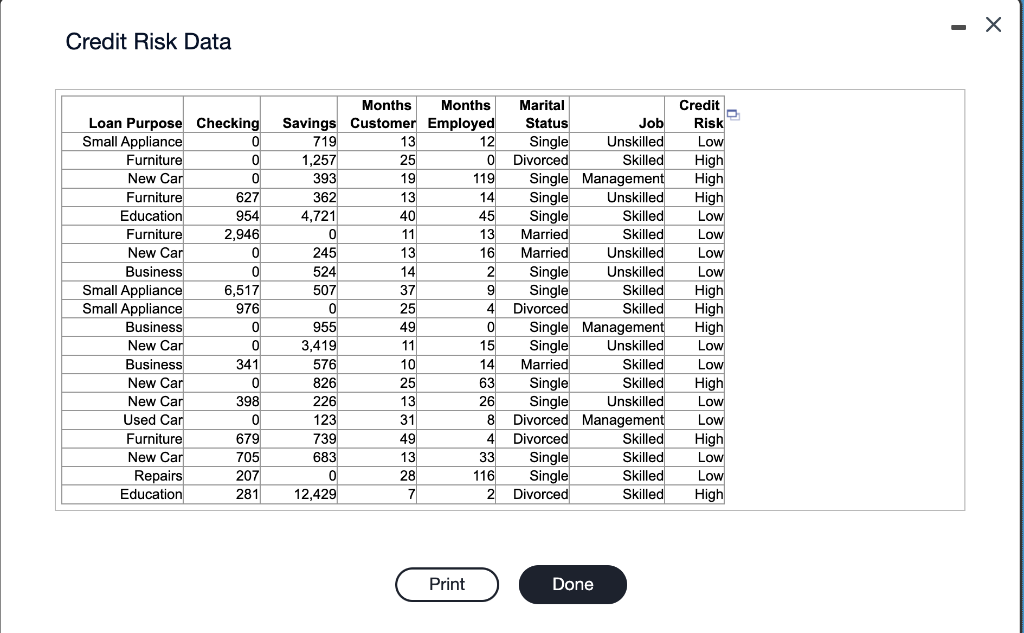

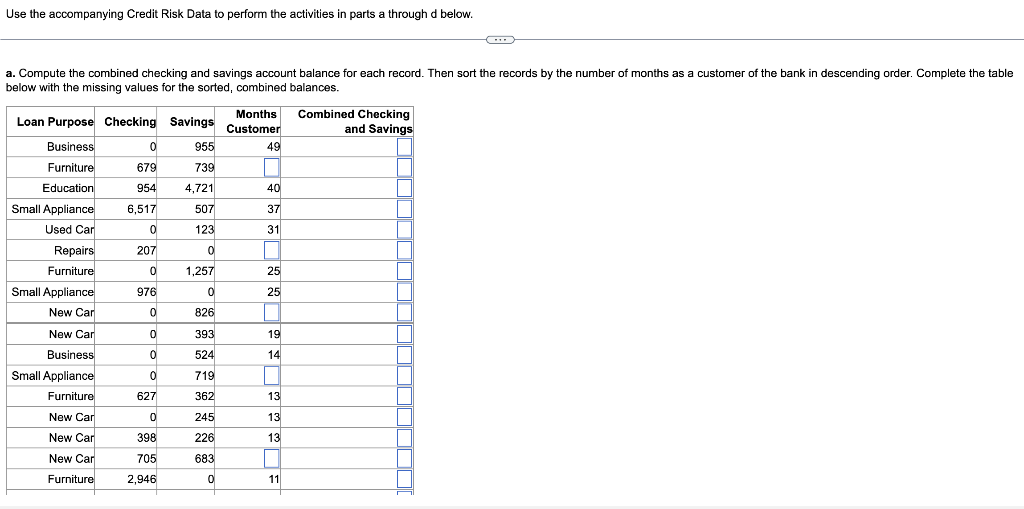

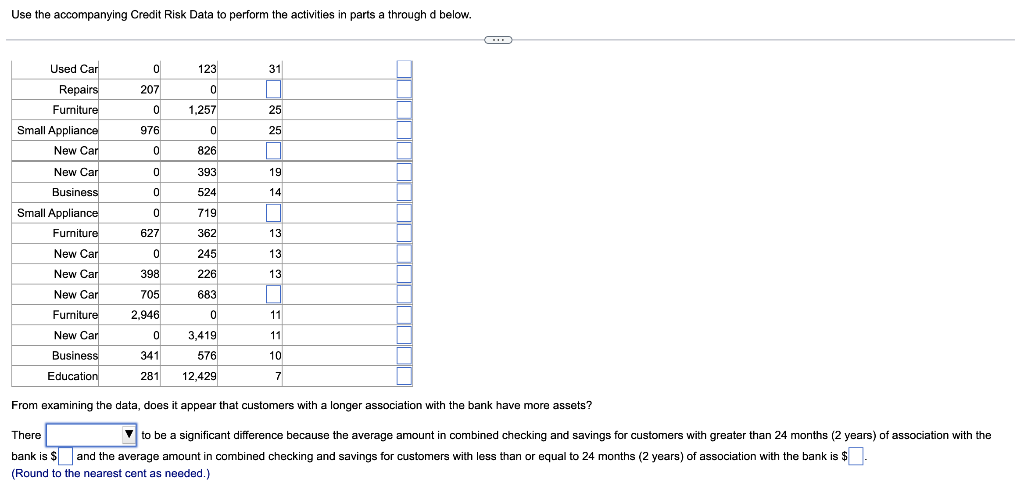

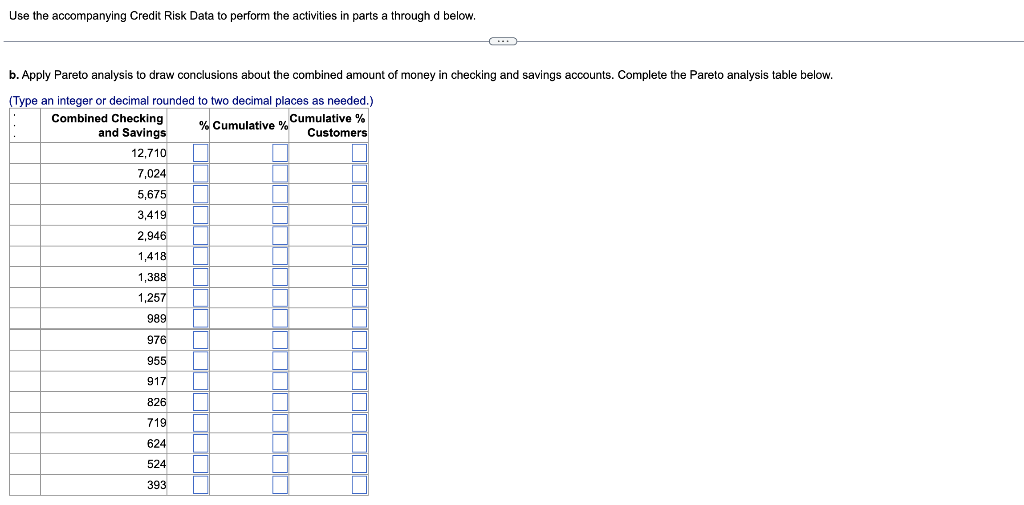

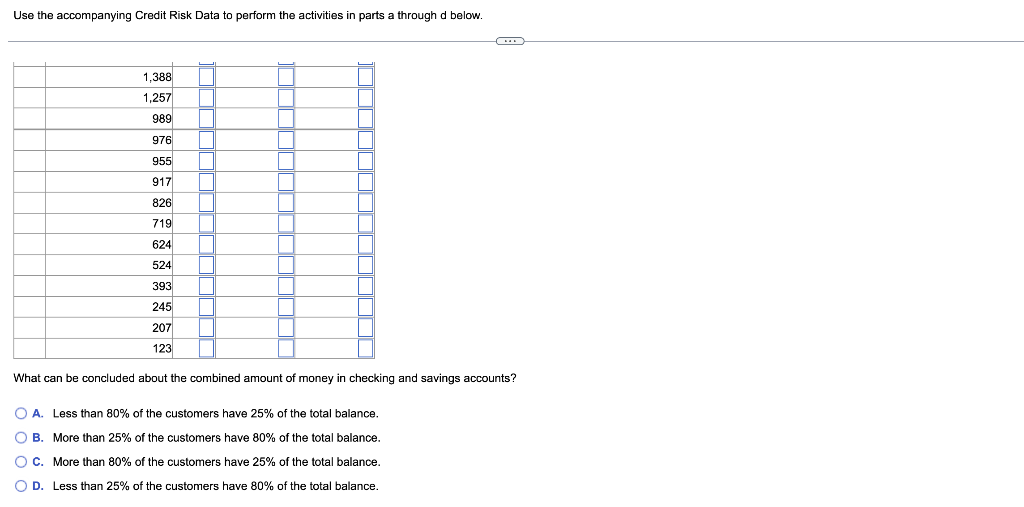

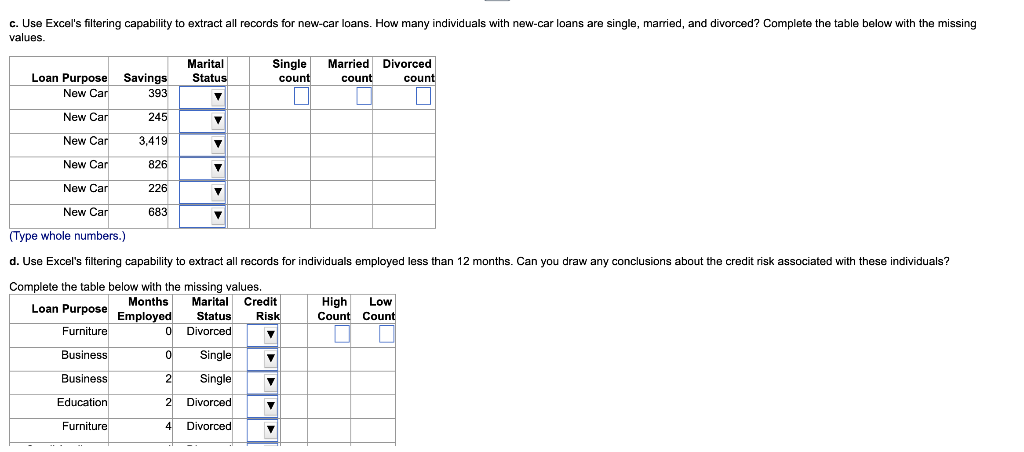

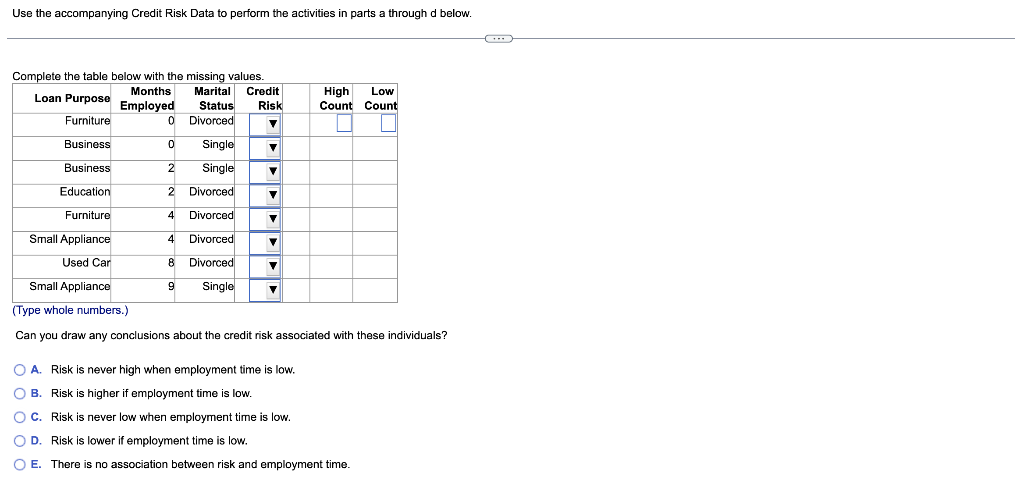

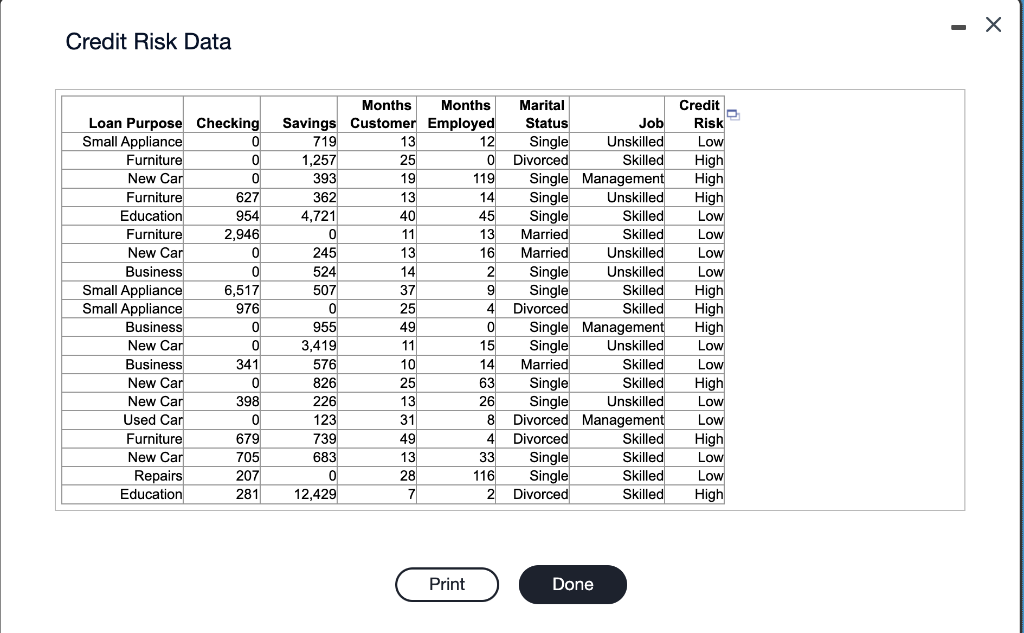

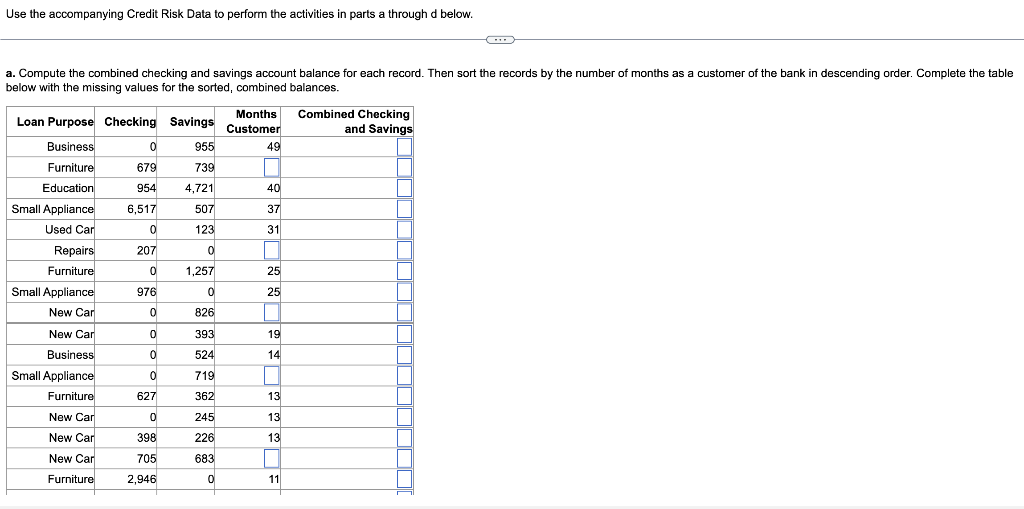

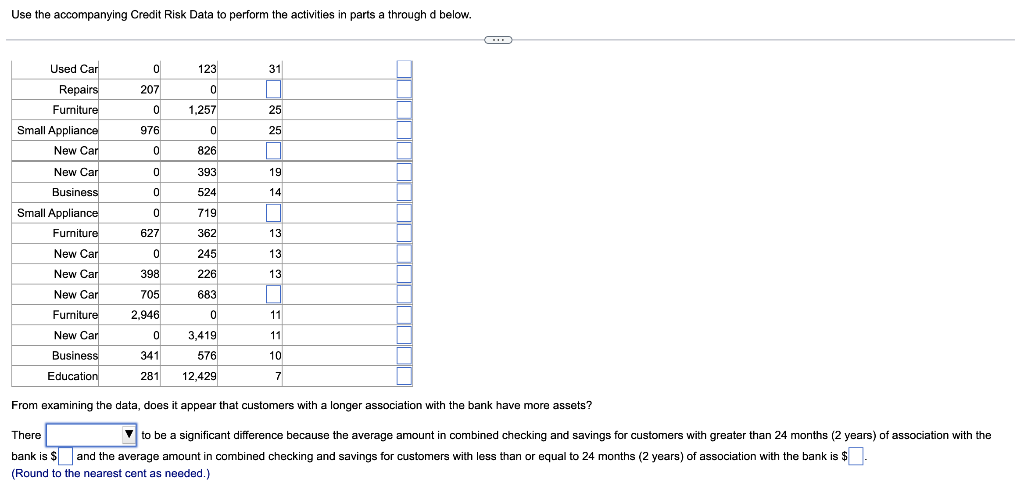

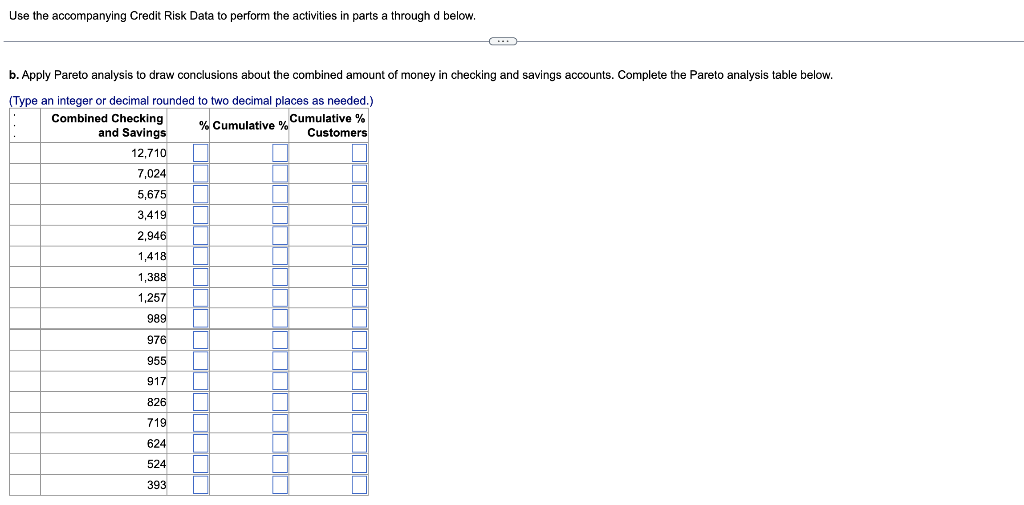

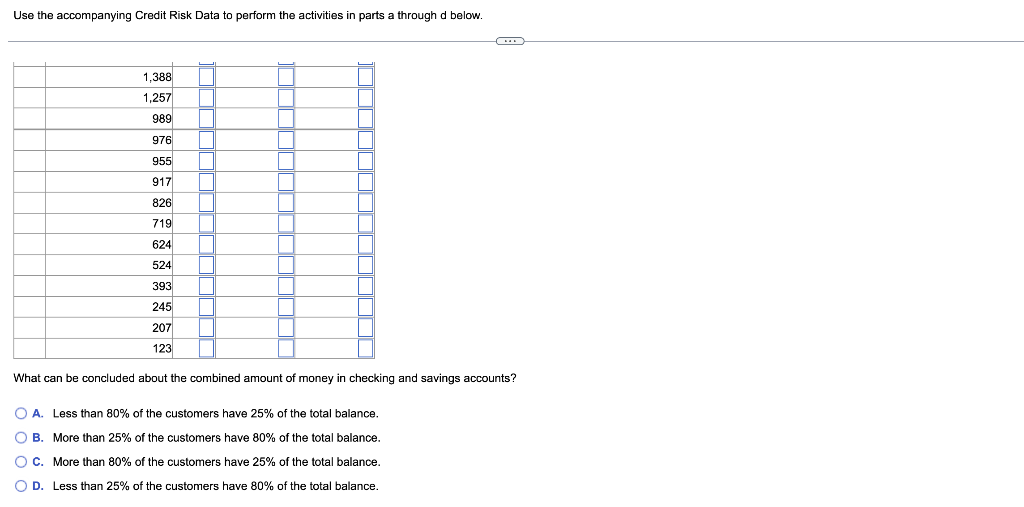

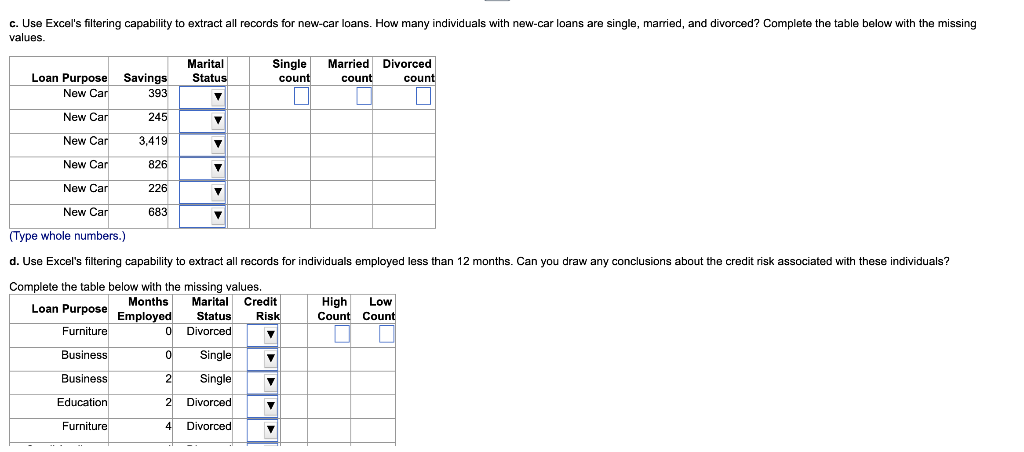

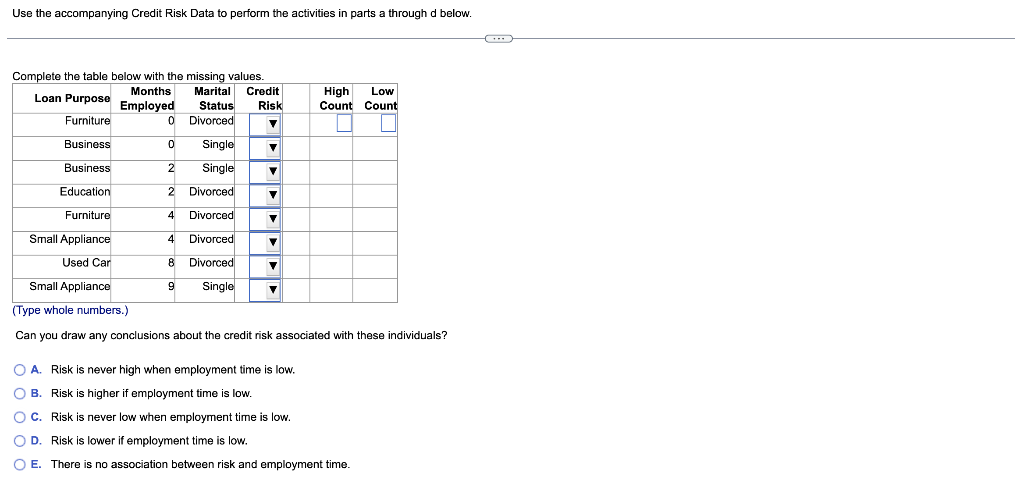

Credit Risk Data Use the accompanying Credit Risk Data to perform the activities in parts a through d below. a. Compute the combined checking and savings account balance for each record. Then sort the records by the number of months as a customer of the bank in descending order. Complete the table below with the missing values for the sorted, combined balances. Use the accompanying Credit Risk Data to perform the activities in parts a through d below. From examining the data, does it appear that customers with a longer association with the bank have more assets? There to be a significant difference because the average amount in combined checking and savings for customers with greater than 24 months ( 2 years) of association with the bank is $ and the average amount in combined checking and savings for customers with less than or equal to 24 months ( 2 years) of association with the bank is $ (Round to the nearest cent as needed.) Use the accompanying Credit Risk Data to perform the activities in parts a through d below. Use the accompanying Credit Risk Data to perform the activities in parts a through d below. What can be concluded about the combined amount of money in checking and savings accounts? A. Less than 80% of the customers have 25% of the total balance. B. More than 25% of the customers have 80% of the total balance. C. More than 80% of the customers have 25% of the total balance. D. Less than 25% of the customers have 80% of the total balance. c. Use Excel's filtering capability to extract all records for new-car loans. How many individuals with new-car loans are single, married, and divorced? Complete the table below with the missing values. \begin{tabular}{|r|r|r|r|r|r|r|} \hline Loan Purpose & Savings & MaritalStatus & \multicolumn{2}{|r|}{Singlecount} & Marriedcount & Divorcedcount \\ \hline New Car & 393 & v & & & \\ \hline New Car & 245 & & & & \\ \hline New Car & 3,419 & 7 & & & & \\ \hline New Car & 826 & 7 & & & \\ \hline New Car & 226 & 7 & & & \\ \hline New Car & 683 & v & & & & \\ \hline \end{tabular} (Type whole numbers.) d. Use Excel's filtering capability to extract all records for individuals employed less than 12 months. Can you draw any conclusions about the credit risk associated with these individuals? Complete the table below with the missing values. \begin{tabular}{|r|r|r|r|r|r|r|} \hline Loan Purpose & MonthsEmployed & MaritalStatus & CreditRisk & HighCount & LowCount \\ \hline Furniture & 0 & Divorced & & & & \\ \hline Business & 0 & Single & & & \\ \hline Business & 2 & Single & & & \\ \hline Education & 2 & Divorced & & & & \\ \hline Furniture & 4 & Divorced & 7 & & \\ \hline \end{tabular} Use the accompanying Credit Risk Data to perform the activities in parts a through d below. Comblete the table below with the missina values. (Iype whole numbers.) Can you draw any conclusions about the credit risk associated with these individuals? A. Risk is never high when employment time is low. B. Risk is higher if employment time is low. C. Risk is never low when employment time is low. D. Risk is lower if employment time is low. E. There is no association between risk and employment time. Credit Risk Data Use the accompanying Credit Risk Data to perform the activities in parts a through d below. a. Compute the combined checking and savings account balance for each record. Then sort the records by the number of months as a customer of the bank in descending order. Complete the table below with the missing values for the sorted, combined balances. Use the accompanying Credit Risk Data to perform the activities in parts a through d below. From examining the data, does it appear that customers with a longer association with the bank have more assets? There to be a significant difference because the average amount in combined checking and savings for customers with greater than 24 months ( 2 years) of association with the bank is $ and the average amount in combined checking and savings for customers with less than or equal to 24 months ( 2 years) of association with the bank is $ (Round to the nearest cent as needed.) Use the accompanying Credit Risk Data to perform the activities in parts a through d below. Use the accompanying Credit Risk Data to perform the activities in parts a through d below. What can be concluded about the combined amount of money in checking and savings accounts? A. Less than 80% of the customers have 25% of the total balance. B. More than 25% of the customers have 80% of the total balance. C. More than 80% of the customers have 25% of the total balance. D. Less than 25% of the customers have 80% of the total balance. c. Use Excel's filtering capability to extract all records for new-car loans. How many individuals with new-car loans are single, married, and divorced? Complete the table below with the missing values. \begin{tabular}{|r|r|r|r|r|r|r|} \hline Loan Purpose & Savings & MaritalStatus & \multicolumn{2}{|r|}{Singlecount} & Marriedcount & Divorcedcount \\ \hline New Car & 393 & v & & & \\ \hline New Car & 245 & & & & \\ \hline New Car & 3,419 & 7 & & & & \\ \hline New Car & 826 & 7 & & & \\ \hline New Car & 226 & 7 & & & \\ \hline New Car & 683 & v & & & & \\ \hline \end{tabular} (Type whole numbers.) d. Use Excel's filtering capability to extract all records for individuals employed less than 12 months. Can you draw any conclusions about the credit risk associated with these individuals? Complete the table below with the missing values. \begin{tabular}{|r|r|r|r|r|r|r|} \hline Loan Purpose & MonthsEmployed & MaritalStatus & CreditRisk & HighCount & LowCount \\ \hline Furniture & 0 & Divorced & & & & \\ \hline Business & 0 & Single & & & \\ \hline Business & 2 & Single & & & \\ \hline Education & 2 & Divorced & & & & \\ \hline Furniture & 4 & Divorced & 7 & & \\ \hline \end{tabular} Use the accompanying Credit Risk Data to perform the activities in parts a through d below. Comblete the table below with the missina values. (Iype whole numbers.) Can you draw any conclusions about the credit risk associated with these individuals? A. Risk is never high when employment time is low. B. Risk is higher if employment time is low. C. Risk is never low when employment time is low. D. Risk is lower if employment time is low. E. There is no association between risk and employment time