Question

CrestAsia Inc. is considering the purchase of a commercial retail building in Paya Lebar. CrestAsia hopes to market the building as an innovative retail mall

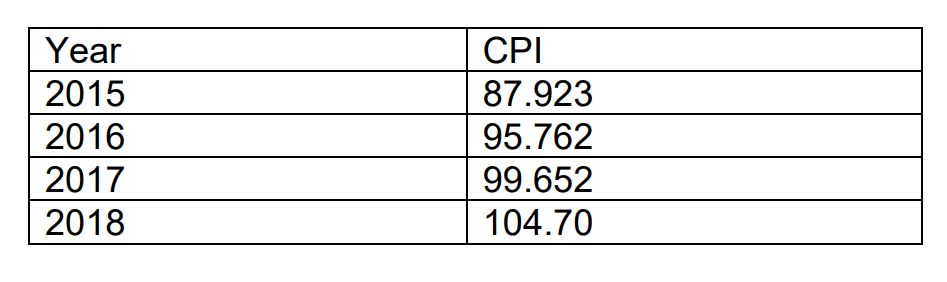

CrestAsia Inc. is considering the purchase of a commercial retail building in Paya Lebar. CrestAsia hopes to market the building as an innovative retail mall that will focus on experiential and activity-based retail concepts, including bringing in pop-ups of startup retailers in overseas markets which do not have a presence here in Singapore. The building is valued at $25,000,000. The property is expected to have a NOI of $1,800,000 in the first year. The NOI is expected to increase with the inflation rate per year thereafter. CrestAsia is looking at a 5- year holding period. As an analyst for CrestAsia, you estimated that the unlevered beta for comparable properties is 0.7. Globally, the market risk premium is estimated to be 12% and the risk-free rate is estimated to be around 4%. You assume that these estimates will remain fairly stable over the 5-year holding period. In addition, you will need to recommend a reasonable CPI adjustment for the NOI. You find that the historical CPI is as follows:

Based on the last three years inflation rates, you decide to find the geometric mean inflation rate (rounded off to the nearest percentage point. Note: 1 percentage point = 0.01 or 1%) and to use that mean as the annual CPI adjustment to the NOI from the start of the second year to the end of the 5-year holding period. Assume that depreciation allowance and carry-over of losses are not applicable and that selling cost is 3% of the sale price of the property. CrestAsia Inc. has a marginal tax rate of 13%.

For financing, CrestAsia presented its marketing plan to ZurBank and is considering two loans from ZurBank:

Loan A: ZurBank is willing to make a participation loan of $20,000,000 with an interest rate of 6% per annum. The loan will be an amortizing loan with monthly payments over a 25-year loan term. In addition to regular mortgage payments, ZurBank will receive 35% of NOI in excess of $1,800,000 each year until the loan is repaid. In the event of a sale, ZurBank will receive 25% of any increase in value as participation. Lenders participation is a tax-deductible.

Loan B: With the same loan amount, ZurBank also has another alternative for CrestAsia. ZurBank is willing to make a convertible mortgage that gives ZurBank the option to convert any mortgage balance into a 50% equity position at the end of year 5. That is, instead of receiving the pay-off on the mortgage, ZurBank would receive 50% of the property price if the property is sold off at the end of 5 years from now. The contract rate for the mortgage is 5.5% per annum and the mortgage will be an amortizing mortgage over a loan term of 25 years. Assume that CrestAsia will choose to default if the value of the property is less than the loan balance at the end of year 5.

(a) What are the before-tax IRR (BTIRR) on equity and the after-tax (ATIRR) on equity for the two different loans, assuming that the property is sold at a price that equals a valuers estimate at the end of year 5? (20 marks)

(b) For both loans, calculate the before-tax effective cost to CrestAsia Inc. assuming the property is sold at a price that equals a valuers estimate at the end of year 5. (10 marks)

(c) Which loan would you recommend? State your reasons which should consider the propertys before- and after-tax IRR, DCR and the respective borrowing costs and whether each loan offers favorable leverage. (15 marks)

Year 2015 2016 2017 2018 CPI 87.923 95.762 99.652 104.70 Year 2015 2016 2017 2018 CPI 87.923 95.762 99.652 104.70Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started