Answered step by step

Verified Expert Solution

Question

1 Approved Answer

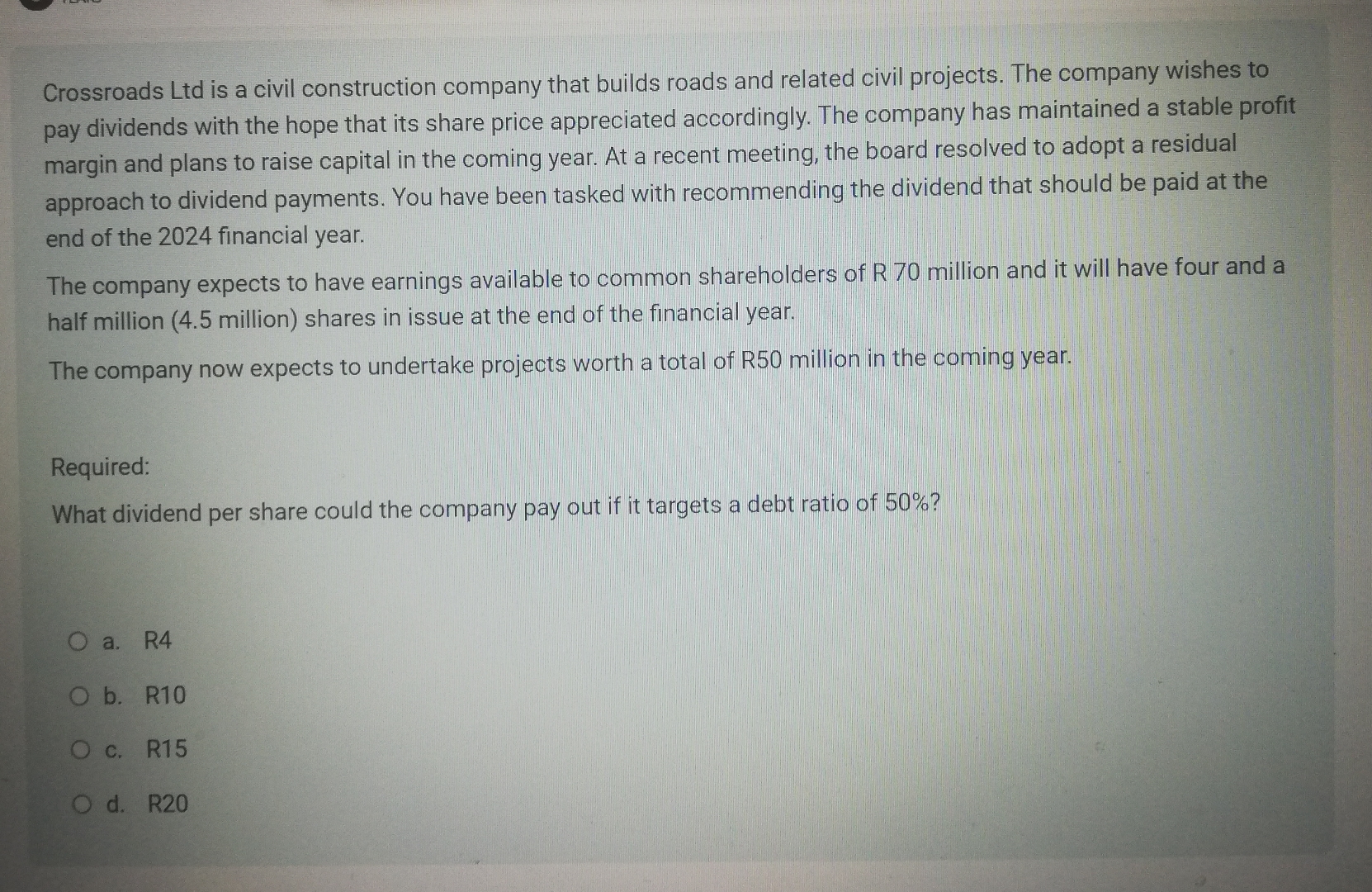

Crossroads Ltd is a civil construction company that builds roads and related civil projects. The company wishes to pay dividends with the hope that its

Crossroads Ltd is a civil construction company that builds roads and related civil projects. The company wishes to

pay dividends with the hope that its share price appreciated accordingly. The company has maintained a stable profit

margin and plans to raise capital in the coming year. At a recent meeting, the board resolved to adopt a residual

approach to dividend payments. You have been tasked with recommending the dividend that should be paid at the

end of the financial year.

The company expects to have earnings available to common shareholders of million and it will have four and a

half million million shares in issue at the end of the financial year.

The company now expects to undertake projects worth a total of R million in the coming year.

Required:

What dividend per share could the company pay out if it targets a debt ratio of

a R

b R

c R

d RIn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started