Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create and complete an adjustment grid You are appraising a single-family residence located in the Notting Hill neighborhood. The property is being acquired by a

Create and complete an adjustment grid

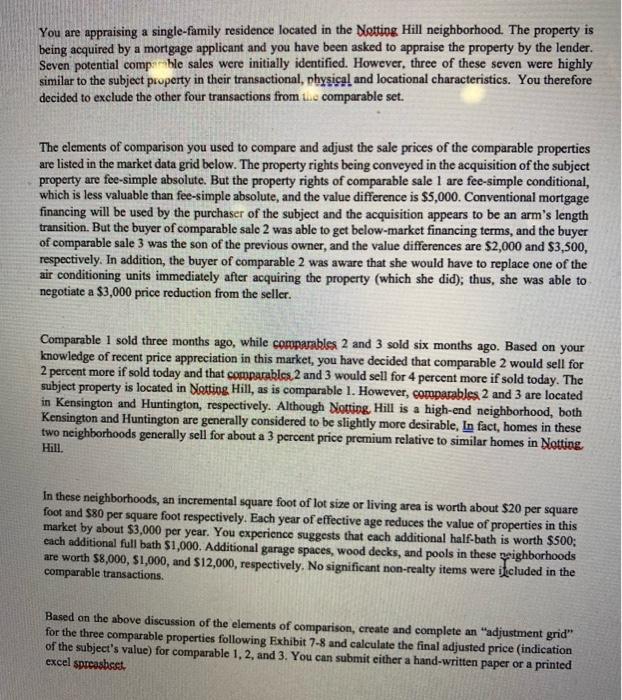

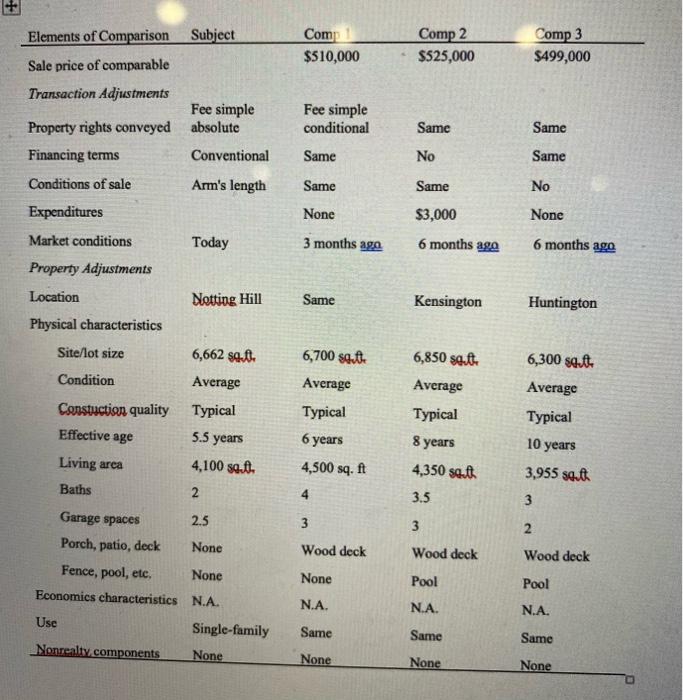

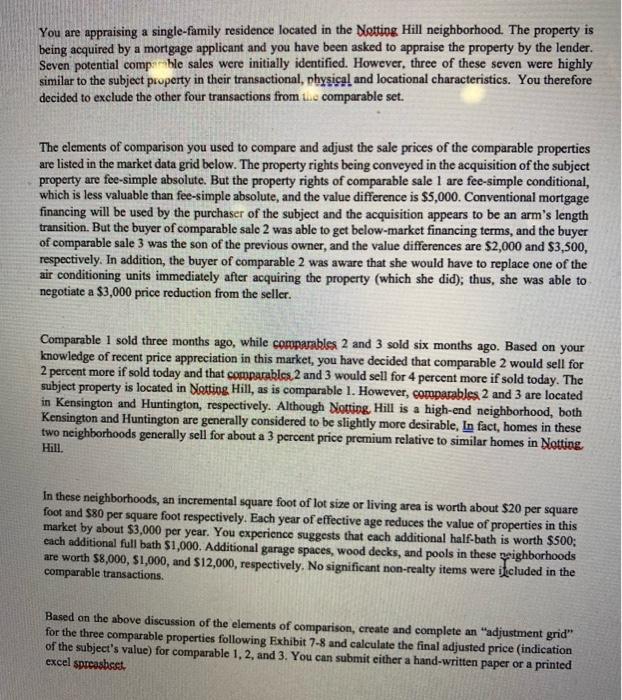

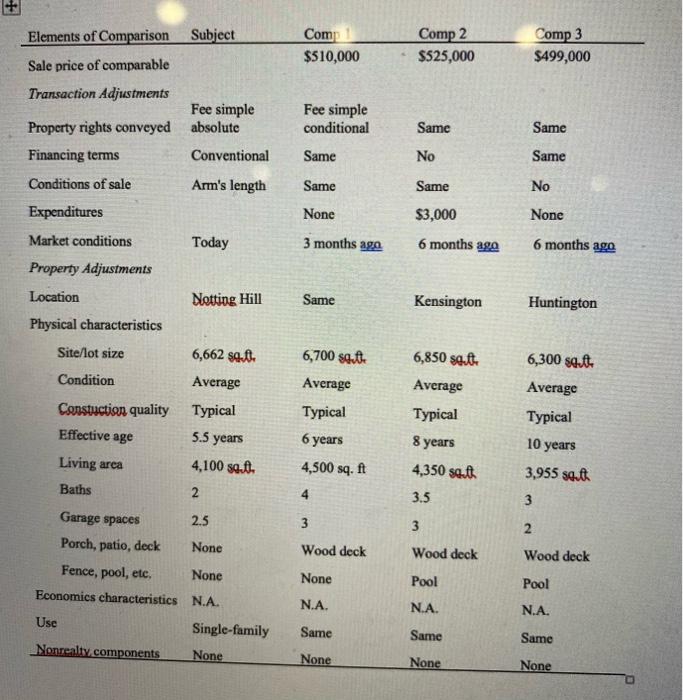

You are appraising a single-family residence located in the Notting Hill neighborhood. The property is being acquired by a mortgage applicant and you have been asked to appraise the property by the lender. Seven potential compable sales were initially identified. However, three of these seven were highly similar to the subject property in their transactional, physical and locational characteristics. You therefore decided to exclude the other four transactions from L. comparable set. The elements of comparison you used to compare and adjust the sale prices of the comparable properties are listed in the market data grid below. The property rights being conveyed in the acquisition of the subject property are fee-simple absolute. But the property rights of comparable sale 1 are fee-simple conditional, which is less valuable than fee-simple absolute, and the value difference is $5,000. Conventional mortgage financing will be used by the purchaser of the subject and the acquisition appears to be an arm's length transition. But the buyer of comparable sale 2 was able to get below-market financing terms, and the buyer of comparable sale 3 was the son of the previous owner, and the value differences are $2,000 and $3,500, respectively. In addition, the buyer of comparable 2 was aware that she would have to replace one of the air conditioning units immediately after acquiring the property (which she did); thus, she was able to negotiate a $3,000 price reduction from the seller. Comparable 1 sold three months ago, while comparables 2 and 3 sold six months ago. Based on your knowledge of recent price appreciation in this market, you have decided that comparable 2 would sell for 2 percent more if sold today and that comparables 2 and 3 would sell for 4 percent more if sold today. The subject property is located in Setting Hill, as is comparable 1. However, comparables 2 and 3 are located in Kensington and Huntington, respectively. Although Notting Hill is a high-end neighborhood, both Kensington and Huntington are generally considered to be slightly more desirable, In fact, homes in these two neighborhoods generally sell for about a 3 percent price premium relative to similar homes in Notting Hill. In these neighborhoods, an incremental square foot of lot size or living area is worth about $20 per square foot and S80 per square foot respectively. Each year of effective age reduces the value of properties in this market by about $3,000 per year. You experience suggests that each additional half-bath is worth $500; each additional full bath $1,000. Additional garage spaces, wood decks, and pools in these pighborhoods are worth $8,000, 51,000, and $12,000, respectively. No significant non-realty items were itcluded in the comparable transactions Based on the above discussion of the elements of comparison, create and complete an "adjustment grid" for the three comparable properties following Exhibit 7-8 and calculate the final adjusted price indication of the subject's value) for comparable 1, 2, and 3. You can submit either a hand-written paper or a printed excel spreasbest Elements of Comparison Subject Sale price of comparable Comp $510,000 Comp 2 $S25,000 Comp 3 $499,000 Fee simple conditional Same Same Transaction Adjustments Fee simple Property rights conveyed absolute Financing terms Conventional Conditions of sale Arm's length Expenditures Same No Same Same Same No None None $3,000 6 months ago Market conditions Today 3 months ago 6 months ago Property Adjustments Location Notting Hill Same Kensington Huntington Physical characteristics Site/lot size 6,662 sq.ft. Average 6,700 sq.. Average Condition 6,300 sq.ft Average Typical Constuction quality Typical Effective age 6,850 sett. Average Typical 8 years 4,350 sq.ft 3.5 Typical 6 years 4,500 sq.ft 5.5 years 10 years Living area Baths 4,100 sq.ft. 2 3,955 sett 4 3 3 3 2 Wood deck Wood deck Wood deck Garage spaces 2.5 Porch, patio, deck None Fence, pool, etc. None Economics characteristics N.A. Use Single-family Nonrealty, components None None Pool Pool N.A. NA N.A. Same Same Same None None None You are appraising a single-family residence located in the Notting Hill neighborhood. The property is being acquired by a mortgage applicant and you have been asked to appraise the property by the lender. Seven potential compable sales were initially identified. However, three of these seven were highly similar to the subject property in their transactional, physical and locational characteristics. You therefore decided to exclude the other four transactions from L. comparable set. The elements of comparison you used to compare and adjust the sale prices of the comparable properties are listed in the market data grid below. The property rights being conveyed in the acquisition of the subject property are fee-simple absolute. But the property rights of comparable sale 1 are fee-simple conditional, which is less valuable than fee-simple absolute, and the value difference is $5,000. Conventional mortgage financing will be used by the purchaser of the subject and the acquisition appears to be an arm's length transition. But the buyer of comparable sale 2 was able to get below-market financing terms, and the buyer of comparable sale 3 was the son of the previous owner, and the value differences are $2,000 and $3,500, respectively. In addition, the buyer of comparable 2 was aware that she would have to replace one of the air conditioning units immediately after acquiring the property (which she did); thus, she was able to negotiate a $3,000 price reduction from the seller. Comparable 1 sold three months ago, while comparables 2 and 3 sold six months ago. Based on your knowledge of recent price appreciation in this market, you have decided that comparable 2 would sell for 2 percent more if sold today and that comparables 2 and 3 would sell for 4 percent more if sold today. The subject property is located in Setting Hill, as is comparable 1. However, comparables 2 and 3 are located in Kensington and Huntington, respectively. Although Notting Hill is a high-end neighborhood, both Kensington and Huntington are generally considered to be slightly more desirable, In fact, homes in these two neighborhoods generally sell for about a 3 percent price premium relative to similar homes in Notting Hill. In these neighborhoods, an incremental square foot of lot size or living area is worth about $20 per square foot and S80 per square foot respectively. Each year of effective age reduces the value of properties in this market by about $3,000 per year. You experience suggests that each additional half-bath is worth $500; each additional full bath $1,000. Additional garage spaces, wood decks, and pools in these pighborhoods are worth $8,000, 51,000, and $12,000, respectively. No significant non-realty items were itcluded in the comparable transactions Based on the above discussion of the elements of comparison, create and complete an "adjustment grid" for the three comparable properties following Exhibit 7-8 and calculate the final adjusted price indication of the subject's value) for comparable 1, 2, and 3. You can submit either a hand-written paper or a printed excel spreasbest Elements of Comparison Subject Sale price of comparable Comp $510,000 Comp 2 $S25,000 Comp 3 $499,000 Fee simple conditional Same Same Transaction Adjustments Fee simple Property rights conveyed absolute Financing terms Conventional Conditions of sale Arm's length Expenditures Same No Same Same Same No None None $3,000 6 months ago Market conditions Today 3 months ago 6 months ago Property Adjustments Location Notting Hill Same Kensington Huntington Physical characteristics Site/lot size 6,662 sq.ft. Average 6,700 sq.. Average Condition 6,300 sq.ft Average Typical Constuction quality Typical Effective age 6,850 sett. Average Typical 8 years 4,350 sq.ft 3.5 Typical 6 years 4,500 sq.ft 5.5 years 10 years Living area Baths 4,100 sq.ft. 2 3,955 sett 4 3 3 3 2 Wood deck Wood deck Wood deck Garage spaces 2.5 Porch, patio, deck None Fence, pool, etc. None Economics characteristics N.A. Use Single-family Nonrealty, components None None Pool Pool N.A. NA N.A. Same Same Same None None None

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started