Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create the following: Time Value of Money Case Study Mr . Good has reached his 6 7 birthday and is ready to retire. He has

Create the following:

Time Value of Money Case Study

Mr Good has reached his birthday and is ready to retire. He has been a hard worker and had

lived a provident life and diligently saved his money. He owns his own home his mortgage was

paid off years ago and he does not want to move. He is a widower and wants to leave the house

and any remaining assets to his only daughter.

He has accumulated savings of $ which are yielding APR He also has $ in a

money market account that pays APR. He wants to keep the money market account intact

for unexpected expenses or emergencies.

His basic living expenses now average about $ per month, and he plans to spend an

additional $ per month on travel and hobbies.

To maintain this planned standard of living, he will have to rely on his investment portfolio, as

well as the $ per month in social security payments he receives. The social security

payments are indexed for inflation.

Inflation has been well below annual, but that is unusually low by historical standards.

Suppose Mr Good will live for more years and is willing to use up all of his investment

portfolio over that period of time. He also assumes his monthly spending will increase along

with inflation over that period of time. He wants his spending to stay the same in real terms.

Assume that the investment portfolio continues to yield a rate of return, and that the inflation

rate is annually.

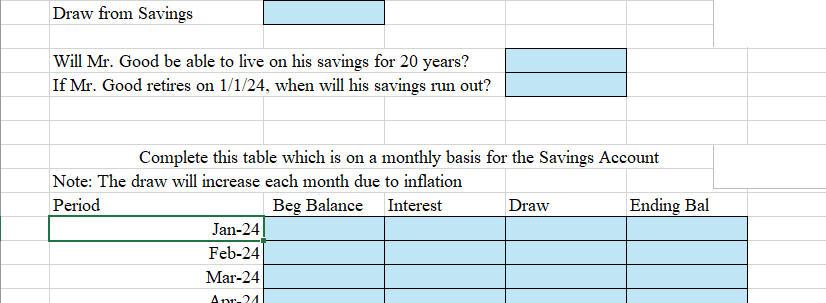

What advice do you have for Mr Good? Draw from Savings

Will Mr Good be able to live on his savings for years?

If Good retires on when will his savings run out?

Complete this table which is on a monthly basis for the Savings Account

Note: The draw will increase each month due to inflation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started