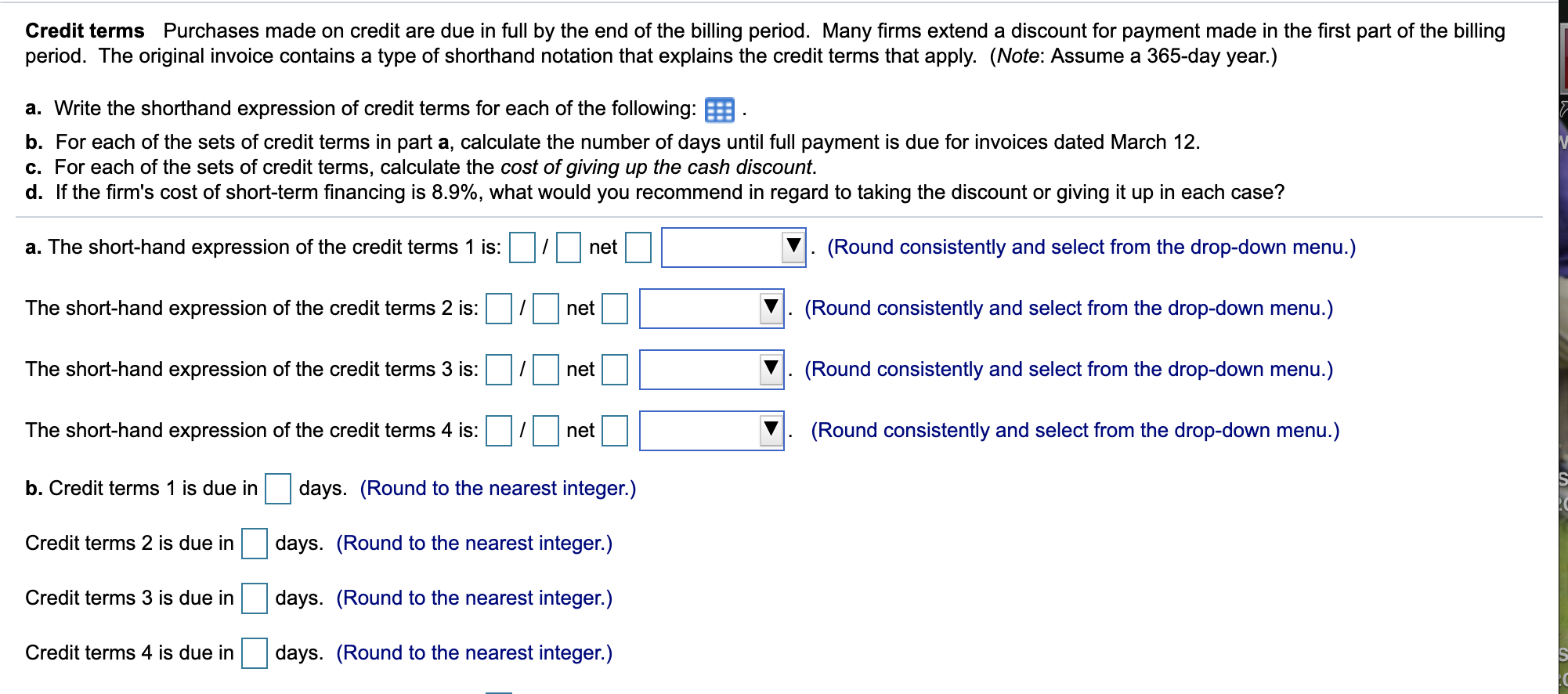

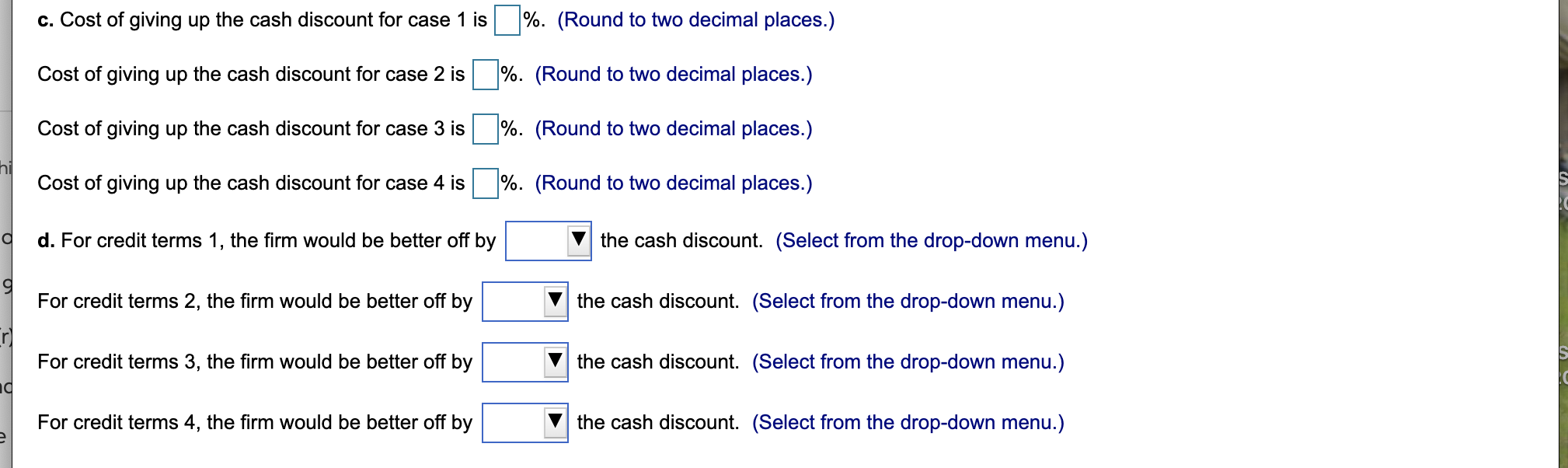

Credit terms Purchases made on credit are due in full by the end of the billing period. Many firms extend a discount for payment made in the first part of the billing period. The original invoice contains a type of shorthand notation that explains the credit terms that apply. (Note: Assume a 365-day year.) a. Write the shorthand expression of credit terms for each of the following: 3. b. For each of the sets of credit terms in part a, calculate the number of days until full payment is due for invoices dated March 12. c. For each of the sets of credit terms, calculate the cost of giving up the cash discount. d. If the firm's cost of short-term financing is 8.9%, what would you recommend in regard to taking the discount or giving it up in each case? a. The short-hand expression of the credit terms 1 is: 1 net V. (Round consistently and select from the drop-down menu.) The short-hand expression of the credit terms 2 is: 1 net | V. (Round consistently and select from the drop-down menu.) The short-hand expression of the credit terms 3 is: 11 net | V. (Round consistently and select from the drop-down menu.) The short-hand expression of the credit terms 4 is: 1 net . v. (Round consistently and select from the drop-down menu.) b. Credit terms 1 is due in days. (Round to the nearest integer.) Credit terms 2 is due in days. (Round to the nearest integer.) Credit terms 3 is due in days. (Round to the nearest integer.) Credit terms 4 is due in days. (Round to the nearest integer.) c. Cost of giving up the cash discount for case 1 is %. (Round to two decimal places.) Cost of giving up the cash discount for case 2 is %. (Round to two decimal places.) Cost of giving up the cash discount for case 3 is %. (Round to two decimal places.) Cost of giving up the cash discount for case 4 is %. (Round to two decimal places.) q d. For credit terms 1, the firm would be better off by V the cash discount. (Select from the drop-down menu.) For credit terms 2, the firm would be better off by V the cash discount. (Select from the drop-down menu.) 5 For credit terms 3, the firm would be better off by V the cash discount. (Select from the drop-down menu.) 0 For credit terms 4, the firm would be better off by V the cash discount. (Select from the drop-down menu.) e Credit terms Purchases made on credit are due in full by the end of the billing period. Many firms extend a discount for payment made in the first part of the billing period. The original invoice contains a type of shorthand notation that explains the credit terms that apply. (Note: Assume a 365-day year.) a. Write the shorthand expression of credit terms for each of the following: 3. b. For each of the sets of credit terms in part a, calculate the number of days until full payment is due for invoices dated March 12. c. For each of the sets of credit terms, calculate the cost of giving up the cash discount. d. If the firm's cost of short-term financing is 8.9%, what would you recommend in regard to taking the discount or giving it up in each case? a. The short-hand expression of the credit terms 1 is: 1 net V. (Round consistently and select from the drop-down menu.) The short-hand expression of the credit terms 2 is: 1 net | V. (Round consistently and select from the drop-down menu.) The short-hand expression of the credit terms 3 is: 11 net | V. (Round consistently and select from the drop-down menu.) The short-hand expression of the credit terms 4 is: 1 net . v. (Round consistently and select from the drop-down menu.) b. Credit terms 1 is due in days. (Round to the nearest integer.) Credit terms 2 is due in days. (Round to the nearest integer.) Credit terms 3 is due in days. (Round to the nearest integer.) Credit terms 4 is due in days. (Round to the nearest integer.) c. Cost of giving up the cash discount for case 1 is %. (Round to two decimal places.) Cost of giving up the cash discount for case 2 is %. (Round to two decimal places.) Cost of giving up the cash discount for case 3 is %. (Round to two decimal places.) Cost of giving up the cash discount for case 4 is %. (Round to two decimal places.) q d. For credit terms 1, the firm would be better off by V the cash discount. (Select from the drop-down menu.) For credit terms 2, the firm would be better off by V the cash discount. (Select from the drop-down menu.) 5 For credit terms 3, the firm would be better off by V the cash discount. (Select from the drop-down menu.) 0 For credit terms 4, the firm would be better off by V the cash discount. (Select from the drop-down menu.) e