Question

Crude oil futures contracts are 1,000 barrels, are quoted in dollars per barrel, and the initial margin is $9,000 per contract. Soybean futures contracts are

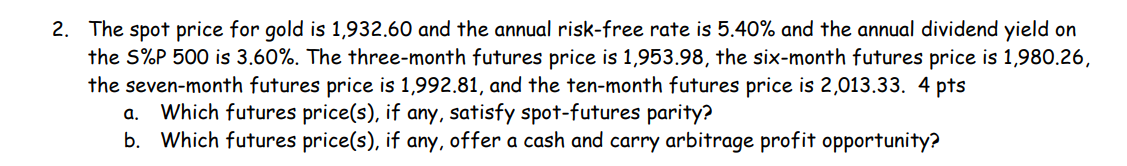

Crude oil futures contracts are 1,000 barrels, are quoted in dollars per barrel, and the initial margin is $9,000 per contract. Soybean futures contracts are 5,000 bushels, are quoted in cents per bushel, and have an initial margin of $4,725. E-mini S&P 500 futures contracts are quoted in S&P 500 index value with a $50 multiplier and have an initial margin of $12,650 per contract. Gold futures contracts are 100 ounces and are quoted in dollars per ounce.

(I see that more information was requested, but there isn't anything else provided. The assignment has 8 questions and has the paragraph attached at the top)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started