Answered step by step

Verified Expert Solution

Question

1 Approved Answer

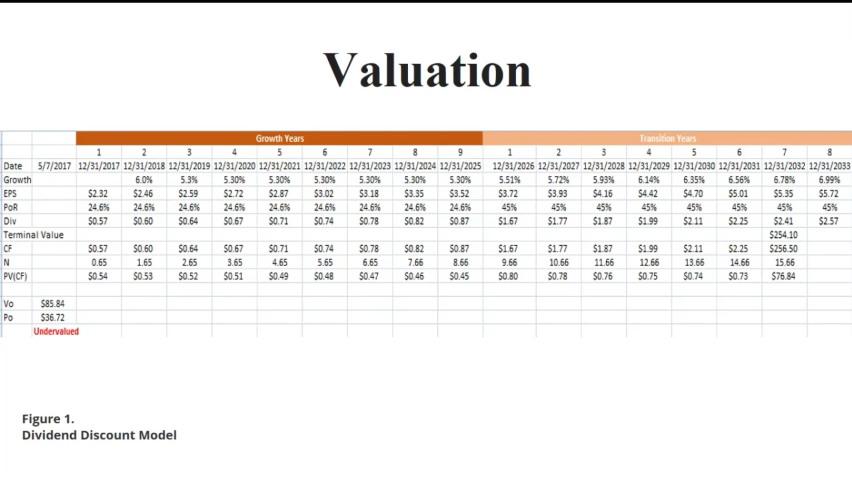

Create Discounted Cash flow Model of Brinker International, Inc. using bloomberg if possible. Include 9 growth years and 8 transition years. An example of what

Create Discounted Cash flow Model of Brinker International, Inc. using bloomberg if possible. Include 9 growth years and 8 transition years. An example of what im looking for is included

http://imgur.com/a/hQWEE (link to image)

Valuation Date Growth 60% 5.3% 5.30% 5.30% 5.30% 5.30% 5.30% 5.30% 5.51% 5.72% 5.93% 614% 635% 6565 678% 6.99% $2.32 S2.46 $259 $2.72 $2.87 $3.02 $318 $3.35 $3.52 $3.72 $3.93 $4.16 $4.42 S4.70 $5.01 $5.35 $5.72 24.6% 24.6% 24.6% 24.6% 24.6% 24.6% 24.6% 24.6% 24.6% 45% 45% 45% 45% 45% 45% 45% $1.87 Div $0.60 $0.71 $0.74 $0.78 $0.82 $167 $199 $2.11 $2.25 $2.41 $257 $254.10 $0.57 $0.60 $064 $0.67 $0.71 S0.74 $0.78 $0.82 $0.87 $1.67 $1.77 S1.87 $1.99 $2.11 $2.25 $256.50 465 5.65 5.65 7.66 10 11.66 12.66 13.66 14.66 15.66 $0.54 $0.53 $0.52 $0.51 $0.49 $0.48 $0.47 $0.46 $0.45 S080 S0.78 S0.76 S0.75 $0.74 $073 S7684 Vo $85.84 Po LS3672 Undervalued Figure 1. Dividend Discount Model Valuation Date Growth 60% 5.3% 5.30% 5.30% 5.30% 5.30% 5.30% 5.30% 5.51% 5.72% 5.93% 614% 635% 6565 678% 6.99% $2.32 S2.46 $259 $2.72 $2.87 $3.02 $318 $3.35 $3.52 $3.72 $3.93 $4.16 $4.42 S4.70 $5.01 $5.35 $5.72 24.6% 24.6% 24.6% 24.6% 24.6% 24.6% 24.6% 24.6% 24.6% 45% 45% 45% 45% 45% 45% 45% $1.87 Div $0.60 $0.71 $0.74 $0.78 $0.82 $167 $199 $2.11 $2.25 $2.41 $257 $254.10 $0.57 $0.60 $064 $0.67 $0.71 S0.74 $0.78 $0.82 $0.87 $1.67 $1.77 S1.87 $1.99 $2.11 $2.25 $256.50 465 5.65 5.65 7.66 10 11.66 12.66 13.66 14.66 15.66 $0.54 $0.53 $0.52 $0.51 $0.49 $0.48 $0.47 $0.46 $0.45 S080 S0.78 S0.76 S0.75 $0.74 $073 S7684 Vo $85.84 Po LS3672 Undervalued Figure 1. Dividend Discount ModelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started