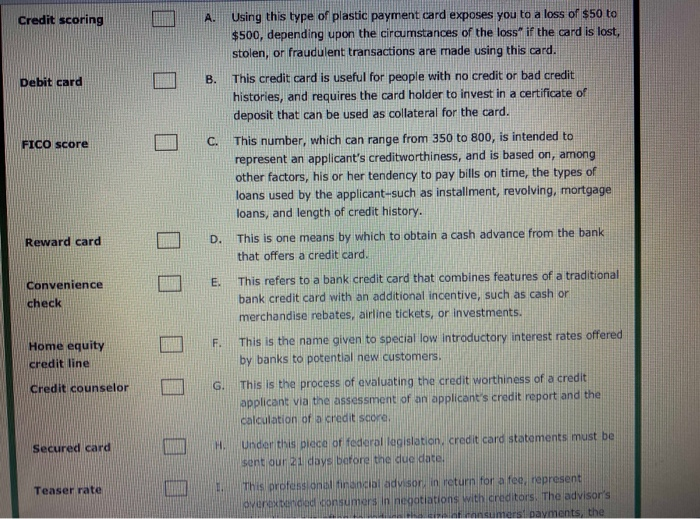

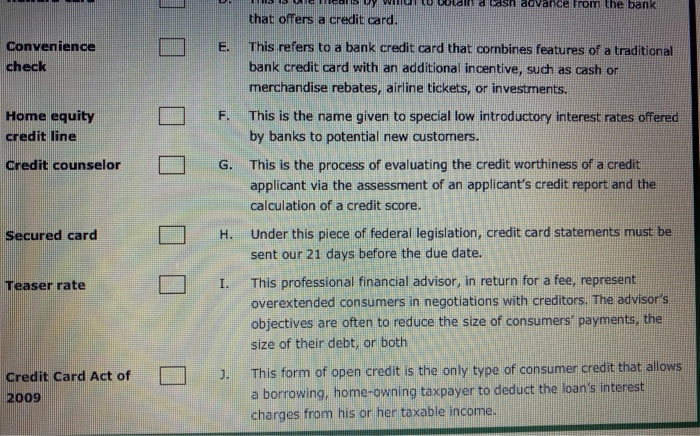

Credit scoring Debit card B. FICO score Reward card Using this type of plastic payment card exposes you to a loss of $50 to $500, depending upon the circumstances of the loss if the card is lost, stolen, or fraudulent transactions are made using this card. This credit card is useful for people with no credit or bad credit histories, and requires the card holder to invest in a certificate of deposit that can be used as collateral for the card. This number, which can range from 350 to 800, is intended to represent an applicant's creditworthiness, and is based on, among other factors, his or her tendency to pay bills on time, the types of loans used by the applicant-such as installment, revolving, mortgage loans, and length of credit history. D. This is one means by which to obtain a cash advance from the bank that offers a credit card. E. This refers to a bank credit card that combines features of a traditional bank credit card with an additional incentive, such as cash or merchandise rebates, airline tickets, or investments. This is the name given to special low introductory interest rates offered by banks to potential new customers. G. This is the process of evaluating the credit worthiness of a credit applicant via the assessment of an applicant's credit report and the calculation of a credit score. Under this piece of federal legislation, credit card statements must be sent our 21 days before the due date. This professional financial advisor in return for a few, represent overextended consumers in negotiations with creditors. The advisor's mansumarsipayments, the Convenience check Home equity credit line Credit counselor Secured card Teaser rate 0 0 Convenience check Home equity credit line Credit counselor 0 0 WY WUL land cash advance from the bank that offers a credit card. E. This refers to a bank credit card that combines features of a traditional bank credit card with an additional incentive, such as cash or merchandise rebates, airline tickets, or investments. F. This is the name given to special low introductory interest rates offered by banks to potential new customers. G. This is the process of evaluating the credit worthiness of a credit applicant via the assessment of an applicant's credit report and the calculation of a credit score. H. Under this piece of federal legislation, credit card statements must be sent our 21 days before the due date. This professional financial advisor, in return for a fee, represent overextended consumers in negotiations with creditors. The advisor's objectives are often to reduce the size of consumers' payments, the size of their debt, or both ). This form of open credit is the only type of consumer credit that allows a borrowing, home-owning taxpayer to deduct the loan's interest charges from his or her taxable income. Secured card 0 0 Teaser rate 0 Credit Card Act of 2009