Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Critically assess the decision of Miss Pennicott to release her underage daughter to the care of a man who is not the child's father. Adina

Critically assess the decision of Miss Pennicott to release her underage daughter to the care of a man who is not the child's father.

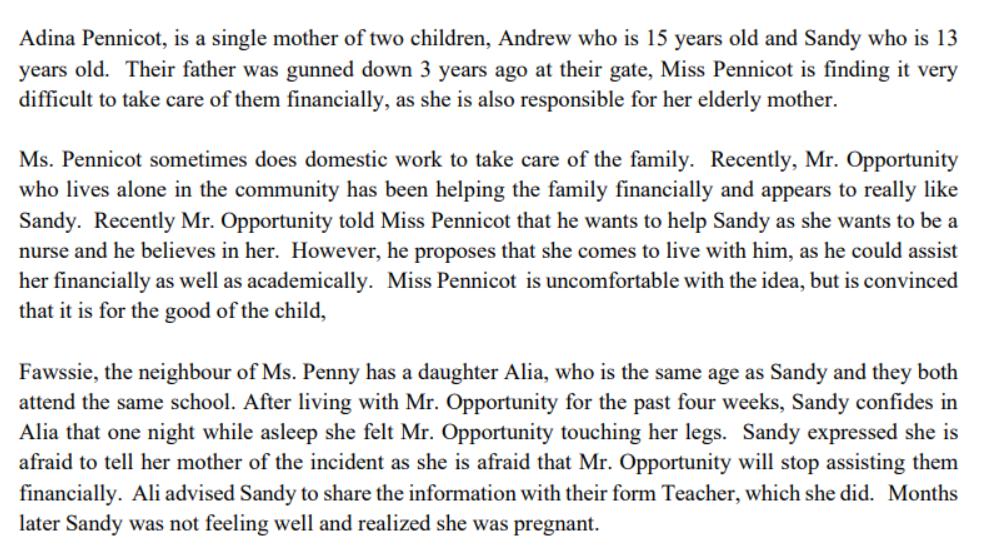

Critically assess the decision of Miss Pennicott to release her underage daughter to the care of a man who is not the child's father. Adina Pennicot, is a single mother of two children, Andrew who is 15 years old and Sandy who is 13 years old. Their father was gunned down 3 years ago at their gate, Miss Pennicot is finding it very difficult to take care of them financially, as she is also responsible for her elderly mother. Ms. Pennicot sometimes does domestic work to take care of the family. Recently, Mr. Opportunity who lives alone in the community has been helping the family financially and appears to really like Sandy. Recently Mr. Opportunity told Miss Pennicot that he wants to help Sandy as she wants to be a nurse and he believes in her. However, he proposes that she comes to live with him, as he could assist her financially as well as academically. Miss Pennicot is uncomfortable with the idea, but is convinced that it is for the good of the child, Fawssie, the neighbour of Ms. Penny has a daughter Alia, who is the same age as Sandy and they both attend the same school. After living with Mr. Opportunity for the past four weeks, Sandy confides in Alia that one night while asleep she felt Mr. Opportunity touching her legs. Sandy expressed she is afraid to tell her mother of the incident as she is afraid that Mr. Opportunity will stop assisting them financially. Ali advised Sandy to share the information with their form Teacher, which she did. Months later Sandy was not feeling well and realized she was pregnant.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

I have some concerns about Miss Pennicotts decision to allow her 13yearold daughter Sandy to live wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started