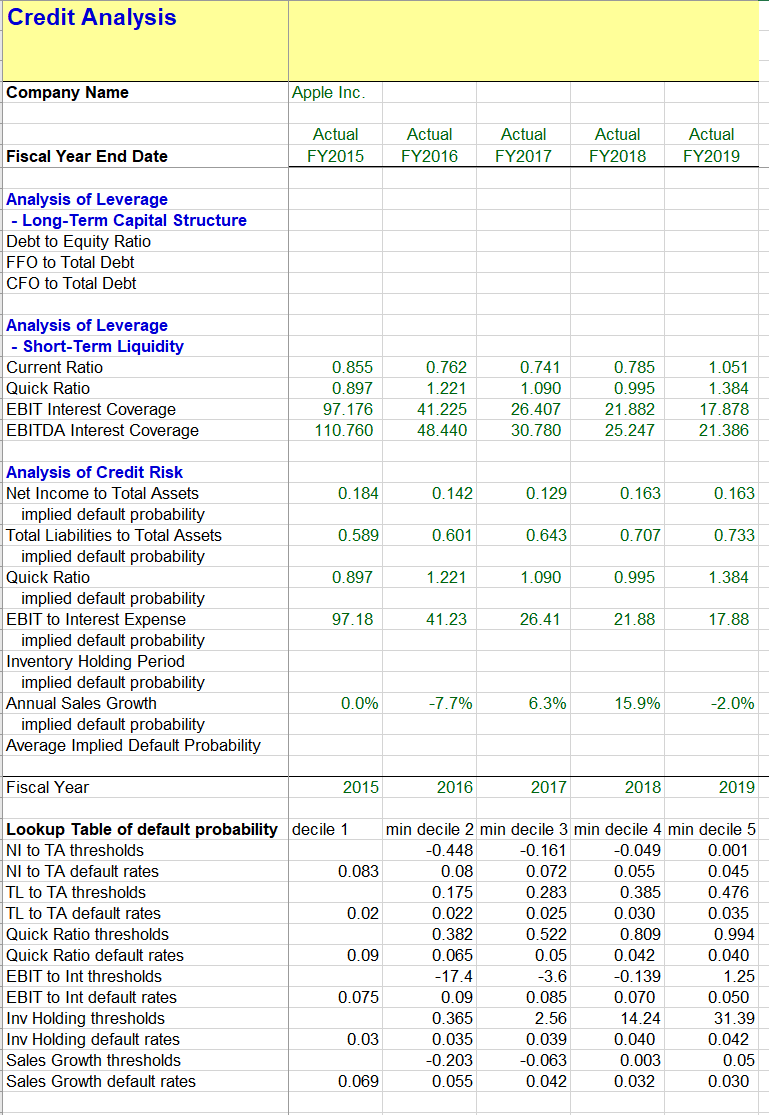

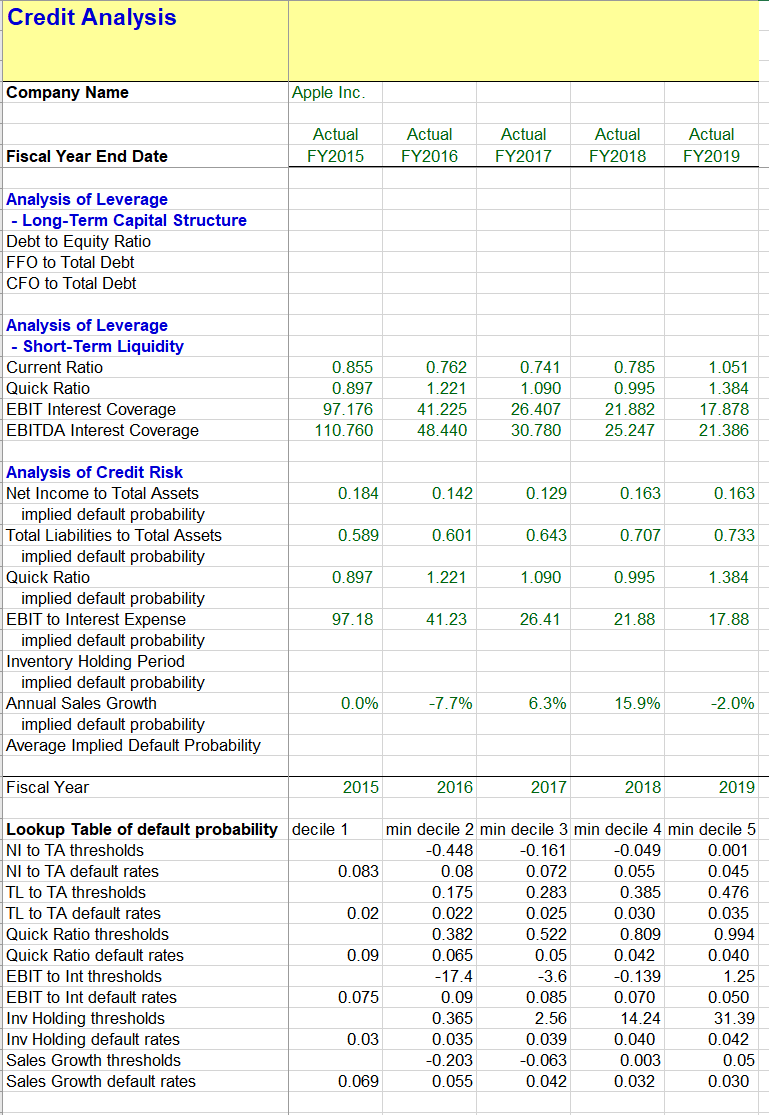

Credit Analysis Apple Inc and Analysis of Credit Risk Q: Trying to solve the implied default probability from the Analysis of Credit Risk using the default probabilities, if you could show me step by step how to solve these that would be very helpful.

Credit Analysis Company Name Apple Inc. Actual FY2015 Actual FY2016 Actual FY2017 Actual FY2018 Actual FY2019 Fiscal Year End Date Analysis of Leverage - Long-Term Capital Structure Debt to Equity Ratio FFO to Total Debt CFO to Total Debt Analysis of Leverage - Short-Term Liquidity Current Ratio Quick Ratio EBIT Interest Coverage EBITDA Interest Coverage 0.855 0.897 97.176 110.760 0.762 1.221 41.225 48.440 0.741 1.090 26.407 30.780 0.785 0.995 21.882 25.247 1.051 1.384 17.878 21.386 0.184 0.142 0.129 0.163 0.163 0.589 0.601 0.643 0.707 0.733 0.897 1.221 1.090 0.995 1.384 Analysis of Credit Risk Net Income to Total Assets implied default probability Total Liabilities to Total Assets implied default probability Quick Ratio implied default probability EBIT to Interest Expense implied default probability Inventory Holding Period implied default probability Annual Sales Growth implied default probability Average Implied Default Probability 97.18 41.23 26.41 21.88 17.88 0.0% -7.7% 6.3% 15.9% -2.0% Fiscal Year 2015 2016 2017 2018 2019 Lookup Table of default probability decile 1 min decile 2 min decile 3 min decile 4 min decile 5 NI to TA thresholds -0.448 -0.161 -0.049 0.001 NI to TA default rates 0.083 0.08 0.072 0.055 0.045 TL to TA thresholds 0.175 0.283 0.385 0.476 TL to TA default rates 0.02 0.022 0.025 0.030 0.035 Quick Ratio thresholds 0.382 0.522 0.809 0.994 Quick Ratio default rates 0.09 0.065 0.05 0.042 0.040 EBIT to Int thresholds -17.4 -3.6 -0.139 1.25 EBIT to Int default rates 0.075 0.09 0.085 0.070 0.050 Inv Holding thresholds 0.365 2.56 14.24 31.39 Inv Holding default rates 0.03 0.035 0.039 0.040 0.042 Sales Growth thresholds -0.203 -0.063 0.003 0.05 Sales Growth default rates 0.069 0.055 0.042 0.032 0.030 Credit Analysis Company Name Apple Inc. Actual FY2015 Actual FY2016 Actual FY2017 Actual FY2018 Actual FY2019 Fiscal Year End Date Analysis of Leverage - Long-Term Capital Structure Debt to Equity Ratio FFO to Total Debt CFO to Total Debt Analysis of Leverage - Short-Term Liquidity Current Ratio Quick Ratio EBIT Interest Coverage EBITDA Interest Coverage 0.855 0.897 97.176 110.760 0.762 1.221 41.225 48.440 0.741 1.090 26.407 30.780 0.785 0.995 21.882 25.247 1.051 1.384 17.878 21.386 0.184 0.142 0.129 0.163 0.163 0.589 0.601 0.643 0.707 0.733 0.897 1.221 1.090 0.995 1.384 Analysis of Credit Risk Net Income to Total Assets implied default probability Total Liabilities to Total Assets implied default probability Quick Ratio implied default probability EBIT to Interest Expense implied default probability Inventory Holding Period implied default probability Annual Sales Growth implied default probability Average Implied Default Probability 97.18 41.23 26.41 21.88 17.88 0.0% -7.7% 6.3% 15.9% -2.0% Fiscal Year 2015 2016 2017 2018 2019 Lookup Table of default probability decile 1 min decile 2 min decile 3 min decile 4 min decile 5 NI to TA thresholds -0.448 -0.161 -0.049 0.001 NI to TA default rates 0.083 0.08 0.072 0.055 0.045 TL to TA thresholds 0.175 0.283 0.385 0.476 TL to TA default rates 0.02 0.022 0.025 0.030 0.035 Quick Ratio thresholds 0.382 0.522 0.809 0.994 Quick Ratio default rates 0.09 0.065 0.05 0.042 0.040 EBIT to Int thresholds -17.4 -3.6 -0.139 1.25 EBIT to Int default rates 0.075 0.09 0.085 0.070 0.050 Inv Holding thresholds 0.365 2.56 14.24 31.39 Inv Holding default rates 0.03 0.035 0.039 0.040 0.042 Sales Growth thresholds -0.203 -0.063 0.003 0.05 Sales Growth default rates 0.069 0.055 0.042 0.032 0.030