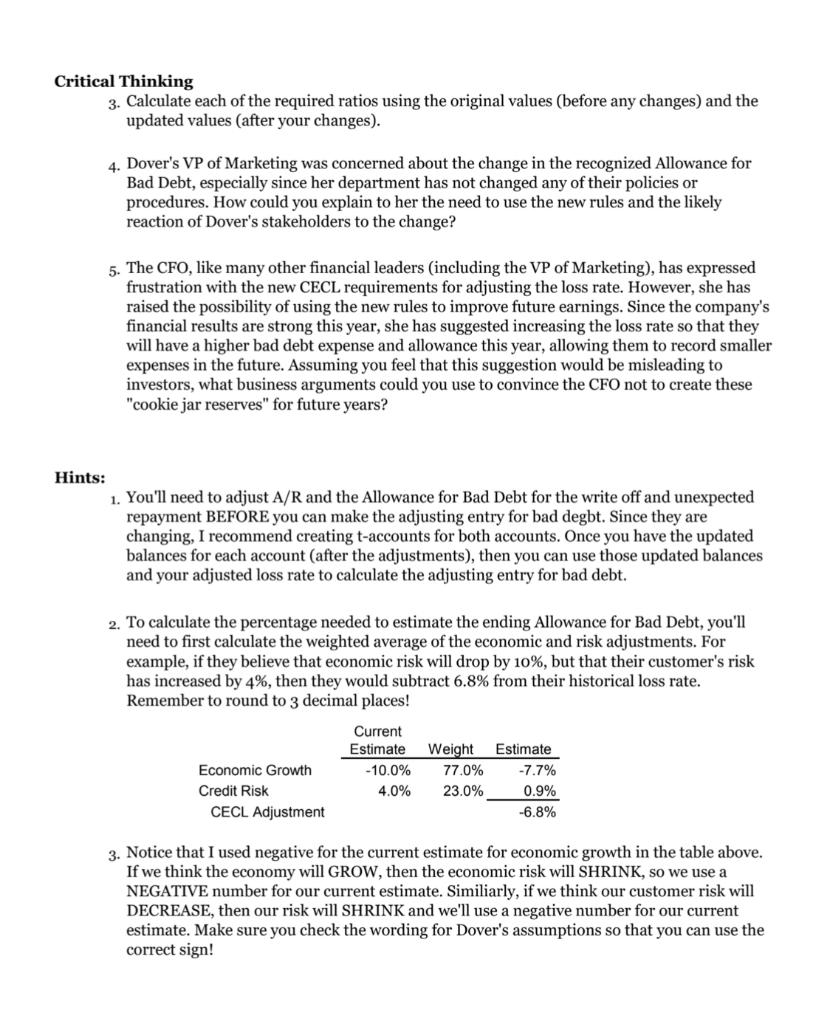

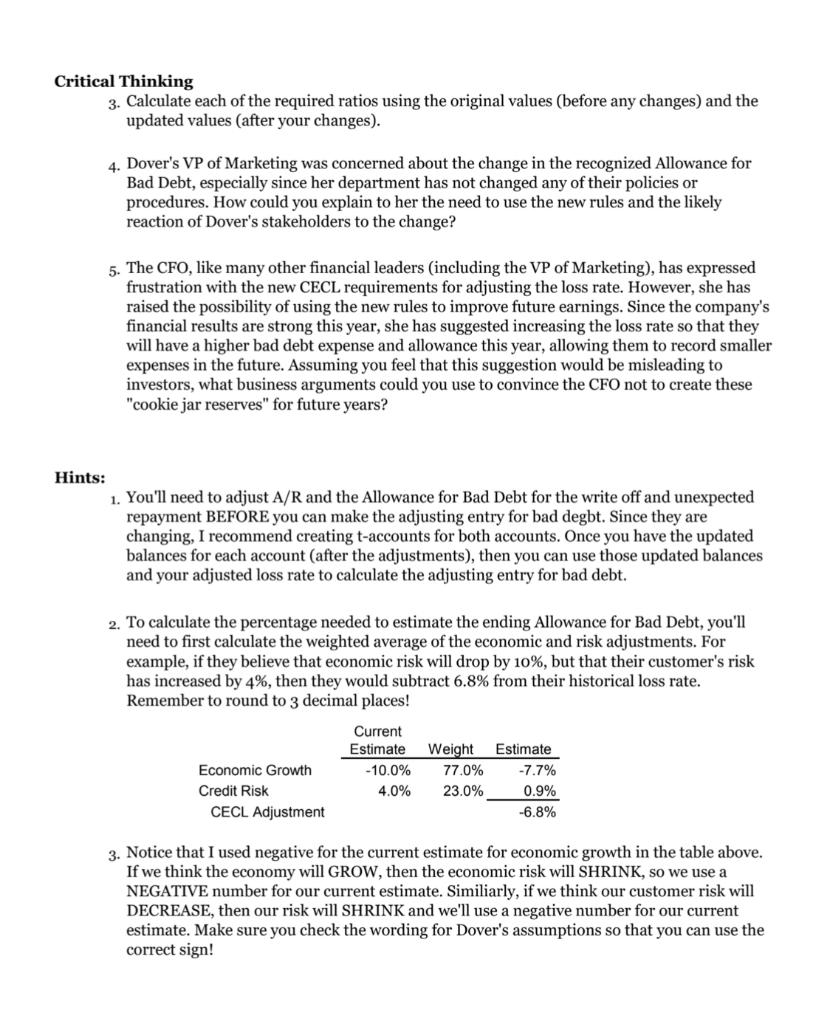

Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. Dover's VP of Marketing was concerned about the change in the recognized Allowance for Bad Debt, especially since her department has not changed any of their policies or procedures. How could you explain to her the need to use the new rules and the likely reaction of Dover's stakeholders to the change? 5. The CFO, like many other financial leaders (including the VP of Marketing), has expressed frustration with the new CECL requirements for adjusting the loss rate. However, she has raised the possibility of using the new rules to improve future earnings. Since the company's financial results are strong this year, she has suggested increasing the loss rate so that they will have a higher bad debt expense and allowance this year, allowing them to record smaller expenses in the future. Assuming you feel that this suggestion would be misleading to investors, what business arguments could you use to convince the CFO not to create these "cookie jar reserves" for future years? Hints: 1. You'll need to adjust A/R and the Allowance for Bad Debt for the write off and unexpected repayment BEFORE you can make the adjusting entry for bad degbt. Since they are changing, I recommend creating t-accounts for both accounts. Once you have the updated balances for each account (after the adjustments), then you can use those updated balances and your adjusted loss rate to calculate the adjusting entry for bad debt. 2. To calculate the percentage needed to estimate the ending Allowance for Bad Debt, you'll need to first calculate the weighted average of the economic and risk adjustments. For example, if they believe that economic risk will drop by 10%, but that their customer's risk has increased by 4%, then they would subtract 6.8% from their historical loss rate. Remember to round to 3 decimal places! 3 Current Estimate - 10.0% 4.0% Economic Growth Credit Risk CECL Adjustment Weight 77.0% 23.0% Estimate -7.7% 0.9% -6.8% 3. Notice that I used negative for the current estimate for economic growth in the table above. If we think the economy will GROW, then the economic risk will SHRINK, so we use a NEGATIVE number for our current estimate. Similiarly, if we think our customer risk will DECREASE, then our risk will SHRINK and we'll use a negative number for our current estimate. Make sure you check the wording for Dover's assumptions so that you can use the correct sign! Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. Dover's VP of Marketing was concerned about the change in the recognized Allowance for Bad Debt, especially since her department has not changed any of their policies or procedures. How could you explain to her the need to use the new rules and the likely reaction of Dover's stakeholders to the change? 5. The CFO, like many other financial leaders (including the VP of Marketing), has expressed frustration with the new CECL requirements for adjusting the loss rate. However, she has raised the possibility of using the new rules to improve future earnings. Since the company's financial results are strong this year, she has suggested increasing the loss rate so that they will have a higher bad debt expense and allowance this year, allowing them to record smaller expenses in the future. Assuming you feel that this suggestion would be misleading to investors, what business arguments could you use to convince the CFO not to create these "cookie jar reserves" for future years? Hints: 1. You'll need to adjust A/R and the Allowance for Bad Debt for the write off and unexpected repayment BEFORE you can make the adjusting entry for bad degbt. Since they are changing, I recommend creating t-accounts for both accounts. Once you have the updated balances for each account (after the adjustments), then you can use those updated balances and your adjusted loss rate to calculate the adjusting entry for bad debt. 2. To calculate the percentage needed to estimate the ending Allowance for Bad Debt, you'll need to first calculate the weighted average of the economic and risk adjustments. For example, if they believe that economic risk will drop by 10%, but that their customer's risk has increased by 4%, then they would subtract 6.8% from their historical loss rate. Remember to round to 3 decimal places! 3 Current Estimate - 10.0% 4.0% Economic Growth Credit Risk CECL Adjustment Weight 77.0% 23.0% Estimate -7.7% 0.9% -6.8% 3. Notice that I used negative for the current estimate for economic growth in the table above. If we think the economy will GROW, then the economic risk will SHRINK, so we use a NEGATIVE number for our current estimate. Similiarly, if we think our customer risk will DECREASE, then our risk will SHRINK and we'll use a negative number for our current estimate. Make sure you check the wording for Dover's assumptions so that you can use the correct sign