Question

Crickey Co, a company quoted on the London Stock Exchange, has cash balances of 23 million which are currently invested in short-term money market deposits.

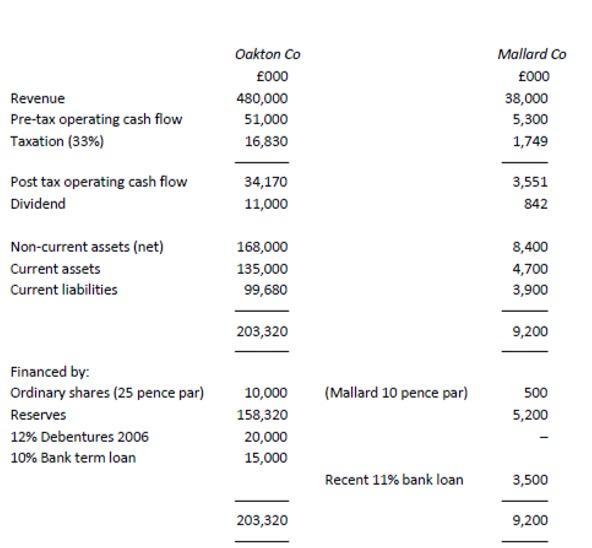

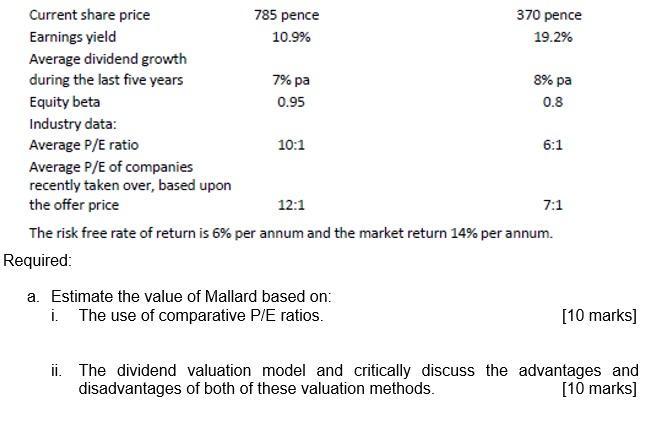

Crickey Co, a company quoted on the London Stock Exchange, has cash balances of £23 million which are currently invested in short-term money market deposits. The cash is intended to be used primarily for strategic acquisitions, and the company has formed an acquisition committee with a remit to identify possible acquisition targets. The committee has suggested the purchase of Mallard Co, a company in a different industry that is quoted on the stock exchange. Although Mallard is quoted, approximately 50% of its shares are still owned by three directors. These directors have stated that they might be prepared to recommend the sale of Mallard, but they consider that its shares are worth £22 million in total.

Revenue Pre-tax operating cash flow Taxation (33%) Post tax operating cash flow Dividend Non-current assets (net) Current assets Current liabilities Financed by: Ordinary shares (25 pence par) Reserves 12% Debentures 2006 10% Bank term loan Oakton Co 000 480,000 51,000 16,830 34,170 11,000 168,000 135,000 99,680 203,320 10,000 158,320 20,000 15,000 203,320 (Mallard 10 pence par) Recent 11% bank loan Mallard Co 000 38,000 5,300 1,749 3,551 842 8,400 4,700 3,900 9,200 500 5,200 3,500 9,200

Step by Step Solution

3.60 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the value of Mallard Co using both the comparative PE ratios method and the dividend valuation model After that Ill provide a brief dis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started