Answered step by step

Verified Expert Solution

Question

1 Approved Answer

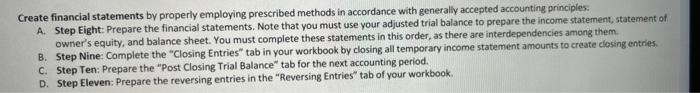

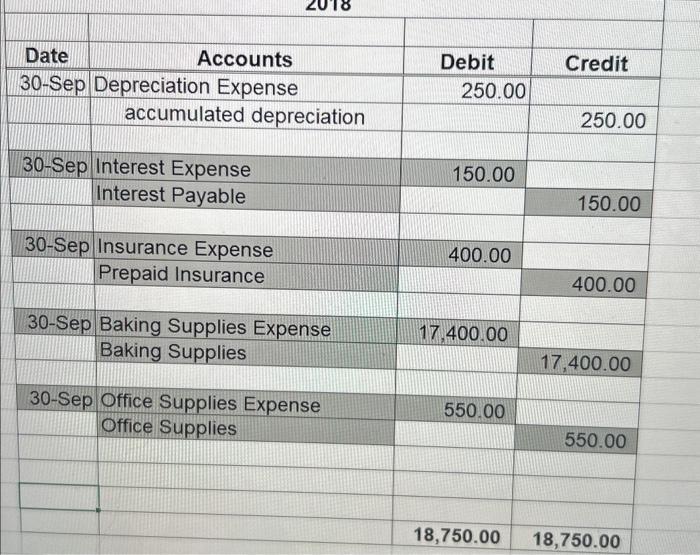

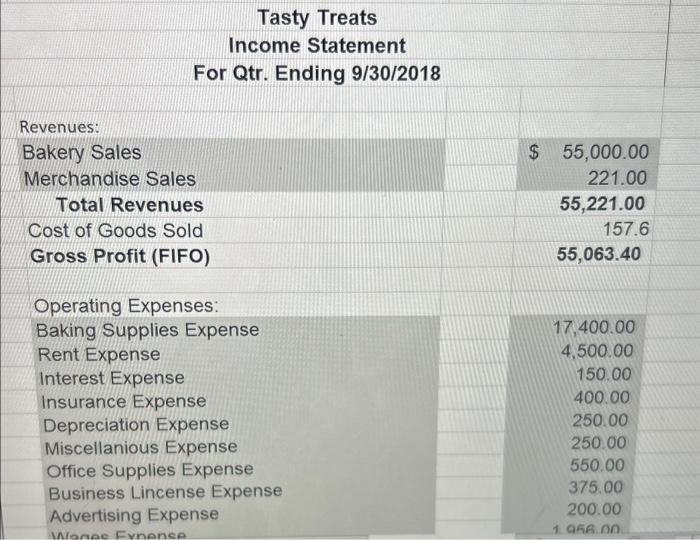

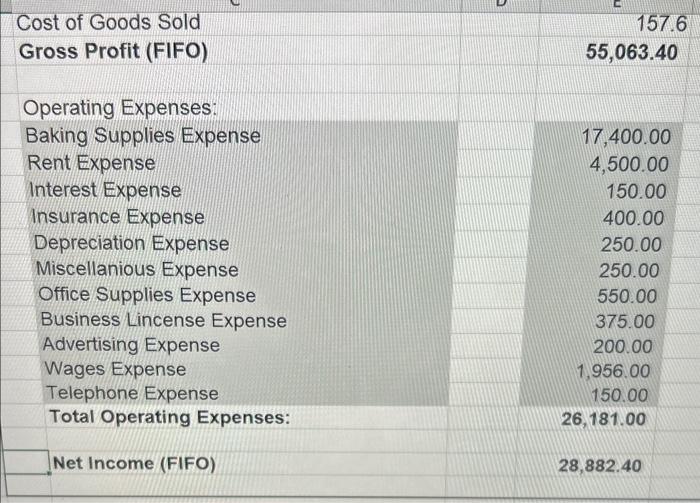

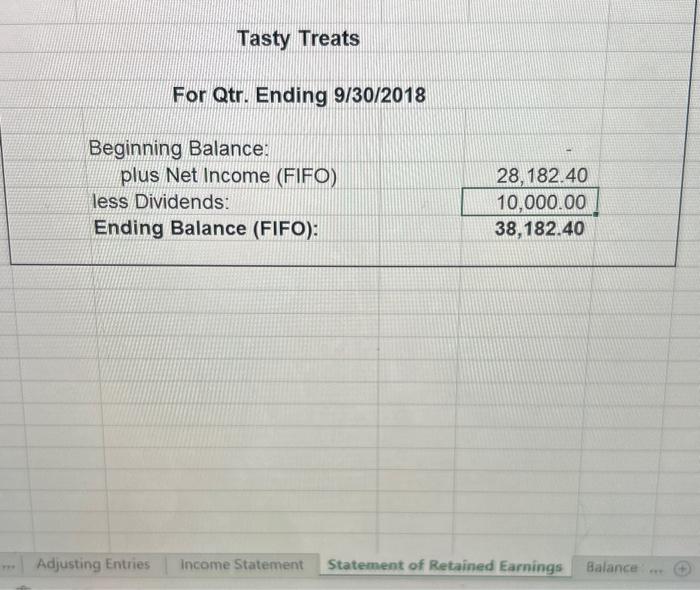

Create financial statements by properly employing prescribed methods in accordance with generally accepted accounting principles: A. Step Eight: Prepare the financial statements. Note that

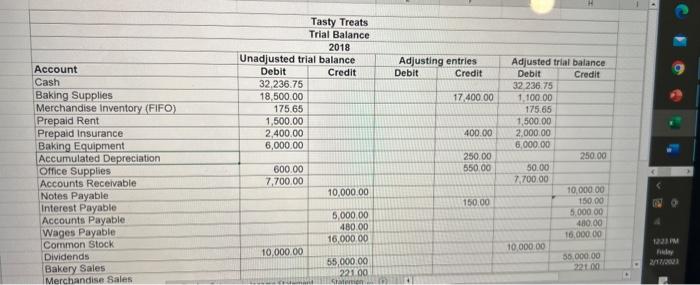

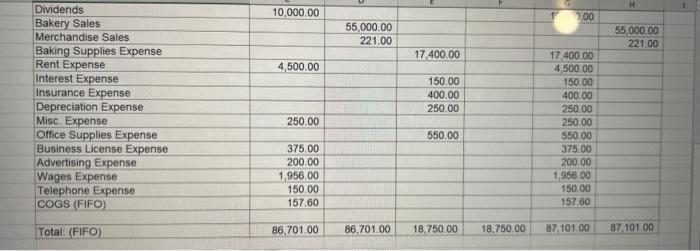

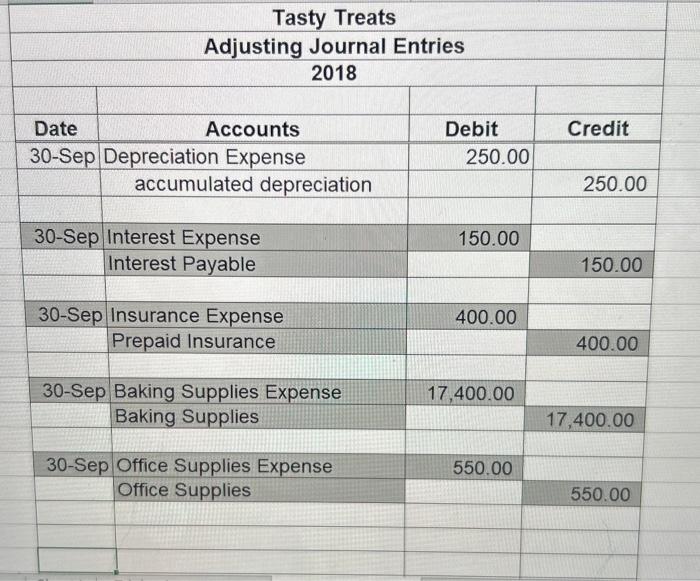

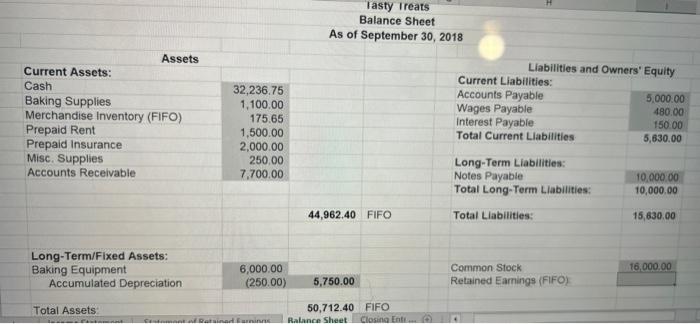

Create financial statements by properly employing prescribed methods in accordance with generally accepted accounting principles: A. Step Eight: Prepare the financial statements. Note that you must use your adjusted trial balance to prepare the income statement, statement of owner's equity, and balance sheet. You must complete these statements in this order, as there are interdependencies among them. B. Step Nine: Complete the "Closing Entries" tab in your workbook by closing all temporary income statement amounts to create closing entries. C. Step Ten: Prepare the "Post Closing Trial Balance" tab for the next accounting period. D. Step Eleven: Prepare the reversing entries in the "Reversing Entries" tab of your workbook. Account Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent Prepaid Insurance. Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable Notes Payable Interest Payable Accounts Payable Wages Payable Common Stock Dividends Bakery Sales Merchandise Sales Unadjusted trial balance Debit Credit 32,236.75 18,500.00 175.65 1,500.00 2,400.00 6,000.00 600.00 7,700.00 Tasty Treats Trial Balance 2018 10,000.00 10,000.00 5,000.00 480.00 16,000.00 55,000.00 221.00 Statemen Adjusting entries Debit Credit 4 17.400.00 400.00 250.00 550.00 150.00 Adjusted trial balance Debit Credit 32,236.75 1,100.00 175.65 1,500.00 2,000.00 6,000.00 50.00 7,700.00 10,000.00 250.00 10,000.00 150.00 5,000.00 480.00 16,000.00 55,000.00 221.00 P 10 1223 PM Fiday 2/17/2023 Dividends Bakery Sales Merchandise Sales Baking Supplies Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense COGS (FIFO) Total: (FIFO) 10,000.00 4,500.00 250.00 375.00 200.00 1,956.00 150.00 157.60 86,701.00 55,000.00 221.00 17,400.00 150.00 400.00 250.00 550.00 86,701.00 18,750.00 12.00 17,400.00 4,500.00 150.00 400.00 250.00 250.00 550.00 375.00 200.00 1,956.00 150.00 157.60 H 55,000.00 221.00 18,750.00 87,101.00 87,101.00 Tasty Treats Adjusting Journal Entries 2018 Date Accounts 30-Sep Depreciation Expense accumulated depreciation 30-Sep Interest Expense Interest Payable 30-Sep Insurance Expense Prepaid Insurance 30-Sep Baking Supplies Expense Baking Supplies 30-Sep Office Supplies Expense Office Supplies Debit 250.00 150.00 400.00 17,400.00 550.00 Credit 250.00 150.00 400.00 17,400.00 550.00 Date Accounts 30-Sep Depreciation Expense accumulated depreciation 30-Sep Interest Expense Interest Payable 30-Sep Insurance Expense Prepaid Insurance 30-Sep Baking Supplies Expense Baking Supplies 30-Sep Office Supplies Expense Office Supplies Debit 250.00 150.00 400.00 17.400.00 550.00 Credit 250.00 150.00 400.00 17,400.00 550.00 18,750.00 18,750.00 Revenues: Bakery Sales Tasty Treats Income Statement For Qtr. Ending 9/30/2018 Merchandise Sales Total Revenues Cost of Goods Sold Gross Profit (FIFO) Operating Expenses: Baking Supplies Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Miscellanious Expense Office Supplies Expense Business Lincense Expense Advertising Expense Wanes Fynense $ 55,000.00 221.00 55,221.00 157.6 55,063.40 17,400.00 4,500.00 150.00 400.00 250.00 250.00 550.00 375.00 200.00 1.966.00 Cost of Goods Sold Gross Profit (FIFO) Operating Expenses: Baking Supplies Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Miscellanious Expense Office Supplies Expense Business Lincense Expense Advertising Expense Wages Expense Telephone Expense Total Operating Expenses: Net Income (FIFO) 5 157.6 55,063.40 17,400.00 4,500.00 150.00 400.00 250.00 250.00 550.00 375.00 200.00 1,956.00 150.00 26,181.00 28,882.40 Tasty Treats For Qtr. Ending 9/30/2018 Beginning Balance: plus Net Income (FIFO) Adjusting Entries less Dividends: Ending Balance (FIFO): 28,182.40 10,000.00 38,182.40 Income Statement Statement of Retained Earnings Balance Current Assets: Cash Baking Supplies Assets Merchandise Inventory (FIFO) Prepaid Rent Prepaid Insurance Misc. Supplies Accounts Receivable Long-Term/Fixed Assets: Baking Equipment Accumulated Depreciation Total Assets: 32,236.75 1,100.00 175.65 1,500.00 2,000.00 250,00 7,700.00 6,000.00 (250.00) (Retained Earnings Tasty Treats Balance Sheet As of September 30, 2018 44,962.40 FIFO 5,750.00 50,712.40 FIFO Balance Sheet Closing Entr... Liabilities and Owners' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Total Current Liabilities- Long-Term Liabilities: Notes Payable Total Long-Term Liabilities: Total Liabilities: Common Stock Retained Earnings (FIFO) 5,000.00 480.00 150.00 5,630.00 10,000.00 10,000.00 15,630.00 16,000.00 Account Tasty Treats Reversing Entries Qtr. Ending 9/30/2018 Unadjusted Trial Balance Debit Credit

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Tasty Treats Financial Statements Step Eight Financial Statements Income Statement Revenue Amount Bakery Sales 5500000 Merchandise Sales 22100 Total R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started