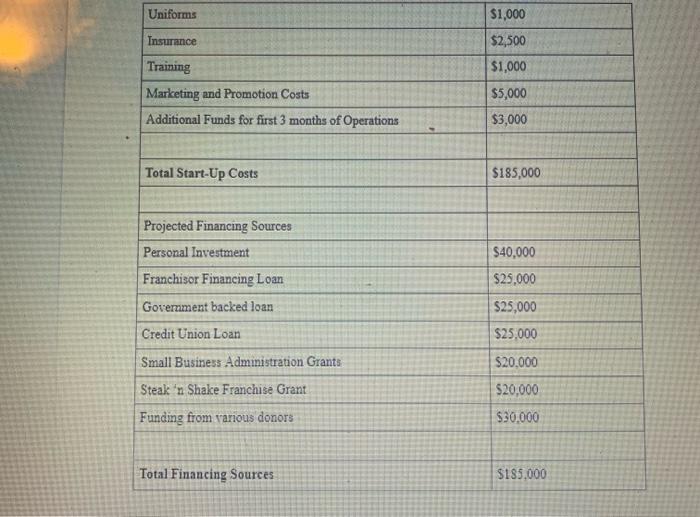

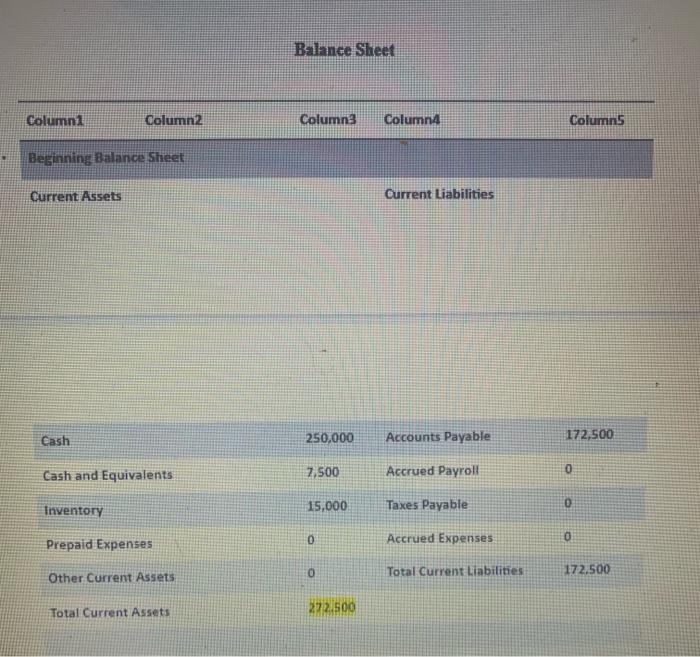

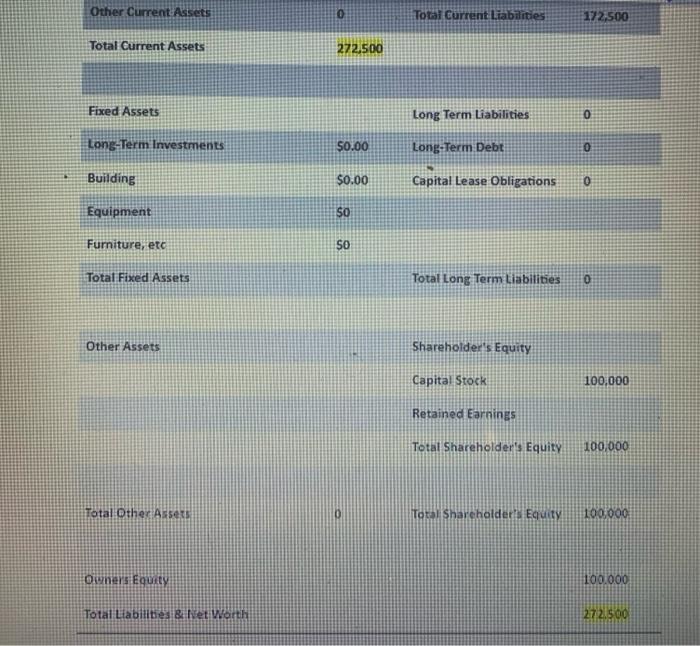

Create an Income statement (Profit & losses) table for steak n' shake ,for 1 year of operation base on the given tables .The 1st two

Create an Income statement (Profit & losses) table for steak n' shake ,for 1 year of operation base on the given tables .The 1st two represents the start-up analysis and the last two represent the balance sheet.

Steak 'n Shake Start-Up Analysis Projected Start-Up Costs Cost in USD Initial Franchise Fee $50,000 Land and Building Development Costs $60,000 Additional Development Costs $25,000 Equipment, Furnitures, etc $4,500 $8,000 Electronic Cash Register Retail Technology $7,000 Computer Hardware and Software $5,000 Licenses, Permits, Fees, and Deposits $8,000 Opening Inventory $5,000 Miscellaneous Opening Costs Uniforms $1,000 Insurance $2,500 $1,000 Training Marketing and Promotion Costs Additional Funds for first 3 months of Operations $5,000 $3,000 Total Start-Up Costs $185,000 $40,000 Projected Financing Sources Personal Investment Franchisor Financing Loan Government backed loan Credit Union Loan Small Business Administration Grants Steak 'n Shake Franchise Grant Funding from various donors $25,000 $25,000 $25,000 $20,000 $20,000 $30,000 Total Financing Sources $185.000 Balance Sheet Columns Column2 Column3 Column Columns Beginning Balance Sheet Current Assets Current Liabilities Cash 250.000 Accounts yable 172,500 7.500 Cash and Equivalents 0 Accrued Payroll Inventory 15,000 0 Taxes Payable 0 0 Prepaid Expenses Accrued Expenses 0 172.500 Other Current Assets Total Current Liabilities Total Current Assets 272.500 Other Current Assets 0 Total Current Liabilities 172,500 Total Current Assets 272.500 Fixed Assets Long Term Liabilities 0 Long-Term Investments 50.00 Long-Term Debt 0 Building $0.00 Capital Lease Obligations 0 Equipment $0 Furniture, etc 50 Total Fixed Assets Total Long Term Liabilities 0 Other Assets Shareholder's Equity Capital Stock 100,000 Retained Earnings Total Shareholder's Equity 100,000 Total Other Assets Toral Shareholder' Equity 100.000 Owners Equity 100.000 Total Liabilities Bilvet Worth 27 2.500 Steak 'n Shake Start-Up Analysis Projected Start-Up Costs Cost in USD Initial Franchise Fee $50,000 Land and Building Development Costs $60,000 Additional Development Costs $25,000 Equipment, Furnitures, etc $4,500 $8,000 Electronic Cash Register Retail Technology $7,000 Computer Hardware and Software $5,000 Licenses, Permits, Fees, and Deposits $8,000 Opening Inventory $5,000 Miscellaneous Opening Costs Uniforms $1,000 Insurance $2,500 $1,000 Training Marketing and Promotion Costs Additional Funds for first 3 months of Operations $5,000 $3,000 Total Start-Up Costs $185,000 $40,000 Projected Financing Sources Personal Investment Franchisor Financing Loan Government backed loan Credit Union Loan Small Business Administration Grants Steak 'n Shake Franchise Grant Funding from various donors $25,000 $25,000 $25,000 $20,000 $20,000 $30,000 Total Financing Sources $185.000 Balance Sheet Columns Column2 Column3 Column Columns Beginning Balance Sheet Current Assets Current Liabilities Cash 250.000 Accounts yable 172,500 7.500 Cash and Equivalents 0 Accrued Payroll Inventory 15,000 0 Taxes Payable 0 0 Prepaid Expenses Accrued Expenses 0 172.500 Other Current Assets Total Current Liabilities Total Current Assets 272.500 Other Current Assets 0 Total Current Liabilities 172,500 Total Current Assets 272.500 Fixed Assets Long Term Liabilities 0 Long-Term Investments 50.00 Long-Term Debt 0 Building $0.00 Capital Lease Obligations 0 Equipment $0 Furniture, etc 50 Total Fixed Assets Total Long Term Liabilities 0 Other Assets Shareholder's Equity Capital Stock 100,000 Retained Earnings Total Shareholder's Equity 100,000 Total Other Assets Toral Shareholder' Equity 100.000 Owners Equity 100.000 Total Liabilities Bilvet Worth 27 2.500 (mutiply each month by a certain percentage)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started