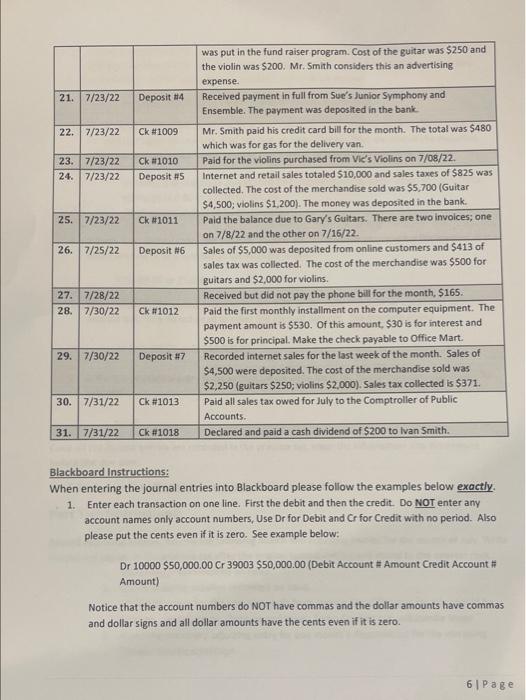

create journal entry using the account in picture 1 for picture 2 and 3

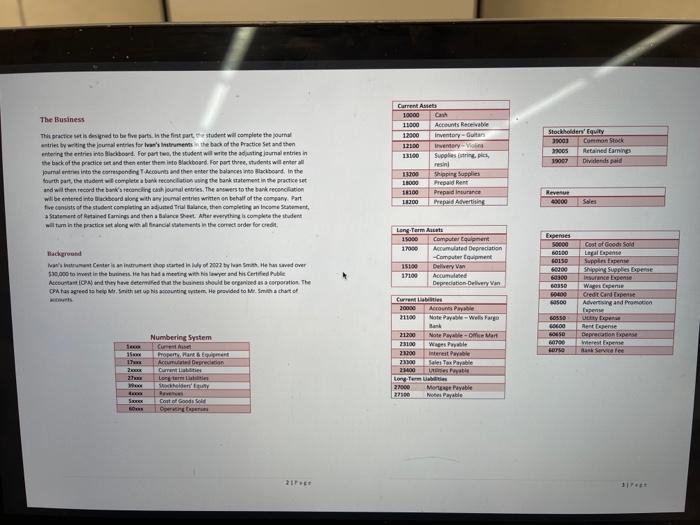

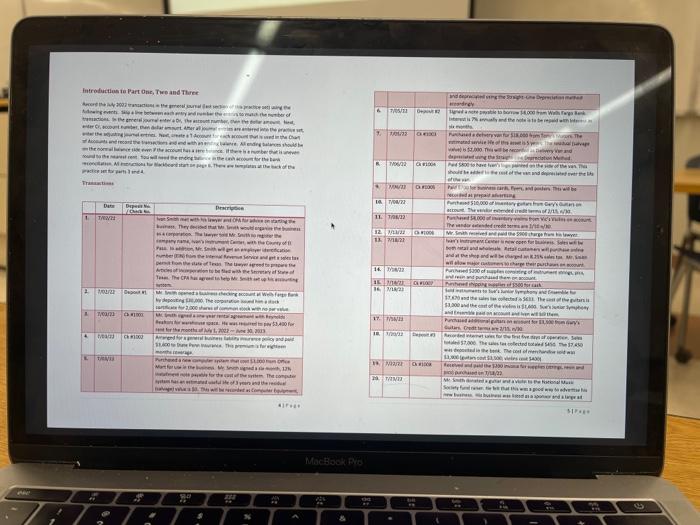

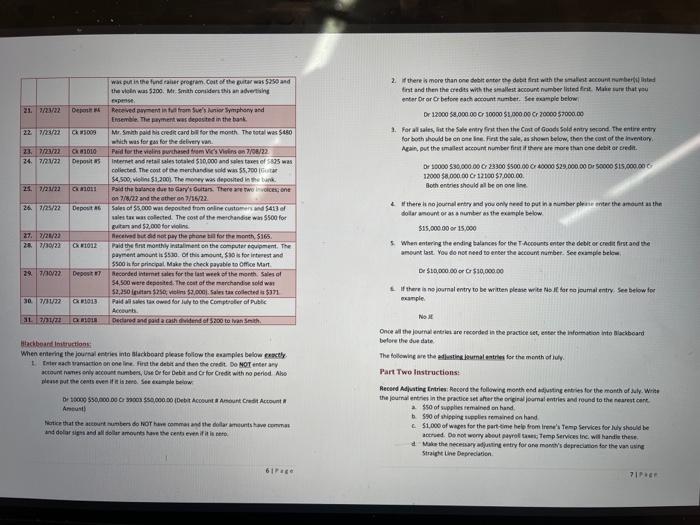

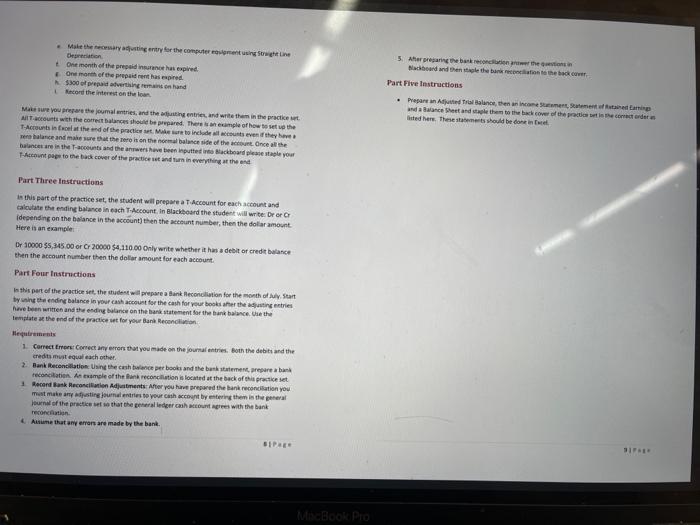

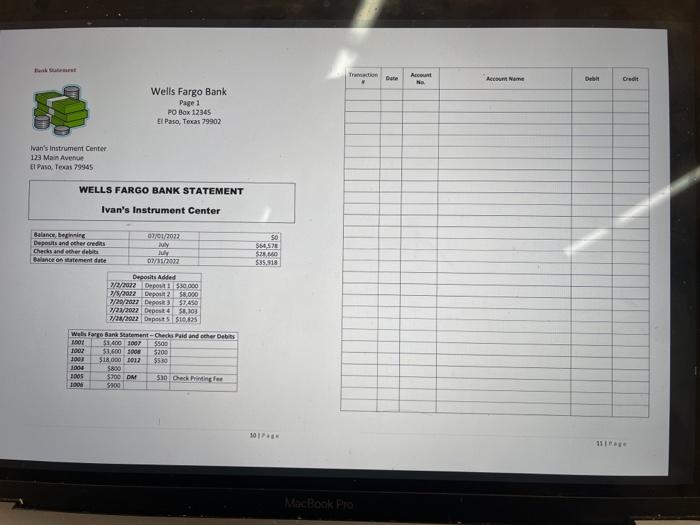

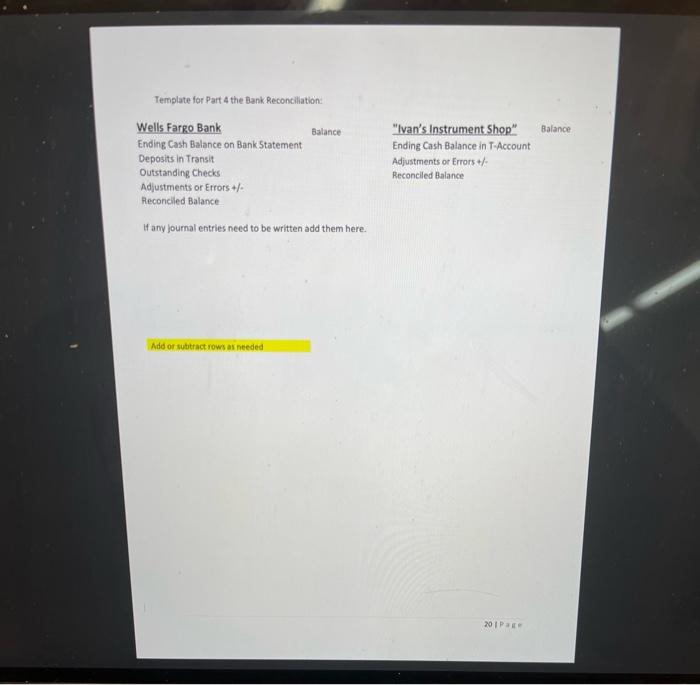

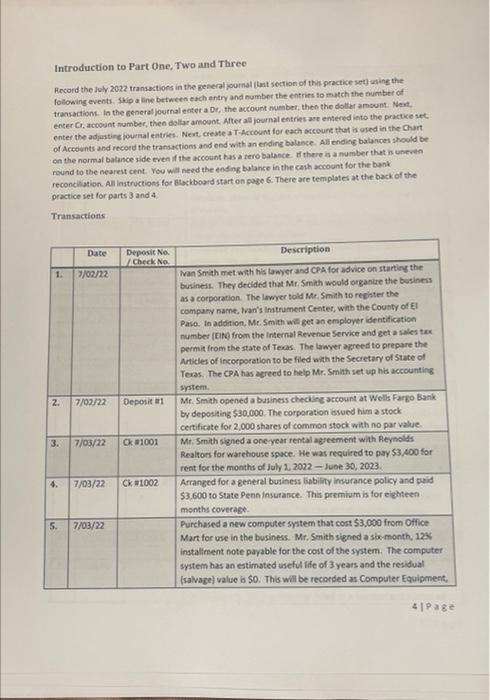

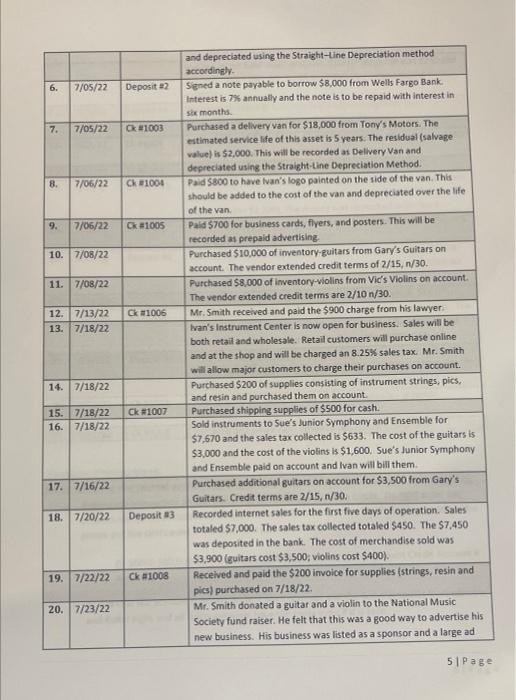

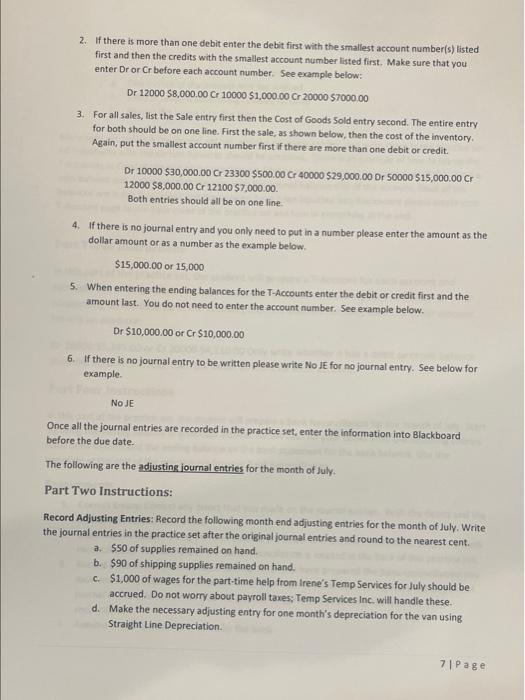

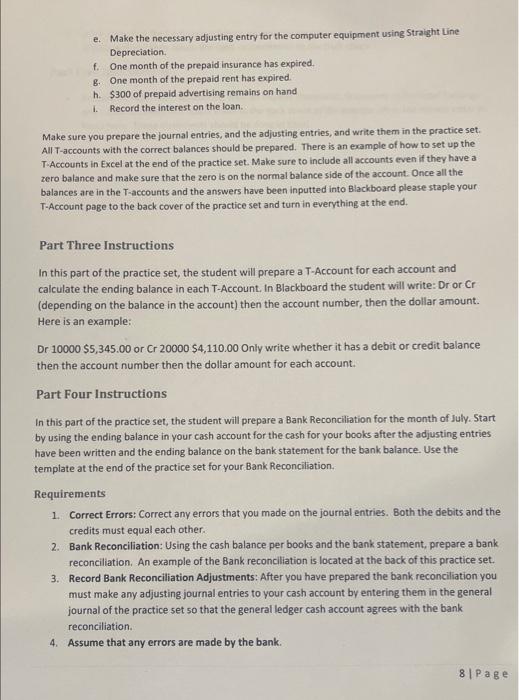

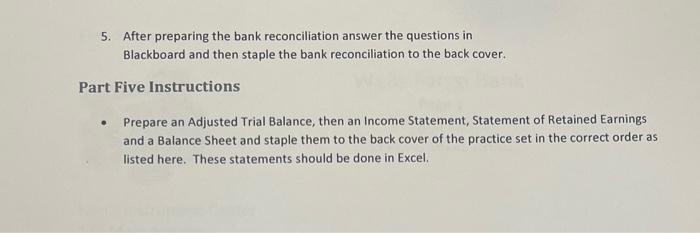

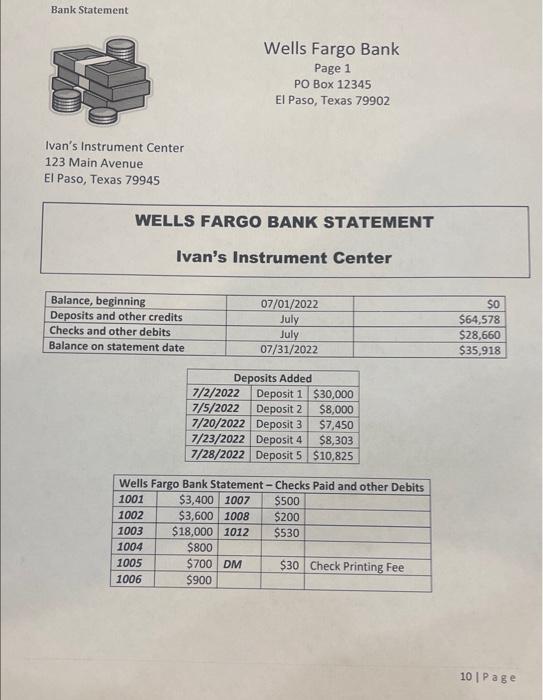

The Business This practee set is des ynad to be five parts. in the fiat gart, Fe student will complete the pouthal a-triet by =itice the four-sa ertries for han's intrumems in the back of the Practice Set and then erternt the erifiet ints blicibosed. for part twa, the joudent well wrie the adgating jaumal entries in a Statement of Retained Camings and then a Balance Seet. Aher wrerpthi-g in complete the thudent Backreatid aimesth Introfuction 1R Part one, Tweand Theree Trasaktias enter for or Gr befone each accourt munber. Ster texapie below. Or 12000$4.00000Cr30000$1.000.00Cr20000$2000.00 1. For al ales, lis the sole enery frit then the Cont of Goode sold entry wecond The entive ertiry for both should be en one ise. Fint the sale, as shawn below, then the cont of ele inverton: Again, pur the amalest account number firt it there ate more than boe eckit ar cedit. 4. Al there is no locital ertiry and you only ieed to put in a niariber phe ine trier the amou-t as the dollar anownt or as a number as the exande telow $15,000 o0 15,000 5. When entering the ending talances for the Thoceurts enter the detit or credit first a co the De $10,000.00 er Cr $1900000 1. If there in nojoarnal entry to be wi then blease write Nis fe har no joumal entry. See below foe ecample. inted here. Thenestakemerts should be dore in fuiet. balantet are is the T-acceunts and the anwertheve been leputtet irbo kiackinard fieare Part Three instructions In this part of the practice set, the student wil prepare a Twceount for each wecoust and caloutate ehe ending balance in each T-Account, in Blacksoard the student will wr te: br or cr idesensing on the badance in the account) tien the acticunt nu=ber, then the dolar amount. Here is an examplei Dr 30000$5,345 o0 or Cr30000$4,11000Only wnte whether it har a debit or cred bulance ehen the account mamber then the dolar amouse for each account. Part Four Instructions ty sing et ending balance in your cask acosust toe the cash for your books after the ad astinc ertries hewe been witrefi and the eding bulance on the barix statement bor the bunk balance. Che the Hequirwnents 1. Carrect emper Cornect ant errors that you made on the jourtal thtries. Both the debits and the credts mint equal each other. teconcilation. At esamele of the fiek reconchilstion is locatrd at the back of eis proctice set. most make any affustire fournal entriet to your cath accosint by ectering then in the geteral Frometartien- 4. Aivime that any enrar are made by the bank. Howb toughaireit Welis Fargo Bank Page 1 PO Box 12345 Ei Paro, Tecas 79902 Wan's instrument Center 123 Main Avenue El Paso, Tesas 79945 WELLS FARGO BANK STATEMENT Ivan's Instrument Center Template for Part 4 the Bank Reconcillation: If any journal entries need to be written add them here. Introduction to Part One. Two and Three Hecord the doly 2022 transetioes in the peneral journal (lmt section of this practice set uting the following events. SHip a line between each entry and number the entries to match the nurtitiof of transactiont. In the general journal eetet a Dr, the account number, then the dollar amsunt: Neat. enser Cr, account number, then doliar anownt. After all jowral entries ase entered into the practice iet enter the adjusting purnal entries. Next, create a T-Mccount for each account that is whed in the Chart of Accewits and record the transactions and end with an ending balance. Alf ending batances should be on the normal balance side even if the account has a tero batance. Th there is a number that is uneven round to the nearest cent. You wat need the ending batance in the carh accoont for the bank reconciasion. Al instructioes for 8 ackboard start on page 6. There are templates at the back of the practice set for parts 3 and 4 : Transactions 51p a e Blackboard instructions: When entering the journal entries into Blackboard please follow the examples below exactly. 1. Enter each transaction on one line. First the debit and then the credit. Do NOT enter any account names only account numbers, Use Dr for Debit and Cr for Credit with no period. Also please put the cents even if it is zero. See example below: Dr 10000$50,000.00Cr39003$50,000.00 (Debit Account # Amount Credit Account # Amount) Notice that the account numbers do NOT have commas and the dollar amounts have commas and dollar signs and all dollar amounts have the cents even if it is zero. 2. If there is more than one debit enter the debit first with the smallest account number(s) listed first and then the credits with the smallest account number listed first. Make sure that you enter Dr or C br before each account number. See example below: Dr 12000$8,000.00Cr10000$1,000.00Cr20000$7000,00 3. For all sales, list the Sale entry first then the Cost of Goods Sold entry second. The entire entry for both should be on one line. First the sale, as shown below, then the cost of the inventory. Again, put the smallest account number first if there are more than one debit or credit. Dr 10000$30,000.00Cr23300$500.00Cr40000$29,000.00 Dr 50000$15,000.00Cr 12000$8,000.00Cr12100$7,000.00. Both entries should all be on one line 4. If there is no journal entry and you only need to put in a number please enter the amount as the dollar amount or as a number as the example below. $15,000.00or15,000 5. When entering the ending balances for the T-Accounts enter the debit or credit first and the amount last. You do not need to enter the account number. See example below. Dr$10,000.00orCr$10,000,00 6. If there is no journal entry to be written please write No JE for no journal entry. See below for example. NoJE Once all the journal entries are recorded in the practice set; enter the information into Blackboard before the due date. The following are the adjusting journal entries for the month of July. Part Two Instructions: Record Adjusting Entries: Record the following month end adjusting entries for the month of July. Write the journal entries in the practice set after the original joumal entries and round to the nearest cent. a. 550 of supplies remained on hand. b. $90 of shipping supplies remained on hand. c. $1,000 of wages for the part-time help from Irene's Temp Services for July should be. accrued. Do not worry about payroll taxes; Temp Services inc. will handle these. d. Make the necessary adjusting entry for one month's depreciation for the van using Straight Line Depreciation. 7 | page e. Make the necessary adjusting entry for the computer equipment using Straight Line Depreciation. f. One month of the prepaid insurance has expired. g. One month of the prepaid rent has expired. h. $300 of prepaid advertising remains on hand i. Record the interest on the loan. Make sure you prepare the journal entries, and the adjusting entries, and write them in the practice set. All T-accounts with the correct balances should be prepared. There is an example of how to set up the T.Accounts in Excel at the end of the practice set. Make sure to include all accounts even if they have a zero balance and make sure that the zero is on the normal balance side of the account. Once all the balances are in the T-accounts and the answers have been inputted into Blackboard please staple your T-Account page to the back cover of the practice set and turn in everything at the end. Part Three Instructions In this part of the practice set, the student will prepare a T-Account for each account and calculate the ending balance in each T-Account. In Blackboard the student will write: Dr or Cr (depending on the balance in the account) then the account number, then the dollar amount. Here is an example: Dr 10000$5,345.00 or Cr20000$4,110.00 Only write whether it has a debit or credit balance then the account number then the dollar amount for each account. Part Four Instructions In this part of the practice set, the student will prepare a Bank Reconciliation for the month of July. Start by using the ending balance in your cash account for the cash for your bcoks after the adjusting entries have been written and the ending balance on the bank statement for the bank balance. Use the template at the end of the practice set for your Bank Reconciliation. Requirements 1. Correct Errors: Correct any errors that you made on the journal entries. Both the debits and the credits must equal each other. 2. Bank Reconciliation: Using the cash balance per books and the bank statement, prepare a bank reconciliation. An example of the Bank reconciliation is located at the back of this practice set. 3. Record Bank Reconciliation Adjustments: After you have prepared the bank reconciliation you must make any adjusting journal entries to your cash account by entering them in the general journal of the practice set so that the general ledger cash account agrees with the bank reconciliation. 4. Assume that any errors are made by the bank. 8P a g 5. After preparing the bank reconciliation answer the questions in Blackboard and then staple the bank reconciliation to the back cover. Part Five Instructions - Prepare an Adjusted Trial Balance, then an Income Statement, Statement of Retained Earnings and a Balance Sheet and staple them to the back cover of the practice set in the correct order as listed here. These statements should be done in Excel. Bank Statement Ivan's Instrument Center 123 Main Avenue El Paso, Texas 79945