Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cristal Clears (Pty) Ltd (hereafter referred to as CC) manufactures windows of different sizes and thicknesses. The company has a 31 December 2020 financial

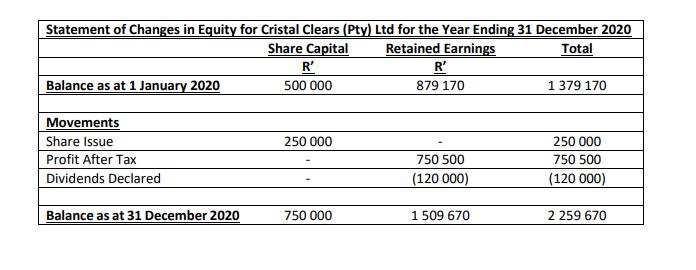

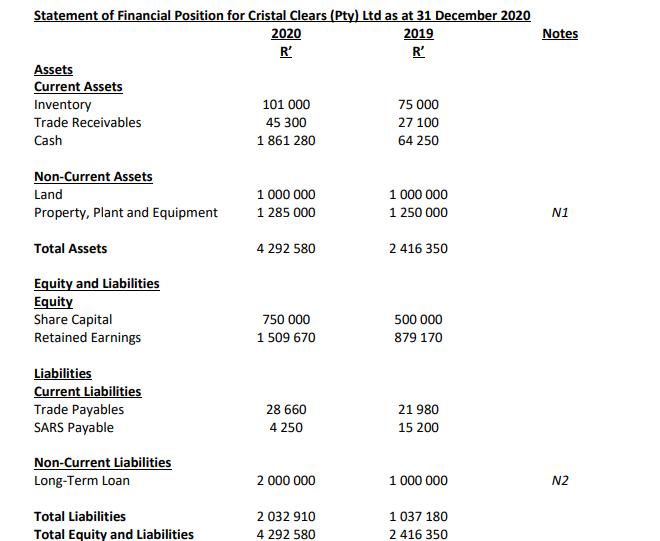

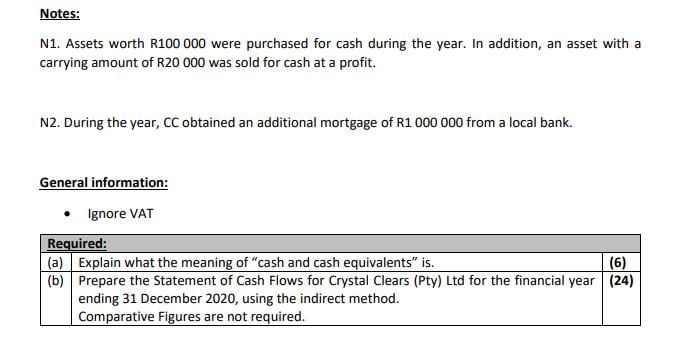

Cristal Clears (Pty) Ltd (hereafter referred to as "CC") manufactures windows of different sizes and thicknesses. The company has a 31 December 2020 financial year-end. You have been given an extract of the financial statements: Statement of Profit or Loss for Cristal Clears (Pty) Ltd for the Year Ending 31 December 2020 2020 R' Sales Cost of Sales Gross Profit Other Income Interest Income Profit on Disposal of PPE Operating Expenses Depreciation Insurance Salaries and Wages Interest Expense Profit Before Tax Tax Expense Profit After Tax 3 400 000 (1 950 000) 1 450 000 17 500 12 500 5 000 (436 770) (45 000) (175 000) (215 000) (1 770) 1 030 730 (280 230) 750 500 Statement of Changes in Equity for Cristal Clears (Pty) Ltd for the Year Ending 31 December 2020 Share Capital Retained Earnings Total Balance as at 1 January 2020 Movements Share Issue Profit After Tax Dividends Declared Balance as at 31 December 2020 R' 500 000 250 000 750 000 R' 879 170 750 500 (120 000) 1 509 670 1 379 170 250 000 750 500 (120 000) 2 259 670 Statement of Financial Position for Cristal Clears (Pty) Ltd as at 31 December 2020 2019 R' Assets Current Assets Inventory Trade Receivables Cash Non-Current Assets Land Property, Plant and Equipment Total Assets Equity and Liabilities Equity Share Capital Retained Earnings Liabilities Current Liabilities Trade Payables SARS Payable Non-Current Liabilities Long-Term Loan Total Liabilities Total Equity and Liabilities 2020 R' 101 000 45 300 1861 280 1 000 000 1 285 000 4 292 580 750 000 1 509 670 28 660 4 250 2 000 000 2 032 910 4 292 580 75 000 27 100 64 250 1 000 000 1 250 000 2 416 350 500 000 879 170 21980 15 200 1 000 000 037 180 1 2 416 350 Notes N1 N2 Notes: N1. Assets worth R100 000 were purchased for cash during the year. In addition, an asset with a carrying amount of R20 000 was sold for cash at a profit. N2. During the year, CC obtained an additional mortgage of R1 000 000 from a local bank. General information: Ignore VAT Required: (a) Explain what the meaning of "cash and cash equivalents" is. (6) (b) Prepare the Statement of Cash Flows for Crystal Clears (Pty) Ltd for the financial year (24) ending 31 December 2020, using the indirect method. Comparative Figures are not required.

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

636899ab9dc44_106414.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started