Question

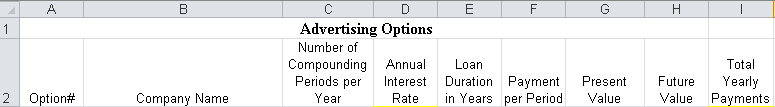

Create the following column headings on your file Advertising that is blank: ACDEFGH 1 Advertising Options Number of Compounding Annual Loan Total Periods per Interest

- Create the following column headings on your file Advertising that is blank:

2. Include the title Advertising Options on your worksheet, merged and centered over the data.

3. Fill in the appropriate data inputs and calculations for each option (across the row) so that all information is listed. For all options, assume payments are made at the end of each period.

• Option 1—AD Executives Inc. has proposed a campaign costing $45,000. This agency will accept full payment over the next two years in equal monthly installments of $2,100. For this option, you need to calculate the annual interest rate.

• Option 2—Bradshaw & Hicks has designed a campaign for $45,000 and indicated that it will charge a 6.25% annual interest rate compounded quarterly on this amount, with fixed quarterly payments paid out over the next 18 months. For this option, you need to calculate periodic payments.

• Option 3—AdWest Inc. has proposed the most modestly priced campaign, costing $30,000. This agency is willing to accept monthly payments of $1,400 until the campaign is completely paid off. AdWest Inc. will charge a 6.5% annual interest rate compounded monthly. For this option, you need to calculate the duration in years that will be required to pay off this debt.

• Option 4—Johnson, Bellview & Associates has shown the Marketing team an excellent campaign that will cost $1,500 a month for the next two years. This agency's payment terms are based on an annual interest rate of 5% compounded monthly. For this option, you need to calculate the initial value of this advertising campaign.

4. In an adjacent column, calculate the total yearly payments required for each option. You will not use a Financial Function to calculate this.

5. Format your worksheet so that it is easy to read. Be certain that dollars and percentages are included where appropriate and that columns display consistent numbers of decimal places. Wrap text, as necessary, to format the column headings within reasonable column widths. Highlight cells with the data outputs.

6. In a row below your data, select an option to recommend if you were trying to minimize the yearly outlay for this campaign. Highlight your recommendation in light green

1 A 2 Option# B Company Name D Advertising Options Number of Compounding Annual Loan Periods per Interest Duration Payment Year Rate in Years per Period E F H Total Yearly Value Payments Present Future Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started