Answered step by step

Verified Expert Solution

Question

1 Approved Answer

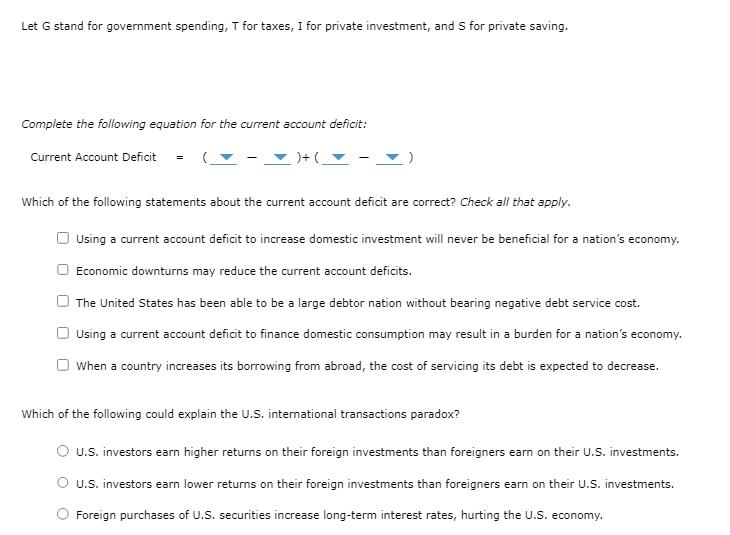

Let G stand for government spending, T for taxes, I for private investment, and S for private saving. Complete the following equation for the

Let G stand for government spending, T for taxes, I for private investment, and S for private saving. Complete the following equation for the current account deficit: Current Account Deficit .) + ( Which of the following statements about the current account deficit are correct? Check all that apply. Using a current account deficit to increase domestic investment will never be beneficial for a nation's economy. Economic downturns may reduce the current account deficits. The United States has been able to be a large debtor nation without bearing negative debt service cost. Using a current account deficit to finance domestic consumption may result in a burden for a nation's economy. When a country increases its borrowing from abroad, the cost of servicing its debt is expected to decrease. Which of the following could explain the U.S. international transactions paradox? O U.S. investors earn higher returns on their foreign investments than foreigners earn on their U.S. investments. O U.S. investors earn lower returns on their foreign investments than foreigners earn on their U.S. investments. Foreign purchases of U.S. securities increase long-term interest rates, hurting the U.S. economy.

Step by Step Solution

★★★★★

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1Using a current account deficit to increase domestic investment will never be beneficial for a nations economy 2 Economic downturns may re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started