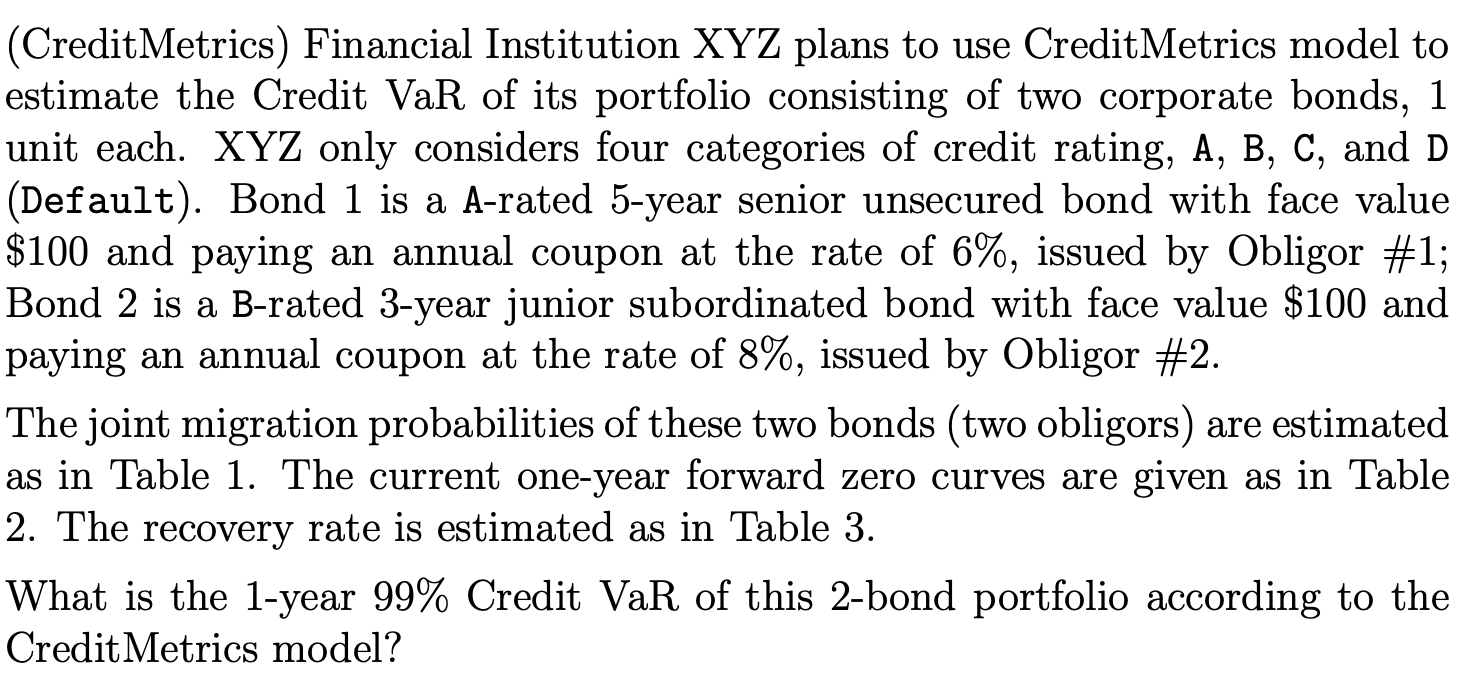

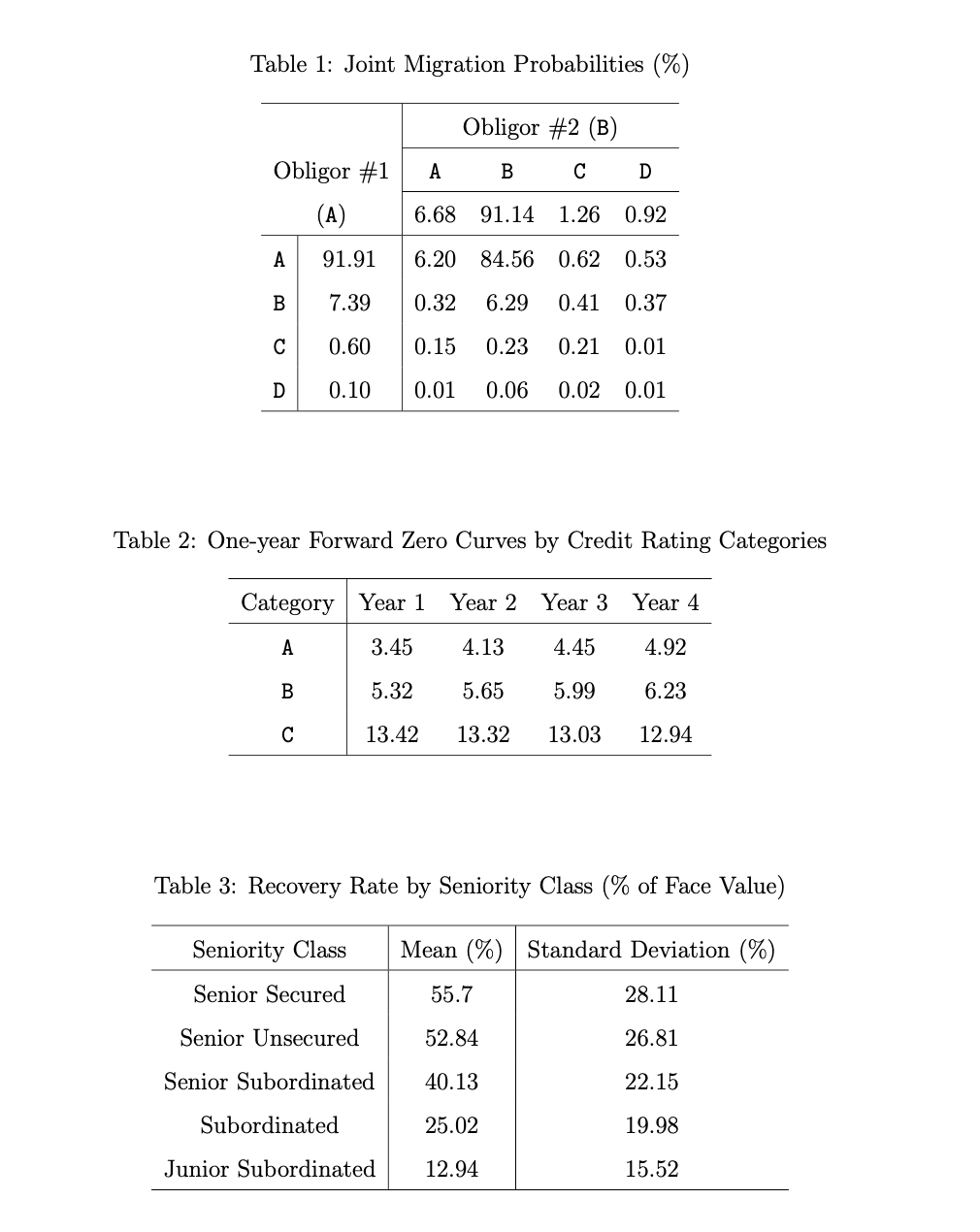

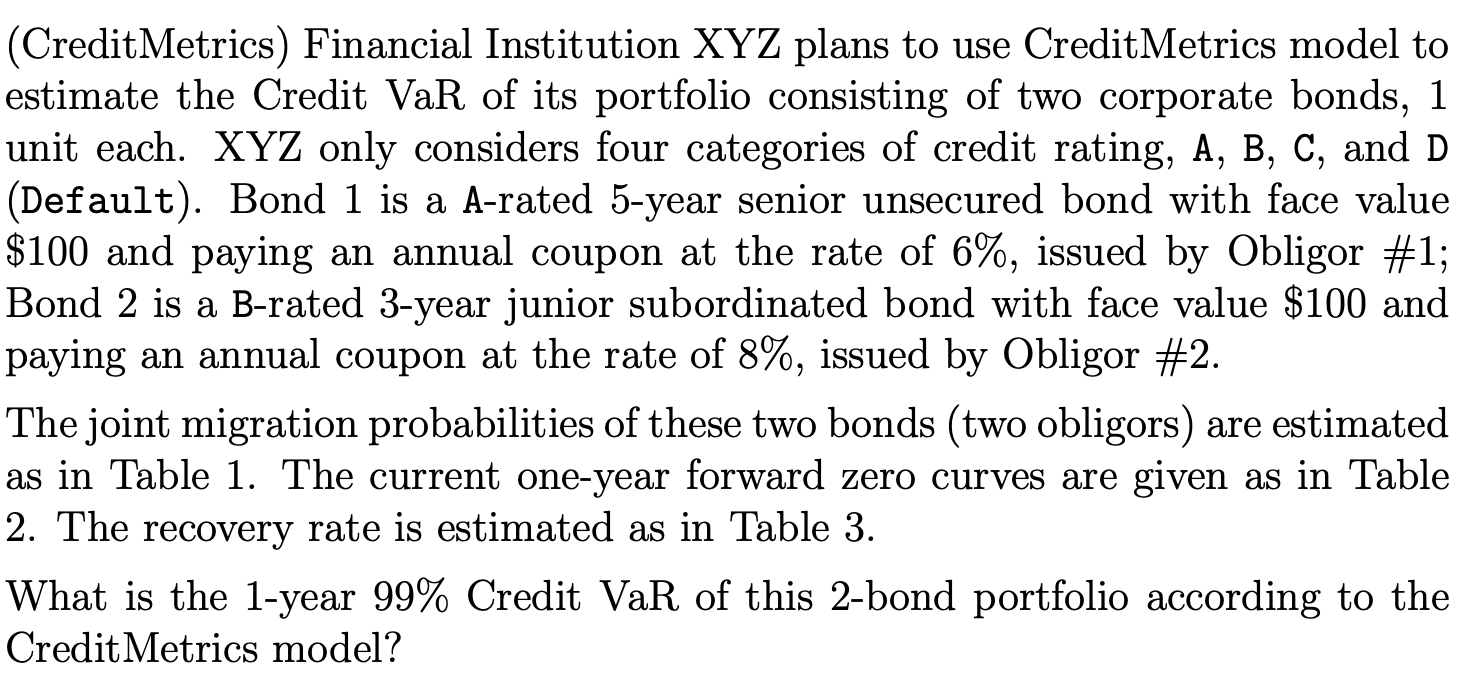

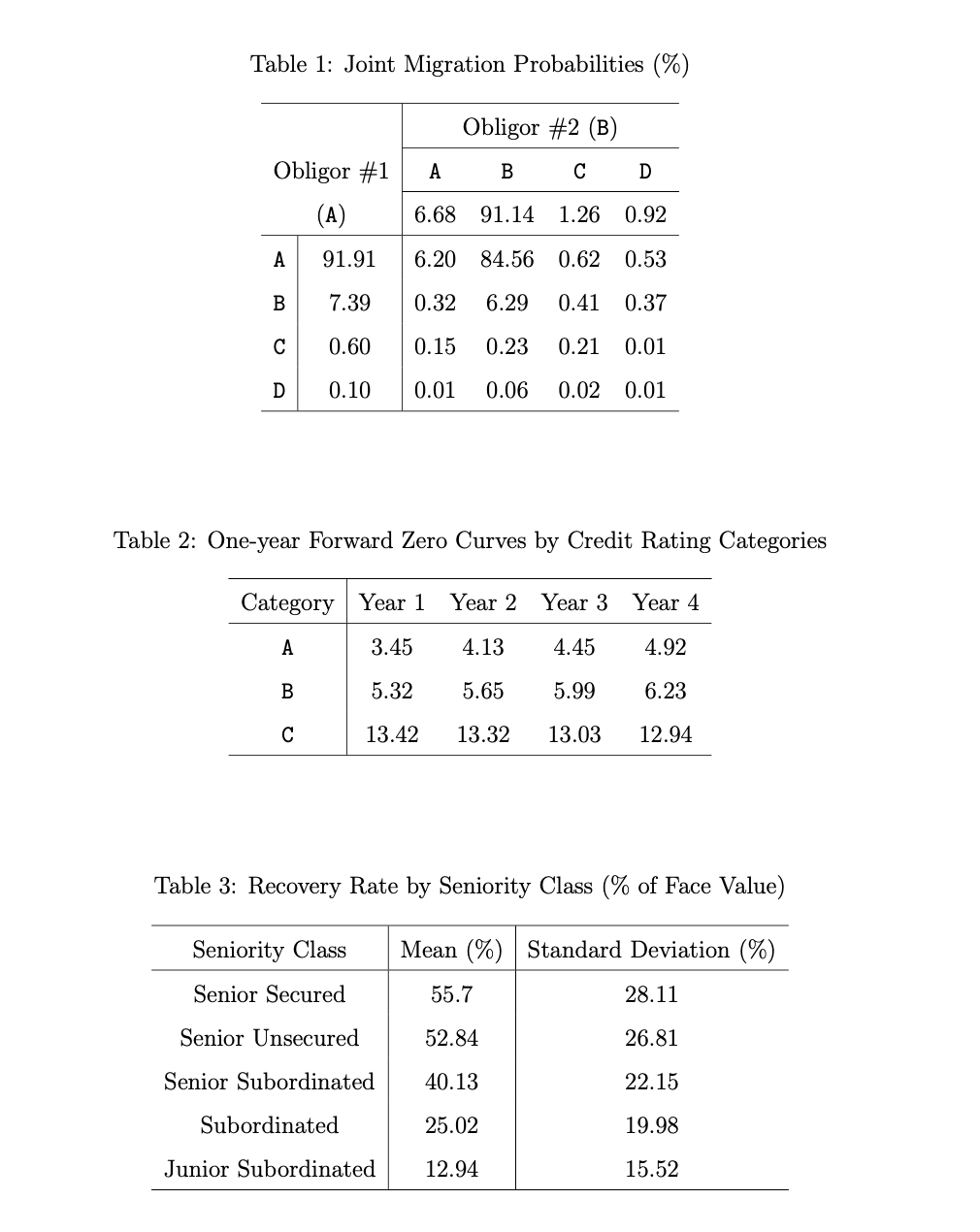

(CreditMetrics) Financial Institution XYZ plans to use Credit Metrics model to estimate the Credit VaR of its portfolio consisting of two corporate bonds, 1 unit each. XYZ only considers four categories of credit rating, A, B, C, and D (Default). Bond 1 is a A-rated 5-year senior unsecured bond with face value $100 and paying an annual coupon at the rate of 6%, issued by Obligor #1; Bond 2 is a B-rated 3-year junior subordinated bond with face value $100 and paying an annual coupon at the rate of 8%, issued by Obligor #2. The joint migration probabilities of these two bonds (two obligors) are estimated as in Table 1. The current one-year forward zero curves are given as in Table 2. The recovery rate is estimated as in Table 3. What is the 1-year 99% Credit VaR of this 2-bond portfolio according to the Credit Metrics model? Table 1: Joint Migration Probabilities (%) Obligor #1 (A) 91.91 Obligor #2 (B) A B C D 6.68 91.14 1.26 0.92 6.20 84.56 0.62 0.53 0.32 6.29 0.41 0.37 0.15 0.23 0.21 0.01 0.01 0.06 0.02 0.01 7.39 0.60 0.10 Table 2: One-year Forward Zero Curves by Credit Rating Categories Category Year 1 Year 2 Year 3 Year 4 3.45 4.13 4.45 4.92 5.325.65 5.996.23 13.42 13.32 13.03 12.94 Table 3: Recovery Rate by Seniority Class (% of Face Value) Mean (%) Standard Deviation (%) 55.7 28.11 Seniority Class Senior Secured Senior Unsecured Senior Subordinated 52.84 26.81 40.13 22.15 Subordinated 25.02 19.98 Junior Subordinated 12.94 15.52 (CreditMetrics) Financial Institution XYZ plans to use Credit Metrics model to estimate the Credit VaR of its portfolio consisting of two corporate bonds, 1 unit each. XYZ only considers four categories of credit rating, A, B, C, and D (Default). Bond 1 is a A-rated 5-year senior unsecured bond with face value $100 and paying an annual coupon at the rate of 6%, issued by Obligor #1; Bond 2 is a B-rated 3-year junior subordinated bond with face value $100 and paying an annual coupon at the rate of 8%, issued by Obligor #2. The joint migration probabilities of these two bonds (two obligors) are estimated as in Table 1. The current one-year forward zero curves are given as in Table 2. The recovery rate is estimated as in Table 3. What is the 1-year 99% Credit VaR of this 2-bond portfolio according to the Credit Metrics model? Table 1: Joint Migration Probabilities (%) Obligor #1 (A) 91.91 Obligor #2 (B) A B C D 6.68 91.14 1.26 0.92 6.20 84.56 0.62 0.53 0.32 6.29 0.41 0.37 0.15 0.23 0.21 0.01 0.01 0.06 0.02 0.01 7.39 0.60 0.10 Table 2: One-year Forward Zero Curves by Credit Rating Categories Category Year 1 Year 2 Year 3 Year 4 3.45 4.13 4.45 4.92 5.325.65 5.996.23 13.42 13.32 13.03 12.94 Table 3: Recovery Rate by Seniority Class (% of Face Value) Mean (%) Standard Deviation (%) 55.7 28.11 Seniority Class Senior Secured Senior Unsecured Senior Subordinated 52.84 26.81 40.13 22.15 Subordinated 25.02 19.98 Junior Subordinated 12.94 15.52