Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Credit Spreads on corporate bonds appear to overcompensate the investor for expected loss from default True False Question 2 (1 point) When we back out

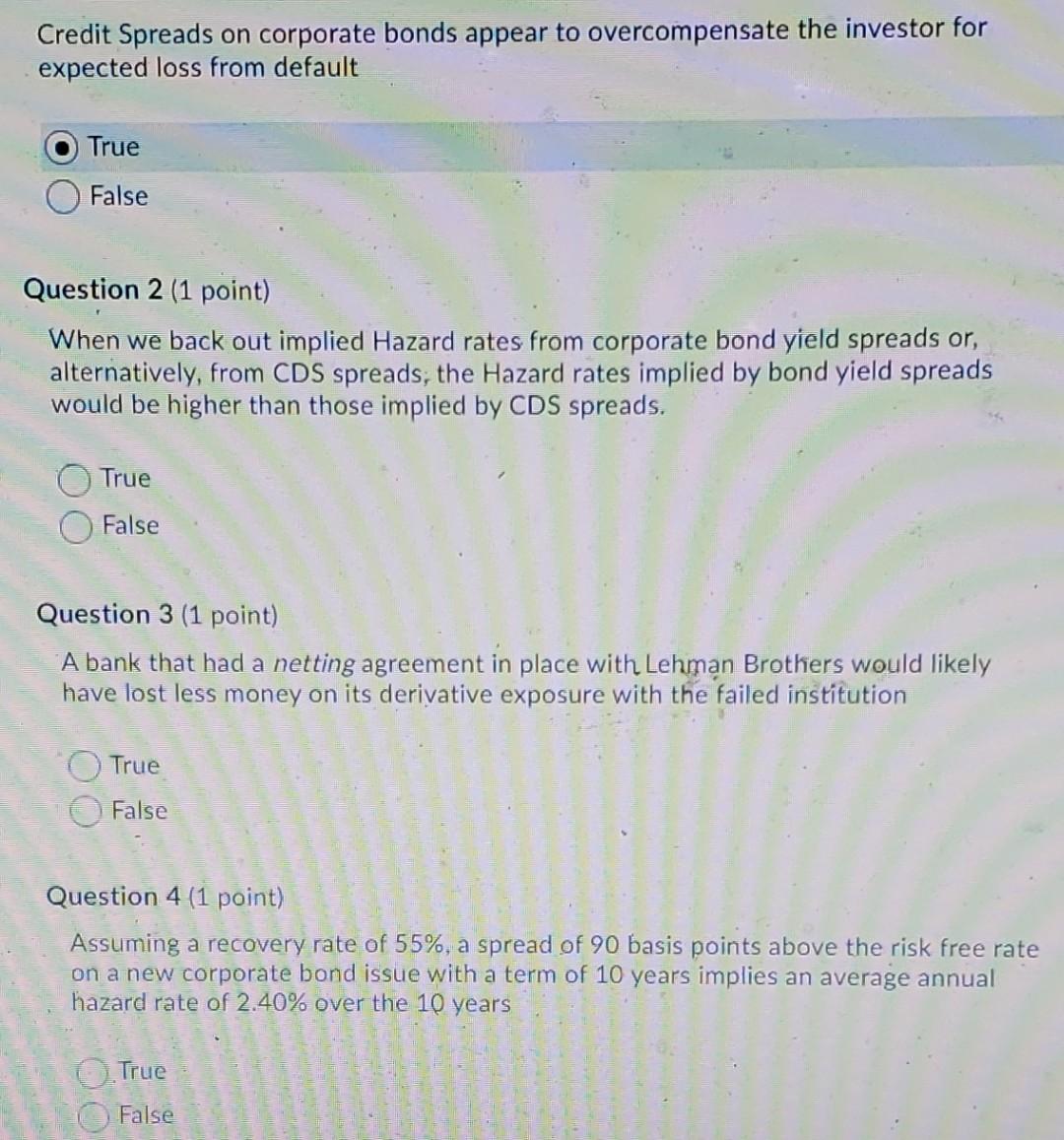

Credit Spreads on corporate bonds appear to overcompensate the investor for expected loss from default True False Question 2 (1 point) When we back out implied Hazard rates from corporate bond yield spreads or, alternatively, from CDS spreads, the Hazard rates implied by bond yield spreads would be higher than those implied by CDS spreads. True False Question 3 (1 point) A bank that had a netting agreement in place with Lehman Brothers would likely have lost less money on its derivative exposure with the failed institution True False Question 4 (1 point) Assuming a recovery rate of 55%, a spread of 90 basis points above the risk free rate on a new corporate bond issue with a term of 10 years implies an average annual hazard rate of 2.40% over the 10 years 5. True False =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started