Question

Criteria Total LIFO Calculation 1.5% FIFO Calculation 1.5% Average Cost Calculation 1.5% Inventory Question .5% Total 5% You work for Global Tracking Inc. a company

Criteria Total

LIFO Calculation 1.5%

FIFO Calculation 1.5%

Average Cost Calculation 1.5%

Inventory Question .5%

Total 5%

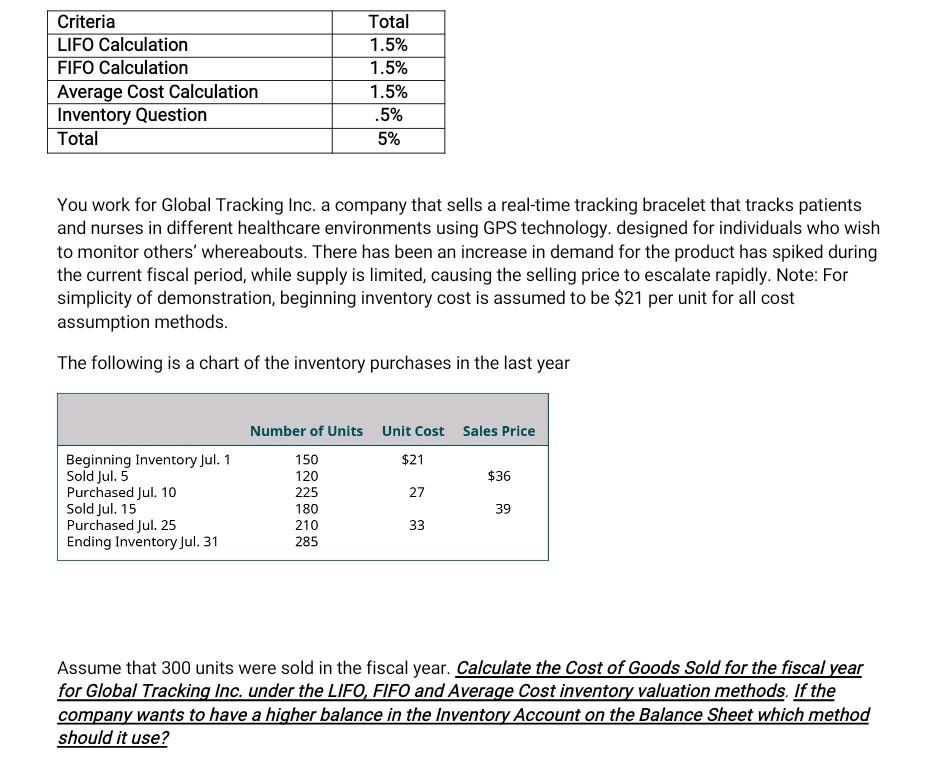

You work for Global Tracking Inc. a company that sells a real-time tracking bracelet that tracks patients and nurses in different healthcare environments using GPS technology. designed for individuals who wish to monitor others whereabouts. There has been an

increase in demand for the product has spiked during the current fiscal period, while supply is limited, causing the selling price to escalate rapidly. Note: For simplicity of demonstration, beginning inventory cost is assumed to be $21 per unit for all cost assumption methods. The following is a chart of the inventory purchases in the last year

Assume that 300 units were sold in the fiscal year. Calculate the Cost of Goods Sold for the fiscal year for Global Tracking Inc. under the LIFO, FIFO and Average Cost inventory valuation methods. If the company wants to have a higher balance in the Inventory Account on the Balance Sheet which method should it use?

Criteria Total LIFO Calculation 1.5% FIFO Calculation 1.5% Average Cost Calculation 1.5% Inventory Question .5% Total 5% You work for Global Tracking Inc. a company that sells a real-time tracking bracelet that tracks patients and nurses in different healthcare environments using GPS technology. designed for individuals who wish to monitor others' whereabouts. There has been an increase in demand for the product has spiked during the current fiscal period, while supply is limited, causing the selling price to escalate rapidly. Note: For simplicity of demonstration, beginning inventory cost is assumed to be $21 per unit for all cost assumption methods. The following is a chart of the inventory purchases in the last year Number of Units Unit Cost Sales Price 150 $21 Beginning Inventory Jul. 1 Sold Jul. 5 120 $36 Purchased Jul. 10 225 27 Sold Jul. 15 180 39 Purchased Jul. 25 210 33 Ending Inventory Jul. 31 285 Assume that 300 units were sold in the fiscal year. Calculate the Cost of Goods Sold for the fiscal year for Global Tracking Inc. under the LIFO, FIFO and Average Cost inventory valuation methods. If the company wants to have a higher balance in the Inventory Account on the Balance Sheet which method should it useStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started