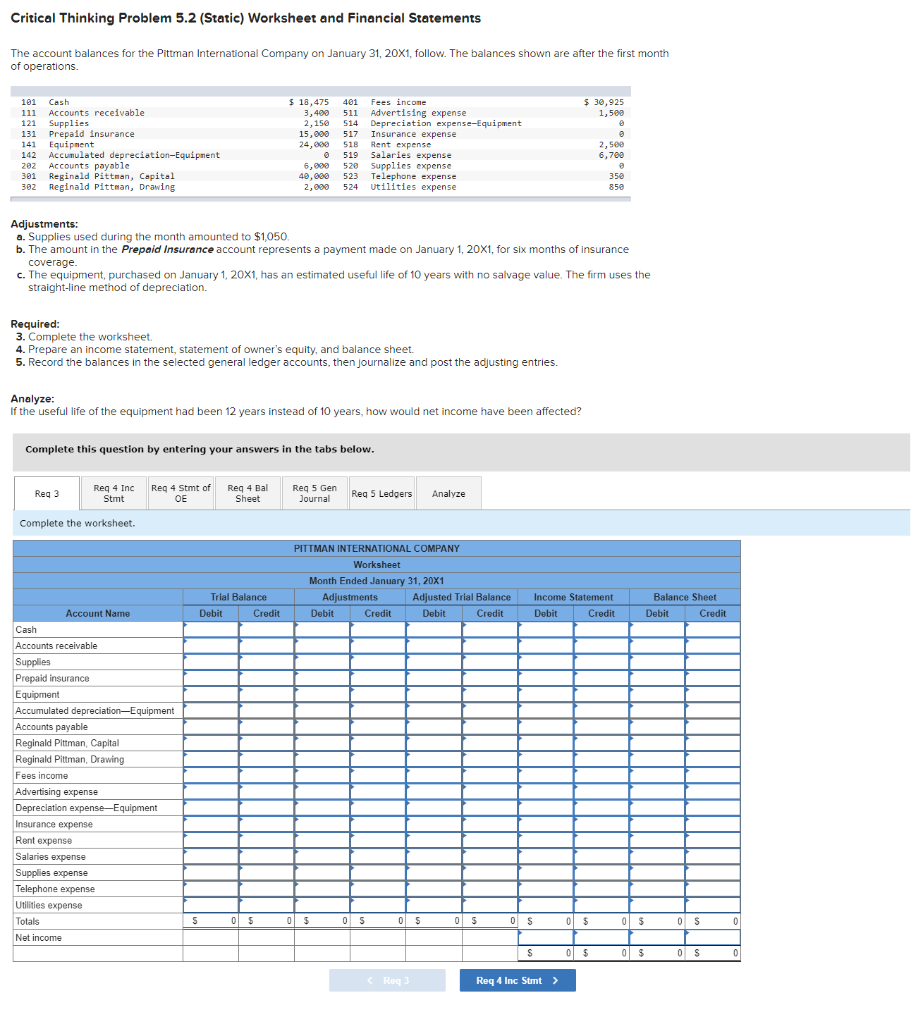

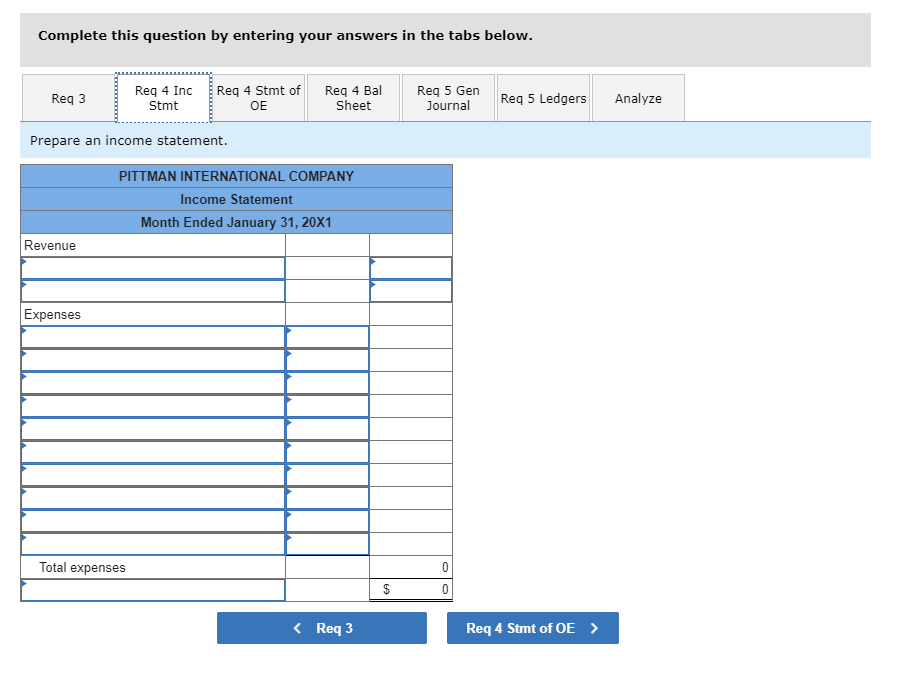

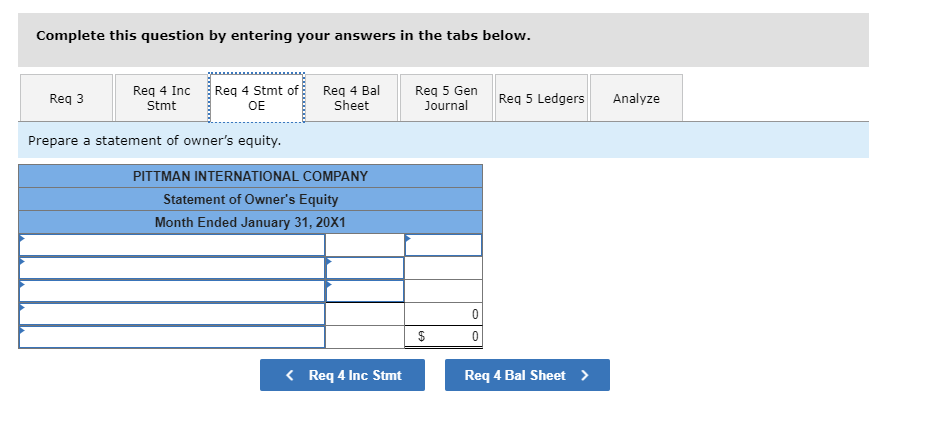

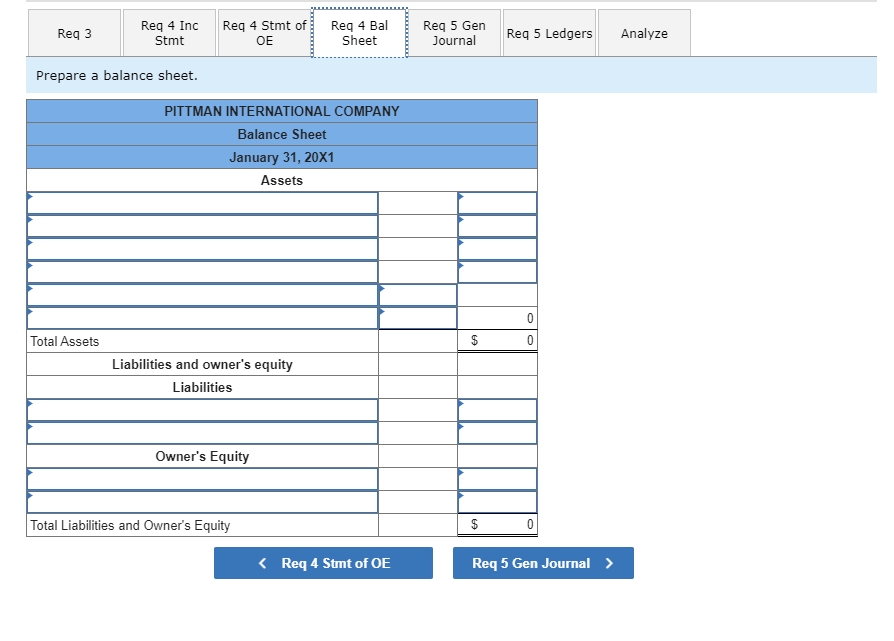

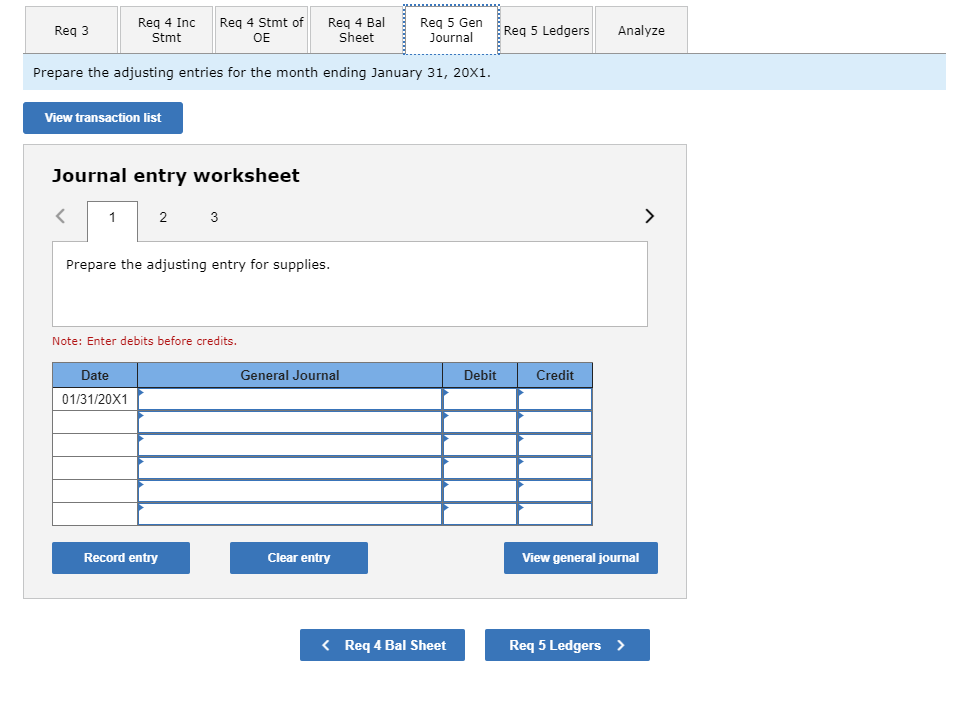

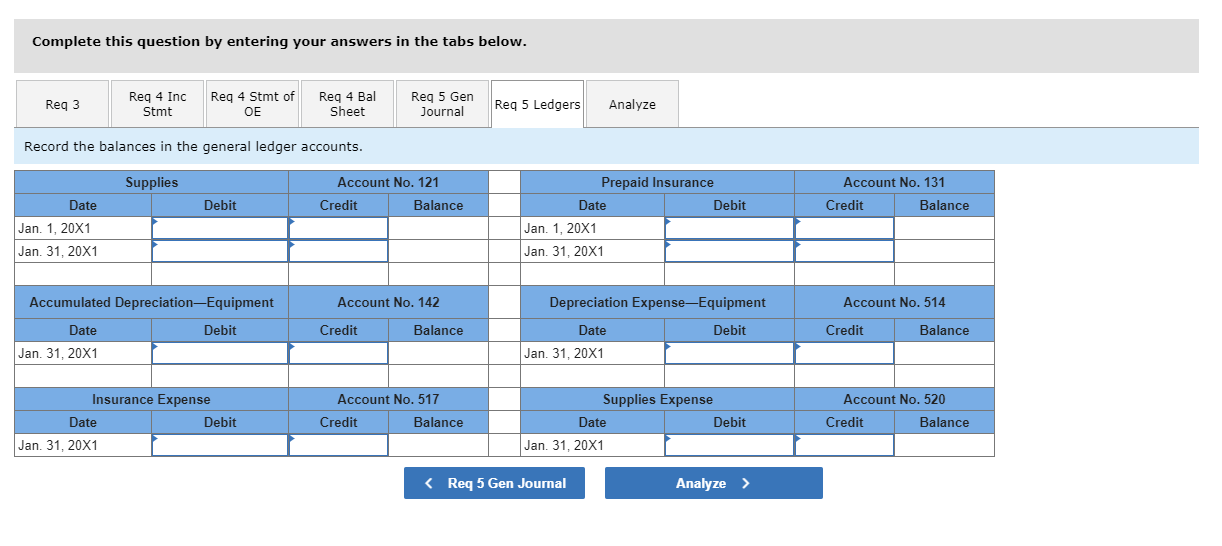

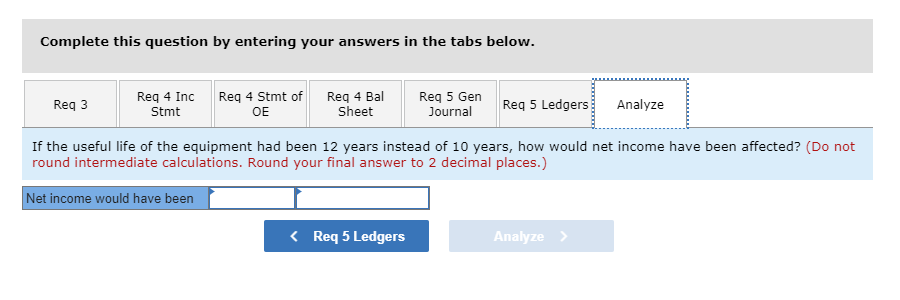

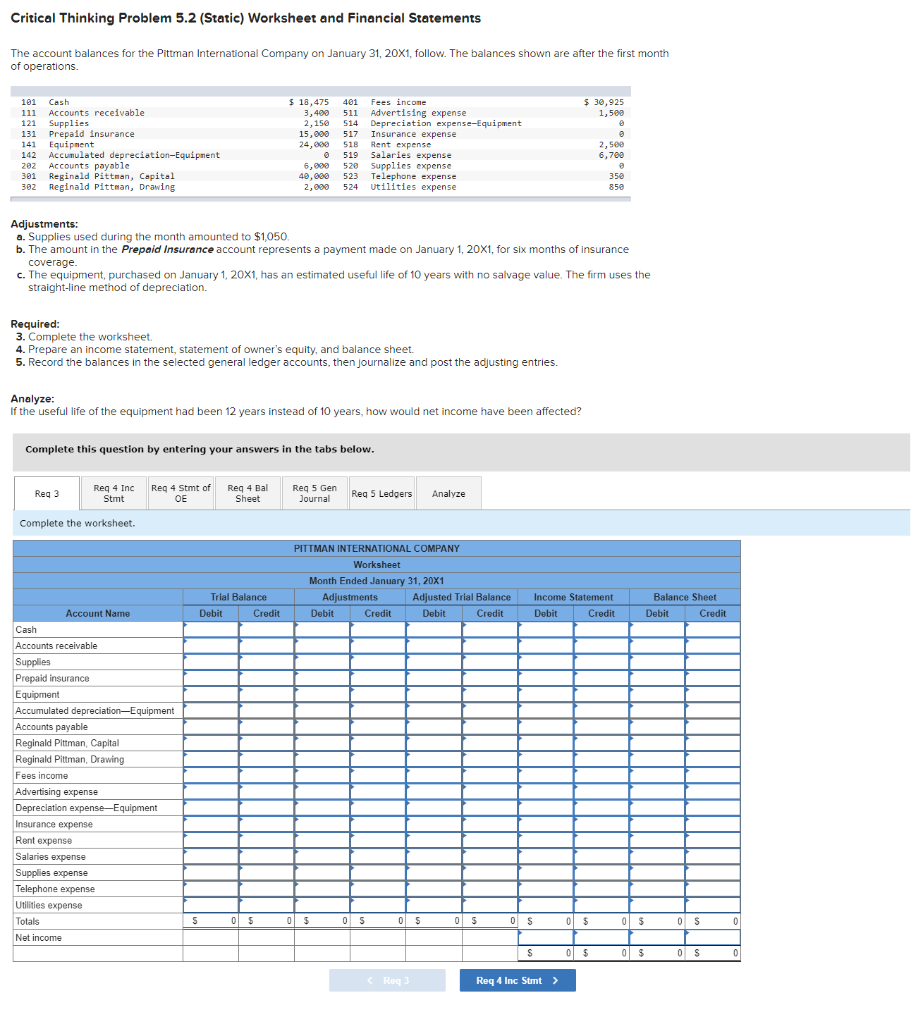

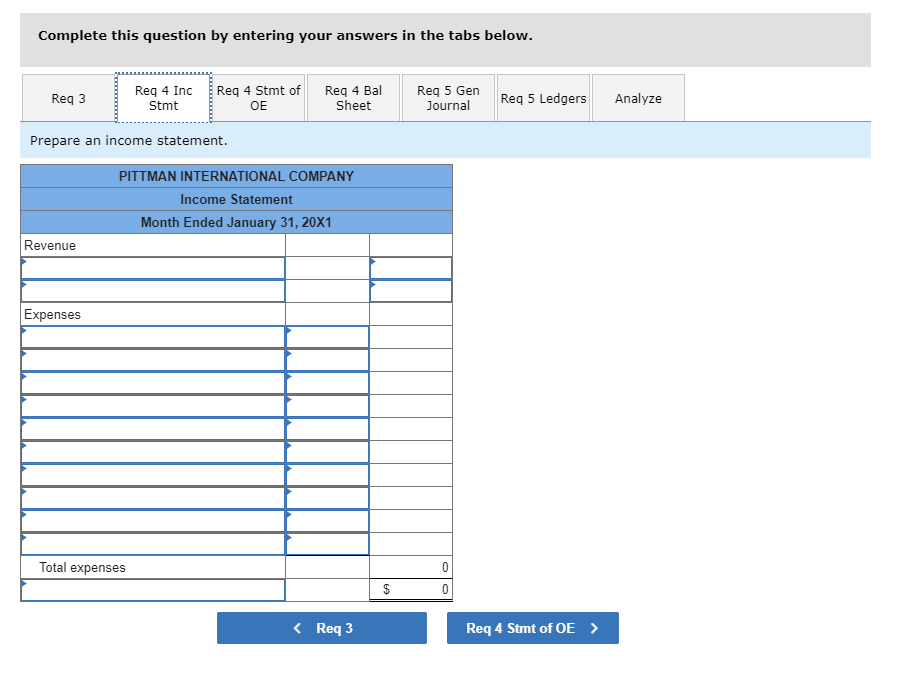

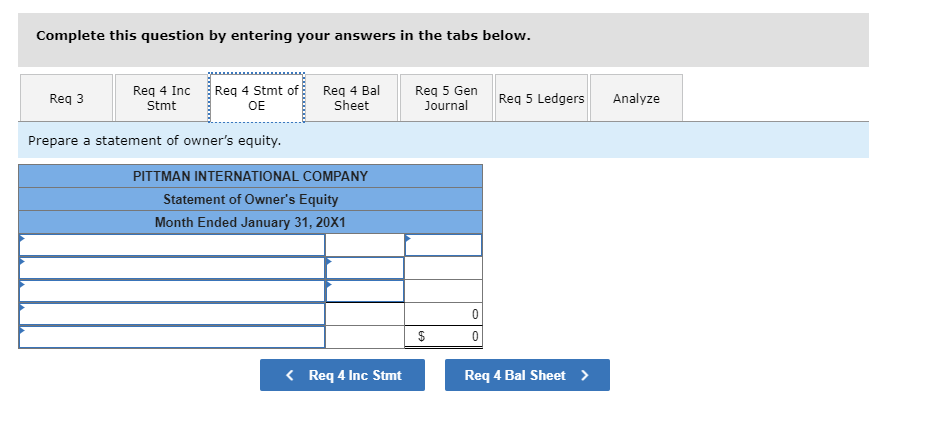

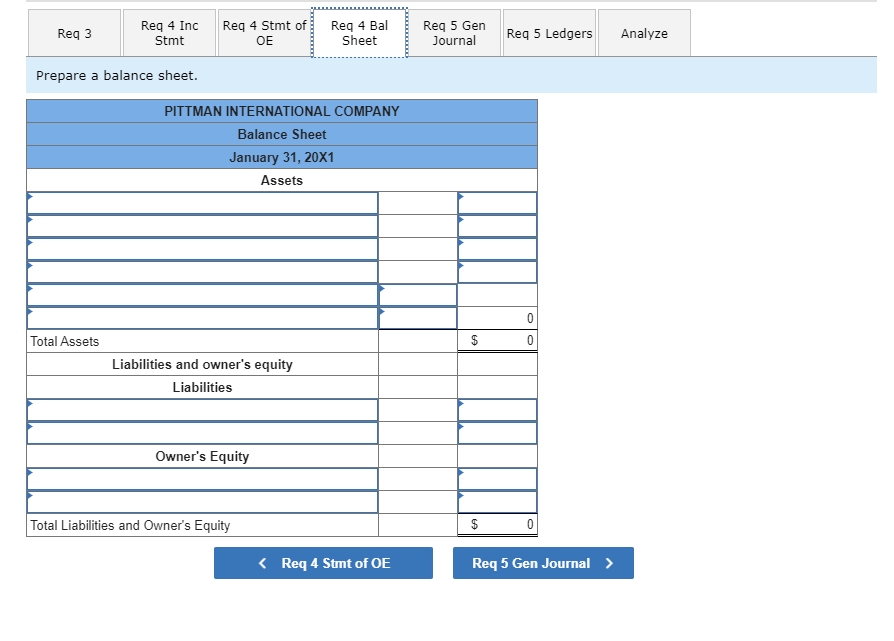

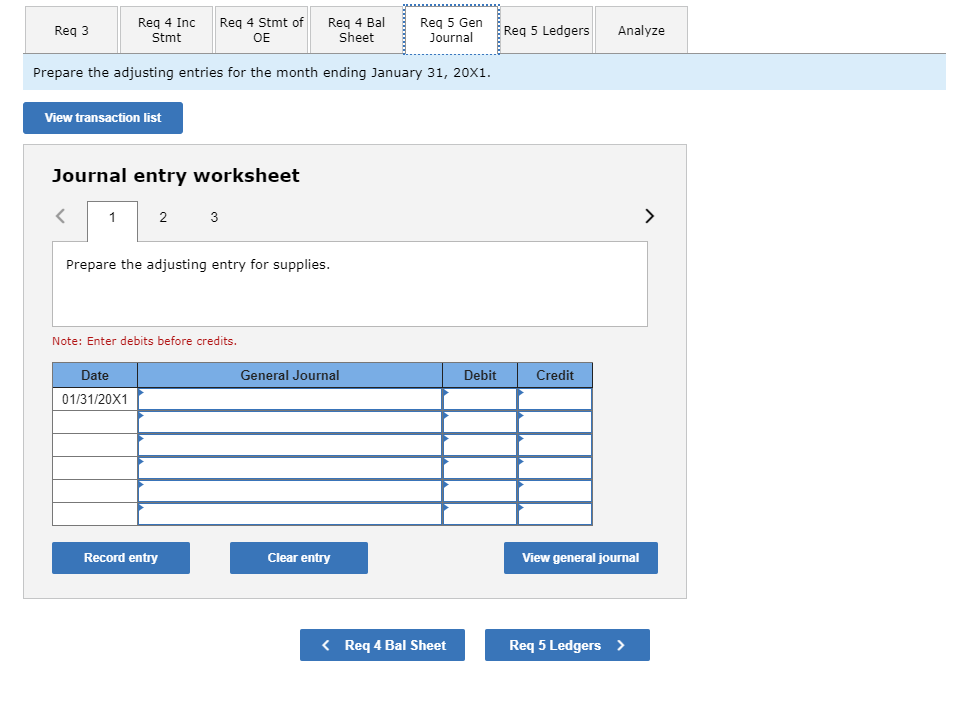

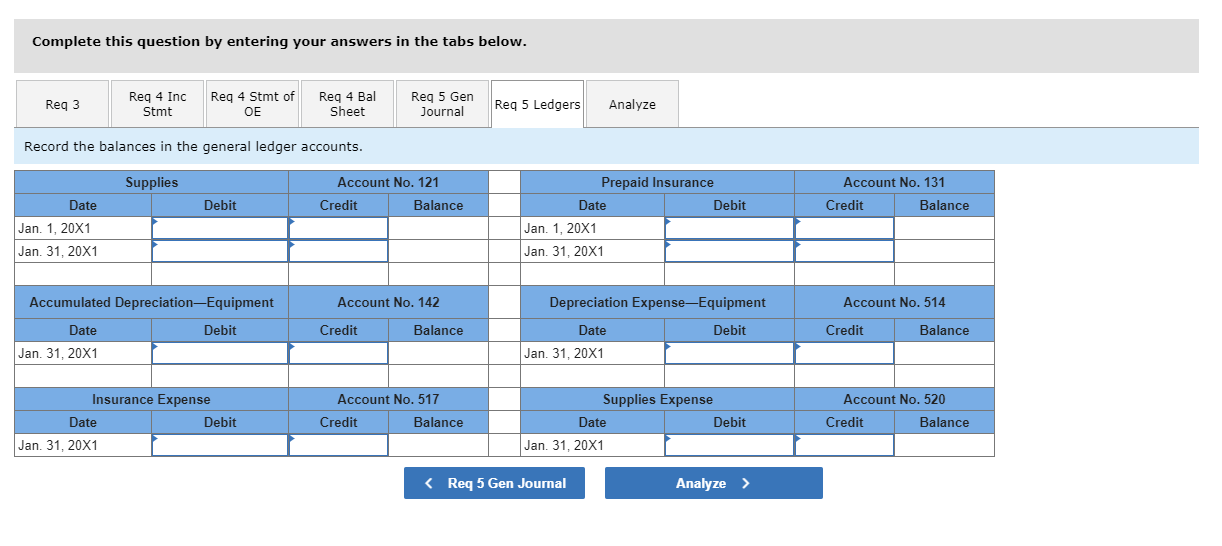

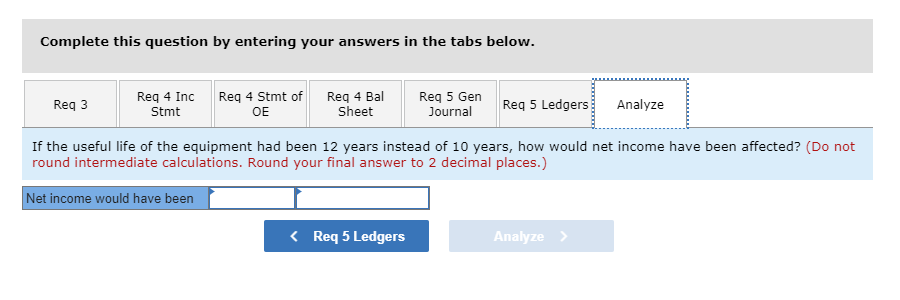

Critical Thinking Problem 5.2 (Static) Worksheet and Financial Statements The account balances for the Pittman International Company on January 31, 20X1, follow. The balances shown are after the first month of operations $ 30,925 1,500 181 Cash 111 Accounts receivable 121 Supplies 131 Prepaid Insurance 141 Equipment 142 Accumulated depreciation-Equipment 292 Accounts payable 301 Reginald Pittman, Capital 302 Reginald Pittman, Drawing $ 18,475 3,400 2,150 15,000 24,820 401 Fees income 511 Advertising expense 514 Depreciation expense-Equipment 517 Insurance expense 518 Rent expense 519 Salaries expense 520 Supplies expense 523 Telephone expense 524 Utilities expense 6,000 40,000 2,000 2,5ee 6,700 e 350 850 Adjustments: a. Supplies used during the month amounted to $1050 b. The amount in the Prepaid Insurance account represents a payment made on January 1, 20X1, for six months of insurance coverage C. The equipment, purchased on January 1, 20x1, has an estimated useful life of 10 years with no salvage value. The firm uses the straight-line method of depreciation. Required: 3. Complete the worksheet. 4. Prepare an income statement, statement of owner's equity, and balance sheet. 5. Record the balances in the selected general ledger accounts, then journalize and post the adjusting entries. Analyze: If the useful life of the equipment had been 12 years instead of 10 years, how would net income have been affected? Complete this question by entering your answers in the tabs below. Reg 3 3 Req 4 Inc Stmt Reg 4 Stmt of OE Req 4 Bal Sheet Req 5 Gen Journal Reg 5 Ledgers Analyze Complete the worksheet. PITTMAN INTERNATIONAL COMPANY Worksheet Month Ended January 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Trial Balance Debit Credit Income Statement Debit Credit Balance Sheet Debit Credit Credit Account Name Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation-Equipment Accounts payable Reginald Pittman, Capital Reginald Pittman, Drawing Fees income Advertising expense Depreciation expense-Equipment Insurance expense Rent expense Salaries expense Supplies expense Telephone expense Utilities expense Totals S 0 $ 0 $ 0 5 0 5 0 5 0 S 0 $ 0 s 0 $ 0 Net income S 0 $ 0 $ 0 S 0 (Reg 3 Req 4 Inc Strnt > Complete this question by entering your answers in the tabs below. Reg 3 Req 4 Inc Stmt Req 4 Stmt of OE Req 4 Bal Sheet Req 5 Gen Journal Req 5 Ledgers Analyze Prepare an income statement. PITTMAN INTERNATIONAL COMPANY Income Statement Month Ended January 31, 20X1 Revenue Expenses Total expenses 0 $ 0 Complete this question by entering your answers in the tabs below. Req3 Req 4 Inc Stmt Req 4 Stmt of OE Req 4 Bal Sheet Req 5 Gen Journal Req 5 Ledgers Analyze Prepare a statement of owner's equity. PITTMAN INTERNATIONAL COMPANY Statement of Owner's Equity Month Ended January 31, 20X1 $ 0 Reg 3 Req 4 Inc Stmt Req 4 Stmt of OE Req 4 Bal Sheet Req 5 Gen Journal Req 5 Ledgers Analyze Prepare a balance sheet. PITTMAN INTERNATIONAL COMPANY Balance Sheet January 31, 20X1 Assets 0 Total Assets $ 0 Liabilities and owner's equity Liabilities Owner's Equity Total Liabilities and Owner's Equity $ 0 Req3 Req 4 Inc Stmt Req 4 Stmt of OE Reg 4 Bal Sheet Reg 5 Gen Journal Req 5 Ledgers Analyze Prepare the adjusting entries for the month ending January 31, 20X1. View transaction list Journal entry worksheet Prepare the adjusting entry for supplies. Note: Enter debits before credits. Date General Journal Debit Credit 01/31/20X1 Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Reg 3 Req 4 Inc Stmt Req 4 Stmt of OE Reg 4 Bal Sheet Req 5 Gen Journal Req 5 Ledgers Analyze Record the balances in the general ledger accounts. Supplies Account No. 121 Credit Balance Account No. 131 Credit Balance Debit Date Jan. 1, 20X1 Jan. 31, 20X1 Prepaid Insurance Date Debit Jan. 1, 20X1 Jan. 31, 20X1 Accumulated Depreciation-Equipment Account No. 142 Depreciation Expense-Equipment Account No. 514 Debit Credit Balance Debit Credit Balance Date Jan. 31, 20X1 Date Jan. 31, 20X1 Insurance Expense Date Debit Jan. 31, 20X1 Account No. 517 Credit Balance Supplies Expense Date Debit Jan. 31, 20X1 Account No. 520 Credit Balance Complete this question by entering your answers in the tabs below. Req3 Req 4 Inc Stmt Req 4 Stmt of OE Req 4 Bal Sheet Req 5 Gen Journal Req 5 Ledgers Analyze If the useful life of the equipment had been 12 years instead of 10 years, how would net income have been affected? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Net income would have been