Question: Creative Consensus, Inc. box 473, HCR 33, Spruce Head, ME 04859 phone: 207-596-6373 fax: 207-596-0538 email: cci@midcoast.com VIKING INVESTMENTS (Principals) Leonard Greenhalgh Dartmouth College ROLE

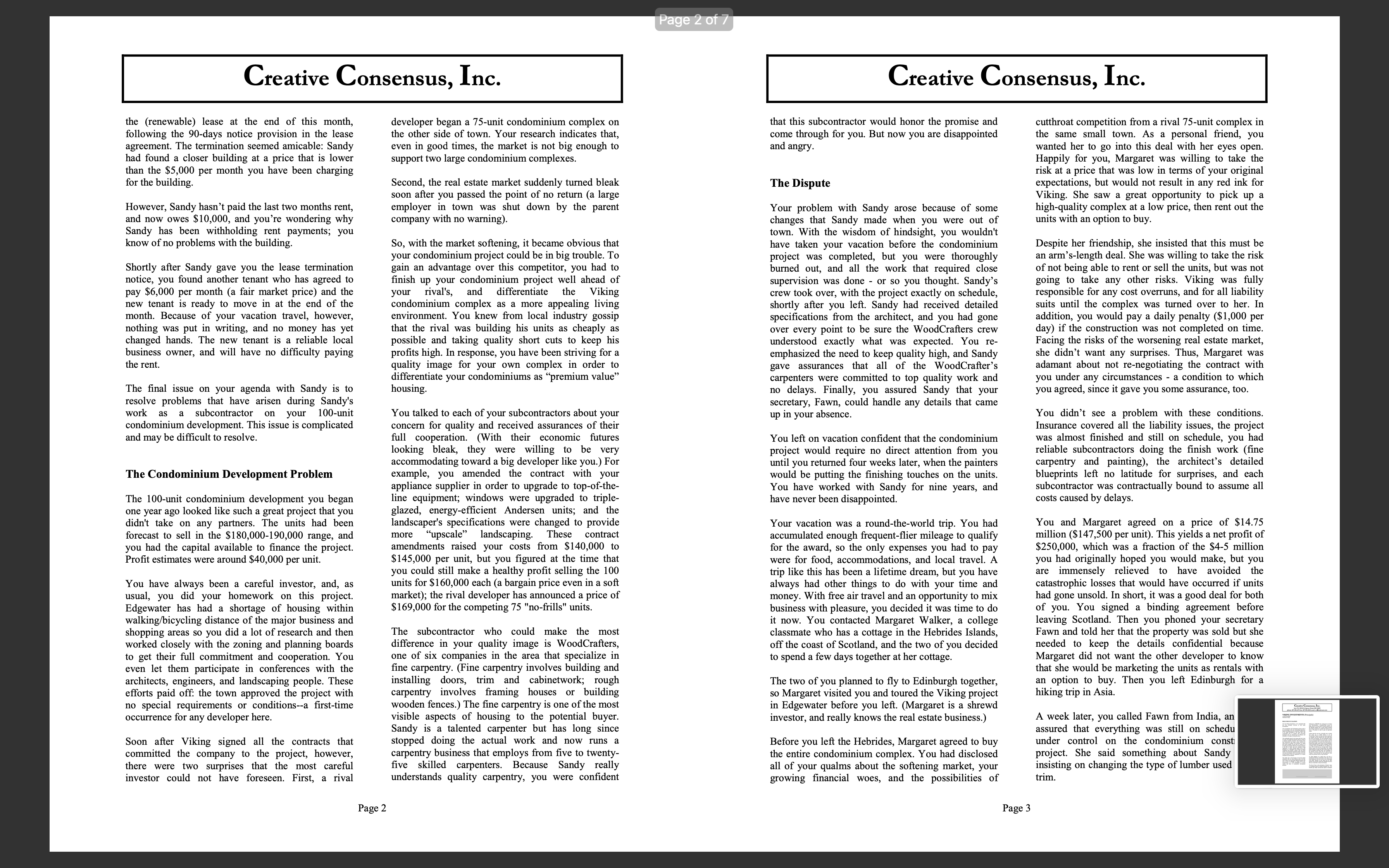

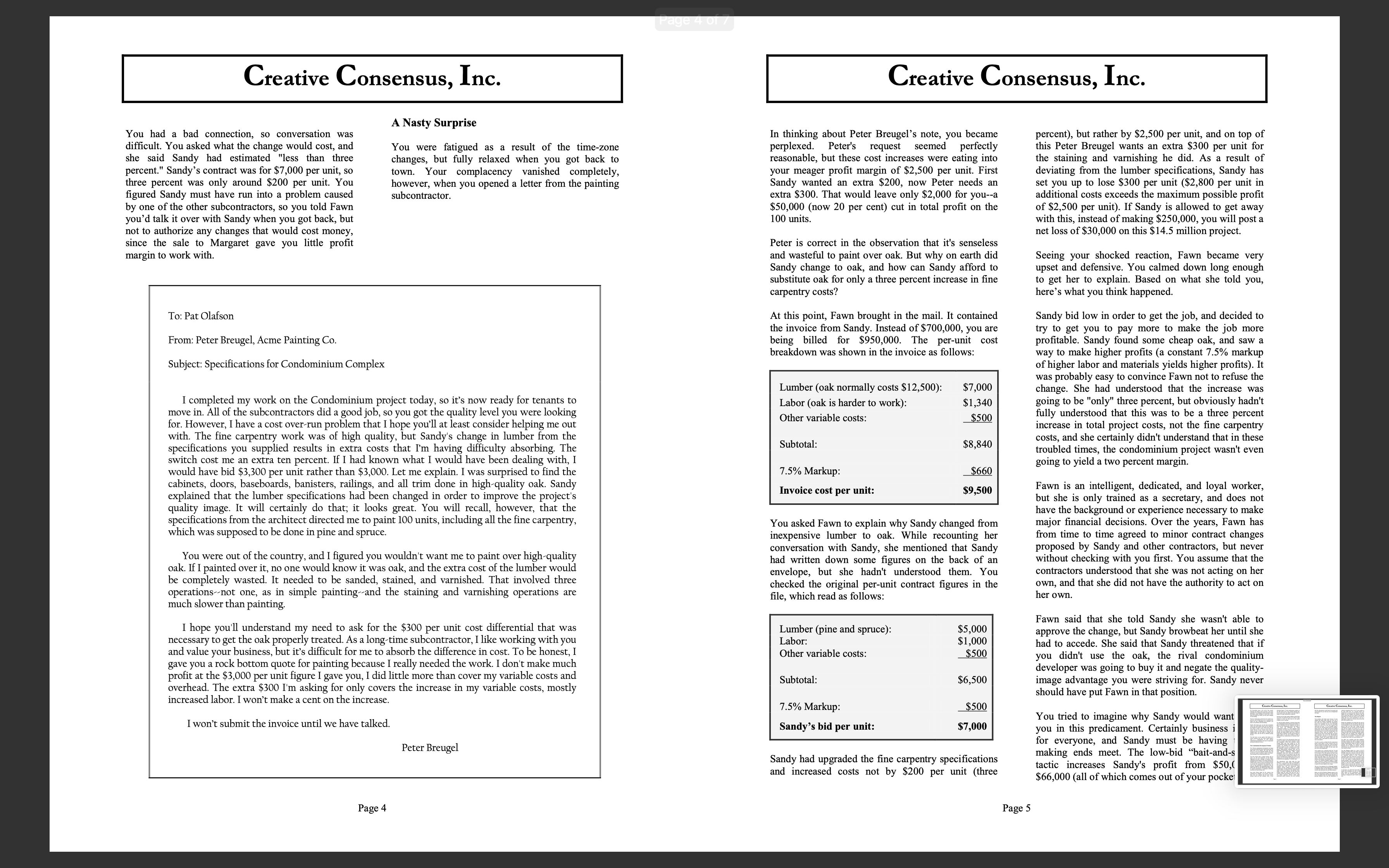

Creative Consensus, Inc. box 473, HCR 33, Spruce Head, ME 04859 phone: 207-596-6373 fax: 207-596-0538 email: cci@midcoast.com VIKING INVESTMENTS (Principals) Leonard Greenhalgh Dartmouth College ROLE FOR PAT OLAFSON You run Viking Investments, a U.S. corporation that Viking has a $200,000 loan coming due in 30 days has been primarily involved in real estate from WoodCrafters, a proprietorship owned by development. Sandy Wood. The loan yields 10 percent interest, but the lakeside property has so much upside potential Your investments and development projects tend to that Viking would have to double the interest on the be concentrated in the area surrounding Edgewater, loan to 20 percent in order to gain an equivalent Illinois, an affluent town in a rural area. Viking is one return. of six major developers in the local area, who occasionally have to compete with out-of-state Viking made the one-year, renewable loan to Sandy developers who are attracted by the affluente and five years ago to enable Sandy to set up abundance of acreage at reasonable prices. WoodCrafters. Sandy has made the interest payments on schedule, and has renewed the loan rather than The comfortable times for real estate sales have come pay back the principal. The loan agreement allows to an end. The market has become weak as a result of you to call the principal due at any time, in which a regional economic recession. New housing starts case the principal and all accrued interest must be have plummeted, and houses remain unsold even paid within 30 days. You stress every time the loan is when prices are slashed. The pressures on Viking renewed that Sandy cannot expect to rely indefinitely have grown steadily over the past six months. It is on the renewable loan as a source of funding, and that becoming increasingly difficult to develop properties if Viking wants the $200,000 for any purpose, the in the face of more and more stringent zoning loan will be called due on 30 days notice. Sandy regulations, to obtain working capital, and to sell always assures you that WoodCrafters has enough properties at a reasonable price during the intense liquid resources to repay the loan on short notice, and competition that attends a slump in the real estate has no problem with these terms. The availability of market. Environmental regulations further complicate the lakeside property makes this the right time for real estate development, and even though you see the Viking to stop renewing the loan and more fully societal wisdom of the new regulations, it's a further realize the potential return on that $200,000. constraint on your business. As often happens in a small town, you have a One bright spot is that because of the bad market multifaceted business relationship with many of the conditions, there are some fabulous deals to be had. local businesses, and this is true of your relationship One of these is an out-of-state lakefront property that with Sandy. Because of this, there are two other can be had for $200,000 if Viking moves fast. agenda items (besides calling the $200,000 loan due) Undeveloped, it is worth $250,000 in a normal that you would like to discuss with Sandy. market, and there is considerable development potential. The first of these is the termination of Sandy's lease of a building owned by Viking Investments, Inc. Two months ago, Sandy exercised the option to terminatePage 2 of / Creative Consensus, Inc. Creative Consensus, Inc. the (renewable) lease at the end of this month, developer began a 75-unit condominium complex on that this subcontractor would honor the promise and cutthroat competition from a rival 75-unit complex in following the 90-days notice provision in the lease the other side of town. Your research indicates that, come through for you. But now you are disappointed the same small town. As a personal friend, you agreement. The termination seemed amicable: Sandy even in good times, the market is not big enough to and angry. wanted her to go into this deal with her eyes open. had found a closer building at a price that is lower support two large condominium complexes Happily for you, Margaret was willing to take the than the $5,000 per month you have been charging risk at a price that was low in terms of your original for the building. Second, the real estate market suddenly turned bleak The Dispute expectations, but would not result in any red ink for soon after you passed the point of no return (a large Viking. She saw a great opportunity to pick up a However, Sandy hasn't paid the last two months rent, employer in town was shut down by the parent Your problem with Sandy arose because of some high-quality complex at a low price, then rent out the and now owes $10,000, and you're wondering why company with no warning). changes that Sandy made when you were out of units with an option to buy. Sandy has been withholding rent payments; you town. With the wisdom of hindsight, you wouldn' know of no problems with the building. So, with the market softening, it became obvious that have taken your vacation before the condominium Despite her friendship, she insisted that this must be your condominium project could be in big trouble. To project was completed, but you were thoroughly an arm's-length deal. She was willing to take the risk Shortly after Sandy gave you the lease termination gain an advantage over this competitor, you had to burned out, and all the work that required close of not being able to rent or sell the units, but was not notice, you found another tenant who has agreed to finish up your condominium project well ahead of supervision was done - or so you thought. Sandy's going to take any other risks. Viking was fully pay $6,000 per month (a fair market price) and the your rival's, and differentiate the Viking crew took over, with the project exactly on schedule, responsible for any cost overruns, and for all liability new tenant is ready to move in at the end of the condominium complex as a more appealing living shortly after you left. Sandy had received detailed suits until the complex was turned over to her. In month. Because of your vacation travel, however, environment. You knew from local industry gossip specifications from the architect, and you had gone addition, you would pay a daily penalty ($1,000 per nothing was put in writing, and no money has yet that the rival was building his units as cheaply as over every point to be sure the WoodCrafters crew day) if the construction was not completed on time. changed hands. The new tenant is a reliable local possible and taking quality short cuts to keep his understood exactly what was expected. You re- Facing the risks of the worsening real estate market, business owner, and will have no difficulty paying profits high. In response, you have been striving for a emphasized the need to keep quality high, and Sandy she didn't want any surprises. Thus, Margaret was the rent. quality image for your own complex in order to gave assurances that all of the WoodCrafter's adamant about not re-negotiating the contract with differentiate your condominiums as "premium value" carpenters were committed to top quality work and you under any circumstances - a condition to which al issue on your agenda with Sandy is to housing. no delays. Finally, you assured Sandy that your you agreed, since it gave you some assurance, too. resolve problems that have arisen during Sandy's secretary, Fawn, could handle any details that came work as a subcontractor on your 100-unit You talked to each of your subcontractors about your up in your absence. You didn't see a problem with these conditions. condominium development. This issue is complicated concern for quality and received assurances of their Insurance covered all the liability issues, the project and may be difficult to resolve. full cooperation. (With their economic futures You left on vacation confident that the condominium was almost finished and still on schedule, you had looking bleak, they were willing to be very project would require no direct attention from you reliable subcontractors doing the finish work (fine accommodating toward a big developer like you.) For until you returned four weeks later, when the painters carpentry and painting), the architect's detailed The Condominium Development Problem example, you amended the contract with your would be putting the finishing touches on the units. blueprints left no latitude for surprises, and each appliance supplier in order to upgrade to top-of-the- You have worked with Sandy for nine years, and subcontractor was contractually bound to assume all The 100-unit condominium development you began line equipment; windows were upgraded to triple- have never been disappointed. costs caused by delays. one year ago looked like such a great project that you glazed, energy-efficient Andersen units; and the didn't take on any partners. The units had been landscaper's specifications were changed to provide Your vacation was a round-the-world trip. You had You and Margaret agreed on a price of $14.75 forecast to sell in the $180,000-190,000 range, and more "upscale" landscaping. These contract accumulated enough frequent-flier mileage to qualify million ($147,500 per unit). This yields a net profit of you had the capital available to finance the project. amendments raised your costs from $140,000 to for the award, so the only expenses you had to pay $250,000, which was a fraction of the $4-5 million Profit estimates were around $40,000 per unit. $145,000 per unit, but you figured at the time that were for food, accommodations, and local travel. A you had originally hoped you would make, but you you could still make a healthy profit selling the 100 trip like this has been a lifetime dream, but you have are immensely relieved to have avoided the You have always been a careful investor, and, as units for $160,000 each (a bargain price even in a soft always had other things to do with your time and catastrophic losses that would have occurred if units usual, you did your homework on this project. market); the rival developer has announced a price of money. With free air travel and an opportunity to mix had gone unsold. In short, it was a good deal for both Edgewater has had a shortage of housing within $169,000 for the competing 75 "no-frills" units. business with pleasure, you decided it was time to do of you. You signed a binding agreement before walking/bicycling distance of the major business and t now. You contacted Margaret Walker, a college leaving Scotland. Then you phoned your secretary shopping areas so you did a lot of research and then The subcontractor who could make the most classmate who has a cottage in the Hebrides Islands, Fawn and told her that the property was sold but she worked closely with the zoning and planning boards difference in your quality image is WoodCrafters, off the coast of Scotland, and the two of you decided needed to keep the details confidential because to get their full commitment and cooperation. You one of six companies in the area that specialize in to spend a few days together at her cottage. Margaret did not want the other developer to know even let them participate in conferences with the fine carpentry. (Fine carpentry involves building and that she would be marketing the units as rentals with architects, engineers, and landscaping people. These installing doors, trim and cabinetwork; rough The two of you planned to fly to Edinburgh together, an option to buy. Then you left Edinburgh for a efforts paid off: the town approved the project with arpentry involves framing houses or building so Margaret visited you and toured the Viking project hiking trip in Asia no special requirements or conditions--a first-time wooden fences.) The fine carpentry is one of the mos in Edgewater before you left. (Margaret is a shrewd occurrence for any developer here. visible aspects of housing to the potential buyer. investor, and really knows the real estate business.) A week later, you called Fawn from India, an Sandy is a talented carpenter but has long since assured that everything was still on schedu Soon after Viking signed all the contracts that stopped doing the actual work and now runs a Before you left the Hebrides, Margaret agreed to buy under control on the condominium const committed the company to the project, however, carpentry business that employs from five to twenty- the entire condominium complex. You had disclosed project. She said something about Sandy there were two surprises that the most careful five skilled carpenters. Because Sandy really all of your qualms about the softening market, your nsisting on changing the type of lumber used investor could not have foreseen. First, a rival understands quality carpentry, you were confident growing financial woes, and the possibilities of trim Page 2 Page 3Creative Consensus, Inc. Creative Consensus, Inc. A Nasty Surprise You had a bad connection, so conversation was In thinking about Peter Breugel's note, you became percent), but rather by $2,500 per unit, and on top of difficult. You asked what the change would cost, and You were fatigued as a result of the time-zone perplexed. Peter's request seemed perfectly this Peter Breugel wants an extra $300 per unit for she said Sandy had estimated "less than three changes, but fully relaxed when you got back to reasonable, but these cost increases were eating into the staining and varnishing he did. As a result of percent." Sandy's contract was for $7,000 per unit, so town. Your complacency vanished completely, your meager profit margin of $2,500 per unit. First deviating from the lumber specifications, Sandy has three percent was only around $200 per unit. You however, when you opened a letter from the painting Sandy wanted an extra $200, now Peter needs an set you up to lose $300 per unit ($2,800 per unit in figured Sandy must have run into a problem caused subcontractor. extra $300. That would leave only $2,000 for you--a additional costs exceeds the maximum possible profit by one of the other subcontractors, so you told Fawn per cent) cut in total profit on the of $2,500 per unit). If Sandy is allowed to get away you'd talk it over with Sandy when you got back, but 100 units. with this, instead of making $250,000, you will post a not to authorize any changes that would cost money, net loss of $30,000 on this $14.5 million project. since the sale to Margaret gave you little profit Peter is correct in the observation that it's senseless margin to work with. and wasteful to paint over oak. But why on earth dic Seeing your shocked reaction, Fawn became very Sandy change to oak, and how can Sandy afford to upset and defensive. You calmed down long enough substitute oak for only a three percent increase in fine to get her to explain. Based on what she told you, carpentry costs? here's what you think happened. To: Pat Olafson At this point, Fawn brought in the mail. It contained Sandy bid low in order to get the job, and decided to the invoice from Sandy. Instead of $700,000, you are ry to get you to pay more to make the job more From: Peter Breugel, Acme Painting Co. being billed for $950,000. The per-unit cost profitable. Sandy found some cheap oak, and saw a breakdown was shown in the invoice as follows: way to make higher profits (a constant 7.5% markup Subject: Specifications for Condominium Complex of higher labor and materials yields higher profits). It was probably easy to convince Fawn not to refuse the Lumber (oak normally costs $12,500): $7,000 change. She had understood that the increase was I completed my work on the Condominium project today, so it's now ready for tenants to Labor (oak is harder to work): $1,340 going to be "only" three percent, but obviously hadn't move in. All of the subcontractors did a good job, so you got the quality level you were looking fully understood that this was to be a three percent for. However, I have a cost over-run problem that I hope you'll at least consider helping me out Other variable costs: $500 increase in total project costs, not the fine carpentry with. The fine carpentry work was of high quality, but Sandy's change in lumber from the specifications you supplied results in extra costs that I'm having difficulty absorbing. The Subtotal: $8,840 costs, and she certainly didn't understand that in these troubled times, the condominium project wasn't even switch cost me an extra ten percent. If I had known what I would have been dealing with, I going to yield a two percent margin. would have bid $3,300 per unit rather than $3,000. Let me explain. I was surprised to find the 7.5% Markup: $660 cabinets, doors, baseboards, banisters, railings, and all trim done in high-quality oak. Sandy explained that the lumber specifications had been changed in order to improve the project's Invoice cost per unit $9,500 Fawn is an intelligent, dedicated, and loyal worker, but she is only trained as a secretary, and does not quality image. It will certainly do that; it looks great. You will recall, however, that the have the background or experience necessary to make specifications from the architect directed me to paint 100 units, including all the fine carpentry, You asked Fawn to explain why Sandy changed from major financial decisions. Over the years, Fawn has which was supposed to be done in pine and spruce. inexpensive lumber to oak. While recounting her from time to time agreed to minor contract changes conversation with Sandy, she mentioned that Sandy proposed by Sandy and other contractors, but never You were out of the country, and I figured you wouldn't want me to paint over high-quality had written down some figures on the back of an without checking with you first. You assume that the oak. If I painted over it, no one would know it was oak, and the extra cost of the lumber would envelope, but she hadn't understood them. You contractors understood that she was not acting on her be completely wasted. It needed to be sanded, stained, and varnished. That involved three checked the original per-unit contract figures in the own, and that she did not have the authority to act on operations-not one, as in simple painting-and the staining and varnishing operations are file, which read as follows: her own. much slower than painting. Fawn said that she told Sandy she wasn't able to I hope you'll understand my need to ask for the $300 per unit cost differential that was Lumber (pine and spruce): $5,000 approve the change, but Sandy browbeat her until she necessary to get the oak properly treated. As a long-time subcontractor, I like working with you Labor: $1,000 had to accede. She said that Sandy threatened that if and value your business, but it's difficult for me to absorb the difference in cost. To be honest, I Other variable costs: $500 you didn't use the oak, the rival condominium gave you a rock bottom quote for painting because I really needed the work. I don't make much developer was going to buy it and negate the quality profit at the $3,000 per unit figure I gave you, I did little more than cover my variable costs and Subtotal $6,500 image advantage you were striving for. Sandy never overhead. The extra $300 I'm asking for only covers the increase in my variable costs, mostly should have put Fawn in that position increased labor. I won't make a cent on the increase. 7.5% Markup: $500 I won't submit the invoice until we have talked. You tried to imagine why Sandy would want Sandy's bid per unit: $7,000 you in this predicament. Certainly business i Peter Breugel for everyone, and Sandy must be having Sandy had upgraded the fine carpentry specifications making ends meet. The low-bid "bait-and-s and increased costs not by $200 per unit (three tactic increases Sandy's profit from $50,( $66,000 (all of which comes out of your pocket Page 4 Page 5Page 6 of / Creative Consensus, Inc. Creative Consensus, Inc. and will be released within 30 days of today, the date spent two years searching for a suitable hotel Sandy must be desperate for cash. You know Sandy Her advice was that you deduct the $200,000 loan of receipt of WoodCrafters' invoice." property. You cannot delay this deal without losing has very expensive tastes, living in one of the most amount plus the $10,000 overdue rent from the it, and you cannot invest less than the $500,000 luxurious houses in the region. It sits proudly on a $700,000 you owe Sandy on the contract, and thus At this point, Sandy exploded. You soon joined in a partnership share you have agreed to. hilltop and must be worth a million dollars or more, pay Sandy only $490,000. round of insulting each other. When both of you had and Sandy keeps making improvements every time vented your pent-up anger and frustration, you agreed To summarize, your investable resources are: the WoodCrafters crew is not busy with outside You then called your lawyer. After reviewing the that the two of you should meet to discuss this issue, projects. Perhaps with the increasing pressures of the situation, and discussing various options, your lawyer as well as the issues of your loan to Sandy and Cash on hand: $300,000 recession, Sandy feels the need to extract more advised you that: Sandy's lease of your building. money from clients in order to cater to those Profit from condominiums expensive tastes. As a result of the two contract clauses referred to (if you pay original bid of $700,000): $220,000 above (which your lawyer had drafted), your position Viking's Current Financial Status As an investor, you don't understand why Sandy has that you owe Sandy only $700,000, the original Sandy's loan due: $200,000 so much capital sitting idle in that house. Several contract price, is quite strong In the meantime, you reviewed your overall financial years ago, you also lived in a "mansion," but sold it status. All of your investments are temporarily Sandy's rent due: $10,000 o raise $750,000 worth of investment capital. Instead . The problem with following Dana Simons' suffering as a result of the downswing in the of living in a pretentious house, you now rent a economy. You are lucky to have sold the Total resources: $730,000 advice as a means of obtaining repayment of the perfectly adequate, energy-efficient apartment, and $200,000 loan and the $10,000 overdue rent is that it condominium project to Margaret; otherwise you the proceeds of the house sale bought you an office may cause Sandy to declare bankruptcy. If Sandy might have taken a loss large enough to bankrupt building which is now worth $3 million. Now that the declares bankruptcy, the court-appointed trustee in you. Aside from your profit from the condominium market for high-end housing is down and may never bankruptcy could treat the loan and rent payments as project (about $220,000 if you pay Peter Breugel for Your investment plans are as follows: fully recover, you're glad you sold your big house improper "preferences," because you were repaid in the extra costs of staining and varnishing), Viking has when you did: doing so was a prudent financial full, while Sandy's other creditors were not. The only another $300,000 left in uncommitted funds to Lakefront property: $200,000 decision. trustee could either recover the $210,000 from you use as seed money for the next investment project. It or seize any assets you had purchased with the is virtually impossible to get any more out of the Hotel partnership: $500,000 Secondly, Sandy is desperate to keep the crew intact. $210,000. banks these days. Your office building and the The core group of five highly skilled carpenters has building that Sandy is leasing are fully leveraged Working capital: $20,000 survived the ups and downs of the building industry, The Telephone Call Even with new property to offer as collateral, you are and Sandy has been very inventive in finding projects viewed by the banks as over-leveraged. Total resources needed: $720,000 o keep them busy. Unfortunately, this time Sandy Feeling more calm and reassured, you called Sandy has stretched out the job at your expense. That's no to object to any changes in the dollar amount of the In addition to needing $200,000 immediately to buy way to treat a client. contract. You told Sandy that you could not absorb the lakefront property (before someone else does), Because of time pressures, you will have to make all the costs of lumber that didn't meet the written Viking needs half a million dollars to participate in a of your final commitments in the upcoming meeting After you felt you fully understood what had specifications. You stifled Sandy's attempt to protest partnership that will buy a hotel on the coast. The with Sandy. You may not put off your decisions with happened, you checked the contract with Sandy. You and you read aloud the clause in the contract that said hotel has come on the market at a very favorable respect to Sandy until some point in the future. found the following two clauses, that appear to you to all amendments to the contract must be made in price because of the recession. The other investors be relevant to this matter: writing and signed by both parties. are long-time friends of yours, and this group has 1. WoodCrafters shall be responsible for any cost You then explained that the condominiums had been overruns on labor or material. In no event shall sold to a speculator and that you weren't going to Viking be obligated to reimburse WoodCrafters for take a loss because of Sandy's attempt to increase any cost overruns not expressly agreed to by Viking. WoodCrafters profit margin. Sandy would be paid the contract amount, $7,000 per unit, within thirty 2. This contract is final and binding. No days. (The money is in your bank account; there are amendments to this contract shall be effective unless no consequences--in terms of interest you will owe-- in writing and signed by both parties. so long as you pay by the end of the 30-day period.) You called Dana Simons, a friend and Still resisting interruption, you explained that you got woman in town, to discuss the situation. She no benefit from the higher-quality lumber; the sales said that the recession was bringing out the worst in contract with the speculator was already signed and people. A large number of people in the building was not re-negotiable. You then stated that "Fawn is trades and real estate businesses were overextended typing a letter confirming the original deal, and it will and grasping at straws to avoid bankruptcy. She said, be hand-delivered this afternoon. The net amount there were rumors around town that Sandy was on the Viking will owe you is sitting in my bank account edge of bankruptcy Page 6 Page 7PLANNING DOCUMENT TEMPLATE Name: Negotiation: [Explain in detail] Role: PAT OLAFSON (11- Please provide the detailed analysis in below format. calculation of BATNA Reservation Point Target] Goal Sou rces of Power Weaknesses Q2- Strategy I Opening Move I Other information (you should also create contingencies and plans of action given potential moves by your counterpart)

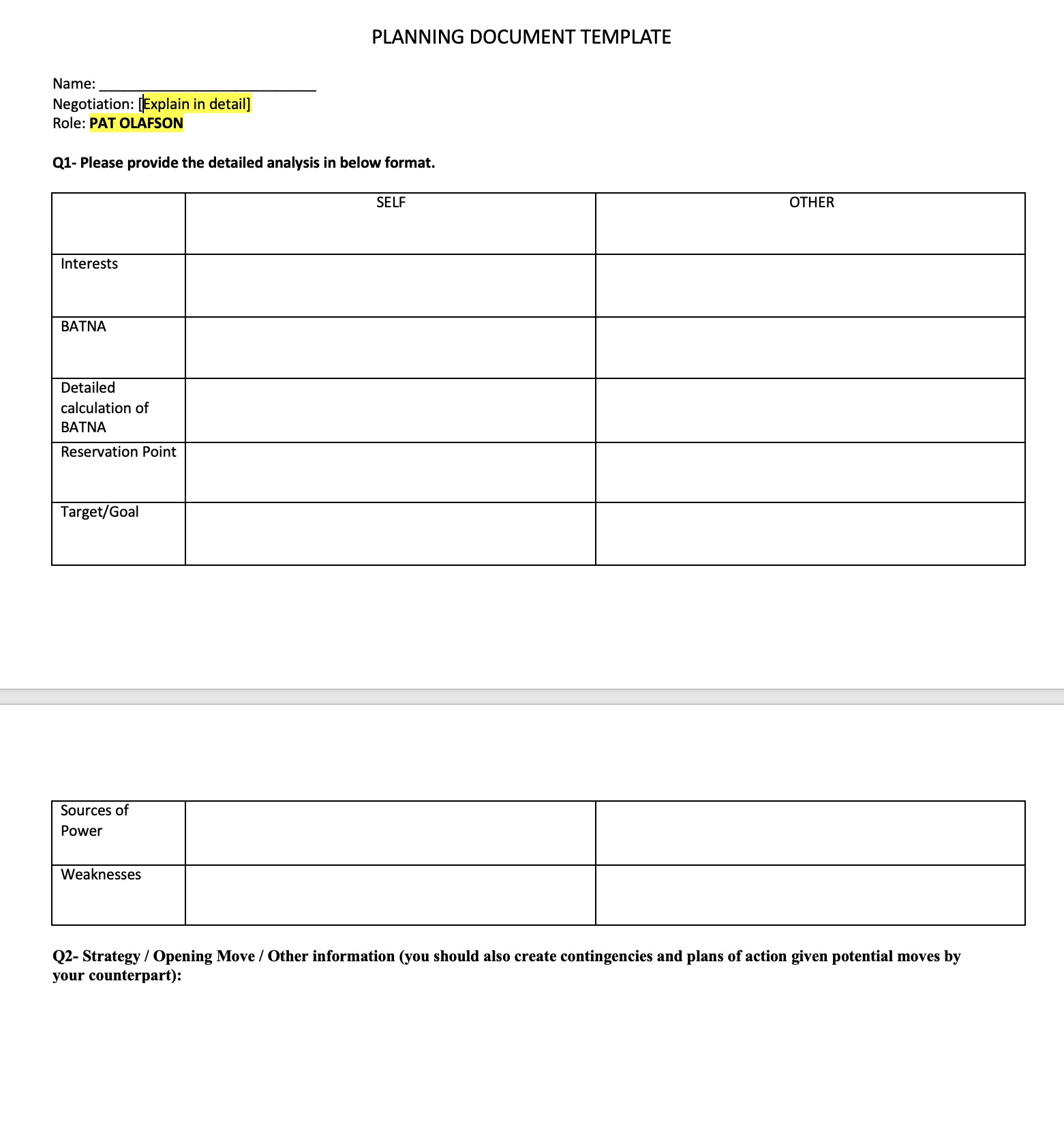

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts