Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Critique the Vision Statement for ROYAL DUTCH SHELL , using the textbook criteria for your analysis If needed use the links https://www.chegg.com/homework-help/Strategic-Management-14th-edition-chapter-4-problem-4ALC-solution-9780134182155 https://www.chegg.com/homework-help/Strategic-Management-15th-edition-chapter-4-problem-4ALC-solution-9780133444896 Perform a

Critique the Vision Statement for ROYAL DUTCH SHELL, using the textbook criteria for your analysis

If needed use the links

https://www.chegg.com/homework-help/Strategic-Management-14th-edition-chapter-4-problem-4ALC-solution-9780134182155

https://www.chegg.com/homework-help/Strategic-Management-15th-edition-chapter-4-problem-4ALC-solution-9780133444896

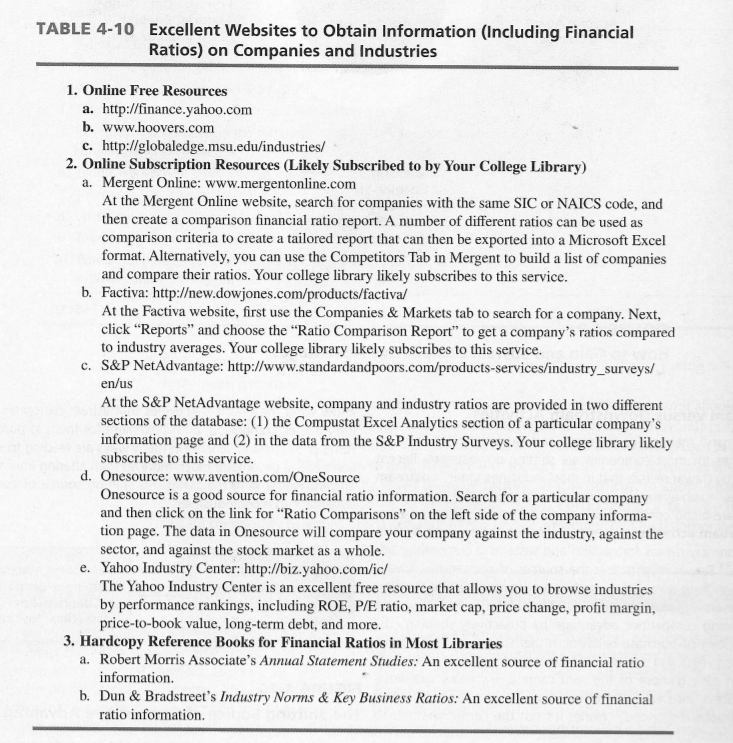

Perform a financial ratio analysis for "ROYAL DUTCH SHELL" Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at firms, financial ratios, making detailed comparisons to industry averages and to previous periods of time. Financial ratio analysis provides vital input information for developing an IFE matrix. Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at firms, financial ratios, making detailed comparisons to industry averages and to previous periods of time. Financial ratio analysis provides vital input information for developing an IFE matrix. Online Free Resources a. http: //finance.yahoo.com b. www.hoovers.com c. http: //globaledge.msu.edu/industries/ Online Subscription Resources (Likely Subscribed to by Your College Library) a. Mergent Online: www.mergentonline.com At the Mergent Online website, search for companies with the same SIC or NAICS code, and then create a comparison financial ratio report. A number of different ratios can be used as comparison criteria to create a tailored report that can then be exported into a Microsoft Excel format. Alternatively, you can use the Competitors Tab in Mergent to build a list of companies and compare their ratios. Your college library likely subscribes to this service. B. Factiva: http: /ew.dowjones.com/products/factiva/ At the Factiva website, first use the Companies & Markets tab to search for a company. Next, click "Reports" and choose the "Ratio Comparison Report" to get a company's ratios compared to industry averages. Your college library" likely subscribes to this service. c. S&P NetAdvantage: http: //www.standardandpoors.com/products-services/industry_surveys/en/us At the S&P NetAdvantage website, company and industry ratios are provided in two different sections of the database: (1) the Compustat Excel Analytics section of a particular company's information page and (2) in the data from the S&P Industry Surveys. Your college library likely subscribes to this service. d. Onesource: www.avention.com/OneSource Onesource is a good source for financial ratio information. Search for a particular company and then click on the link for "Ratio Comparisons" on the left side of the company information page. The data in Onesource will compare your company against the industry, against the sector, and against the stock market as a whole. e. Yahoo Industry Center: http: //biz.yahoo.com/ic/ The Yahoo Industry Center is an excellent free resource that allows you to browse industries by performance rankings, including ROE, P/E ratio, market cap, price change, profit margin, price-to-book value, long-term debt, and more. Hardcopy Reference Books for Financial Ratios in Most Libraries a. Robert Morris Associate's Annual Statement Studies: An excellent source of financial ratio information. b. Dun & Bradstreet's Industry Norms & Key Business Ratios: An excellent source of financial ratio information. Perform a financial ratio analysis for "ROYAL DUTCH SHELL" Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at firms, financial ratios, making detailed comparisons to industry averages and to previous periods of time. Financial ratio analysis provides vital input information for developing an IFE matrix. Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at firms, financial ratios, making detailed comparisons to industry averages and to previous periods of time. Financial ratio analysis provides vital input information for developing an IFE matrix. Online Free Resources a. http: //finance.yahoo.com b. www.hoovers.com c. http: //globaledge.msu.edu/industries/ Online Subscription Resources (Likely Subscribed to by Your College Library) a. Mergent Online: www.mergentonline.com At the Mergent Online website, search for companies with the same SIC or NAICS code, and then create a comparison financial ratio report. A number of different ratios can be used as comparison criteria to create a tailored report that can then be exported into a Microsoft Excel format. Alternatively, you can use the Competitors Tab in Mergent to build a list of companies and compare their ratios. Your college library likely subscribes to this service. B. Factiva: http: /ew.dowjones.com/products/factiva/ At the Factiva website, first use the Companies & Markets tab to search for a company. Next, click "Reports" and choose the "Ratio Comparison Report" to get a company's ratios compared to industry averages. Your college library" likely subscribes to this service. c. S&P NetAdvantage: http: //www.standardandpoors.com/products-services/industry_surveys/en/us At the S&P NetAdvantage website, company and industry ratios are provided in two different sections of the database: (1) the Compustat Excel Analytics section of a particular company's information page and (2) in the data from the S&P Industry Surveys. Your college library likely subscribes to this service. d. Onesource: www.avention.com/OneSource Onesource is a good source for financial ratio information. Search for a particular company and then click on the link for "Ratio Comparisons" on the left side of the company information page. The data in Onesource will compare your company against the industry, against the sector, and against the stock market as a whole. e. Yahoo Industry Center: http: //biz.yahoo.com/ic/ The Yahoo Industry Center is an excellent free resource that allows you to browse industries by performance rankings, including ROE, P/E ratio, market cap, price change, profit margin, price-to-book value, long-term debt, and more. Hardcopy Reference Books for Financial Ratios in Most Libraries a. Robert Morris Associate's Annual Statement Studies: An excellent source of financial ratio information. b. Dun & Bradstreet's Industry Norms & Key Business Ratios: An excellent source of financial ratio information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started