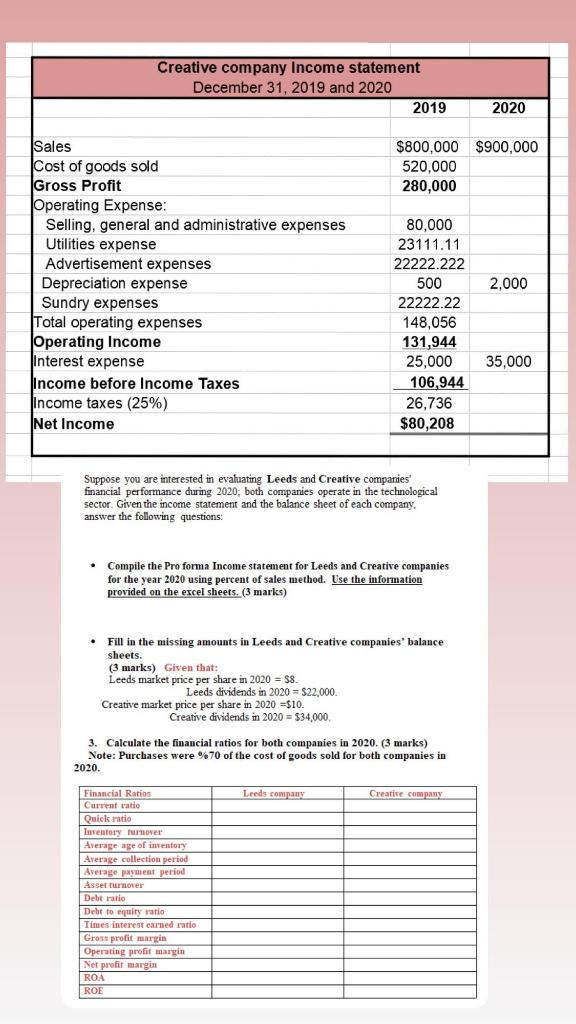

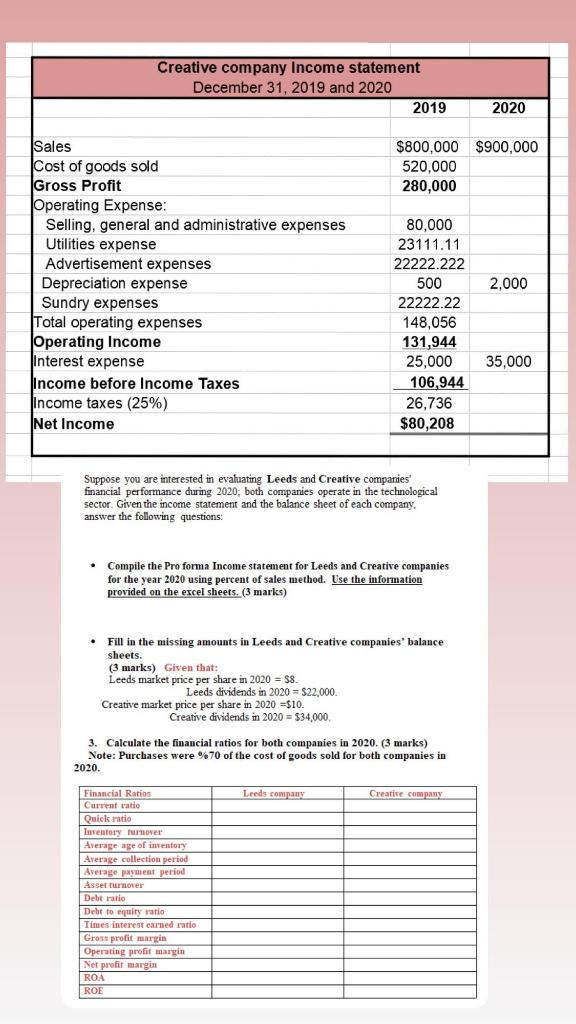

Creative company Income statement December 31, 2019 and 2020 2019 2020 $800,000 $900,000 520,000 280,000 Sales Cost of goods sold Gross Profit Operating Expense: Selling, general and administrative expenses Utilities expense Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating Income Interest expense Income before Income Taxes Income taxes (25%) Net Income 2,000 80,000 23111.11 22222.222 500 22222.22 148,056 131,944 25,000 106,944 26,736 $80,208 35,000 Suppose you are interested in evaluating Leeds and Creative companies financial performance during 2020, both companies operate in the technological sector. Given the income statement and the balance sheet of each company, answer the following questions: Compile the Proforma Income statement for Leeds and Creative companies for the year 2020 using percent of sales method. Use the information provided on the excel sheets. (3 marks) Fill in the missing amounts in Leeds and Creative companies' balance sheets (3 marks) Given that: Leeds market price per share in 2020 = $8. Leeds dividends in 2020 = $22,000. Creative market price per share in 2020 =$10 Creative dividends in 2020 = $34,000 3. Calculate the financial ratios for both companies in 2020. (3 marks) Note: Purchases were %70 of the cost of goods sold for both companies in 2020. Leeds company Creative company Financial Ratios Current ratio Quick ratio Inventory turnover Average age of inventory Average collection period Average payment period Assetturmoves Debt ratio Debt to quity ratio Times interest earned ratio Gross profit margin Operating profit margin Net profit margin ROA ROE Creative company Income statement December 31, 2019 and 2020 2019 2020 $800,000 $900,000 520,000 280,000 Sales Cost of goods sold Gross Profit Operating Expense: Selling, general and administrative expenses Utilities expense Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating Income Interest expense Income before Income Taxes Income taxes (25%) Net Income 2,000 80,000 23111.11 22222.222 500 22222.22 148,056 131,944 25,000 106,944 26,736 $80,208 35,000 Suppose you are interested in evaluating Leeds and Creative companies financial performance during 2020, both companies operate in the technological sector. Given the income statement and the balance sheet of each company, answer the following questions: Compile the Proforma Income statement for Leeds and Creative companies for the year 2020 using percent of sales method. Use the information provided on the excel sheets. (3 marks) Fill in the missing amounts in Leeds and Creative companies' balance sheets (3 marks) Given that: Leeds market price per share in 2020 = $8. Leeds dividends in 2020 = $22,000. Creative market price per share in 2020 =$10 Creative dividends in 2020 = $34,000 3. Calculate the financial ratios for both companies in 2020. (3 marks) Note: Purchases were %70 of the cost of goods sold for both companies in 2020. Leeds company Creative company Financial Ratios Current ratio Quick ratio Inventory turnover Average age of inventory Average collection period Average payment period Assetturmoves Debt ratio Debt to quity ratio Times interest earned ratio Gross profit margin Operating profit margin Net profit margin ROA ROE