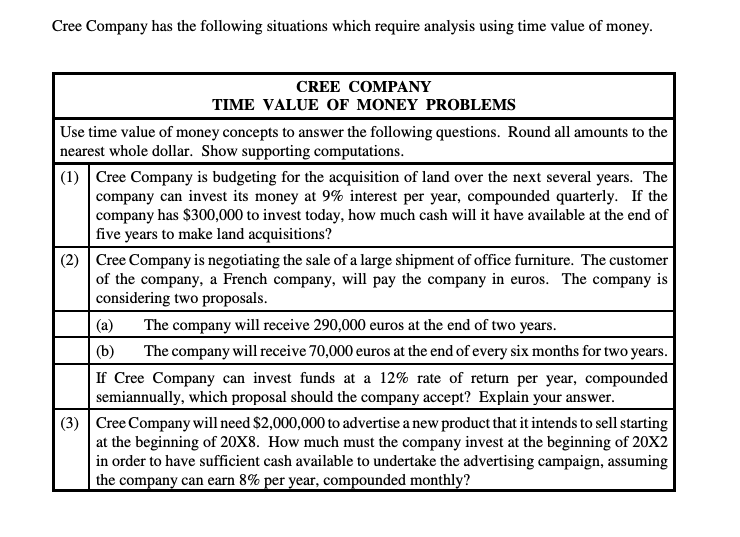

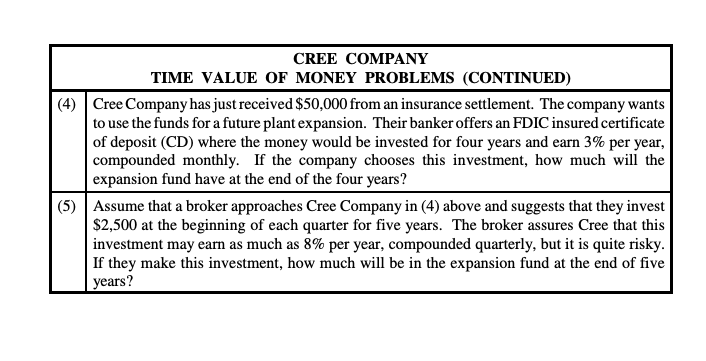

Cree Company has the following situations which require analysis using time value of money. CREE COMPANY TIME VALUE OF MONEY PROBLEMS Use time value of money concepts to answer the following questions. Round all amounts to the nearest whole dollar. Show supporting computations. (1) Cree Company is budgeting for the acquisition of land over the next several years. The company can invest its money at 9% interest per year, compounded quarterly. If the company has $300,000 to invest today, how much cash will it have available at the end of five years to make land acquisitions? (2) Cree Company is negotiating the sale of a large shipment of office furniture. The customer of the company, a French company, will pay the company in euros. The company is considering two proposals. (a) The company will receive 290,000 euros at the end of two years. (b) The company will receive 70,000 euros at the end of every six months for two years. If Cree Company can invest funds at a 12% rate of return per year, compounded semiannually, which proposal should the company accept? Explain your answer. (3) Cree Company will need $2,000,000 to advertise a new product that it intends to sell starting at the beginning of 20X8. How much must the company invest at the beginning of 20X2 in order to have sufficient cash available to undertake the advertising campaign, assuming the company can earn 8% per year, compounded monthly? CREE COMPANY TIME VALUE OF MONEY PROBLEMS (CONTINUED) (4) Cree Company has just received $50,000 from an insurance settlement. The company wants to use the funds for a future plant expansion. Their banker offers an FDIC insured certificate of deposit (CD) where the money would be invested for four years and earn 3% per year, compounded monthly. If the company chooses this investment, how much will the expansion fund have at the end of the four years? (5) Assume that a broker approaches Cree Company in (4) above and suggests that they invest $2,500 at the beginning of each quarter for five years. The broker assures Cree that this investment may earn as much as 8% per year, compounded quarterly, but it is quite risky. If they make this investment, how much will be in the expansion fund at the end of five years