Question

Creating a Stock Portfolio for your Clients Overview: You are an equity investment analyst for a small financial advisory firm. You are tasked to build

Creating a Stock Portfolio for your Clients

Overview:

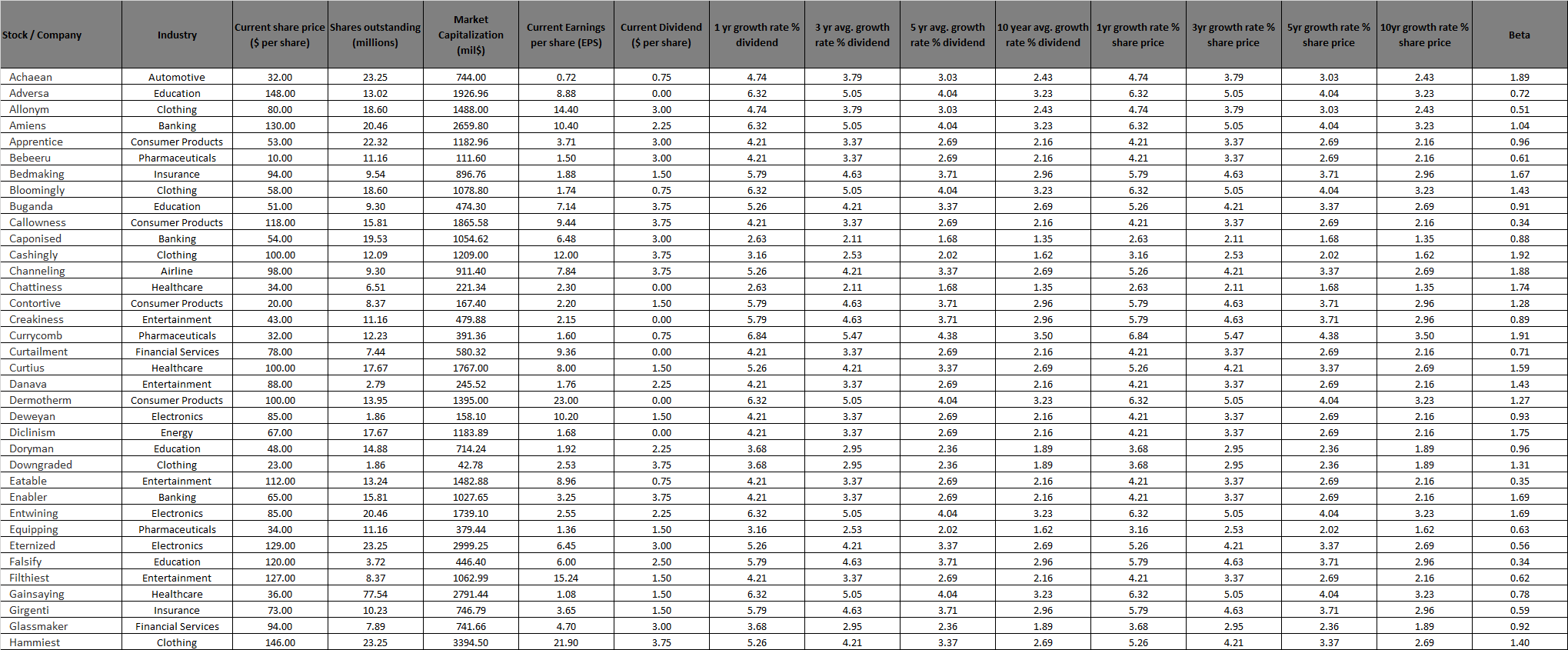

You are an equity investment analyst for a small financial advisory firm. You are tasked to build a portfolio of stocks for each of your 3 clients (Lucy, Brady and Douglas). Each portfolio must contain no more than 12 stocks and be chosen from the attached list of 36 stocks. You must build each portfolio based on the investment criteria of each of the three clients. After building each portfolio, write a one-page memo about each clients portfolio. Explain what approach you used to create the portfolio, what stocks you picked, how much of each and why. How is the portfolio expected to perform (anticipated returns) over the clients investment time horizon, whether it provides annual income and discuss how risky is the portfolio? Each client has different investment criteria, so each portfolio needs to be highly customized to that persons objectives.

Client #1:

Lucy Steamboat is a 65-year-old retired teacher. She has combined net assets of $2 million. Her assets are properly balanced between stocks, bonds and cash and she is living comfortably on her retirement, social security payments and pension amounts. She would like you to construct a portfolio of stocks of $1 million. She is relatively risk adverse. She also like for her stocks to provide current income (payments) each year in addition to growing in value if possible. Her personal discount rate is 4% and her tax rate is 15%. Her investment time horizon is 3 years.

Client #2:

Brady Seasons is a 55-year-old senior manager at a local bank. He plans on working for at last another 10 years and is trying to accumulate wealth for his retirement. He has combined net assets of $6 million. His assets are properly balanced between stocks, bonds and cash and is heavily weighted towards equities. He is living comfortably with his family and would like you to construct a portfolio of stocks of $3 million. He accepts an average amount of risk in the market. He is less concerned about yearly income from his portfolio but more focused on longer term increases in value and capital appreciation. His personal discount rate is 4.5% and his tax rate is 25%. His investment time horizon is 5 years.

Client #3:

Douglas Fairmont is a 40-year-old rich socialite who lives off his familys wealth. He has no plans of working and will be living entirely off his investments to fund his extravagant lifestyle. He has combined net assets of $100 million. His investment horizon is long, so much of his portfolio is invested in stocks, real estate and other long-term business ventures. He is living very comfortably with his family and would like you to construct a portfolio of stocks of $10 million. For this $10 million portfolio, he likes high risk high return investments and is entirely focused on total return on his investment. His personal discount rate is 5.5% and his tax rate is 31%. His investment time horizon is 10 years.

INSTRUCTIONS:

This assignment has 1 business situation with 3 scenarios. Each scenario requires you to write a 1-page memo (three 1-page memos in total). Please do those in Word Doc as well as show your calculations in Excel Doc. PLEASE ZOOM IN TO SEE THE PHOTO!

Stock / Company Industry Current share price Shares outstanding ($ per share) (millions) Market Capitalization (mil) Current Earnings per share (EPS) Current Dividend 1 yr growth rate % ($ per share) dividend 3 yr avg. growth rate % dividend 5 yr avg. growth 10 year avg. growth 1yr growth rate % 3yr growth rate % 5yr growth rate % 10yr growth rate % rate % dividend rate % dividend share price share price share price share price Beta 3.03 0.72 8.88 4.74 6.32 4.74 2.43 3.23 2.43 4.04 2.43 3.23 2.43 1.89 0.72 3.03 23.25 13.02 18.60 20.46 22.32 11.16 9.54 14.40 10.40 32.00 148.00 80.00 130.00 53.00 10.00 94.00 58.00 51.00 118.00 3.79 5.05 3.79 5.05 3.37 3.37 4.04 3.23 0.51 1.04 0.96 0.61 2.69 2.69 2.16 2.16 6.32 4.21 4.21 5.79 6.32 5.26 3.71 1.50 1.88 1.74 7.14 9.44 2.96 3.71 4.04 3.79 5.05 3.79 5.05 3.37 3.37 4.63 5.05 4.21 3.37 2.11 2.53 4.21 2.11 4.63 4.63 3.23 2.16 2.16 2.96 3.23 2.69 2.16 4.63 5.05 4.21 3.23 2.69 18.60 9.30 15.81 19.53 1.67 1.43 0.91 0.34 3.37 2.69 2.16 4.21 2.63 3.37 2.11 54.00 6.48 12.00 4.74 6.32 4.74 6.32 4.21 4.21 5.79 6.32 5.26 4.21 2.63 3.16 5.26 2.63 5.79 5.79 6.84 4.21 5.26 4.21 0.75 0.00 3.00 2.25 3.00 3.00 1.50 0.75 3.75 3.75 3.00 3.75 3.75 0.00 1.50 0.00 0.75 0.00 1.50 2.25 0.00 1.50 1.68 2.02 1.35 1.62 0.88 1.92 100.00 98.00 34.00 3.16 5.26 2.63 1.35 1.62 2.69 1.35 3.37 1.68 2.53 4.21 2.11 4.63 2.69 1.35 1.88 1.74 20.00 5.79 2.96 3.71 3.71 3.03 4.04 3.03 4.04 2.69 2.69 3.71 4.04 3.37 2.69 1.68 2.02 3.37 1.68 3.71 3.71 4.38 2.69 3.37 2.69 4.04 2.69 2.69 2.36 2.36 2.69 2.69 4.04 2.96 2.96 1.28 0.89 5.79 6.84 4.21 2.96 3.50 7.84 2.30 2.20 2.15 1.60 9.36 8.00 1.76 23.00 4.63 5.47 Achaean Adversa Allonym Amiens Apprentice Bebeeru Bedmaking Bloomingly Buganda Callowness Caponised Cashingly Channeling Chattiness Contortive Creakiness Currycomb Curtailment Curtius Danava Dermotherm Deweyan Diclinism Doryman Downgraded Eatable Enabler Entwining Equipping Eternized Falsify Filthiest Gainsaying Girgenti Glassmaker Hammiest 744.00 1926.96 1488.00 2659.80 1182.96 111.60 896.76 1078.80 474.30 1865.58 1054.62 1209.00 911.40 221.34 167.40 479.88 391.36 580.32 1767.00 245.52 1395.00 158.10 1183.89 714.24 42.78 1482.88 1027.65 1739.10 379.44 2999.25 446.40 1062.99 2791.44 746.79 741.66 1.91 Automotive Education Clothing Banking Consumer Products Pharmaceuticals Insurance Clothing Education Consumer Products Banking Clothing Airline Healthcare Consumer Products Entertainment Pharmaceuticals Financial Services Healthcare Entertainment Consumer Products Electronics Energy Education Clothing Entertainment Banking Electronics Pharmaceuticals Electronics Education Entertainment Healthcare Insurance Financial Services Clothing 4.38 2.69 2.16 0.71 43.00 32.00 78.00 100.00 88.00 100.00 85.00 5.26 4.21 6.32 2.69 2.16 3.23 1.59 1.43 1.27 6.32 4.21 10.20 4.21 2.16 0.93 3.37 2.69 4.04 2.69 2.69 2.36 2.36 2.69 67.00 3.37 4.21 3.37 5.05 3.37 3.37 2.95 2.95 3.37 3.37 0.00 12.09 9.30 6.51 8.37 11.16 12.23 7.44 17.67 2.79 13.95 1.86 17.67 14.88 1.86 13.24 15.81 20.46 11.16 23.25 3.72 8.37 77.54 10.23 7.89 23.25 4.21 2.16 4.21 48.00 1.75 0.96 5.47 3.37 4.21 3.37 5.05 3.37 3.37 2.95 2.95 3.37 3.37 5.05 2.53 4.21 4.63 1.89 23.00 112.00 1.68 1.92 2.53 8.96 3.25 2.55 1.36 6.45 3.68 3.68 4.21 4.21 2.25 3.75 0.75 3.75 2.25 1.50 1.89 2.16 3.50 2.16 2.69 2.16 3.23 2.16 2.16 1.89 1.89 2.16 2.16 3.23 1.62 2.69 2.96 2.16 1.31 0.35 65.00 2.69 4.04 2.16 3.23 1.69 1.69 1.62 2.02 3.37 5.05 2.53 4.21 0.63 0.56 2.69 3.68 3.68 4.21 4.21 6.32 3.16 5.26 5.79 4.21 6.32 5.79 3.68 5.26 3.00 2.50 6.00 3.71 85.00 34.00 129.00 120.00 127.00 36.00 73.00 94.00 146.00 4.63 6.32 3.16 5.26 5.79 4.21 6.32 5.79 3.68 5.26 0.34 0.62 15.24 3.37 2.69 5.05 1.50 1.50 1.50 3.00 3.75 3.23 2.02 3.37 3.71 2.69 4.04 3.71 2.36 3.37 1.08 3.65 2.96 2.16 3.23 2.96 1.89 2.69 4.04 3.71 2.36 3.37 3.37 5.05 4.63 2.95 4.21 4.63 2.95 4.21 4.70 0.78 0.59 0.92 1.40 2.96 1.89 2.69 3394.50 21.90 Stock / Company Industry Current share price Shares outstanding ($ per share) (millions) Market Capitalization (mil) Current Earnings per share (EPS) Current Dividend 1 yr growth rate % ($ per share) dividend 3 yr avg. growth rate % dividend 5 yr avg. growth 10 year avg. growth 1yr growth rate % 3yr growth rate % 5yr growth rate % 10yr growth rate % rate % dividend rate % dividend share price share price share price share price Beta 3.03 0.72 8.88 4.74 6.32 4.74 2.43 3.23 2.43 4.04 2.43 3.23 2.43 1.89 0.72 3.03 23.25 13.02 18.60 20.46 22.32 11.16 9.54 14.40 10.40 32.00 148.00 80.00 130.00 53.00 10.00 94.00 58.00 51.00 118.00 3.79 5.05 3.79 5.05 3.37 3.37 4.04 3.23 0.51 1.04 0.96 0.61 2.69 2.69 2.16 2.16 6.32 4.21 4.21 5.79 6.32 5.26 3.71 1.50 1.88 1.74 7.14 9.44 2.96 3.71 4.04 3.79 5.05 3.79 5.05 3.37 3.37 4.63 5.05 4.21 3.37 2.11 2.53 4.21 2.11 4.63 4.63 3.23 2.16 2.16 2.96 3.23 2.69 2.16 4.63 5.05 4.21 3.23 2.69 18.60 9.30 15.81 19.53 1.67 1.43 0.91 0.34 3.37 2.69 2.16 4.21 2.63 3.37 2.11 54.00 6.48 12.00 4.74 6.32 4.74 6.32 4.21 4.21 5.79 6.32 5.26 4.21 2.63 3.16 5.26 2.63 5.79 5.79 6.84 4.21 5.26 4.21 0.75 0.00 3.00 2.25 3.00 3.00 1.50 0.75 3.75 3.75 3.00 3.75 3.75 0.00 1.50 0.00 0.75 0.00 1.50 2.25 0.00 1.50 1.68 2.02 1.35 1.62 0.88 1.92 100.00 98.00 34.00 3.16 5.26 2.63 1.35 1.62 2.69 1.35 3.37 1.68 2.53 4.21 2.11 4.63 2.69 1.35 1.88 1.74 20.00 5.79 2.96 3.71 3.71 3.03 4.04 3.03 4.04 2.69 2.69 3.71 4.04 3.37 2.69 1.68 2.02 3.37 1.68 3.71 3.71 4.38 2.69 3.37 2.69 4.04 2.69 2.69 2.36 2.36 2.69 2.69 4.04 2.96 2.96 1.28 0.89 5.79 6.84 4.21 2.96 3.50 7.84 2.30 2.20 2.15 1.60 9.36 8.00 1.76 23.00 4.63 5.47 Achaean Adversa Allonym Amiens Apprentice Bebeeru Bedmaking Bloomingly Buganda Callowness Caponised Cashingly Channeling Chattiness Contortive Creakiness Currycomb Curtailment Curtius Danava Dermotherm Deweyan Diclinism Doryman Downgraded Eatable Enabler Entwining Equipping Eternized Falsify Filthiest Gainsaying Girgenti Glassmaker Hammiest 744.00 1926.96 1488.00 2659.80 1182.96 111.60 896.76 1078.80 474.30 1865.58 1054.62 1209.00 911.40 221.34 167.40 479.88 391.36 580.32 1767.00 245.52 1395.00 158.10 1183.89 714.24 42.78 1482.88 1027.65 1739.10 379.44 2999.25 446.40 1062.99 2791.44 746.79 741.66 1.91 Automotive Education Clothing Banking Consumer Products Pharmaceuticals Insurance Clothing Education Consumer Products Banking Clothing Airline Healthcare Consumer Products Entertainment Pharmaceuticals Financial Services Healthcare Entertainment Consumer Products Electronics Energy Education Clothing Entertainment Banking Electronics Pharmaceuticals Electronics Education Entertainment Healthcare Insurance Financial Services Clothing 4.38 2.69 2.16 0.71 43.00 32.00 78.00 100.00 88.00 100.00 85.00 5.26 4.21 6.32 2.69 2.16 3.23 1.59 1.43 1.27 6.32 4.21 10.20 4.21 2.16 0.93 3.37 2.69 4.04 2.69 2.69 2.36 2.36 2.69 67.00 3.37 4.21 3.37 5.05 3.37 3.37 2.95 2.95 3.37 3.37 0.00 12.09 9.30 6.51 8.37 11.16 12.23 7.44 17.67 2.79 13.95 1.86 17.67 14.88 1.86 13.24 15.81 20.46 11.16 23.25 3.72 8.37 77.54 10.23 7.89 23.25 4.21 2.16 4.21 48.00 1.75 0.96 5.47 3.37 4.21 3.37 5.05 3.37 3.37 2.95 2.95 3.37 3.37 5.05 2.53 4.21 4.63 1.89 23.00 112.00 1.68 1.92 2.53 8.96 3.25 2.55 1.36 6.45 3.68 3.68 4.21 4.21 2.25 3.75 0.75 3.75 2.25 1.50 1.89 2.16 3.50 2.16 2.69 2.16 3.23 2.16 2.16 1.89 1.89 2.16 2.16 3.23 1.62 2.69 2.96 2.16 1.31 0.35 65.00 2.69 4.04 2.16 3.23 1.69 1.69 1.62 2.02 3.37 5.05 2.53 4.21 0.63 0.56 2.69 3.68 3.68 4.21 4.21 6.32 3.16 5.26 5.79 4.21 6.32 5.79 3.68 5.26 3.00 2.50 6.00 3.71 85.00 34.00 129.00 120.00 127.00 36.00 73.00 94.00 146.00 4.63 6.32 3.16 5.26 5.79 4.21 6.32 5.79 3.68 5.26 0.34 0.62 15.24 3.37 2.69 5.05 1.50 1.50 1.50 3.00 3.75 3.23 2.02 3.37 3.71 2.69 4.04 3.71 2.36 3.37 1.08 3.65 2.96 2.16 3.23 2.96 1.89 2.69 4.04 3.71 2.36 3.37 3.37 5.05 4.63 2.95 4.21 4.63 2.95 4.21 4.70 0.78 0.59 0.92 1.40 2.96 1.89 2.69 3394.50 21.90Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started