Answered step by step

Verified Expert Solution

Question

1 Approved Answer

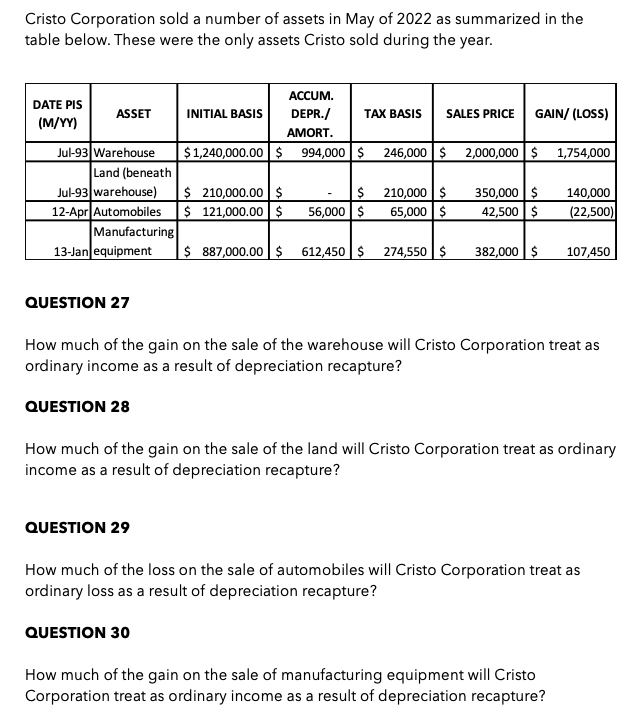

Cristo Corporation sold a number of assets in May of 2022 as summarized in the table below. These were the only assets Cristo sold

Cristo Corporation sold a number of assets in May of 2022 as summarized in the table below. These were the only assets Cristo sold during the year. DATE PIS (M/YY) ASSET Jul-93 Warehouse Land (beneath Jul-93 warehouse) 12-Apr Automobiles Manufacturing 13-Jan equipment QUESTION 27 ACCUM. DEPR./ AMORT. $1,240,000.00 $ 994,000 $ 246,000 $2,000,000 $ 1,754,000 INITIAL BASIS QUESTION 29 TAX BASIS SALES PRICE $ 210,000.00 $ $ 121,000.00 $ $ 887,000.00 $ 612,450 $ 274,550 $ $ 56,000 $ GAIN/ (LOSS) 210,000 $ 350,000 $ 140,000 65,000 $ 42,500 $ (22,500) 382,000 $ 107,450 How much of the gain on the sale of the warehouse will Cristo Corporation treat as ordinary income as a result of depreciation recapture? QUESTION 28 How much of the gain on the sale of the land will Cristo Corporation treat as ordinary income as a result of depreciation recapture? How much of the loss on the sale of automobiles will Cristo Corporation treat as ordinary loss as a result of depreciation recapture? QUESTION 30 How much of the gain on the sale of manufacturing equipment will Cristo Corporation treat as ordinary income as a result of depreciation recapture?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 27 The gain on the sale of the warehouse is 760000 2000000 sales price 1240000 initial basis ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started