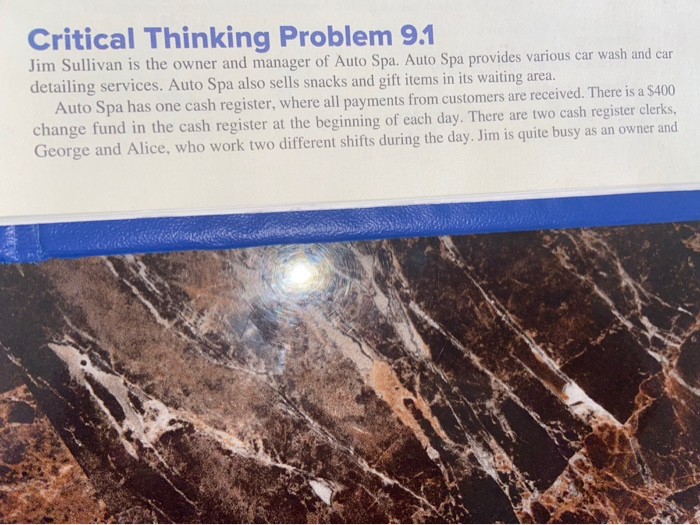

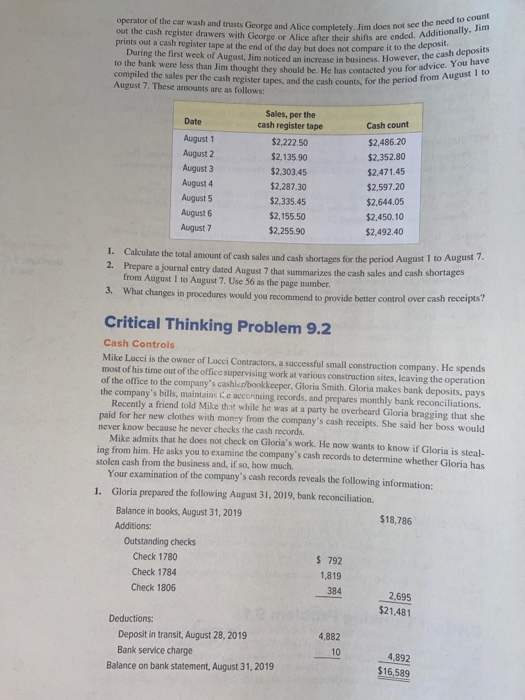

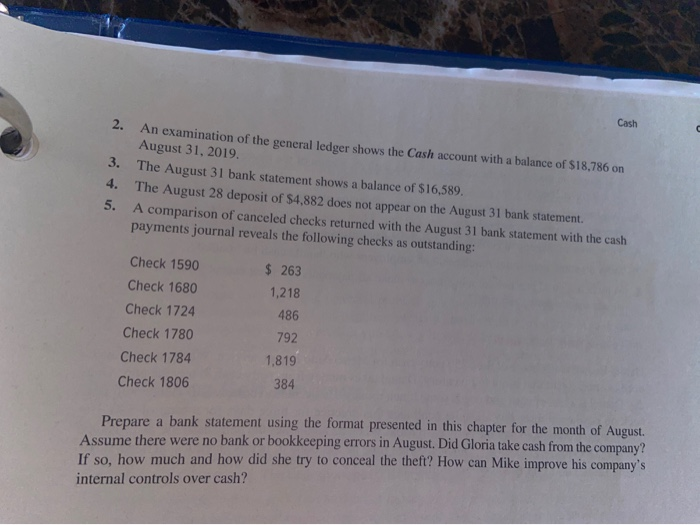

Critical Thinking Problem 9.1 Jim Sullivan is the owner and manager of Auto Spa. Auto Spa provides various car wash and car detailing services. Auto Spa also sells snacks and gift items in its waiting area. Auto Spa has one cash register, where all payments from customers are received. There is a $400 change fund in the cash register at the beginning of each day. There are two cash register clerks, George and Alice, who work two different shifts during the day. Jim is quite busy as an owner and operator of the car wash and trusts Geore and Alice completely Jim does not see out the cash register drawers with George or Alice after their shifts are ended. prints out a cash register tape at the end of the day but does not compare it to the During the first week of August. Jim notised an increase in business. However, to the bank were less than Jim thought they should be. He has contacted you for compiled the sales per the cash register tapes, and the cash counts, for the period August 7. These amounts are as follows: y. Jim does not see the need to count shifts are ended. Additionally, Jim compare it to the deposit ess. However, the cash deposits acted you for advice. You have ats, for the period from August I to Sales, per the cash register tape August 1 August 2 August 3 August 4 August 5 August 6 August 7 $2.222.50 $2,135.90 $2,303.45 $2,287.30 $2,335.45 $2,155.50 $2,255.90 Cash count $2,486.20 $2,352.80 $2.471.45 $2,597.20 $2,644.05 $2,450.10 $2,492.40 1. Calculate the total amount of cash sales and cash shortages for the period August I to August 2. Prepare a journal entry dated August 7 that summarizes the cash sales and cash shortages from August 1 to August 7. Use 56 as the page number. 3. What changes in procedures would you recommend to provide better control over cash receipts Critical Thinking Problem 9.2 Cash Controls Mike Lucci is the owner of Lacci Contractors, a successful small construction company. He spends most of his time out of the office supervising work at various construction sites, leaving the operation of the office to the company's cashier bookkeeper. Gloria Smith. Gloria makes bank deposits, pays the company's bills, maintains Ce accounting records, and prepares monthly bank reconciliations. Recently a friend told Mike that while he was at a party he overheard Gloria bragging that she paid for her new clothes with money from the company's cash receipts. She said her boss would never know because he never checks the cash records. Mike admits that he does not check on Gloria's work. He now wants to know if Gloria is steal- ing from him. He asks you to examine the company's cash records to determine whether Gloria has stolen cash from the business and, if so, how much Your examination of the company's cash records reveals the following information: 1. Gloria prepared the following August 31, 2019, bank reconciliation Balance in books, August 31, 2019 $18,786 Additions: Outstanding checks Check 1780 $ 792 Check 1784 1,819 Check 1806 2,695 $21.481 Deductions: Deposit in transit, August 28, 2019 Bank service charge 4,892 Balance on bank statement, August 31, 2019 $16,589 384 4,882 2. Cash 3. 4. 5. An examination of the general ledger shows the Cash account with a balance of $18,786 on August 31, 2019. The August 31 bank statement shows a balance of $16,589. The August 28 deposit of $4.882 does not appear on the August 31 bank statement A comparison of canceled checks returned with the August 31 bank statement with the cash payments journal reveals the following checks as outstanding Check 1590 Check 1680 Check 1724 Check 1780 Check 1784 Check 1806 $ 263 1,218 486 792 1,819 384 Prepare a bank statement using the format presented in this chapter for the month of August. Assume there were no bank or bookkeeping errors in August. Did Gloria take cash from the company? If so, how much and how did she try to conceal the theft? How can Mike improve his company's internal controls over cash