Question

Create the following schedules, financial statements, and calculations A) Pro forma cost of goods manufactured B) Pro forma Cost of goods sold- both financial and

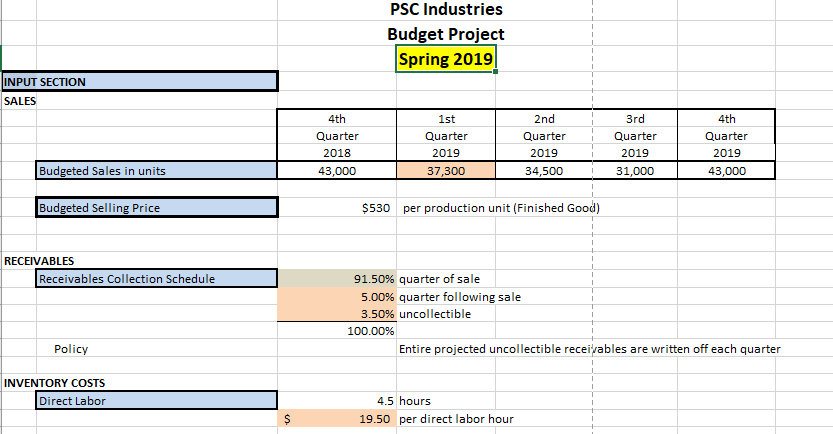

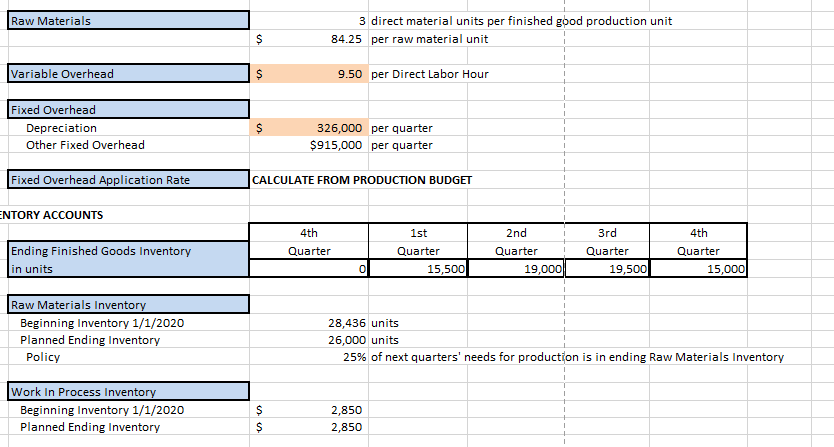

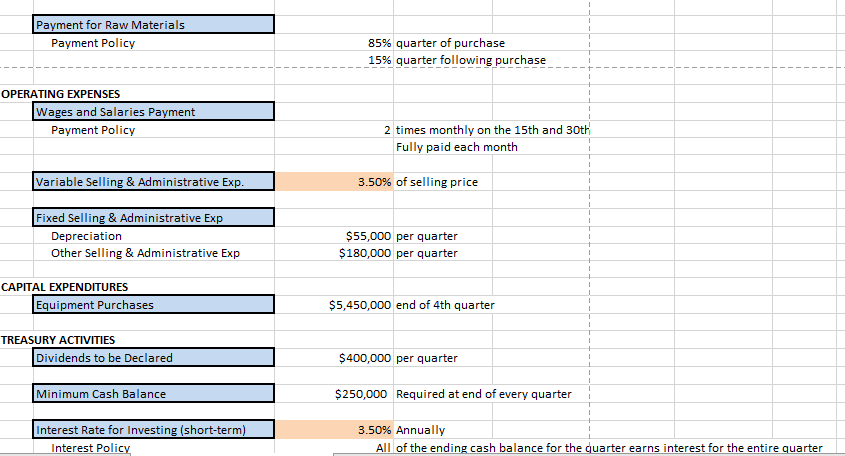

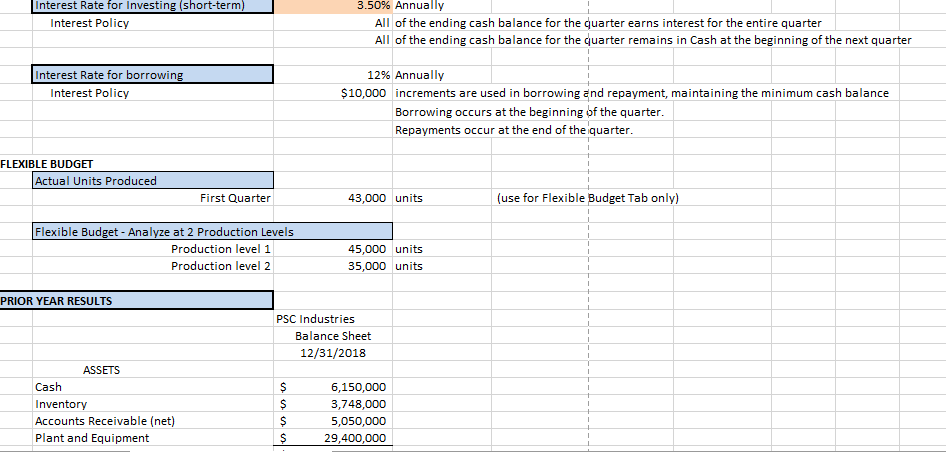

Create the following schedules, financial statements, and calculations A) Pro forma cost of goods manufactured B) Pro forma Cost of goods sold- both financial and variable cost basis C) Pro forma income statement (financial basis) D) Pro forma balance sheet E)Pro forma Income statement (variable cost basis) F) Pro forma statement of retained earnings G) breakeven analysis: 1. breakeven sales level in units and dollars. 2. cost volume profit graph showing the breakeven point H) Flexible Budget 1. Create the flexible budget results for production costs as if actual production were 160,000 units in the first quarter of 2019 2. Add flexible budget results for slightly higher and slightly lower production at 170,000 units and 150,000 units, respectively. Here are the numbers:

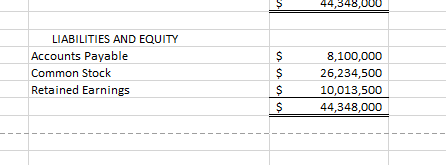

Raw Materials 3 direct material units per finished good production unit 84.25 per raw material unit Variable Overhead 9.50 per Direct Labor Hour Fixed Overhead Depreciation Other Fixed Overhead 326,000 per quarter $915,000 per quarter Fixed Overhead Application Rate CALCULATE FROM PRODUCTION BUDGET NTORY ACCOUNTS 4th 2nd Quarter 4th 1st Quarter Ending Finished Goods Inventory in units Quarter Quarter Quarter 0 15,500 19,000 19,500 15,000 Raw Materials Inventor Beginning Inventory 1/1/2020 Planned Ending Inventory 28,436 units 26,000 units Policy 25% of next quarters' needs for production is in ending Raw Materials Inventory Work In Process Inventory Beginning Inventory 1/1/2020 Planned Ending Inventory 2,850 2,850 Payment for Raw Materials 85% quarter of purchase 15% quarterfollowing purchase Payment Policy + OPERATING EXPENSES Wages and Salaries Payment Payment Policy 2 times monthly on the 15th and 30th Fully paid each month Variable Selling & Administrative Exp 3.50% of selling price Fixed Selling& Administrative Exp Depreciation Other Selling & Administrative Exp $55,000 per quarter $180,000 per quarter CAPITAL EXPENDITURES Equipment Purchases $5,450,000 end of 4th quarter TREASURY ACTIVITIES Dividends to be Declared $400,000 per quarter Minimum Cash Balance $250,000 Required at end of every quarter Interest Rate for Investing (short-term) 3.50% Annually Interest Policy All of the ending cash balance for the quarter earns interest for the entire quarter Interest Rate for Investing (short-term) 3.50% Annually Interest Policy All of the ending cash balance for the quarter earns interest for the entire quarter All of the ending cash balance for the quarter remains in Cash at the beginning of the next quarter Interest Rate for borrowing 12% Annually Interest Policy $10,000 increments are used in borrowing and repayment, maintaining the minimum cash balance Borrowing occurs at the beginning of the quarter Repayments occur at the end of the iquarter FLEXIBLE BUDGET Actual Units Produced First Quarter 43,000 units (use for Flexible Budget Tab only) Flexible Budget - Analyze at 2 Production Levels Production level 1 Production level 2 45,000 units 35,000 units PRIOR YEAR RESULTS PSC Industries Balance Sheet 12/31/2018 ASSETS Cash Inventory Accounts Receivable (net) Plant and Equipment 6,150,000 3,748,000 5,050,000 29,400,000 LIABILITIES AND EQUITY Accounts Payable Common Stock Retained Earnings 8,100,000 26,234,500 $ 10,013,500 44,348,000 Raw Materials 3 direct material units per finished good production unit 84.25 per raw material unit Variable Overhead 9.50 per Direct Labor Hour Fixed Overhead Depreciation Other Fixed Overhead 326,000 per quarter $915,000 per quarter Fixed Overhead Application Rate CALCULATE FROM PRODUCTION BUDGET NTORY ACCOUNTS 4th 2nd Quarter 4th 1st Quarter Ending Finished Goods Inventory in units Quarter Quarter Quarter 0 15,500 19,000 19,500 15,000 Raw Materials Inventor Beginning Inventory 1/1/2020 Planned Ending Inventory 28,436 units 26,000 units Policy 25% of next quarters' needs for production is in ending Raw Materials Inventory Work In Process Inventory Beginning Inventory 1/1/2020 Planned Ending Inventory 2,850 2,850 Payment for Raw Materials 85% quarter of purchase 15% quarterfollowing purchase Payment Policy + OPERATING EXPENSES Wages and Salaries Payment Payment Policy 2 times monthly on the 15th and 30th Fully paid each month Variable Selling & Administrative Exp 3.50% of selling price Fixed Selling& Administrative Exp Depreciation Other Selling & Administrative Exp $55,000 per quarter $180,000 per quarter CAPITAL EXPENDITURES Equipment Purchases $5,450,000 end of 4th quarter TREASURY ACTIVITIES Dividends to be Declared $400,000 per quarter Minimum Cash Balance $250,000 Required at end of every quarter Interest Rate for Investing (short-term) 3.50% Annually Interest Policy All of the ending cash balance for the quarter earns interest for the entire quarter Interest Rate for Investing (short-term) 3.50% Annually Interest Policy All of the ending cash balance for the quarter earns interest for the entire quarter All of the ending cash balance for the quarter remains in Cash at the beginning of the next quarter Interest Rate for borrowing 12% Annually Interest Policy $10,000 increments are used in borrowing and repayment, maintaining the minimum cash balance Borrowing occurs at the beginning of the quarter Repayments occur at the end of the iquarter FLEXIBLE BUDGET Actual Units Produced First Quarter 43,000 units (use for Flexible Budget Tab only) Flexible Budget - Analyze at 2 Production Levels Production level 1 Production level 2 45,000 units 35,000 units PRIOR YEAR RESULTS PSC Industries Balance Sheet 12/31/2018 ASSETS Cash Inventory Accounts Receivable (net) Plant and Equipment 6,150,000 3,748,000 5,050,000 29,400,000 LIABILITIES AND EQUITY Accounts Payable Common Stock Retained Earnings 8,100,000 26,234,500 $ 10,013,500 44,348,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started