Create T-account for following accounts

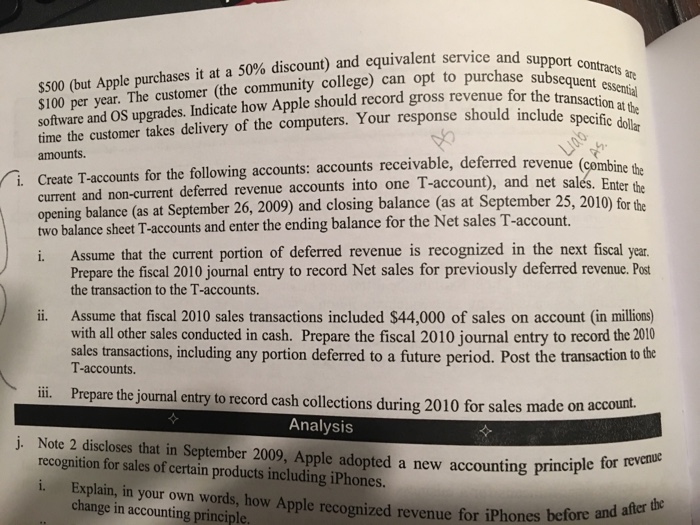

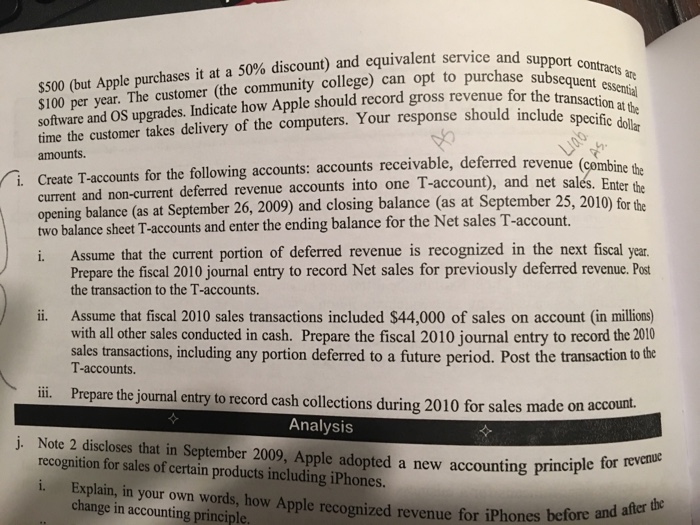

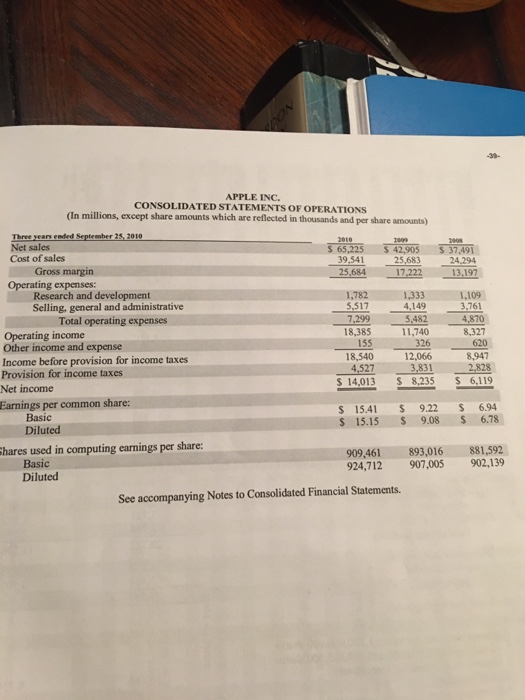

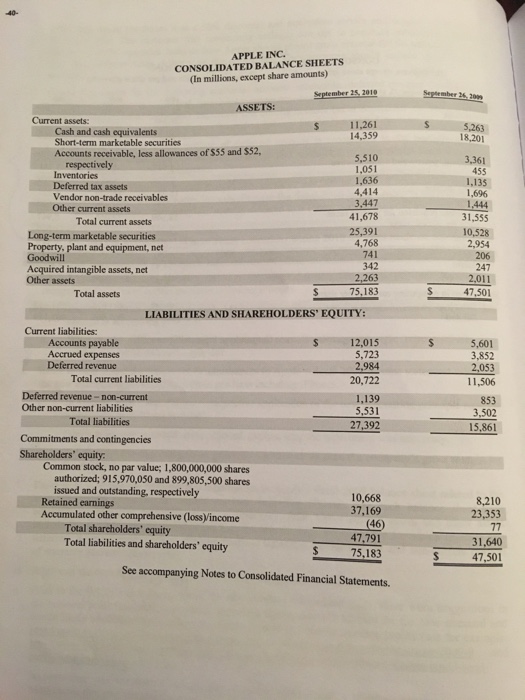

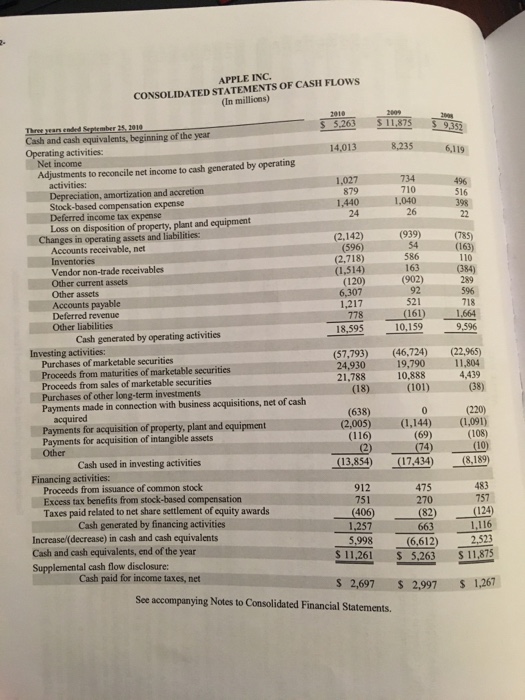

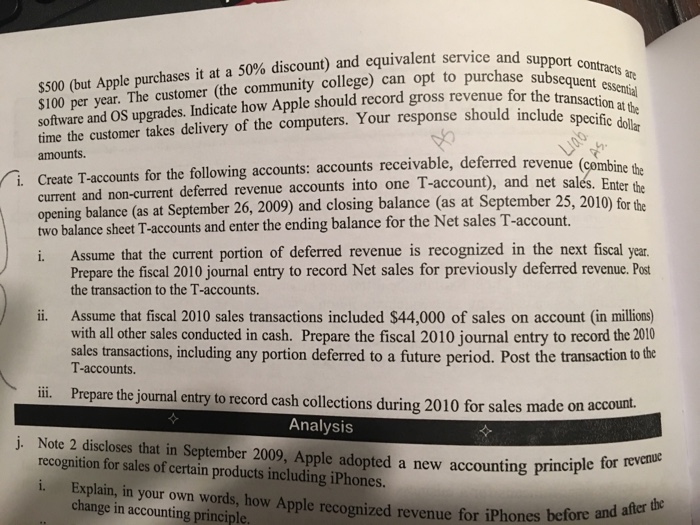

support contracts are $100 per year. The customer (the community college) can opt to software and OS upgrades. Indicate how Apple should record gross revenue for the time the customer takes delivery of the computers. Your response should include specific $500 (but Apple purchases it at a 50% discount) and equivalent service and su nsac ion at the amounts Create T-accounts for the following accounts: accounts receivable, deferred revenue (con current and non-current deferred revenue accounts into one T-account), and net sal opening balance (as at September 26, 2009) and closing balance (as at September 25, 201 two balance sheet T-accounts and enter the ending balance for the Net sales T-account. s. Enter the Assume that the current portion of deferred revenue is recognized in the next fiscal year Prepare the fiscal 2010 journal entry to record Net sales for previously deferred revenue. Post the transaction to the T-accounts ii. Assume that fiscal 2010 sales transactions included $44,000 of sales on account (in millions) with all other sales conducted in cash. Prepare the fiscal 2010 journal entry to record the 2010 sales transactions, including any portion deferred to a future period. Post the transaction to the T-accounts ii. Prepa are the journal entry to record cash collections during 2010 for sales made on account Analysis j. Note 2 discloses that in September 2009, Apple adopted a new accounting principle for recognition for sales of certain products including iPhones. i. Explain, in your own words, how Apple recognized revenue for iPhones change in accounting principl before and after the support contracts are $100 per year. The customer (the community college) can opt to software and OS upgrades. Indicate how Apple should record gross revenue for the time the customer takes delivery of the computers. Your response should include specific $500 (but Apple purchases it at a 50% discount) and equivalent service and su nsac ion at the amounts Create T-accounts for the following accounts: accounts receivable, deferred revenue (con current and non-current deferred revenue accounts into one T-account), and net sal opening balance (as at September 26, 2009) and closing balance (as at September 25, 201 two balance sheet T-accounts and enter the ending balance for the Net sales T-account. s. Enter the Assume that the current portion of deferred revenue is recognized in the next fiscal year Prepare the fiscal 2010 journal entry to record Net sales for previously deferred revenue. Post the transaction to the T-accounts ii. Assume that fiscal 2010 sales transactions included $44,000 of sales on account (in millions) with all other sales conducted in cash. Prepare the fiscal 2010 journal entry to record the 2010 sales transactions, including any portion deferred to a future period. Post the transaction to the T-accounts ii. Prepa are the journal entry to record cash collections during 2010 for sales made on account Analysis j. Note 2 discloses that in September 2009, Apple adopted a new accounting principle for recognition for sales of certain products including iPhones. i. Explain, in your own words, how Apple recognized revenue for iPhones change in accounting principl before and after the