Answered step by step

Verified Expert Solution

Question

1 Approved Answer

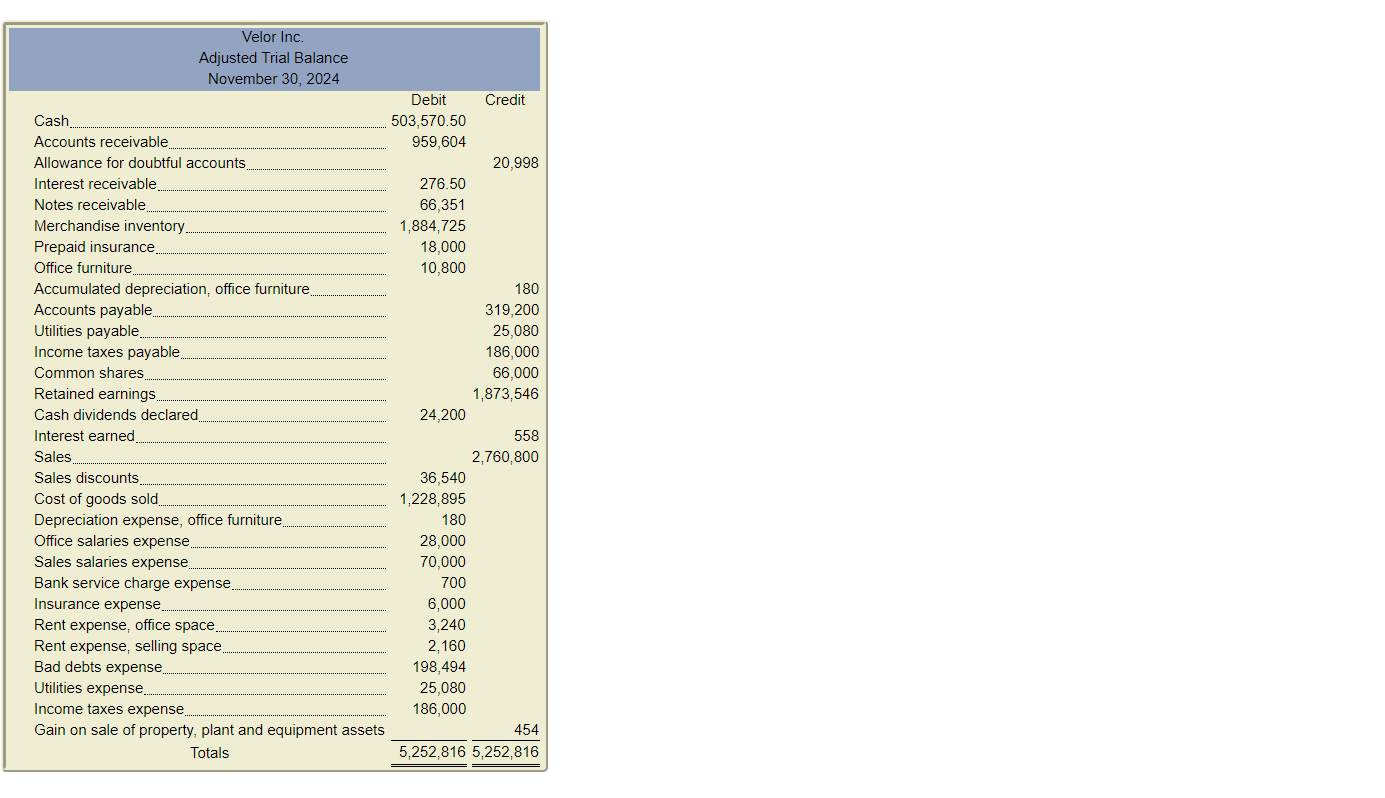

Create the income statement from the adjusted trial balance begin{tabular}{|c|c|c|} hline begin{tabular}{c} Velor Inc. Adjusted Trial Balance November 30,2024 end{tabular} & &

Create the income statement from the adjusted trial balance

\begin{tabular}{|c|c|c|} \hline \begin{tabular}{c} Velor Inc. \\ Adjusted Trial Balance \\ November 30,2024 \end{tabular} & & \\ \hline Cash..... & \begin{tabular}{l} Debit \\ 503,570.50 \end{tabular} & Credit \\ \hline Accounts receivable.... & 959,604 & \\ \hline Allowance for doubtful accounts....... & & 20,998 \\ \hline Interest receivable & 276.50 & \\ \hline Notes receivable.... & 66,351 & \\ \hline Merchandise inventory.... & 1,884,725 & \\ \hline & 18,000 & \\ \hline Office furniture & 10,800 & \\ \hline Accumulated depreciation, office furniture.... & & 180 \\ \hline Accounts payable & & 319,200 \\ \hline Utilities payable............. & & 25,080 \\ \hline Income taxes payable.... & & 186,000 \\ \hline & & 66,000 \\ \hline Retained earnings & & 1,873,546 \\ \hline Cash dividends declared... & 24,200 & \\ \hline Interest earned & & 558 \\ \hline & & 2,760,800 \\ \hline Sales discounts....... & 36,540 & \\ \hline Cost of goods sold & 1,228,895 & \\ \hline Depreciation expense, office furniture & 180 & \\ \hline Office salaries expense & 28,000 & \\ \hline Sales salaries expense...... & 70,000 & \\ \hline Bank service charge expense....... & 700 & \\ \hline Insurance expense. & 6,000 & \\ \hline Rent expense, office space..... & 3,240 & \\ \hline Rent expense, selling space..... & 2,160 & \\ \hline Bad debts expense & 198,494 & \\ \hline Utilities expense & 25,080 & \\ \hline Income taxes expense..... & 186,000 & \\ \hline \multirow{2}{*}{\begin{tabular}{l} Gain on sale of property, plant and equipment assets \\ Totals \end{tabular}} & & 454 \\ \hline & 5,252,816 & 5,252,816 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started