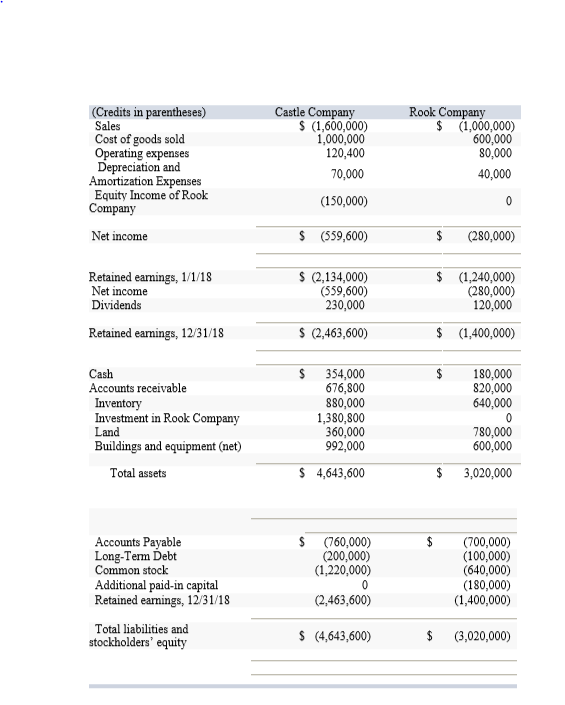

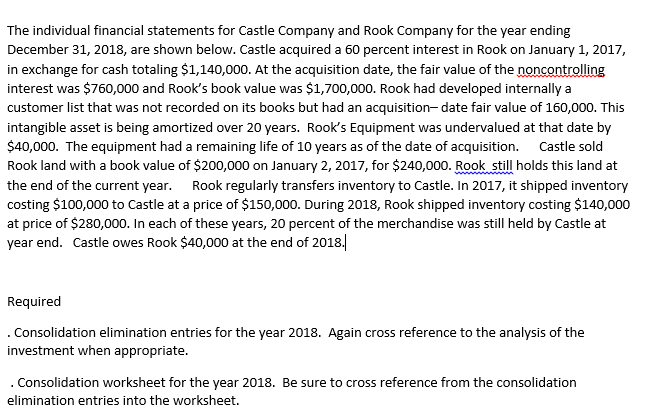

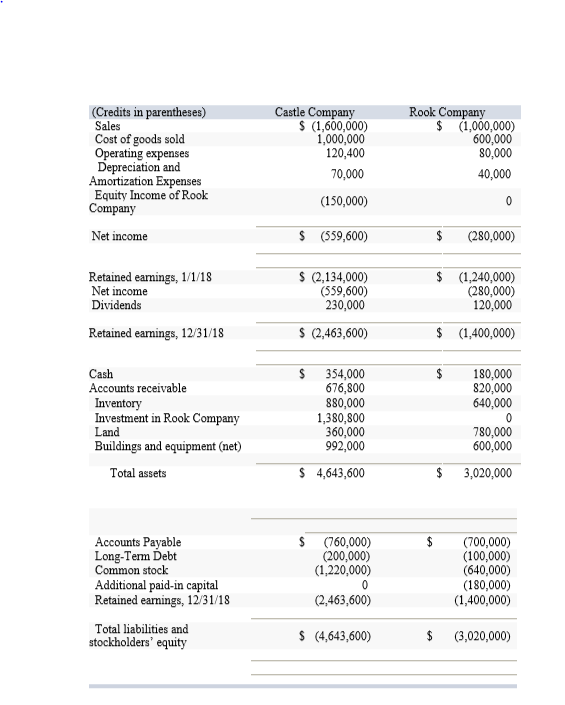

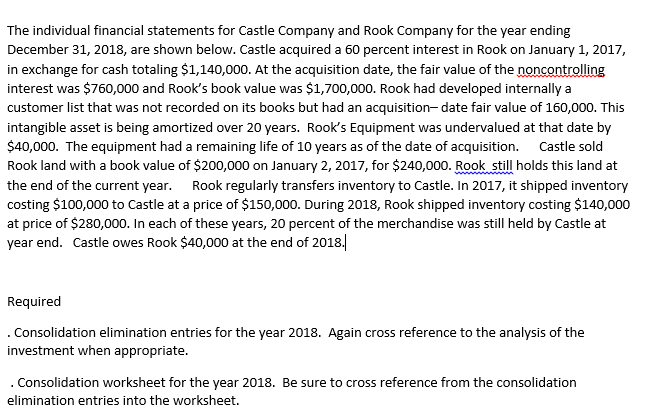

(Credits in parentheses) Sales Cost of goods sold Operating expenses Depreciation and Amortization Expenses Equity Income of Rook Company Castle Company Rook Company S (1,600,000) 1,000,000 120,400 (1,000,000) 600,000 80,000 70,000 (150,000) S (559,600) 40,000 Net income $ (280,000) (2,134,000) (559,600) 230,000 $(1,240,000) (280,000) 120,000 eamings, 1/1/18 Net income Dividends Retained eamings, 1 S (2,463,600) $(1,400,000) $ 354,000 676,800 880,000 1,380,800 360,000 992,000 $ 180,000 820,000 640,000 Cash receivable Inventory Investment in Rook Company 780,000 600,000 Buildings and equipment (net) Total assets S 4,643,600 $3,020,000 (760,000) (200,000) (1,220,000) $ (700,000) (100,000) (640,000) (180,000) (1,400,000) Accounts Payable Long-Term Debt Common stock Additional paid-in capital Retained eamings, 1 Total liabilities and 2/31/18 (2,463,600) S (4,643,600) (3,020,000) stockholders' equity The individual financial statements for Castle Company and Rook Company for the year ending December 31, 2018, are shown below. Castle acquired a 60 percent interest in Rook on January 1, 2017, in exchange for cash totaling $1,140,000. At the acquisition date, the fair value of the noncontrolling interest was $760,000 and Rook's book value was $1,700,000. Rook had developed internally a customer list that was not recorded on its books but had an acquisition- date fair value of 160,000. This intangible asset is being amortized over 20 years. Rook's Equipment was undervalued at that date by $40,000. The equipment had a remaining life of 10 years as of the date of acquisition. Castle sold Rook land with a book value of $200,000 on January 2, 2017, for $240,000. Rook still holds this land at the end of the current year. Rook regularly transfers inventory to Castle. In 2017, it shipped inventory costing $100,000 to Castle at a price of $150,000. During 2018, Rook shipped inventory costing $140,000 at price of $280,000. In each of these years, 20 percent of the merchandise was still held by Castle at year end. Castle owes Rook $40,000 at the end of 2018 Required Consolidation elimination entries for the year 2018. Again cross reference to the analysis of the investment when appropriate . Consolidation worksheet for the year 2018. Be sure to cross reference from the consolidation elimination entries into the worksheet (Credits in parentheses) Sales Cost of goods sold Operating expenses Depreciation and Amortization Expenses Equity Income of Rook Company Castle Company Rook Company S (1,600,000) 1,000,000 120,400 (1,000,000) 600,000 80,000 70,000 (150,000) S (559,600) 40,000 Net income $ (280,000) (2,134,000) (559,600) 230,000 $(1,240,000) (280,000) 120,000 eamings, 1/1/18 Net income Dividends Retained eamings, 1 S (2,463,600) $(1,400,000) $ 354,000 676,800 880,000 1,380,800 360,000 992,000 $ 180,000 820,000 640,000 Cash receivable Inventory Investment in Rook Company 780,000 600,000 Buildings and equipment (net) Total assets S 4,643,600 $3,020,000 (760,000) (200,000) (1,220,000) $ (700,000) (100,000) (640,000) (180,000) (1,400,000) Accounts Payable Long-Term Debt Common stock Additional paid-in capital Retained eamings, 1 Total liabilities and 2/31/18 (2,463,600) S (4,643,600) (3,020,000) stockholders' equity The individual financial statements for Castle Company and Rook Company for the year ending December 31, 2018, are shown below. Castle acquired a 60 percent interest in Rook on January 1, 2017, in exchange for cash totaling $1,140,000. At the acquisition date, the fair value of the noncontrolling interest was $760,000 and Rook's book value was $1,700,000. Rook had developed internally a customer list that was not recorded on its books but had an acquisition- date fair value of 160,000. This intangible asset is being amortized over 20 years. Rook's Equipment was undervalued at that date by $40,000. The equipment had a remaining life of 10 years as of the date of acquisition. Castle sold Rook land with a book value of $200,000 on January 2, 2017, for $240,000. Rook still holds this land at the end of the current year. Rook regularly transfers inventory to Castle. In 2017, it shipped inventory costing $100,000 to Castle at a price of $150,000. During 2018, Rook shipped inventory costing $140,000 at price of $280,000. In each of these years, 20 percent of the merchandise was still held by Castle at year end. Castle owes Rook $40,000 at the end of 2018 Required Consolidation elimination entries for the year 2018. Again cross reference to the analysis of the investment when appropriate . Consolidation worksheet for the year 2018. Be sure to cross reference from the consolidation elimination entries into the worksheet