Create Income statement and balance sheet

Create Income statement and balance sheet

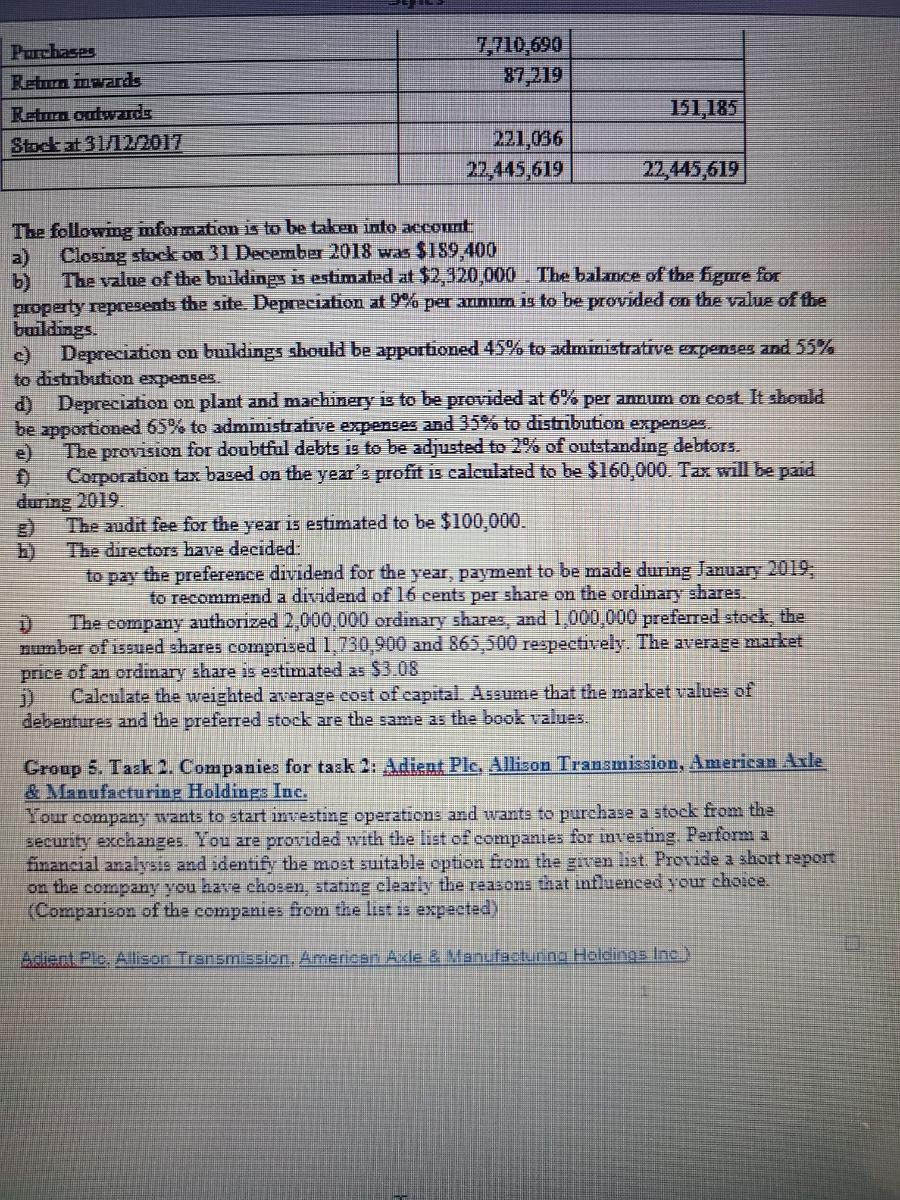

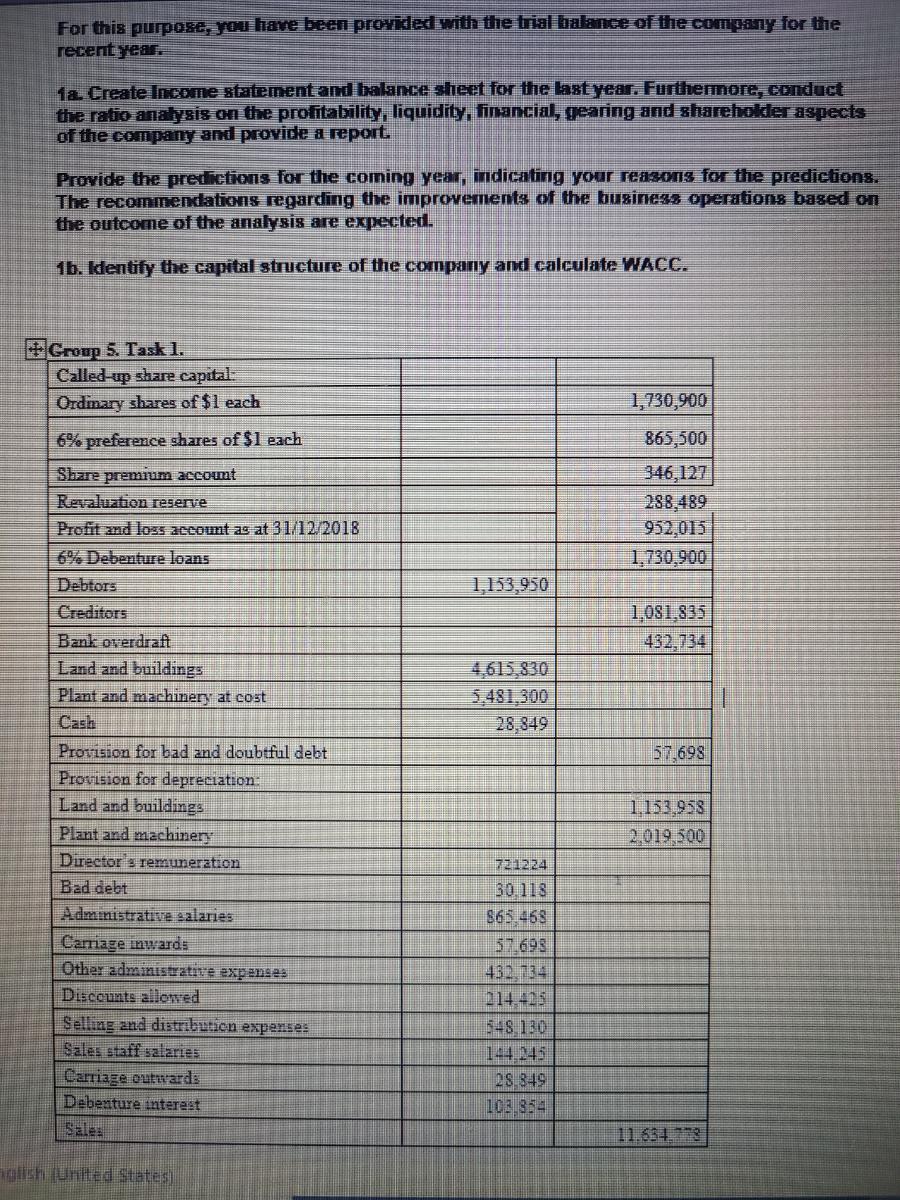

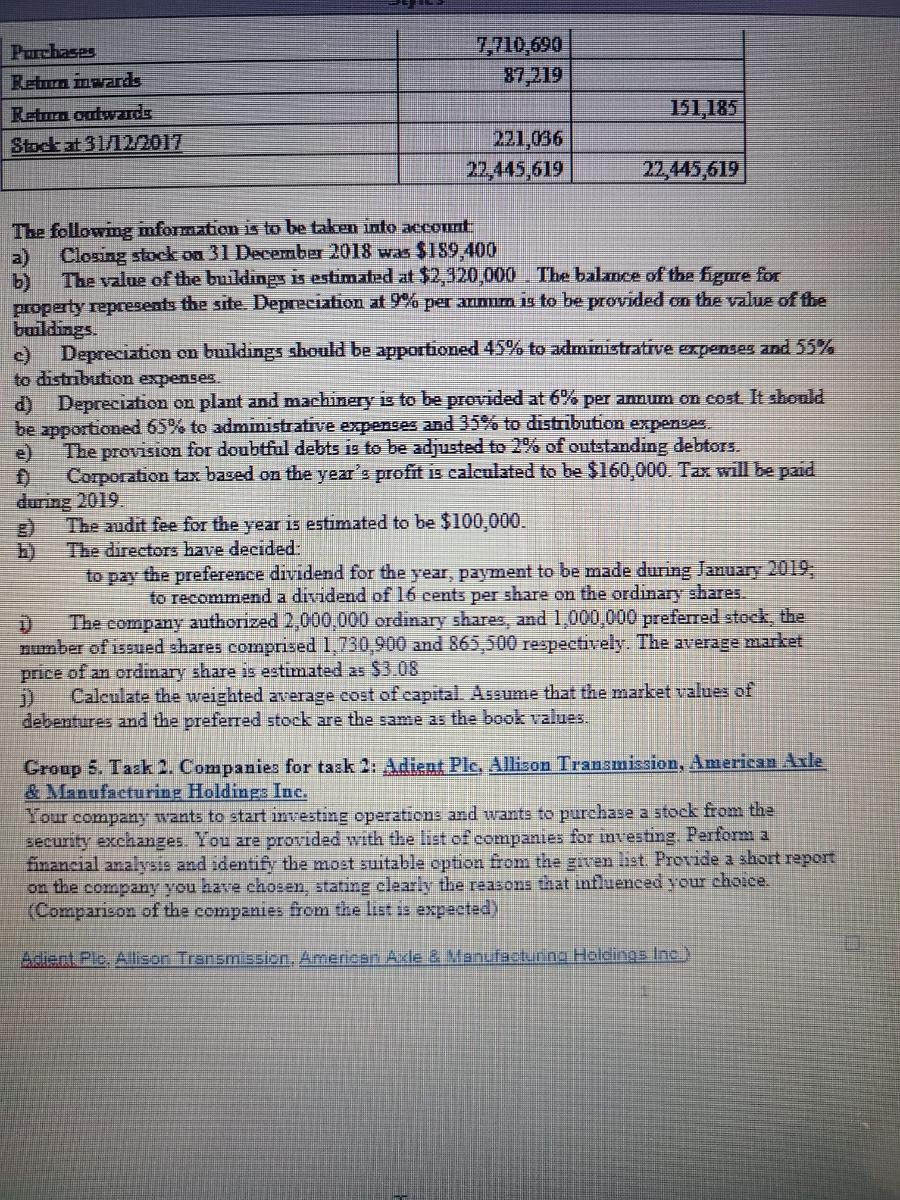

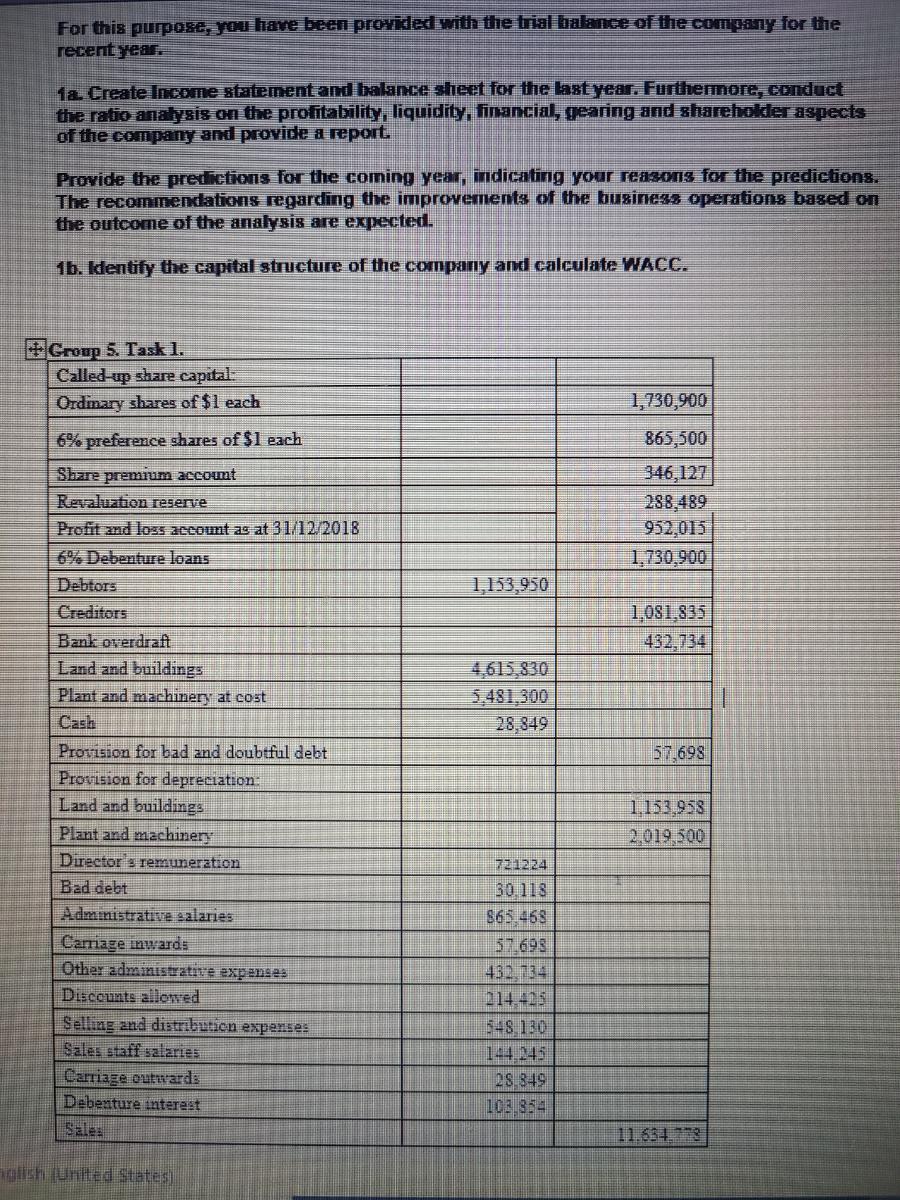

For this purpose, you have been provided with the trial balance of the company for the recent year. 1a Create Income statement and balance sheet for the last year. Furthermore, conduct the ratio analysis on the profitability, liquidity, financial, gearing and shareholder aspects of the company and provide a report. Provide the predictions for the coming year, indicating your reasons for the predictions. The recommendations regarding the improvements of the business operations based on the outcome of the analysis are expected. 1b. Identify the capital structure of the company and calculate WACC. 1,730,900 865,500 346,127 288,489 952,015 1,730,900 1,153,950 1,081,835 432.734 4,615,830 5.481,300 28,849 Group 5. Task 1. Called up share capital: Ordinary shares of $1 each 6% preference shares of $1 each Share premium account Revaluation reserve Profit ad loss account as at 31/12/2018 69. Debenture loans Debtors Creditors Bank overdraft Land and buildings Plant and machinery at cost Cash Provision for bad and doubtful debt Provision for depreciation: Land and buildings Plant and machinery Director : remuneration Bad debt Administrative salaries Carriage ward: Other administrative expenses Discounts allowed Selling and distribution expenses Sales staff salaries Carriage outward: Debenture interest Sale: 57,698 1,153958 2,019,500 721224 30.118 $6S 468 57.698 432.734 114.-25 5-S 130 144 145 28.849 108.354 11.634 ish United States 7,710,690 87,219 Purchases Belen mezards Return outware Stockat 31/12/2017 151,185 221,036 22,445,619 22,445,619 The following information is to be taken into account a) Closing stock on 31 December 2018 was $189,400 b) The value of the buildings is estimated at $2,320,000 . The balance of the figure for property represents the site. Depreciation at 9% per annum is to be provided on the value of the buildings. e) Depreciation on buildings should be apportioned 45% to administrative expenses and 55% to distribution expenses. d) Depreciztion on plant and machinery is to be provided at 6% per annum on cost. It should be apportioned 65% to administrative expenses and 35% to distribution expenses. The provision for doubtful debts is to be adjusted to 2% of outstanding debtors. Corporation tax based on the year's profit is calculated to be $160,000. Tax will be paid during 2019 The audit fee for the year is estimated to be $100,000. The directors have decided: to pay the preference dividend for the year, payment to be made during January 2019, to recommend a dividend of 16 cents per share on the ordinary shares. The company authorized 2,000,000 ordinary sharez, and 1,000,000 preferred stock, the number of issued shares comprised 1.730,900 and 865,500 respectively. The average market price of an ordinary share is estimated as $3.08 Calculate the weighted average cost of eapital. Assume that the market values of debentures and the preferred stock are the same as the book values. Group 5. Tack 2. Companies for task 2: Adient Plc. Allison Transmission, American Axle & Manufacturine Holdings Inc. Your company wants to start investing operations and wants to purchase a stock from the security exchanges. You are provided with the list of companies for investing. Perform 2 financial analysis and identify the most suitable option from the given list. Provide a short raport on the company you have chosen, stating clearly the reasons that influenced your choice. (Comparison of the companies from the list is expected) Adient. Pib. Allison Transmission, American Axle & Manufactunna Holdings Ine) For this purpose, you have been provided with the trial balance of the company for the recent year. 1a Create Income statement and balance sheet for the last year. Furthermore, conduct the ratio analysis on the profitability, liquidity, financial, gearing and shareholder aspects of the company and provide a report. Provide the predictions for the coming year, indicating your reasons for the predictions. The recommendations regarding the improvements of the business operations based on the outcome of the analysis are expected. 1b. Identify the capital structure of the company and calculate WACC. 1,730,900 865,500 346,127 288,489 952,015 1,730,900 1,153,950 1,081,835 432.734 4,615,830 5.481,300 28,849 Group 5. Task 1. Called up share capital: Ordinary shares of $1 each 6% preference shares of $1 each Share premium account Revaluation reserve Profit ad loss account as at 31/12/2018 69. Debenture loans Debtors Creditors Bank overdraft Land and buildings Plant and machinery at cost Cash Provision for bad and doubtful debt Provision for depreciation: Land and buildings Plant and machinery Director : remuneration Bad debt Administrative salaries Carriage ward: Other administrative expenses Discounts allowed Selling and distribution expenses Sales staff salaries Carriage outward: Debenture interest Sale: 57,698 1,153958 2,019,500 721224 30.118 $6S 468 57.698 432.734 114.-25 5-S 130 144 145 28.849 108.354 11.634 ish United States 7,710,690 87,219 Purchases Belen mezards Return outware Stockat 31/12/2017 151,185 221,036 22,445,619 22,445,619 The following information is to be taken into account a) Closing stock on 31 December 2018 was $189,400 b) The value of the buildings is estimated at $2,320,000 . The balance of the figure for property represents the site. Depreciation at 9% per annum is to be provided on the value of the buildings. e) Depreciation on buildings should be apportioned 45% to administrative expenses and 55% to distribution expenses. d) Depreciztion on plant and machinery is to be provided at 6% per annum on cost. It should be apportioned 65% to administrative expenses and 35% to distribution expenses. The provision for doubtful debts is to be adjusted to 2% of outstanding debtors. Corporation tax based on the year's profit is calculated to be $160,000. Tax will be paid during 2019 The audit fee for the year is estimated to be $100,000. The directors have decided: to pay the preference dividend for the year, payment to be made during January 2019, to recommend a dividend of 16 cents per share on the ordinary shares. The company authorized 2,000,000 ordinary sharez, and 1,000,000 preferred stock, the number of issued shares comprised 1.730,900 and 865,500 respectively. The average market price of an ordinary share is estimated as $3.08 Calculate the weighted average cost of eapital. Assume that the market values of debentures and the preferred stock are the same as the book values. Group 5. Tack 2. Companies for task 2: Adient Plc. Allison Transmission, American Axle & Manufacturine Holdings Inc. Your company wants to start investing operations and wants to purchase a stock from the security exchanges. You are provided with the list of companies for investing. Perform 2 financial analysis and identify the most suitable option from the given list. Provide a short raport on the company you have chosen, stating clearly the reasons that influenced your choice. (Comparison of the companies from the list is expected) Adient. Pib. Allison Transmission, American Axle & Manufactunna Holdings Ine)

Create Income statement and balance sheet

Create Income statement and balance sheet