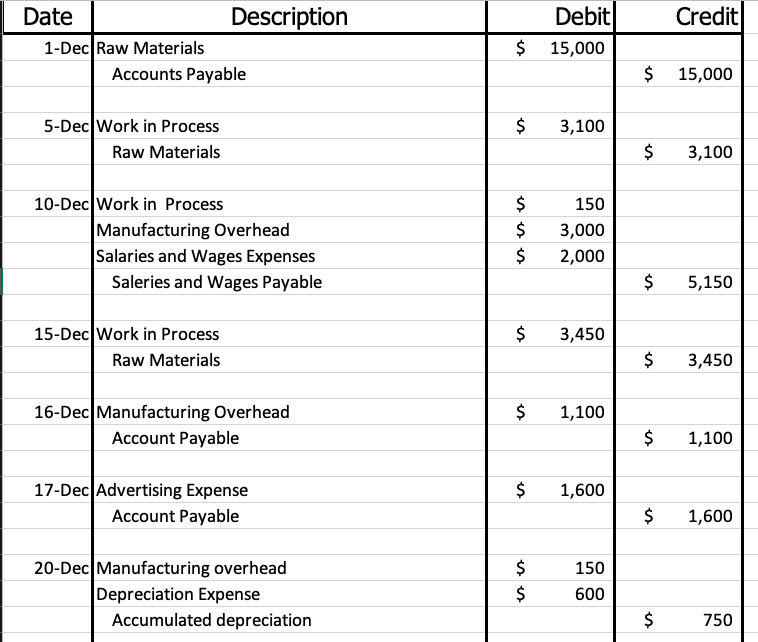

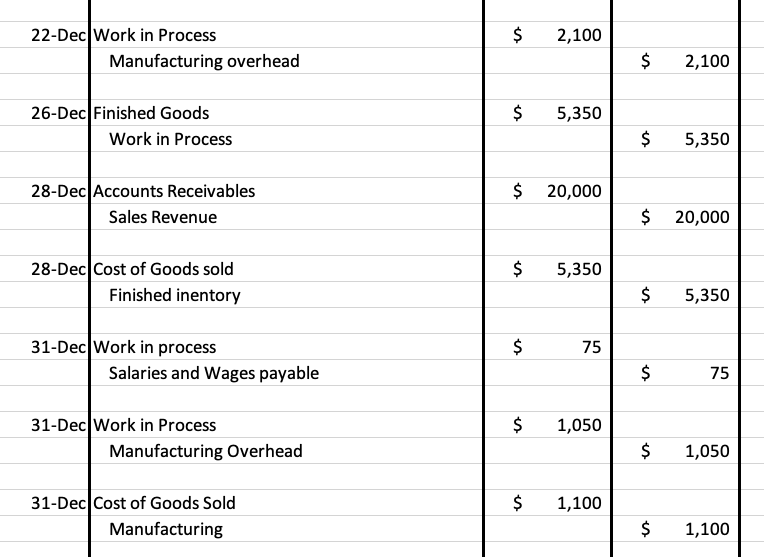

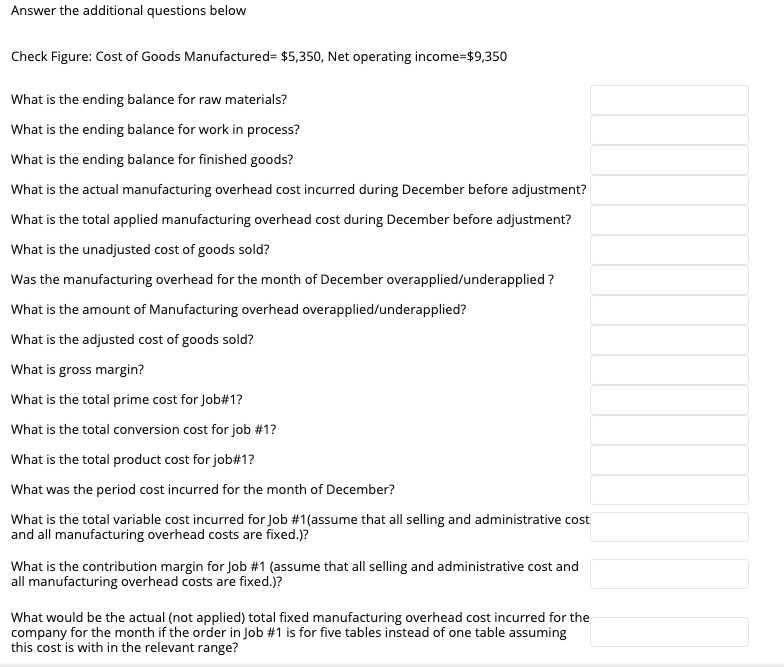

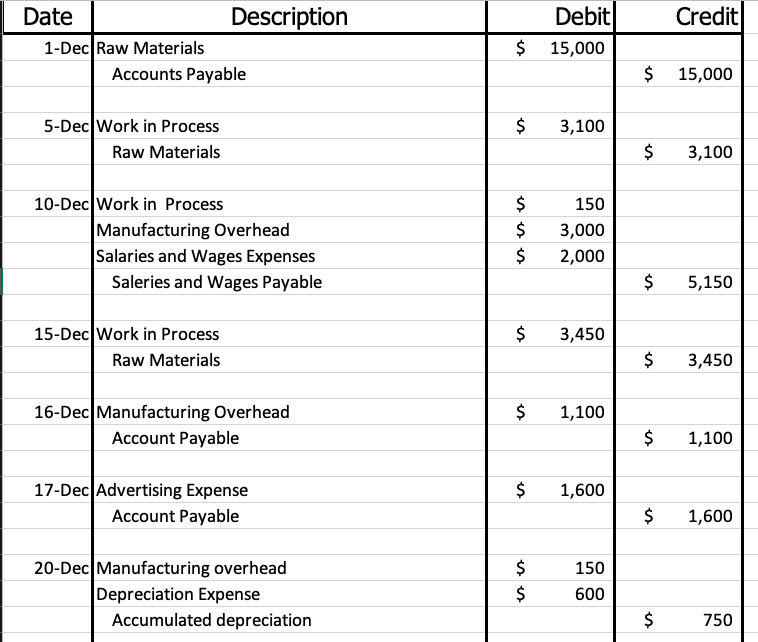

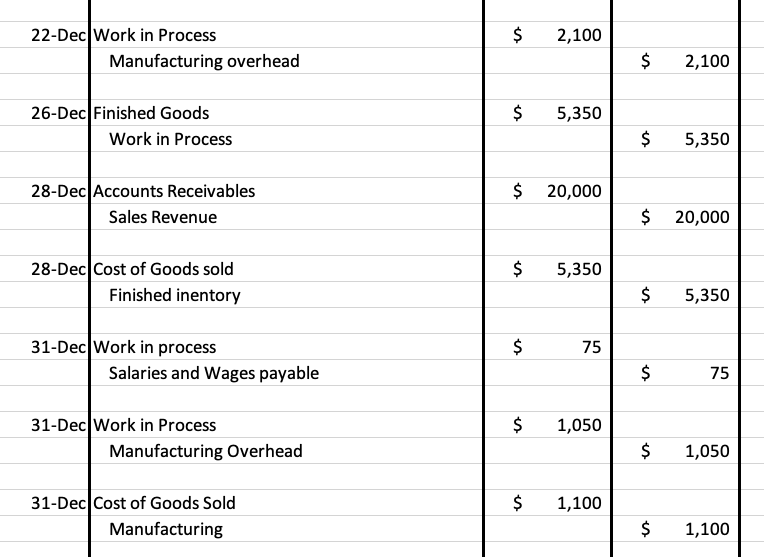

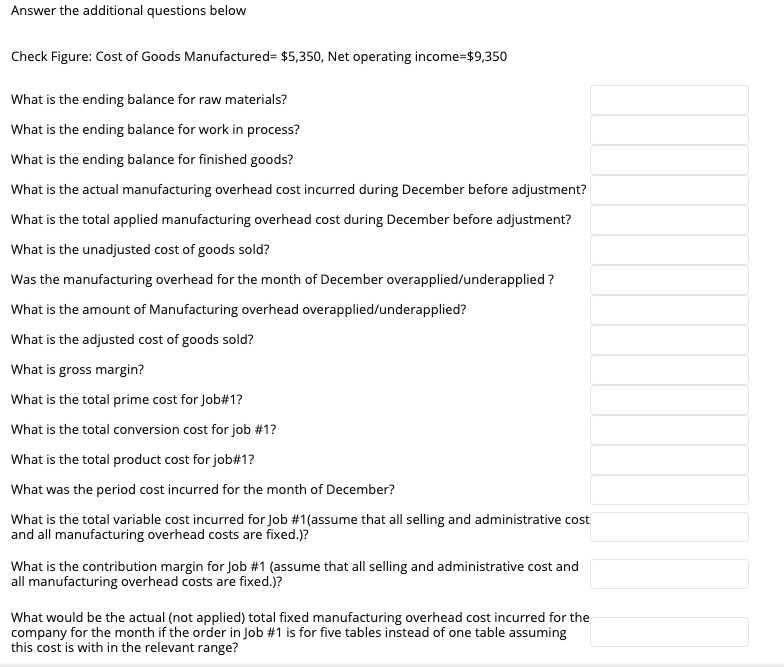

Credit Date Description 1-Dec Raw Materials Accounts Payable Debit $ 15,000 $ 15,000 $ 3,100 5-Dec Work in Process Raw Materials $ 3,100 10-Dec Work in Process Manufacturing Overhead Salaries and Wages Expenses Saleries and Wages Payable $ $ $ 150 3,000 2,000 $ 5,150 $ 3,450 15-Dec Work in Process Raw Materials $ 3,450 $ 1,100 16-Dec Manufacturing Overhead Account Payable $ 1,100 $ 1,600 17-Dec Advertising Expense Account Payable $ 1,600 20-Dec Manufacturing overhead Depreciation Expense Accumulated depreciation $ $ 150 600 $ 750 $ 2,100 22-Dec Work in Process Manufacturing overhead $ 2,100 $ 5,350 26-Dec Finished Goods Work in Process $ 5,350 $ 20,000 28-Dec Accounts Receivables Sales Revenue $ 20,000 $ 5,350 28-Dec cost of Goods sold Finished inentory $ 5,350 $ $ 75 31-Dec Work in process Salaries and Wages payable $ 75 $ 1,050 31-Dec Work in Process Manufacturing Overhead $ 1,050 $ 1,100 31-Dec Cost of Goods Sold Manufacturing $ 1,100 Answer the additional questions below Check Figure: Cost of Goods Manufactured= $5,350, Net operating income=$9,350 What is the ending balance for raw materials? What is the ending balance for work in process? What is the ending balance for finished goods? What is the actual manufacturing overhead cost incurred during December before adjustment? What is the total applied manufacturing overhead cost during December before adjustment? What is the unadjusted cost of goods sold? Was the manufacturing overhead for the month of December overapplied/underapplied ? What is the amount of Manufacturing overhead overapplied/underapplied? What is the adjusted cost of goods sold? What is gross margin? What is the total prime cost for Job#1? What is the total conversion cost for job #1? What is the total product cost for job#1? What was the period cost incurred for the month of December? What is the total variable cost incurred for Job #1(assume that all selling and administrative cost and all manufacturing overhead costs are fixed.)? What is the contribution margin for Job #1 (assume that all selling and administrative cost and all manufacturing overhead costs are fixed.)? What would be the actual (not applied) total fixed manufacturing overhead cost incurred for the company for the month if the order in Job #1 is for five tables instead of one table assuming this cost is with in the relevant range