Answered step by step

Verified Expert Solution

Question

1 Approved Answer

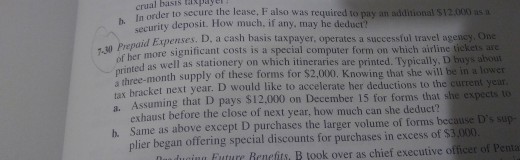

crual basr tr order to secure the lease, F also was required to pay an additional $12.000 as a security deposit. How much, if any,

crual basr tr order to secure the lease, F also was required to pay an additional $12.000 as a security deposit. How much, if any, may he deduct? Puenaid Expenses. D, a cash basis taxpayer, operates a successful travel agency, One her more significant costs is a special computer form on which airline tickets are 0 1. printed as well as stationery on which itineraries are printed. Typically, D buys abou athree-month supply of these forms for $2.0?). Knowing that she will be in a lower tax bracket next year. D would like to accelerate her deductions to the current year ssuming that D pays $12.000 on December 15 for forms that she expects to exhaust before the close of next year, how much can she deduct? a. h. Same as above except D purchases the larger volume of forms because D's su plier began offering special discounts for purchases in excess of $3.000 Future Benefts, B took over as chief executive offhicer of Penta crual basr tr order to secure the lease, F also was required to pay an additional $12.000 as a security deposit. How much, if any, may he deduct? Puenaid Expenses. D, a cash basis taxpayer, operates a successful travel agency, One her more significant costs is a special computer form on which airline tickets are 0 1. printed as well as stationery on which itineraries are printed. Typically, D buys abou athree-month supply of these forms for $2.0?). Knowing that she will be in a lower tax bracket next year. D would like to accelerate her deductions to the current year ssuming that D pays $12.000 on December 15 for forms that she expects to exhaust before the close of next year, how much can she deduct? a. h. Same as above except D purchases the larger volume of forms because D's su plier began offering special discounts for purchases in excess of $3.000 Future Benefts, B took over as chief executive offhicer of Penta

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started