Question

Create the journal records for the scenario below using a table with the following: date|description|debit|credit Mario is a helper at the local convent. He helps

Create the journal records for the scenario below using a table with the following:

date|description|debit|credit

Mario is a helper at the local convent. He helps maintain the financial independence of the convent with a shop that sells blueberry jam. He started the business with 100K cash with an equipment of 50K and an inventory of 50K and all is under the convent's name.

Each bottle of jam is sold at 100 where 75% is the total cost while the remaining is the net profit. At the end of April, May, and June she sold 10K; 30K; and 10K respectively. Meanwhile, he manufactured another 50K of inventory during those months equal to the inventory sold. By the end of June, Mario asks your help to form the journal entries for the end of the tax period. Use accrual basis. The date should start at April 1. eg: April 1, April 31, May 31, …

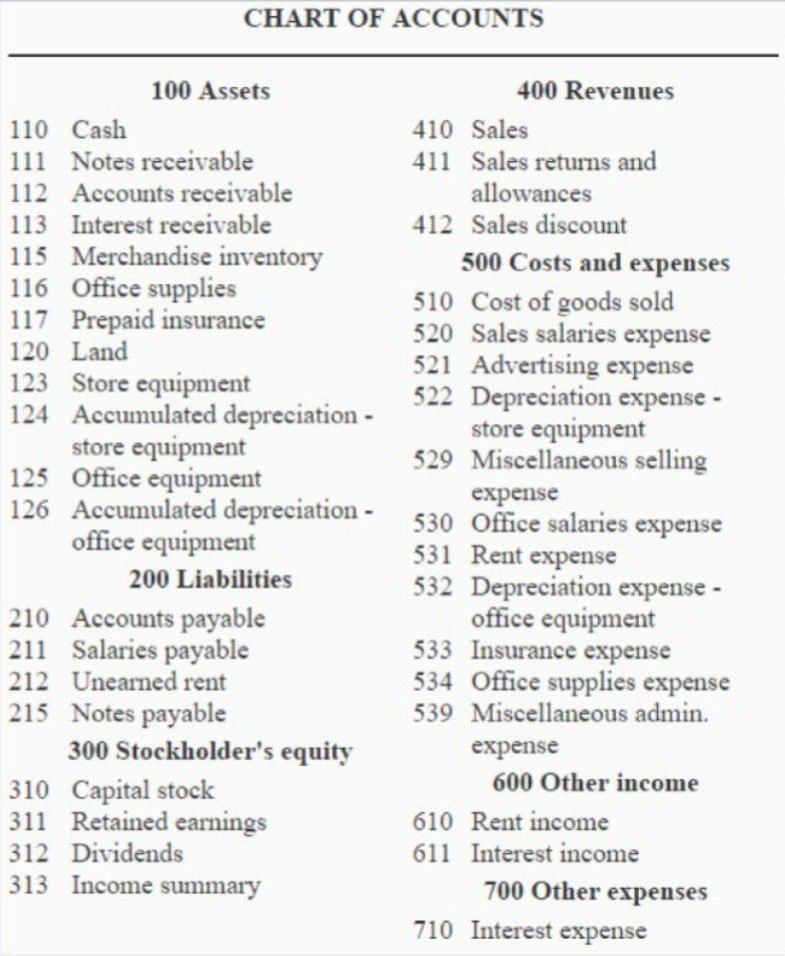

Use the following as chart of accounts:

CHART OF ACCOUNTS 100 Assets 110 Cash 111 Notes receivable 112 Accounts receivable 113 Interest receivable 115 Merchandise inventory 116 Office supplies 117 Prepaid insurance 120 Land 123 Store equipment 124 Accumulated depreciation - 300 Stockholder's equity store equipment 125 Office equipment 126 Accumulated depreciation - 530 office equipment 200 Liabilities 210 Accounts payable 211 Salaries payable 212 Unearned rent 215 Notes payable 310 Capital stock 311 Retained earnings 312 Dividends 313 Income summary 400 Revenues 410 Sales 411 Sales returns and allowances 412 Sales discount 500 Costs and expenses 510 Cost of goods sold 520 Sales salaries expense 521 Advertising expense 522 Depreciation expense - store equipment 529 Miscellaneous selling expense Office salaries expense 531 Rent expense 532 Depreciation expense - office equipment 533 Insurance expense 534 Office supplies expense 539 Miscellaneous admin. expense 600 Other income 610 Rent income 611 Interest income 700 Other expenses 710 Interest expense

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Initial Setup on April 1 Date Description Debit Credit April 1 Cash 100000 April 1 Store Equipment 50000 April 1 Merchandise Inventory 50000 April Tra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started